The importance of longevity literacy—and managing the risks—in retirement

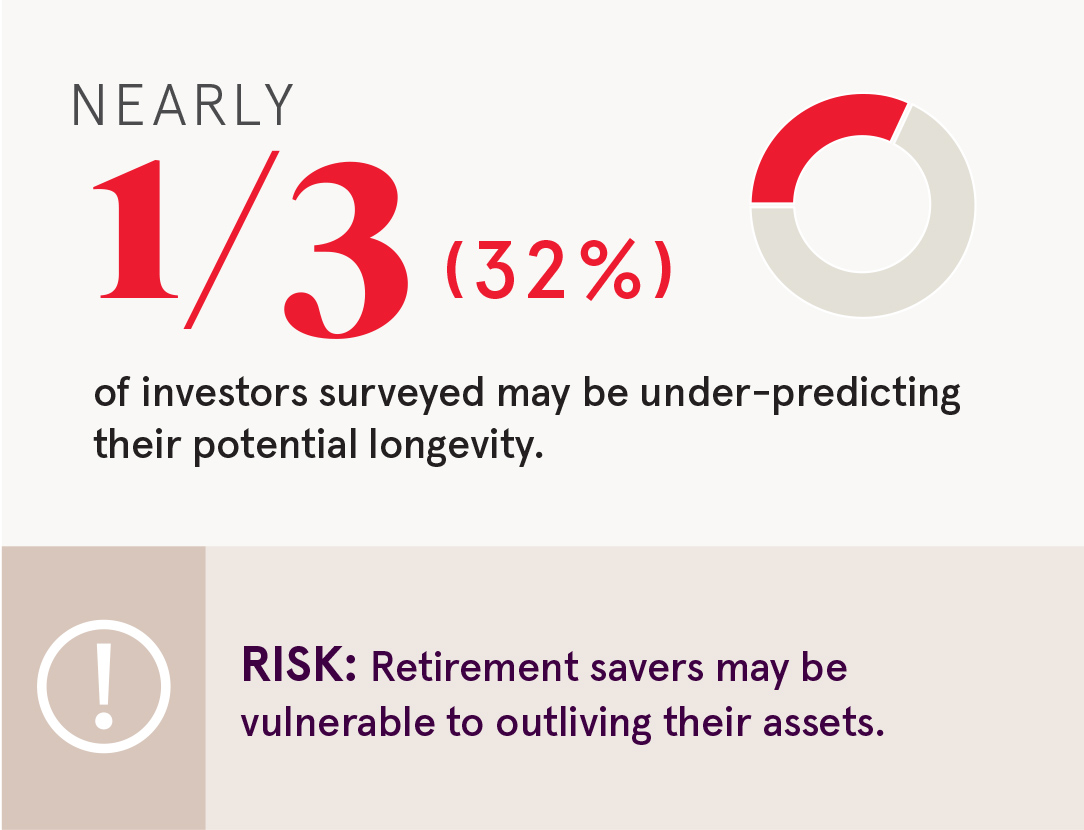

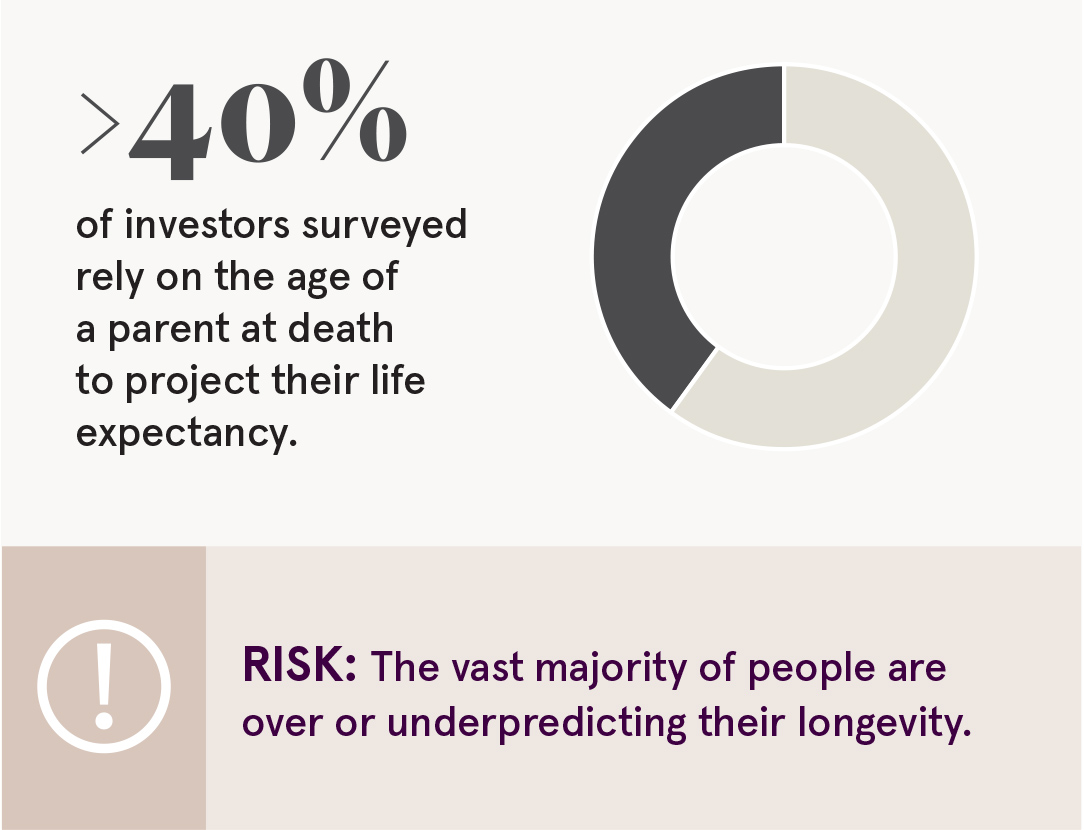

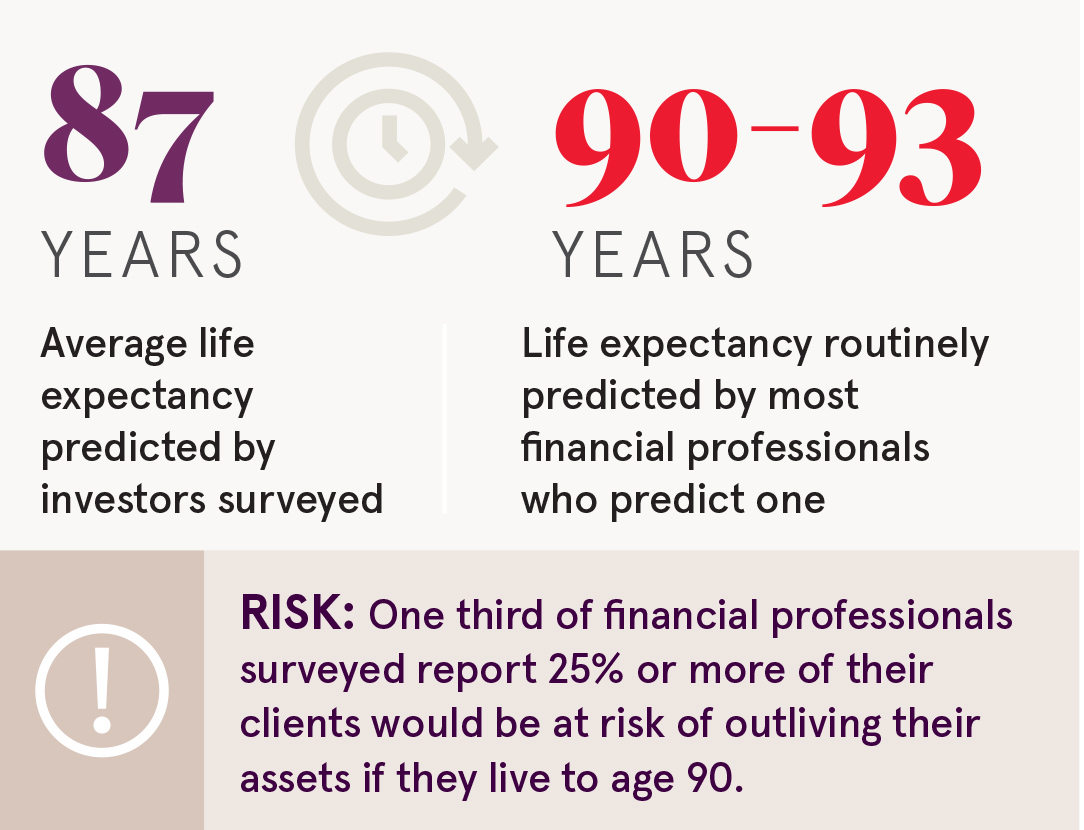

We polled financial professionals and retirement investors to provide new information and uncover new insights on retirement planning opportunities related to longevity risk.

