1Q Deferred Annuity Sales Strong, Despite Late COVID-19 Impact

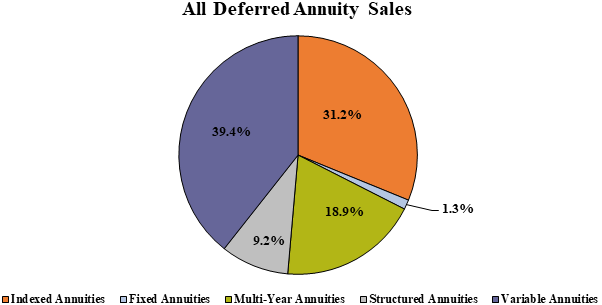

Despite the COVID-19 market devastation, deferred annuity sales remained strong in the first quarter at $52.7 billion, a slim 1.1% decline, according to Wink’s Sales & Market Report.

The pandemic effects came late in the first quarter, industry sources note, and its impacts might be seen in second quarter results. But for now, industry can celebrate good sales numbers.

“It is amazing that annuity sales are only down in the single digits, given the devastating effects that COVID-19 has wreaked on the annuity industry,” said Sheryl J. Moore, president and CEO of both Moore Market Intelligence and Wink, Inc.

Total quarterly sales of deferred annuities declined 4% when compared to the same period last year. Noteworthy highlights include Jackson National Life ranking as the No. 1 carrier overall for deferred annuity sales, with a market share of 9.5%.

Lincoln National Life followed in second place, while AIG, Equitable Financial and Allianz Life rounded-out the top five carriers in the market, respectively. Jackson National’s Perspective II Flexible Premium Variable & Fixed Deferred Annuity, a variable annuity, was the No. 1 selling deferred annuity, for all channels combined in overall sales for the fifth consecutive quarter.

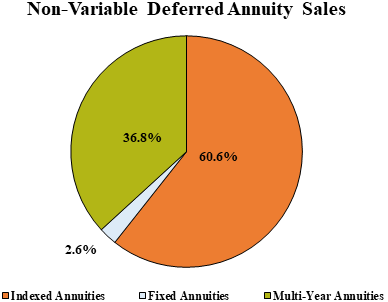

Total first-quarter non-variable deferred annuity sales were $27 billion, down 0.3% when compared to the previous quarter and down 19% when compared to the same period last year. Non-variable deferred annuities include the indexed annuity, traditional fixed annuity, and MYGA product lines.

Noteworthy highlights for non-variable deferred annuity sales in the first quarter include AIG ranking as the No. 1 carrier overall for non-variable deferred annuity sales, with a market share of 7.7%. Global Atlantic Financial Group moved into second place, while Allianz Life, New York Life, and Nationwide rounded-out the top five carriers in the market, respectively.

Allianz Life’s Allianz 222 Annuity, an indexed annuity, was the No. 1 selling non-variable deferred annuity, for all channels combined, in overall sales for the sixteenth consecutive quarter.

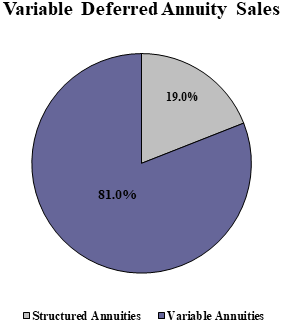

Total first-quarter variable deferred annuity sales were $25.6 billion, a decline of 2.7% when compared to the previous quarter and an increase of 18.9% when compared to the same period last year. Variable deferred annuities include the structured annuity and variable annuity product lines.

Noteworthy highlights for variable deferred annuity sales in the first quarter include Jackson National Life ranking as the No. 1 carrier overall for variable deferred annuity sales, with a market share of 15.6%. Equitable Financial retained their second place position, as Lincoln National Life, Prudential, and Brighthouse Financial rounded-out the top five carriers in the market, respectively.

Jackson National’s Perspective II Flexible Premium Variable & Fixed Deferred Annuity, a variable annuity, was the No. 1 selling variable deferred annuity, for all channels combined, in overall sales for the fifth consecutive quarter.

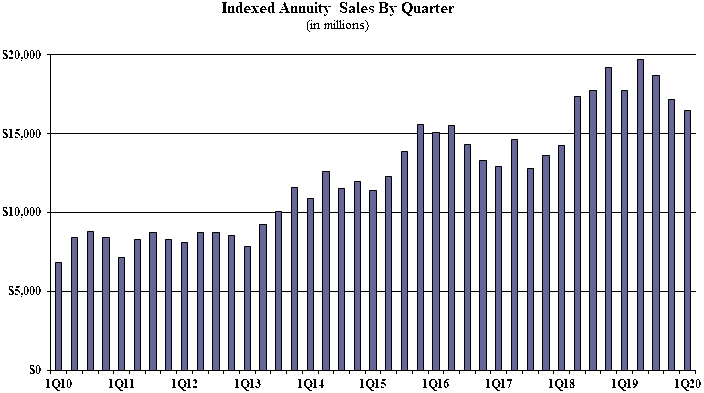

Indexed annuity sales for the first quarter were $16.4 billion, down 4.3% when compared to the previous quarter, and down 7.4% when compared with the same period last year. Indexed annuities have a floor of no less than zero percent and limited excess interest that is determined by the performance of an external index, such as Standard and Poor’s 500®.

