Tax Armageddon Is Coming, but You and Your Clients Can Come Out on Top

It’s easy to be distracted by all that is going on both in the financial world and elsewhere. But amid these distractions, it’s crucial not to overlook the looming deadline for tax changes. And if you’ve been wondering about the potential impact of these tax changes, you’re not alone.

Talking to Your Clients About Tax Deferral

As a financial professional, you know the value of tax deferral but your clients might need a refresher. Here’s a quick pitch you can use to help them understand how they can benefit from tax-deferred savings vehicles like nonqualified deferred annuities.

Tax deferral helps your clients keep more of their money working for them. A nonqualified deferred annuity can:

» Allow them to delay paying taxes on their earnings.

» Provide more control over their income and the ability to take advantage of the benefits of compounding.

» Potentially help them avoid “stealth” taxes such as the taxation of Social Security benefits, the income-related monthly adjustment amount surtax on Medicare Parts B and D premiums, the net investment income tax, and other income thresholds that can eat into their retirement savings.

While these features are beneficial at any time, they will become even more important if and when TCJA expires.

Preparing for the TCJA Sunset

As TCJA’s expiration looms, it’s essential to anticipate how its changes could impact your clients’ tax bill. If the act sunsets, tax rates will revert to their 2017 levels, potentially leading to higher taxes for many individuals. The following consequences should be considered in helping clients mitigate their tax burden.

Standard deduction cut in half: If TCJA sunsets in 2025, income tax rates will revert to the 2017 rates and generally less generous thresholds in 2026. But that’s not the only provision that will impact taxes owed. TCJA doubled the then-current standard deduction. If the act sunsets in 2025, the standard deduction will be cut in half. In 2024, it’s $29,200 for married couples filing jointly and $14,600 for single filers.

Return of personal exemptions: TCJA also eliminated the personal exemption. If the act sunsets, the personal exemption will return and will be indexed for the intervening years. Generally, the personal exemption could be claimed for each taxpayer and each person claimed as a dependent. Unfortunately, deductions for personal exemptions were subject to a phaseout, and a return of this could adversely affect high-income earners. Specifically, the exemptions phased out by 2% for every $2,500 of adjusted gross income (AGI) over the threshold (every $1,250 for those married filing separately). Any resulting reduction would apply to all personal exemptions.

Reinstatement of the limitation on itemized deductions: TCJA eliminated the overall limitation on itemized deductions — often called the Pease limitation.

If the act sunsets, the Pease limitation on itemized deductions will return in 2026. The beginning threshold of the phaseout range in 2017 was the same as for the personal exemption, but it worked a little differently. For every dollar of AGI over the specified threshold, 3% of that amount would be subtracted from the taxpayer’s itemized deductions. In addition, there was no ending threshold since the number of itemized deductions is unlimited, as opposed to the personal exemption being a set amount.

Keep in mind that increasing deductions — that is, using tax-saving strategies such as charitable deductions — still makes sense when and if the Pease limitation on itemized deductions returns in 2026. In any case, the more deductions the better. Managing your clients’ income and tax brackets can play a critical role in minimizing taxes paid.

AMT impact on more taxpayers: An important provision for clients that will sunset, and one often forgotten, is the alternative minimum tax (AMT). Briefly, the AMT requires certain taxpayers to compute their income tax liability twice, once under the ordinary individual income tax rules and again under AMT rules that allow fewer tax preferences, and then pay whichever is highest.

Since TCJA, the AMT has only affected ultra-high-income earners due to increased exemptions and phaseout thresholds. For instance, the phaseout thresholds increased to $500,000 for single filers and $1,000,000 for married couples filing joint returns. And these amounts continue to be indexed for inflation — for example, the phaseout of the exemption for married couples filing jointly in 2024 is $1,218,700-$1,751,900. Without any new legislation, the 2017 exemption amounts and phaseout limits will return in 2026, although they will be indexed for the intervening years.

According to the Tax Policy Center Briefing Book, the AMT affected approximately 5.1 million taxpayers in 2017. The book estimates that after TCJA’s passage, the number of taxpayers fell to just 200,000 in 2018 and would remain constant through 2025. Barring legislation, it will affect 6.7 million in 2026 and rise to 7.6 million by 2030. It is estimated that the AMT will affect about 50% of taxpayers with $200,000 in income. How many of these will be among your clients?

Reduction of estate and gift tax exemption: In addition to the income tax changes, TCJA doubled the then-current estate and gift tax exemption from $5,000,000 to $10,000,000 beginning in 2018, subject to indexing. The estate and gift tax amount for 2024 is $13,610,000 per person and $27,220,000 per married couple. If there is no legislation, the estate and gift tax exemption will revert to $5,000,000, indexed for intervening years since 2011 – most likely it will be around $6,000,000 or $7,000,000.

