Carriers Cut Age Groups From Coverage

The life insurance industry finds itself in an awkward position of finding increased demand from consumers intensely aware of mortality during a pandemic, just as companies have to restrict products because of the mysterious, novel coronavirus.

The coronavirus is most dangerous to the elderly, who are increasingly shut out of life insurance because of the uncertain risk that companies cannot underwrite. The restrictions have busy independent agents and marketing organizations scrambling to find companies that will accept their applicants.

The squeeze made mainstream news when The Wall Street Journal reported earlier this month that consumers were being turned down.

Life companies depend on predictable mortality tables to price products, a process that’s been turned upside down by the pandemic, said The American Council of Life Insurers.

"There’s no question that COVID-19 has raised underwriting challenges," said Whit Cornman, ACLI director of media relations. "Information from a variety of sources shows that the pandemic is hitting older Americans especially hard, resulting in an unprecedented disruption to mortality data. This has created a lot of uncertainty that makes it difficult for life insurers to set premiums in the near term for this important group."

Insurance applications for those over 60 have dropped precipitously in March and April, according to the MIB Life Index.

“April’s age groups distinctly display pandemic purchasing preferences with the slight dip in younger ages showing a greater comfort with online life insurance purchases and sharp dip in older buyers (60+) show the impact of COVID-19 on face-to-face sales and product changes at carriers,” MIB reported.

Applications Down Overall

Although the over-60 group was the leading age band in applications in 2019, the number was down 9.7% in April compared to April 2019, according to MIB.

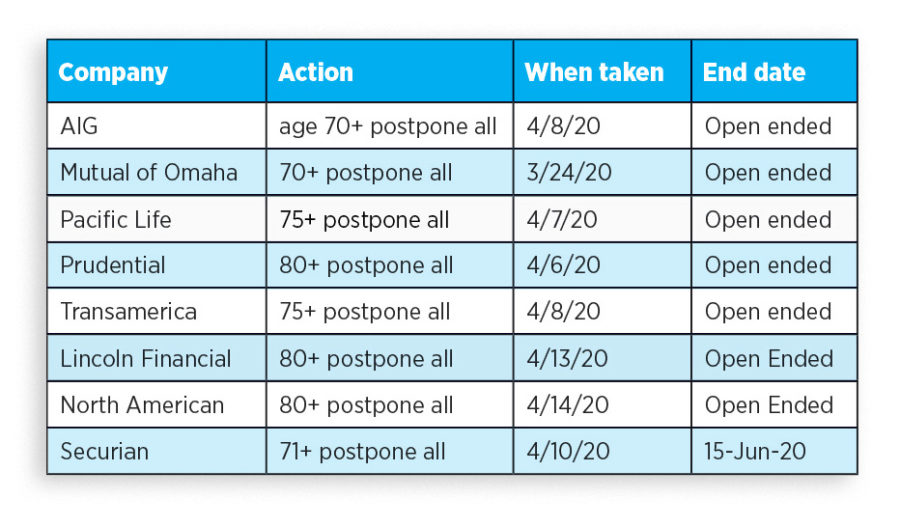

An InsuranceNewsNet review of companies found that almost all major carriers have restricted some age groups.

At least a dozen major insurers paused life insurance sales in March and April for consumers ages 70 and over. Many insurers also restricted sales for younger consumers based on selected underwriting outcomes.

For example, industry sources say some insurers are disqualifying applicants who have any of the underlying medical conditions health experts say make them more susceptible to COVID-19. These include respiratory and heart conditions. One insurer is not taking applications from applications of any age for 30 days after testing positive for the virus.

InsuranceNewsNet contacted insurers known to have suspended sales. Those who responded say they did not take the decision lightly.

Prudential is being less conservative than most companies, cutting off policy sales at age 80 and above, which accounted for .1% of total sales volume in 2019 and so far in 2020, said Jamie Lorenz, manager of global communications.

"We will continue to maintain a prudent financial approach, continuously evaluating our product portfolio and making adjustments that enable us to continue to deliver for our customers," Lorenz said in an email.

The Wall Street Journal article reported that Prudential told brokers that its late-April rate increases of 8% to 12% on select policies, along with other actions, “put us in a much better position to withstand the low interest-rate environment.”

The nation's largest insurer by assets, Prudential also suspended sales of its 30-year term life insurance offering on April 13.

'We Will Revisit'

The company cited the other side of the squeeze, historically low interest rates. The suspension, which will last until June, is in response to "unprecedented market volatility over the past month and the anticipated low interest rate environment for the foreseeable future," Prudential said in a statement.

Prudential said the suspension will last until at least June. Although carriers said the restrictions were set for a few months, many, like Securian Financial, were indistinct when those restrictions might be removed.

"We do not take making these changes lightly and did so after considering the impact on our prospective customers and business," said Jeff Bakken, public relations manager at Securian Financial, which suspended life insurance underwriting for consumers ages 71 and older. "We will revisit this decision as the impact of the pandemic becomes clearer."

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

© Entire contents copyright 2020 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

DOL Rule Will Allow Plan Providers To Utilize Electronic Communication

1Q Deferred Annuity Sales Strong, Despite Late COVID-19 Impact

Advisor News

- Emergency Preparedness: How advisors can prepare clients for hurricanes

- Federal employees: An emerging market for advisors

- The financial advisor’s guide to creating an effective value proposition

- Thrivent survey finds gap between financial fear and action

- 1 in 3 say it doesn’t make financial sense to retire in their location

More Advisor NewsAnnuity News

Health/Employee Benefits News

- Health insurance for millions could vanish as states put Medicaid expansion on chopping block

- AG releases tips to stay protected from debt collectors

- NE Lawmakers give First-Round Yes to Bill to Increase Medicaid Reimbursement Rates without General Fund Dollars

- After more than 1,000 layoffs, worries persist about CVS Health's future in Connecticut

- Unraveling Medicaid hospital payments

More Health/Employee Benefits NewsLife Insurance News

- Best's Review Examines Value in Innovation Culture

- Initial Registration Statement for Employee Benefit Plan (Form S-8)

- Securian Financial Enhances Its Flagship Indexed Universal Life Insurance Product

- AM Best Affirms Credit Ratings of The Dai-ichi Life Insurance Company, Limited

- Annual Report for Fiscal Year Ending December 31, 2024 (Form 40-F)

More Life Insurance News