A month to consider women’s history — and why change is needed

The observance of Women’s History Month in March is one reminder of the many ways women in the U.S. have a history different from men’s. While men — white men, that is — have had the right to vote since the founding of the country in 1776, women did not have the right to vote until the passage of the 19th Amendment, passed by Congress on June 4, 1919, and ratified on Aug. 18, 1920. That is 144 years after the founding of the country and 103 years prior to 2023.

So, women have had the vote for fewer years than the period of time when they were not permitted to vote.

Of course, there are so many other ways women’s history has differed, whether in the job market or finances on the home front — at one time women even lacked the ability to get credit. In times gone by, the social norm was that the man was the de facto financial leader of the household. Glass ceilings are still being broken.

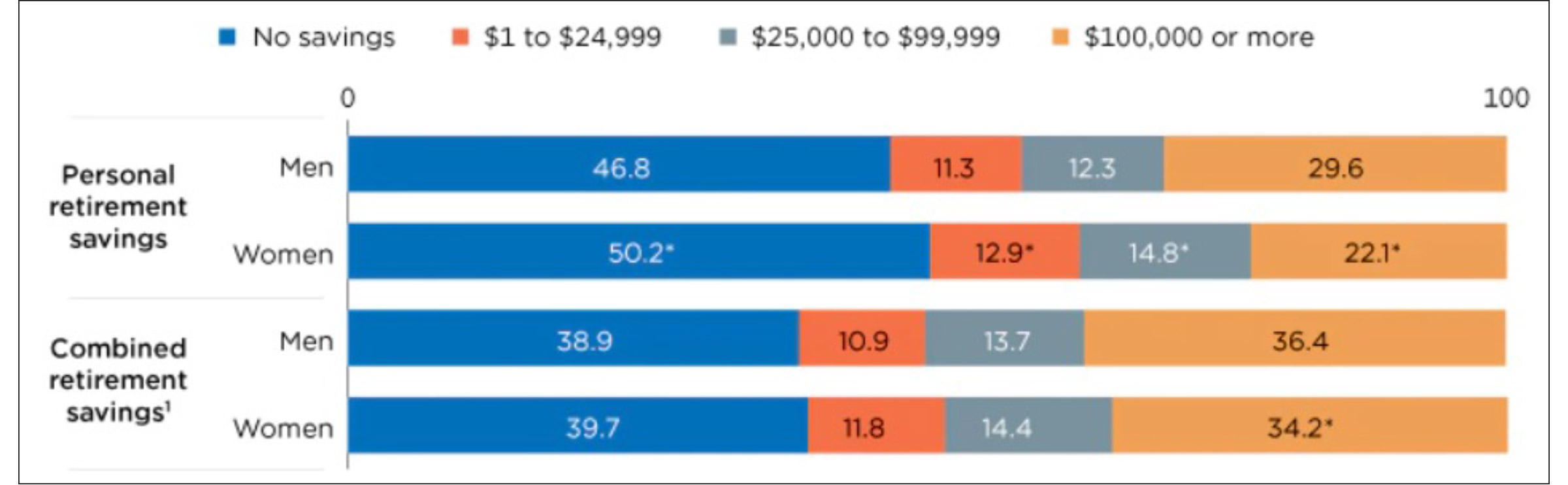

All of this has led to survey after survey that shows women don’t have as much confidence as men have in their finances. This is an even more significant problem when you consider that women make up the majority of the workforce, constituting 58.4% in Sept. 2022 — down from 59.2% just prior to the pandemic. Also, more women head households — but often earn less than men do. And recent U.S. government figures have shown that about 50% of women ages 55 to 66, compared to 47% of men, have no personal retirement savings. (See chart.)

According to the U.S. census, women also lag men at the other end of the spectrum: 22% of women, compared to 30% of men, have $100,000 or more in personal retirement savings.

When it comes to retirement, this leaves many women today woefully behind their male counterparts regarding being prepared for retirement.

