A man on a mission — With Foresters Financial’s Matt Berman

Matt Berman said that while Foresters Financial looks economically like a mutual, the difference is that “we are operating with mission, with purpose. Our North Star is simply enriching the lives of middle-market families.”

While most fraternal organizations have a religious or cultural denomination, Berman says “Foresters is unique in that we are nondenominational.” He credits “the foresight of our founders thinking about this charter to enrich the well-being of middle-market families in their communities” a century and a half ago.

Prior to serving in his current position, Berman is credited with heading the transformation of Foresters’ distribution channels, product portfolio, operations and underwriting. His achievements also include new agent-intermediated and direct-to-consumer sales partnerships, diversifying the product portfolio and a commitment to enhancing the digital customer journey. He has championed a culture of well-being by introducing first-in-market products and member benefits protecting individuals living with diabetes.

In this interview with InsuranceNewsNet Publisher Paul Feldman, Berman describes how Foresters is committed to building a better future, starting with protecting the financial futures of its members and their families.

Paul Feldman: You were recently named CEO and president of Foresters Financial. You were previously the president of their U.S. division. How do your responsibilities change compared to your previous position?

Matt Berman: In my former role, I was president of the U.S. and the Canada divisions. And so, my line of sight was laser focused on the profitability of those two divisions. In this new role, the mandate is much broader.

We have a business in the U.K., so my line of sight now expands across our global footprint, and I have all of the additional functional areas — whether it’s human resources, legal, finance — that now fall under my mandate. Now I’m in this seat and engaging with our board of directors, engaging with all our stakeholders around the globe — it has been a big step forward.

Feldman: You’ve had an illustrious career in insurance. Tell us a little bit about your background.

Matt Berman: I’ve been fortunate to have seen the insurance business from both the property and casualty sector as well as the life and savings sector. Before coming to Foresters, I spent 10 years at AXA, which is now Equitable. And those were amazing years — the experience I had, the things I learned. In many ways, it was a Ph.D. in the life insurance sector, and it was an incredible journey.

Prior to that, I spent most of my years on the property and casualty side, both on the principal side of the business — more focused on the underwriting and on the intermediary side. In those years in the property and casualty sector, I was focused on large commercial risk, looking at professional liability, directors and officers, liability errors, and admissions liability — the totality of all of it. It has given me some fantastic perspective on the movement of capital, the value of underwriting. And I think it showed me the immense gravity that we have as an industry to not only buoy financial markets but provide a social good to our customers and our clients.

Feldman: Foresters is a fraternal company. Tell us a little bit about what makes that different.

Matt Berman: In the life insurance sector, you have stock companies and you have the mutuals. I think the delineation is very clear. On the mutual side, the policyholders own the entity; on the stock side, you have shareholders. In many ways, we look economically like a mutual, but what differentiates us is that we are operating with mission, with purpose. There are fraternals in our ecosystem that have an affiliation to either religion or maybe cultural heritage. Foresters is unique in that we are nondenominational. We don’t have a religious affiliation we don’t have an affiliation to any cultural heritage.

Our North Star is simply enriching the lives of middle-market families. And that nexus of well-being has been part of our charter for 150 years. What that means, more practically speaking, is that a portion of our earnings goes back to our members, and it goes back to our members in the form of benefits.

Now, those benefits could be scholarship opportunities, granting opportunities. We have invested in wellness platforms. When you think about the importance of purpose to social well-being, these are elements to our organization, elements within our DNA that have been alive and authentic for a century and a half.

We will be a fraternal for another 150 years. I find our structure to be unique. I am forever fascinated by the foresight of our founders’ thinking about this charter to enrich the well-being of middle-market families in their communities. As I’m sure you’ve seen, many organizations — not necessarily life and savings or property and casualty insurers, but organizations around corporate North America — are embracing this concept of social responsibility and purpose. I laugh a little bit because I feel like folks have gotten newfound religion on this topic of purpose. Purpose has been in our DNA for 150 years.

Not only does the structure enable financial strength, but it also allows me and my executive team and all of our employees to think equally about the long term and the short term. We’re not handcuffed to Wall Street or analysts thinking about “Hey, where do earnings per share land this quarter?” Sometimes you have to plant the seed for something that may not be immediate, and we can do that inside of our construct. But I think what makes us even more unique inside of this fraternal framework is our ability to earmark a portion of our earnings, bring it back to our membership and make sure that it’s complementary to the products and offerings we provide.