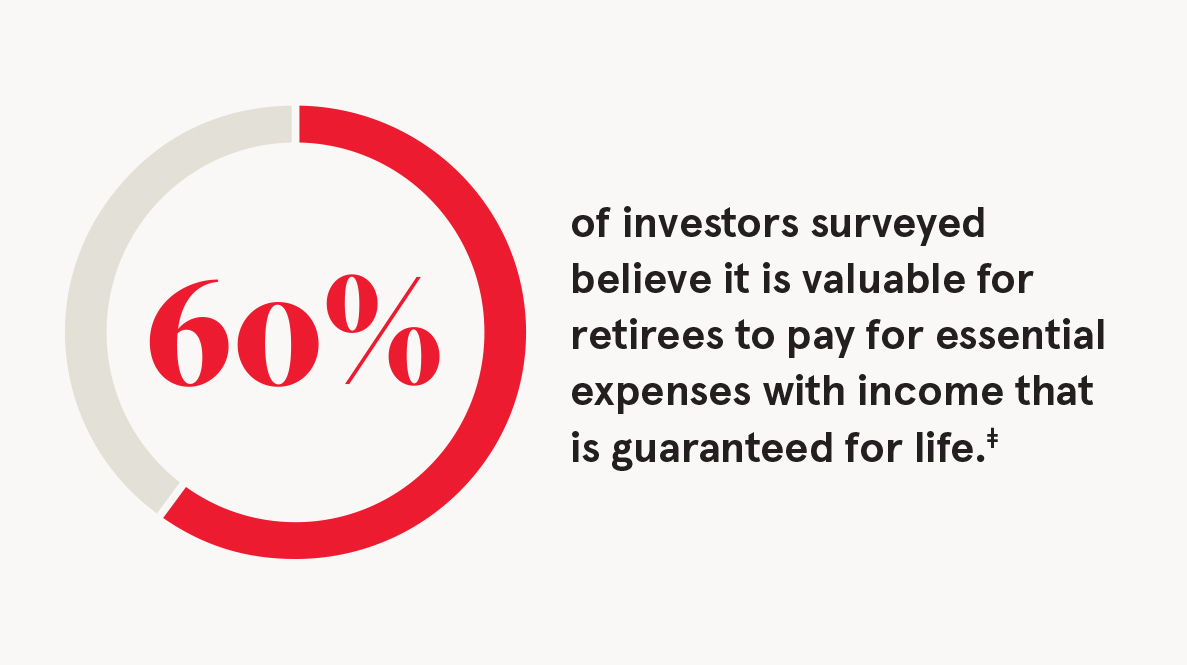

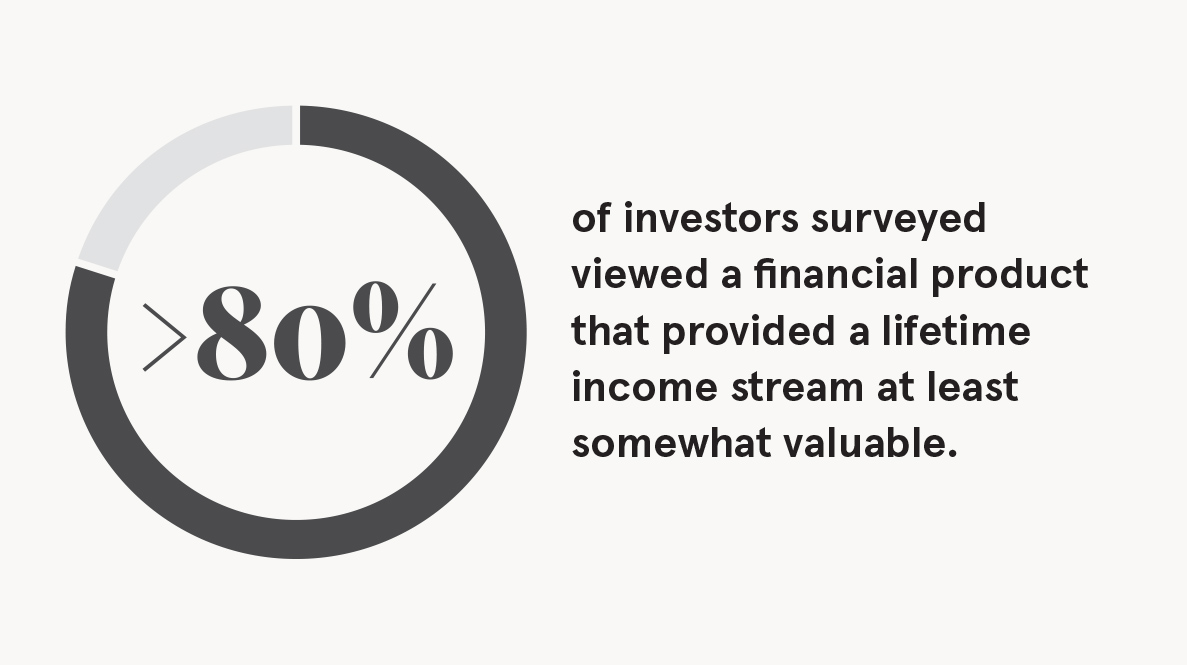

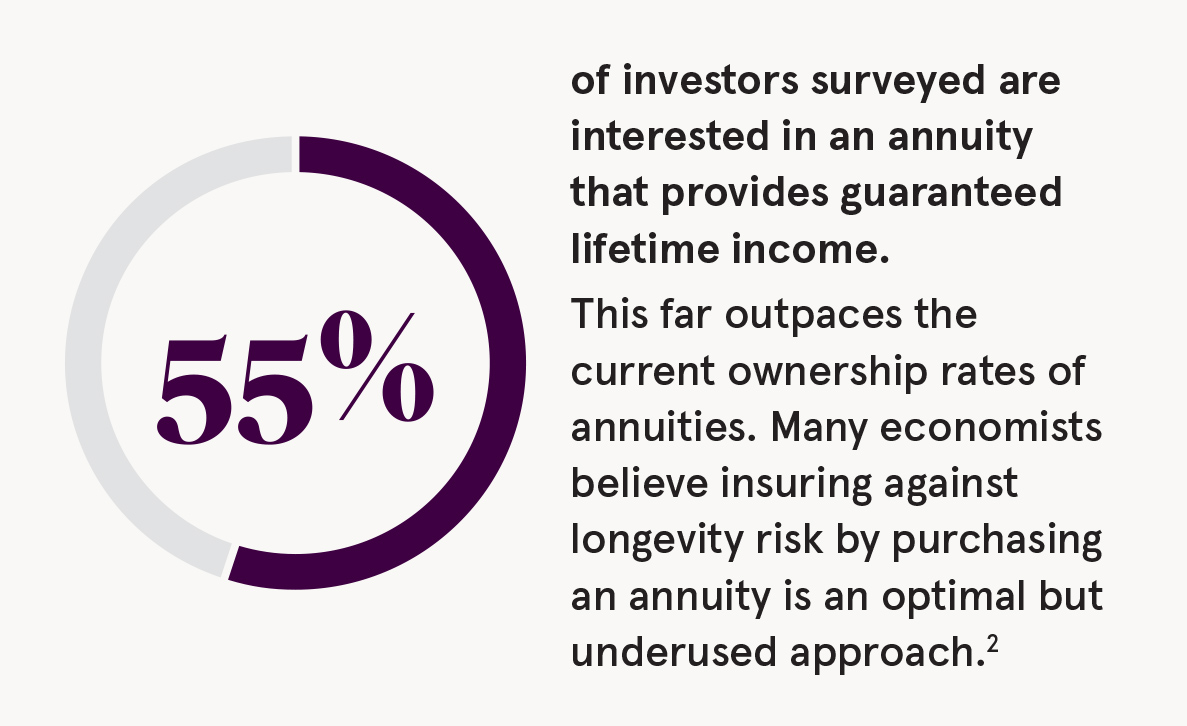

See the survey stats:

Longer lives reinforce the need for reliable lifetime income.

Many investors are interested in guaranteed† income products to insure against longevity risk.

Learn more at jackson.com/researchcenter or call your financial professional.

Jackson® is the marketing name for Jackson Financial Inc., Jackson National Life Insurance Company® (Home Office: Lansing, Michigan), and Jackson National Life Insurance Company of New York® (Home Office: Purchase, New York). Jackson National Life Distributors LLC, member FINRA.

† Guarantees are backed by the claims-paying ability of the issuing insurance company.

‡ There is no guarantee that a variable annuity will provide sufficient supplemental retirement income.

¹ Jackson’s study on addressing longevity risk, conducted in partnership with Greenwald & Associates and the Center for Retirement Research at Boston College, surveyed 1,009 investors between 55 and 84 years of age and at least shared financial decision-making responsibilities in their household. Of the respondents, 109 had assets of between $100,000 and