“While no one likes to see a sales decline, it is amazing indexed annuities fared as well as they did,” stated Moore. “Other types of fixed annuities saw sales declines of 27% - 32% amidst the drop in the 10-year Treasury and market volatility."

Noteworthy highlights for indexed annuities in the first quarter include Allianz Life retaining their No. 1 ranking in indexed annuities, with a market share of 9.5%. AIG held the second-ranked position while Nationwide, Athene USA, and Lincoln National Life rounded-out the top five carriers in the market, respectively.

Allianz Life’s Allianz 222 Annuity was the No. 1 selling indexed annuity, for all channels combined, for the nineteenth consecutive quarter.

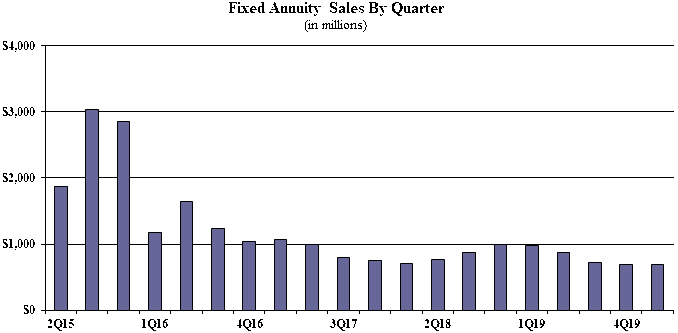

Traditional fixed annuity sales in the first quarter were $691.3 million. Sales were flat when compared to the previous quarter, and down 27.1% when compared with the same period last year. Traditional fixed annuities have a fixed rate that is guaranteed for one year only.

Noteworthy highlights for traditional fixed annuities in the first quarter include Modern Woodmen of America ranking as the No. 1 carrier in fixed annuities, with a market share of 10.9%. Jackson National Life ranked second, while Global Atlantic Financial Group, OneAmerica, and EquiTrust rounded-out the top five carriers in the market, respectively.

Forethought Life ForeCare Fixed Annuity was the No. 1 selling fixed annuity for the fourth consecutive quarter, for all channels combined.

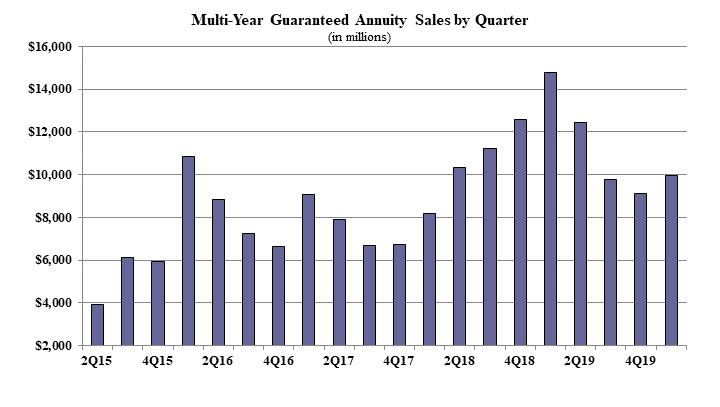

Multi-year guaranteed annuity (MYGA) sales in the first quarter were $9.9 billion, up 9% when compared to the previous quarter, and down 32.4% when compared to the same period last year. MYGAs have a fixed rate that is guaranteed for more than one year.

Noteworthy highlights for MYGAs in the first quarter include New York Life ranking as the No. 1 carrier, with a market share of 14.4%. Massachusetts Mutual Life Companies moved to the second-ranked position, as Global Atlantic Financial Group, AIG and Western-Southern Life Assurance Company rounded-out the top five carriers in the market, respectively.

Massachusetts Mutual Life Stable Voyage 3-Year was the No. 1 selling multi-year guaranteed annuity for the second consecutive quarter, for all channels combined.