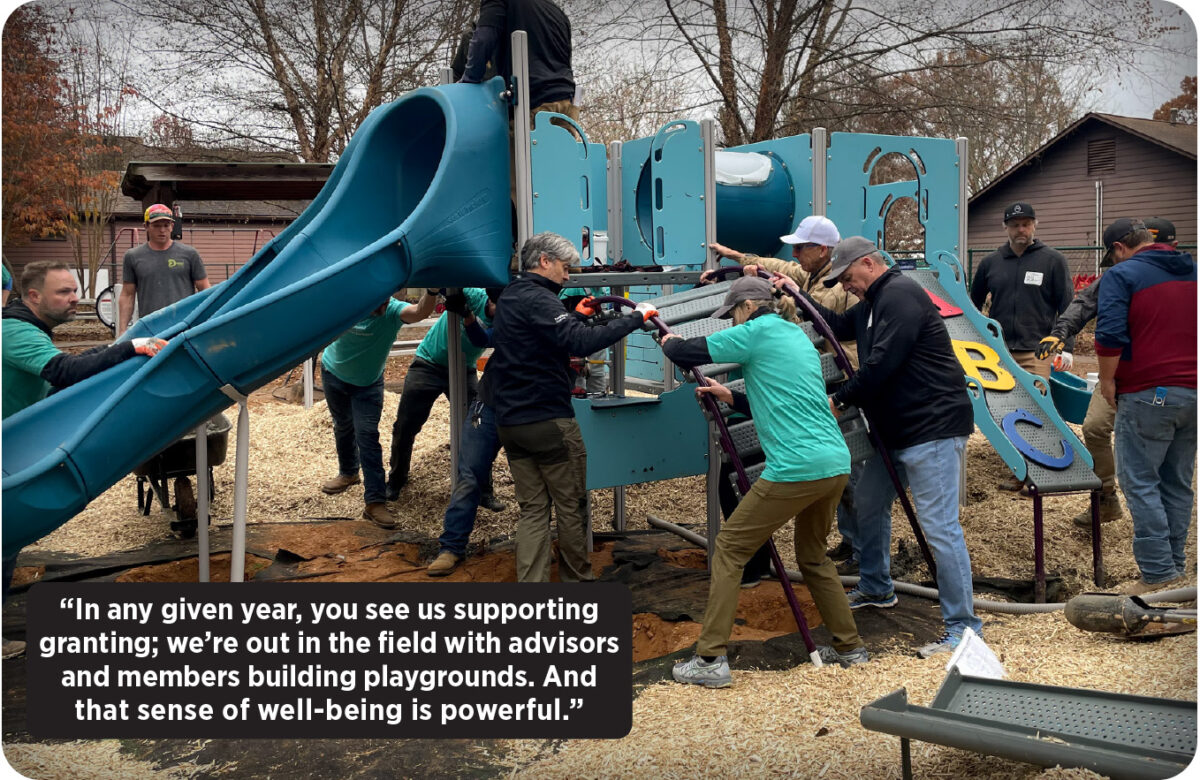

I’m a big believer that at our core, what differentiates us in this fraternal world is that we were founded on volunteerism. In any given year, you see us supporting granting; we’re out in the field with advisors and members building playgrounds. And that sense of well-being is powerful.

We’ve invested in these engagement platforms. We partnered with a Swiss insurtech, dacadoo, and our members are eligible to participate in this custom-designed engagement platform that allows individuals to engage in healthy activities, engage in volunteerism. There’s a reward system based on that platform. But I think the hurdle for us is whether a policyholder will see their life insurance company as their health advisor. I think that’s still a mindset hurdle. We should promote these wellness platforms because it’s a win-win for all stakeholders. But it may not seem so intuitive at the customer level. For us, it’s easier because it has been in our DNA; it’s in our mission to support well-being. But the industry as a whole has a way to go.

Feldman: One of the things that I noticed on your website, through your communications and certainly in this conversation, is the use of “members” rather than “policyholders.” Policyholder feels like a number to me. A member seems like something I’m a part of. I know that you do a lot of things, from scholarships to all kinds of funding. What are some of the things that members get through Foresters?

Matt Berman: You mentioned the scholarship opportunities, the granting opportunities. Granting is big. It allows individuals to accumulate grant dollars so they can do good work in their community. Our granting platform allows members to promote a range of activities. We’re really proud of that. We have a partnership with an organization, LawAssure, which provides assistance on all sorts of areas around building a will, estate planning — again, services that are complementary to what we do as a life insurance organization.