Possibly the Only Welcome Changes

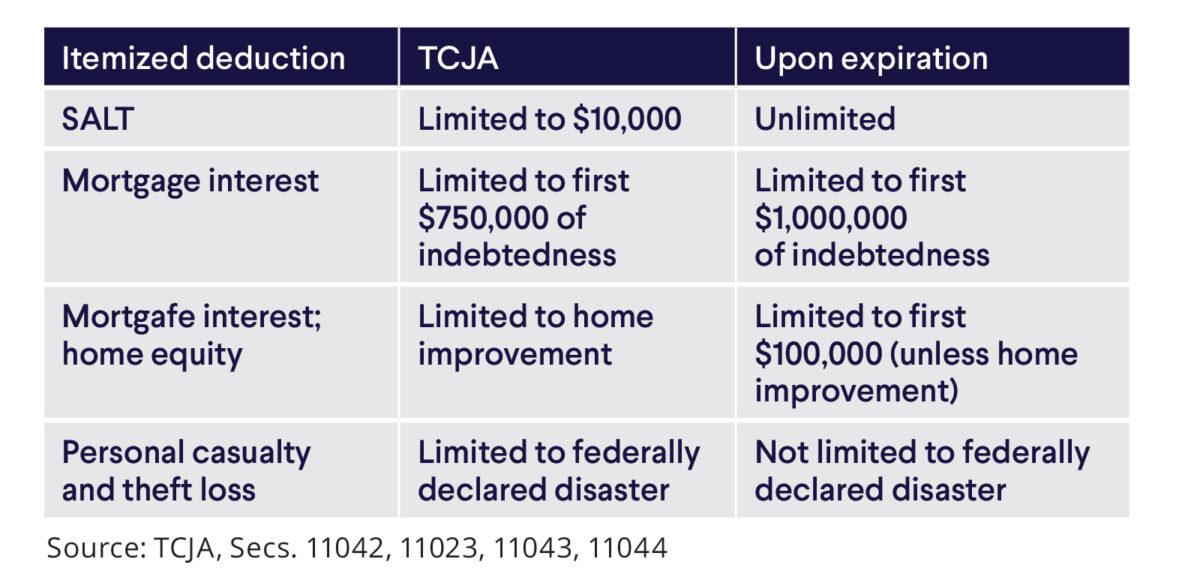

The sunset of TCJA carries significant implications for tax planning strategies and your clients. Among the few favorable changes is the elimination of the state and local tax (SALT) cap. In addition to the Pease limitation, TCJA made several other changes to itemized deductions, most of which were not considered taxpayer friendly. The most notorious was the $10,000 limitation for SALT deductions. Since 2017, numerous efforts have been made to increase the SALT cap, but none made it into law. The cap on the SALT deduction will go away in 2026 if no new tax legislation is passed.

Some welcome changes:

5 Tips to Tackle Potential Tax Changes

With myriad changes on the horizon, now is the time to make yourself invaluable to your clients. Here are some top tips to consider.

1. Accelerate income: If income taxes are going up, then clients may want to consider ways to accelerate income. They can consider executing Roth conversions, selling capital assets with large gains, and exercising stock options in 2024 and 2025.

2. Diversify taxes: Remember the importance of tax diversification when looking at retirement solutions. Clients need taxable, tax-deferred and tax-free buckets of income to manage their income tax brackets in retirement.

3. Gift assets: If income from certain income-producing assets is not needed for current or future living expenses, then consider gifting such assets to family members in lower income tax brackets.

4. Gather a team: For clients who may have a taxable estate, start working with estate planning attorneys now.

5. Flexibility is key: Ensure that your clients’ retirement solutions offer flexibility. For example, Delaware Life’s nonqualified deferred annuities offer:

• Income control. Your clients can decide when to take or forgo distributions.

• The ability to delay the choice of single or joint income until income is needed.

• The ability to delay taxation until income is taken, when they may be in a lower tax bracket.

To learn more about how fixed index annuities can be the perfect weapon to help your clients get a leg up on tax changes, scan the code or visit https://links.delawarelife.com/INNTLS.

For complete information regarding the Tax Cuts and Jobs Act, please visit https://bit.ly/tcja2024.

Annuities are long-term investment vehicles designed for retirement purposes. Annuity contracts contain exclusions, limitations, reductions of benefits and terms for keeping them in force.

Customers buying an annuity to fund an IRA or qualified retirement plan should do so for reasons other than tax deferral. IRAs and qualified plans – such as 401(k)s and 403(b)s – are already tax-deferred. Therefore, an annuity should be used only to fund an IRA or qualified plan to benefit from the annuity’s features other than tax deferral.

Delaware Life Insurance Company (Zionsville, IN) is authorized to transact business in all states (except New York), the District of Columbia, Puerto Rico and the U.S. Virgin Islands, and is a member of Group One Thousand One LLC (Group1001).

This information is for informational purposes only and should not be relied on for tax or legal purposes. Financial professionals and their clients should not rely on this information as applicable to their particular situation.

2024030034 EXP 03/25

The importance of longevity literacy—and managing the risks—in retirement

How annuities can help younger generations secure their future

Advisor News

- 5 things I wish I knew before leaving my broker-dealer

- Global economic growth will moderate as the labor force shrinks

- Estate planning during the great wealth transfer

- Main Street families need trusted financial guidance to navigate the new Trump Accounts

- Are the holidays a good time to have a long-term care conversation?

More Advisor NewsAnnuity News

- Product understanding will drive the future of insurance

- Prudential launches FlexGuard 2.0 RILA

- Lincoln Financial Introduces First Capital Group ETF Strategy for Fixed Indexed Annuities

- Iowa defends Athene pension risk transfer deal in Lockheed Martin lawsuit

- Pension buy-in sales up, PRT sales down in mixed Q3, LIMRA reports

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- Best’s Market Segment Report: Hong Kong’s Non-Life Insurance Segment Shows Growth and Resilience Amid Market Challenges

- Product understanding will drive the future of insurance

- Nearly Half of Americans More Stressed Heading into 2026, Allianz Life Study Finds

- New York Life Investments Expands Active ETF Lineup With Launch of NYLI MacKay Muni Allocation ETF (MMMA)

- LTC riders: More education is needed, NAIFA president says

More Life Insurance News