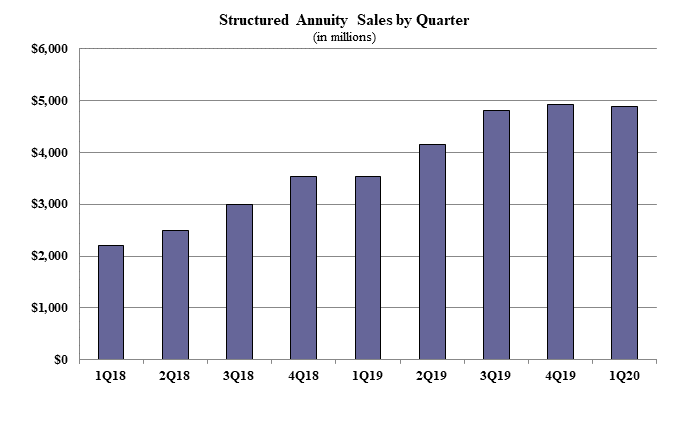

Structured annuity sales in the first quarter were $4.8 billion, down 1% as compared to the previous quarter, and up 37.8% as compared to the previous year. Structured annuities have a limited negative floor and limited excess interest that is determined by the performance of an external index or subaccounts.

“Structured annuity is the fastest-growing segment of the annuity market, thanks to record-low interest rates," Moore said. "While sales were down 1% from last quarter, they were up nearly 40% from this time last year.”

Noteworthy highlights for structured annuities in the first quarter include Equitable Financial ranking as the No. 1 carrier in structured annuities, with a market share of 25.1%. Lincoln National Life Level Advantage B Share was the No. 1 selling structured annuity for the quarter, for all channels combined.

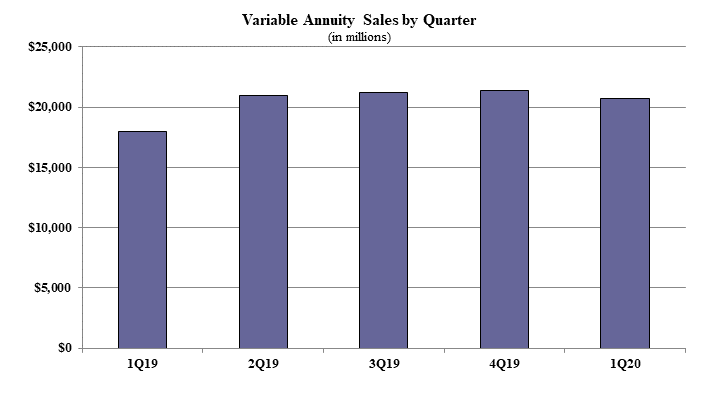

Variable annuity sales in the first quarter were $20.7 billion, a decline of 3.1% as compared to the previous quarter and an increase of 15.1% as compared to the same period last year. Variable annuities have no floor, and potential for gains/losses that are determined by the performance of the subaccounts that may be invested in an external index, stocks, bonds, commodities, or other investments.

Noteworthy highlights for variable annuities in the first quarter include Jackson National Life holding-on to their ranking as the No. 1 carrier in variable annuities, with a market share of 19.2%. Prudential ranked second, while Lincoln National Life, Equitable Financial, and Nationwide rounded-out the top five carriers in the market, respectively.

Jackson National’s Perspective II Flexible Premium Variable & Fixed Deferred Annuity was the No. 1 selling variable annuity for the fifth consecutive quarter, for all channels combined.

Wink reports on indexed annuity, fixed annuity, multi-year guaranteed annuity, structured annuity, variable annuity, and multiple life insurance lines’ product sales. Sales reporting on additional product lines will follow in the future, Moore said.

Sixty-one indexed annuity providers, 48 fixed annuity providers, 68 multi-year guaranteed annuity (MYGA) providers, 12 structured annuity providers, and 47 variable annuity providers participated in the 91st edition of Wink’s Sales & Market Report for the first quarter 2020.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

© Entire contents copyright 2019 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

Carriers Cut Age Groups From Coverage

Some Annuity Carriers Getting Ready To Return Products To Market

Advisor News

- Global economic growth will moderate as the labor force shrinks

- Estate planning during the great wealth transfer

- Main Street families need trusted financial guidance to navigate the new Trump Accounts

- Are the holidays a good time to have a long-term care conversation?

- Gen X unsure whether they can catch up with retirement saving

More Advisor NewsAnnuity News

- Lincoln Financial Introduces First Capital Group ETF Strategy for Fixed Indexed Annuities

- Iowa defends Athene pension risk transfer deal in Lockheed Martin lawsuit

- Pension buy-in sales up, PRT sales down in mixed Q3, LIMRA reports

- Life insurance and annuities: Reassuring ‘tired’ clients in 2026

- Insurance Compact warns NAIC some annuity designs ‘quite complicated’

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- Flawed Social Security death data puts life insurance benefits at risk

- EIOPA FLAGS FINANCIAL STABILITY RISKS RELATED TO PRIVATE CREDIT, A WEAKENING DOLLAR AND GLOBAL INTERCONNECTEDNESS

- Envela partnership expands agent toolkit with health screenings

- Legals for December, 12 2025

- AM Best Affirms Credit Ratings of Manulife Financial Corporation and Its Subsidiaries

More Life Insurance News