With our partnership with Dacadoo, members can immediately, on registration, download an app that has been custom designed between Foresters and Dacadoo to allow our members to manage their well-being in a fun, engaging way. That covers so many dimensions — nutrition, exercise or, again, back to our core volunteerism. And members can accumulate reward points on a number of items on the app.

Feldman: You have a 150-year history. What are you seeing right now? What does your future look like?

Matt Berman: I am positive we’ll be around for another 150 years. Focusing on our future is front and center. My guiding compass has always been sticking to the fundamentals. I take a lot of pride in the culture that we’ve built. It’s the aggregate of generations of leaders and individuals contributing to our experiences collectively.

Our ability to collaborate, to work well together and be resourceful has given us a lot of wind in our sails. But in terms of more practical or, let’s say, business-focused priorities, we continue to invest in technology. Technology is a key enabler for all of our stakeholders, whether that’s our employees, our advisors or our members. We continue to focus on data to make sure that we can deliver accurate, precise decisions for our future members and do it in a way that’s seamless.

Finally, we’re making sure that we have state-of-the-art products in terms of driving value for our members and investing in our advisors. The advisor is critical in our world. There’s certainly a place for direct-to-consumer opportunities, and we’ve invested in direct-to-consumer opportunities. The lion’s share of business sold inside the life and savings sector will be intermediated because everyone’s needs are different. And the advisor is so critical to making what we do a reality.

Feldman: So how are you investing in advisors?

Matt Berman: We want to make sure that they have the best technology. We are looking to make their experiences with us turnkey. We’ve made a footprint in our specific sector through nonmedical underwriting. A portion of our business can be underwritten without blood or fluid. And we must ensure that we have the best data to make the best possible decisions. An advantage for the advisor and for our end customer is that the experience can be very transactional — as opposed to applying for life insurance, working with a paramedic to get blood and fluid, and going through the underwriting process that could take up to 30 days.

The life insurance sector hasn’t been known as the bellwether of customer experience, but that’s not to say we can’t be. No one wakes up in the morning thinking that “Hey, I want to go out and explore all of my options around protection or supplemental retirement savings.” It’s usually initiated by an advisor. And for that reason, it’s important that the advisor has the best technology, they can enjoy the best experience and they can get paid quickly. And that is just so important to make sure that they’re driving the best possible outcomes for their clients.

Feldman: Tell me a bit about the products Foresters Financial offers.

Matt Berman: I’ll start with the U.K. That’s an investments business, and we manage and sell child trust funds. So think about tax-advantaged growth for children. In North America, we are a life insurance business. We have a Canadian division; we have a U.S. division. Within both those divisions, we have a full suite of life insurance offerings. We offer universal life in the U.S., not in Canada. We have a suite of term products, and that’s really where we’re hyperfocused right now.

Our big product is our par (participating) whole life product both in the U.S. and Canada. For an organization like ours, we have a strong durable balance sheet. We can provide those products; we can price them effectively. We’ve designed them innovatively, and they compete with the big mutuals. And what makes us a bit unique is that we have this offering inside of independent distribution, both in the U.S. and Canada. The trending from all the industry data suggests that there is more interest with par whole life. It’s one of those products that offers an immense amount of stability in a world that feels more complex with every passing year.

Feldman: In the U.S., you distribute mostly through independent distribution. Is that correct?

Matt Berman: That’s right. We had a career captive sales force, but we sold that when we divested a number of assets. We had an asset manager, a broker-dealer and a career sales force that was attached to the broker-dealer. They were selling asset management products as well as life insurance products. But for the good of the entire organization, we wanted to stick within our core capabilities. We felt that some of those businesses were better partnered and aligned with businesses that were strictly in the asset management sector. Our distribution today, both in the U.S. and Canada, is independent distribution.

Feldman: What are some of the challenges you’re seeing in distribution? There have been a lot of mergers and acquisitions. How does that affect you at the carrier level?

Matt Berman: I would say that we have not seen any big shifts in behavior. We’re certainly vigilant. We’ve been tracking all that’s been happening with the private-

equity-fueled consolidation that you’re seeing. There have been a number of players that have been very active over the past five years. We maintain excellent relationships with those distribution organizations at the top of the house.

What I see happening inside those consolidations is that they’re looking to drive scale through a better allocation of resources. We keep our eyes on it. We want to make sure that the partnership is durable, that it’s working. But yes, it certainly could pose some challenges down the road, but nothing is without its challenges.