$199,999, and 900 had assets of at least $200,000. Additionally, 400 financial professionals with three or more years of experience at a firm with at least 75 clients and $30 million in assets under management were surveyed. Surveys were conducted online from June 12 to July 7, 2023.

² Hallie Davis et. al., Global Financial Literacy Excellence Center, “Examining the Barrier to Annuity Ownership for Older Americans,” October 6, 2021. Greenwald & Associates and the Center for Retirement Research at Boston College are not affiliated with Jackson National Life Distributors LLC.

CMN105806 02/24

The Virtual Advisor: How to Use Digital Tools to Better Serve Your Clients

Tax Armageddon Is Coming, but You and Your Clients Can Come Out on Top

Advisor News

- CFP Board announces CEO leadership transition

- State Street study looks at why AUM in model portfolios is increasing

- Supreme Court to look at ERISA rules in upcoming Cornell case

- FPA announces passing of CEO, succession plan

- Study: Do most affluent investors prefer a single financial services provider?

More Advisor NewsAnnuity News

Health/Employee Benefits News

- Opinion | The Cost Of Health Insurance In Connecticut Could Skyrocket If Congress Does Not Act

- Health centers brace for possibility of limited funds

- Senators pitch aid for rural health care

- Waitlists and attendant care: House lawmakers move major Medicaid bills

- Pharmacists ask for lawmakers to pass bill regulating pharmacy benefit managers

More Health/Employee Benefits NewsLife Insurance News

- 10 reasons we must embrace the Northwestern Life Insurance building in Minneapolis

- AM Best Revises Outlooks to Stable for Lincoln National Corporation and Most of Its Subsidiaries

- Aflac Northern Ireland: Helping Children, Caregivers and the Community

- AM Best Affirms Credit Ratings of Well Link Life Insurance Company Limited

- Top 8 trends that will impact insurance in 2025

More Life Insurance News