2Q Indexed Life Sales Rocket To Near Record Highs

Indexed life sales for the second quarter were $552.7 million; up more than 13.6 percent when compared with the prior quarter, and up over 13.9 percent compared to the same period last year.

“This was the second-highest quarter ever for indexed life insurance sales,” said Sheryl J. Moore, president and CEO of both Moore Market Intelligence and Wink, Inc. "If you thought the close of last year’s sales were impressive, you need to see the products that are being sold today— they are definitely going to drive us to record-breaking sales this year.”

Items of interest in the indexed life market included Pacific Life Companies retaining the No. 1 ranking in indexed life sales, with a 16.5 percent market share. National Life Group, Transamerica, Minnesota Life-Securian, and Nationwide concluded the top five sellers, respectively.

Pacific Life’s Pacific Discovery Xelerator IUL was the No. 1 selling indexed life insurance product, for all channels combined, for the quarter. The top pricing objective for sales this quarter was Cash Accumulation, capturing 82.6 percent of sales.

The average indexed life target premium reported for the quarter was $8,869, a decline of nearly 4 percent as compared to the prior quarter.

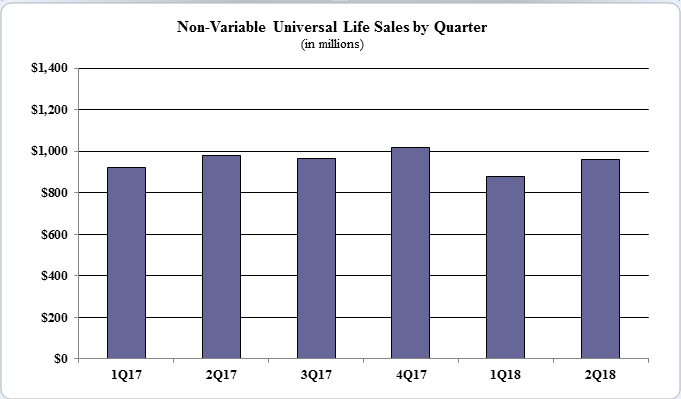

Non-Variable UL Up And Down

Non-variable universal life sales for the second quarter were more than $958.1 million -- up more than 9 percent compared to the previous quarter and down more than 2.2% as compared to the same period last year.

Non-variable universal life sales include both indexed UL and fixed UL product sales.

Noteworthy highlights for total non-variable universal life sales in the second quarter included Pacific Life Companies retaining their rank as the No. 1 company overall for non-variable universal life sales, with a market share of 9.8 percent.

Pacific Life’s Pacific Discovery Xelerator IUL was the No. 1 selling product for non-variable universal life sales, for all channels combined, in the second quarter.

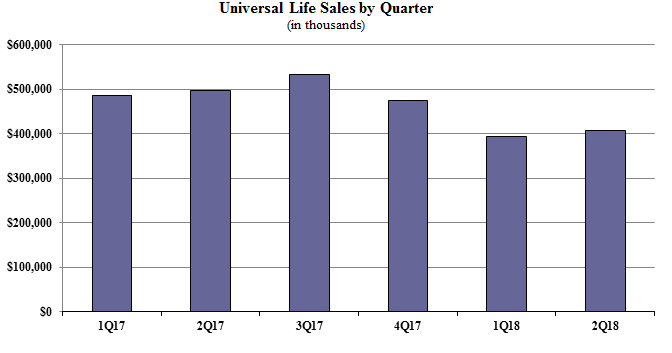

Fixed UL second quarter sales were $406.7 million. Noteworthy highlights for fixed universal life in the second quarter include the top pricing objective of No Lapse Guarantee, capturing 63.8 percent of sales. The average UL target premium reported for the quarter was $5,021, a decline of 2 percent from the prior quarter.

Whole Life Steady

Whole life second-quarter sales were $1.1 billion. Items of interest in the whole life market included the top pricing objective of Cash Accumulation capturing 72.7 percent of sales.

The average annual premium per whole life policy reported for the quarter was $3,296, an increase of less than 1 percent from the prior quarter.

Wink is focusing on increasing participation with their current product lines of indexed universal life, traditional universal life, indexed whole life, and traditional whole life product sales. Additional product lines, such as term life insurance, will be added to Wink’s Sales & Market Report in upcoming quarters.

Lincoln Steers Annuity Distribution Into IMO Channel With New Deal

2Q Individual Life Insurance New Premium Grows At 2%

Advisor News

- Millennials seek trusted financial advice as they build and inherit wealth

- NAIFA: Financial professionals are essential to the success of Trump Accounts

- Changes, personalization impacting retirement plans for 2026

- Study asks: How do different generations approach retirement?

- LTC: A critical component of retirement planning

More Advisor NewsAnnuity News

- Symetra Enhances Fixed Indexed Annuities, Introduces New Franklin Large Cap Value 15% ER Index

- Ancient Financial Launches as a Strategic Asset Management and Reinsurance Holding Company, Announces Agreement to Acquire F&G Life Re Ltd.

- FIAs are growing as the primary retirement planning tool

- Edward Wilson Joins SEDA, Bringing Deep Expertise in Risk Management, Derivatives Trading and Institutional Prime Brokerage

- Trademark Application for “INSPIRING YOUR FINANCIAL FUTURE” Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

More Annuity NewsHealth/Employee Benefits News

- Mystic resident attends State of Union to highlight healthcare cost increases

- Findings from University of Connecticut School of Medicine Provides New Data about Managed Care (Nursing Home Ratings and Characteristics Predict Hospice Use Among Decedents With Serious Illnesses): Managed Care

- Missouri, Kansas families pay nearly 10% of their income on employer-provided health insurance

- Researchers from California Polytechnic State University Report on Findings in COVID-19 (Exploring the Role of Race/Ethnicity, Metropolitan Status, and Health Insurance in Long COVID Among U.S. Adults): Coronavirus – COVID-19

- TrumpRx: Better prescription drug deals may already exist

More Health/Employee Benefits NewsLife Insurance News