Feldman: Everything is easier because you don’t have hundreds of different distributors all funneling into you.

Matt Berman: We are connecting at so many touch points. We certainly have relationships at the top of the house, so to speak, to make sure that our strategy aligns with theirs and we can support them and they can support us. But cascading down into the partner level and then looking at the advisors, we’re engaged with everybody in that value chain. You have to be. I think that’s where, as a life insurance company supporting these organizations with a number of advisors that roll up into these organizations, that scalability can be very beneficial for us.

Feldman: There has been a lot of talk about this declining agent force. Are you seeing that on your side? People are aging out of the business. I don’t know that we’re bringing enough people into the business.

Matt Berman: It is a great question. We definitely saw a surge during COVID-19. I think the urgency of life insurance during the pandemic spiked interest in our market. A lot of individuals came into this marketplace as a second career, perhaps being displaced given the challenges of the pandemic on the economy at the outset. That has plateaued, but we’re still seeing incredible interest — individuals looking for that second career or individuals looking to find perhaps an opportunity that’s financially and socially rewarding. We’re seeing good momentum on appointments, and those degrees of interest are coming into our sector where they’re needed most to begin addressing the protection gap.

Feldman: What type of technology investments are you making? Where do you see artificial intelligence playing a role?

Matt Berman: That has been the question of the day, right? We’ve been investing in AI for quite some time. At this point, you may classify it as fundamental. We’ve invested in technology that allows us to expedite what I will call transactions that don’t necessarily require emotional intelligence. You could also make the case that underwriting has spent a fair amount of time investing in rudimentary AI to accelerate that life cycle in the risk assessment process.

In many ways, you could say that the industry as a whole — and certainly our organization — has invested in those technologies. In terms of where generative AI would play out, I see more opportunities in our operations ecosystem.

The customer requires emotional intelligence in the transaction. I would never want to make AI a substitute for emotional intelligence. But to the degree that there are transactions that are easily supported by self-service and internal transactions that are invisible to the customer, we will continue to invest. But I don’t want to sacrifice the moments where our customers need us most.

Paul Feldman started the website InsuranceNewsNet in 1999, followed by InsuranceNewsNet Magazine in 2008. Paul was a third-generation insurance agent before venturing into the media business. Paul won the 2012 Integrated Marketing Award (IMA) for Lead Gen Initiative for his Truth about Agent Recruiting video and was the runner-up for IMA's Marketer of the Year, a competition that includes consumer and B2B publishing companies. Find out more about Paul at www.paulfeldman.com.

Saving for college can impact your clients’ retirement

Standing on the shoulders of giants — With Bryan Simms

Advisor News

- Advisors underestimate demand for steady, guaranteed income, survey shows

- D.C. Digest: 'One Big Beautiful Bill' rebranded 'Working Families Tax Cut'

- OBBBA and New Year’s resolutions

- Do strong financial habits lead to better health?

- Winona County approves 11% tax levy increase

More Advisor NewsAnnuity News

- An Application for the Trademark “EMPOWER PERSONAL WEALTH” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Talcott Financial Group Launches Three New Fixed Annuity Products to Meet Growing Retail Demand for Secure Retirement Income

- Judge denies new trial for Jeffrey Cutter on Advisors Act violation

- Great-West Life & Annuity Insurance Company Trademark Application for “EMPOWER BENEFIT CONSULTING SERVICES” Filed: Great-West Life & Annuity Insurance Company

- 2025 Top 5 Annuity Stories: Lawsuits, layoffs and Brighthouse sale rumors

More Annuity NewsHealth/Employee Benefits News

- CT Senator, Health Care Advocate Push For Action On Health Insurance Costs

- Study Results from Kristi Martin and Colleagues Broaden Understanding of Managed Care and Specialty Pharmacy (Drugs anticipated to be selected for Medicare price negotiation in 2026 for implementation in 2028): Drugs and Therapies – Managed Care and Specialty Pharmacy

- Amid rising health care costs, Maryland officials to boost ‘Easy Enrollment’

- POLICY CHANGES BRING RENEWED FOCUS ON HIGH-DEDUCTIBLE HEALTH PLANS

- PAYMENT RATES FOR MEDICAID HOME CARE AHEAD OF THE 2025 RECONCILIATION LAW

More Health/Employee Benefits NewsLife Insurance News