5 questions to ask small-business owners about their exit strategies

Exit and key person strategies are critical for the survival and continuation of most small businesses — and never more so than in today’s economy. These strategies also can play a vital role in helping founders derive maximum value from their company.

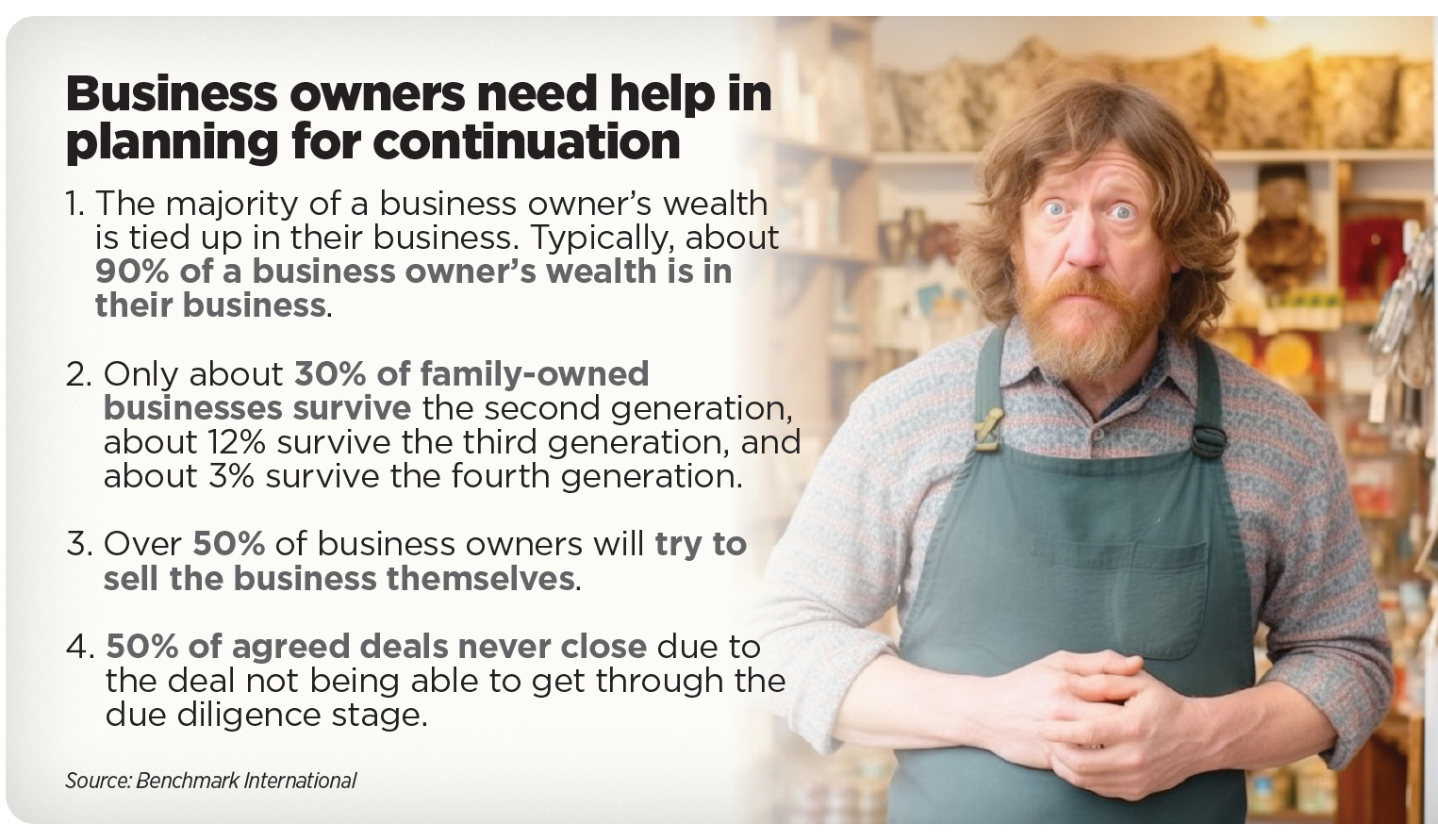

Yet, getting these strategies right isn’t always easy. In fact, according to the largest online broker site, BizBuySell.com, only between one-fifth and one-third of small firms posted for sale every year are actually sold. Likewise, many business owners are unaware of the options available to them when it comes to mitigating the risk of losing a partner or key employee.

Financial advisors play a valuable role in helping clients understand the details behind their most important financial decisions and then arrive at the best possible choice for them. It’s never too early to begin discussing exit and key person strategies. Here are five critical questions to ask your business owner clients.

1. Do they have a backup plan?

Many business owners figure that when they’re ready to retire, they’ll simply go right ahead and sell their business to a third party. But the reality is often rather different, either because the sale takes a long time or because the sale doesn’t happen at all.