Add to this the rocky market and inflation, and retirement is a murky — even scary — prospect for many women. A recent Nationwide survey found that 62% of women, compared to 47% of men, are putting off retirement or don’t believe they will ever retire due to inflation.

That is only the beginning of the disparities. Women often live longer than men, with wives often outliving their husbands. So whether single, married or widowed, women stand to be in the worst position as retirement funds begin to run out in old age. As longevity extends and women live longer, the problems compound.

Marital status also impacts the retirement plight of women. Census surveys show that among those married once, about 35% have no retirement savings, compared to 60% of those who never married and 40% of those who married more than once.

Also, about 40% of those who married once have $100,000 or more in retirement savings, compared to about 20% of those who never married and about 33% of those who married two or more times.

And women who never married tend to be worse off financially than those who did marry.

The financial advisory community has a disparate balance of male and female advisors, with estimates ranging from male advisors outnumbering female advisors by ratios from 6:1 to 10:1.

Some studies show this imbalance is improving somewhat, but the numbers are still heavily out of balance.

This has reverberating impacts, since having more female advisors might make it easier — and more comfortable — for women to seek advisors.

Since women are outliving men, they are, by definition, controlling the vast majority of inherited wealth as they age. Figures show that at some point, 80% of women will be responsible for their household income.

Building the ranks of female advisors — and working to retain them — as well as building a practice that makes special efforts to reach out to female investors and heads of households is just good business sense, in addition to offering a necessary remedy for the serious financial challenges that many women face.

This year, Women’s History Month should mark the start of an ongoing effort to recognize the unfair financial history of women — and to change it.

Welcome to Society of FSP

As we strive to broaden the voices in the magazine, we are working to expand the number of professional associations providing useful information and discussion for our readers. With this issue, we welcome the Society of Financial Service Professionals to our pages. We know that FSP, which is such a great resource for information and education, will add to the valuable discussions and provide actionable insights for our readers. Welcome to FSP!

ICYMI > In Case You Missed It

Also, starting with this issue, the magazine will feature a new section called ICYMI, or In Case You Missed It. This new section will feature some of the great articles published on the INN website. In addition to all the valuable content you read every month in the magazine, there is more to be found on InsuranceNewsNet.com. With ICYMI, we’ll provide a snapshot of some of that great content — and we hope to entice you to explore more.

John Forcucci is InsuranceNewsNet editor-in-chief. He has had a long career in daily and weekly journalism. Contact him at johnf@innemail.

Keep your emails out of the spam folder

Women agents and advisors making history in 2023

Advisor News

- Global economic growth will moderate as the labor force shrinks

- Estate planning during the great wealth transfer

- Main Street families need trusted financial guidance to navigate the new Trump Accounts

- Are the holidays a good time to have a long-term care conversation?

- Gen X unsure whether they can catch up with retirement saving

More Advisor NewsAnnuity News

- Pension buy-in sales up, PRT sales down in mixed Q3, LIMRA reports

- Life insurance and annuities: Reassuring ‘tired’ clients in 2026

- Insurance Compact warns NAIC some annuity designs ‘quite complicated’

- MONTGOMERY COUNTY MAN SENTENCED TO FEDERAL PRISON FOR DEFRAUDING ELDERLY VICTIMS OF HUNDREDS OF THOUSANDS OF DOLLARS

- New York Life continues to close in on Athene; annuity sales up 50%

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- Legals for December, 12 2025

- AM Best Affirms Credit Ratings of Manulife Financial Corporation and Its Subsidiaries

- AM Best Upgrades Credit Ratings of Starr International Insurance (Thailand) Public Company Limited

- PROMOTING INNOVATION WHILE GUARDING AGAINST FINANCIAL STABILITY RISKS SPEECH BY RANDY KROSZNER

- Life insurance and annuities: Reassuring ‘tired’ clients in 2026

More Life Insurance News