Therefore, in the same way they have a business plan to guide the growth of their company, every small-business owner should have a plan that guides the company to conclusion.

This plan should include a backup option in case a third-party sale isn’t possible, such as passing the business on to a family member or grooming a partner, investor or key employee for a buy-sell agreement.

2. Are they using key person life insurance?

Every small company has at least one employee — the founder — and often others who serve as the bedrock for the company to function. The loss of this key person or employee can have an outsized impact on the business’s performance.

A life insurance policy for owners or key employees means if one of the people covered by the policy leaves due to disability or death or to pursue another career opportunity, those remaining with the company can use the cash value of the plan as liquidity to buy out that person’s share of the business. This mitigates the financial risk and ensures continuity. It also offers an extra incentive for key employees to stay with the company.

3. Are they planning their exit already?

For most business owners, it feels strange to think of leaving the company when they’re just setting out or still in the midst of growing it. Even so, they should start planning their exit from Day One. Many owners, for example, will want to draw income from the business for their own benefit throughout their working life. But when it comes to sale, this can make it harder to prove the company’s value.

Again, a good option here (especially for those not looking to sell for many years) is to use a key person life insurance policy. Over time, this will allow them to build a substantial cash value in a tax-optimal way. It will also make the business more attractive to buyers because it offers reassurance that if a key person were to walk away after acquisition, the policy could help fund a buy-sell agreement or contribute toward the cost of recruiting a successor.

4. Are they saving for retirement?

Running a small business is hard work, often leaving little time to think about anything else!

Many owners may therefore forget there’s more to life — and personal finance — than business, neglecting the crucial need to create economic value for themselves outside their company. A large majority of business owners don’t even save regularly for retirement, relying instead on their business as their biggest asset.

Yet ideally, owners should build a diversified financial portfolio that ensures they’re financially well prepared for exit no matter what. Whether it’s through tax-efficient savings vehicles, retirement accounts, solid insurance coverage or personal assets not tied to the business (such as real estate), it’s vital to ensure owners are actively planning for life after work.

5. Have they determined a valuation?

A key aspect of any exit strategy is the business valuation, so owners should consult a qualified advisor to determine this. There are also transition managers whose role is to assist sellers with their business exit strategies. Even the smallest companies can find buyers if the business is in a position to transfer value to a different owner — but this transferability of value is key.

Businesses for which success hinges on the unique drive, talents or social relationships of a single individual often don’t meet this standard, making a sale more unlikely.

Of course, there are many other ways small-business owners can build assets and cash value over time. It’s the advisor’s job to lay out those options and help the owners decide which one (or more) best suits the unique needs of their lifestyle and their company. While the answer to these five questions may be different for every small-business owner, what’s invariably true is that by discussing their exit and key person strategies with them now, we can significantly improve the likelihood of their leaving their company exactly how they want to in future.

Perry Goldschein, J.D., is a financial professional with Equitable Advisors. He may be contacted at [email protected].

Commercial property owners stressed in a challenging P/C market

Will AG 49-B be a May Day or meh day for IUL illustrations?

Advisor News

- The best way to use a tax refund? Create a holistic plan

- CFP Board appoints K. Dane Snowden as CEO

- TIAA unveils ‘policy roadmap’ to boost retirement readiness

- 2026 may bring higher volatility, slower GDP growth, experts say

- Why affluent clients underuse advisor services and how to close the gap

More Advisor NewsAnnuity News

- Pinnacle Financial Services Launches New Agent Website, Elevating the Digital Experience for Independent Agents Nationwide

- Insurer Offers First Fixed Indexed Annuity with Bitcoin

- Assured Guaranty Enters Annuity Reinsurance Market

- Ameritas: FINRA settlement precludes new lawsuit over annuity sales

- Guaranty Income Life Marks 100th Anniversary

More Annuity NewsHealth/Employee Benefits News

- On the hook for uninsured, counties weighing costs

- Research from Northwestern University Feinberg School of Medicine Yields New Findings on Managed Care (Systematic Review of Managed Care Medicaid Outcomes Versus Fee-for-Service Medicaid Outcomes for Youth in Foster Care): Managed Care

- Researchers from University of Alabama Report Details of New Studies and Findings in the Area of Managed Care (Nursing leadership in Housing First implementation: A comparative analysis of care coordination approaches across four U.S. states): Managed Care

- Studies from Johns Hopkins University Bloomberg School of Public Health in the Area of Mental Health Diseases and Conditions Described (Mental health care use after leaving Medicare Advantage for traditional Medicare): Mental Health Diseases and Conditions

- New Findings from Robert L. Phillips and Co-Authors in the Area of Health and Medicine Reported (Estimation of Mortality via the Neighborhood Atlas and Reproducible Area Deprivation Indices): Health and Medicine

More Health/Employee Benefits NewsLife Insurance News