Research Reveals Insurance Agents Are a Critical Source of Information for Medicare

This is the second article in this series based on DDG’s National Medicare Enumeration Survey and 2022 Medicare Options Consumer Key Driver Study. Please reference the introductory article for survey methodology.

The simple exercise of Googling available Medicare Advantage plans in a specific county —Rockwall County, Texas — yields 39 plans available in addition to Medicare parts A and B. That’s a lot of choices for an audience that will be largely unfamiliar with options like Medicare Advantage, Medicare Supplement and Medicare Part D when they begin their research.

Consumer understanding of Medicare choices

Despite the complexity in the Medicare market, consumers who are either currently or about to be eligible for Medicare believe they have a reasonably good understanding of what their options are.

In a recent study conducted by datadecisions Group, * 76% of them consider their understanding “pretty good” or “very good,” while only 2% say they don’t understand their options at all.

Age-ins (64-year-olds) versus those currently eligible for Medicare

Given their lack of experience in navigating the Medicare process, age-in consumers are more likely to indicate they don’t have a great understanding of what their plan options are, as demonstrated by the chart below. Only about half have a pretty good or very good understanding of their options. This is in contrast with consumers ages 65+, whose self-reported understanding is much higher. The opportunity for providers trying to obtain new customers therefore exists especially among the age-ins, who have yet to experience the Medicare decision-making process.

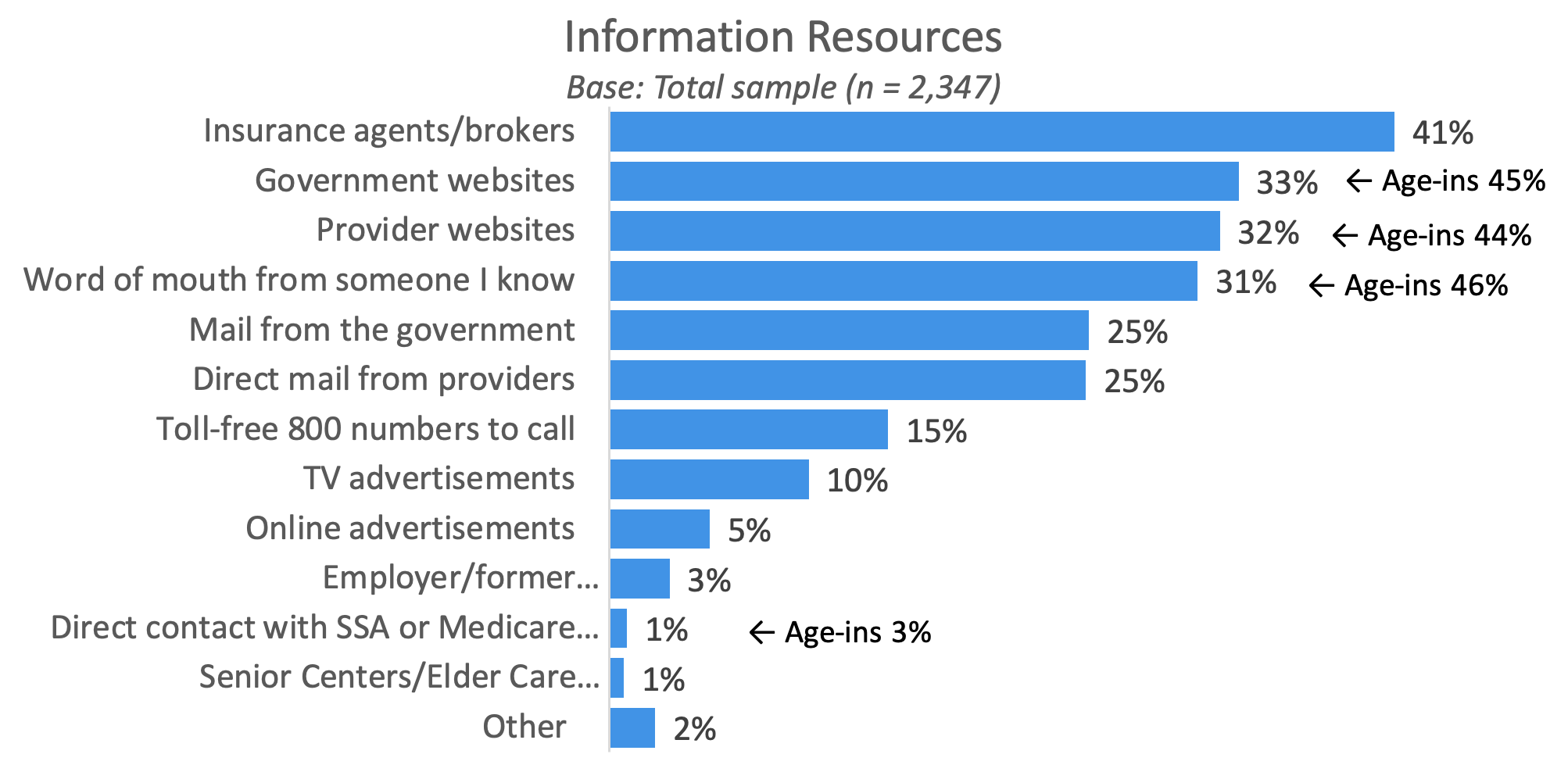

Information resources

Insurance agents and insurance brokers are resources used by almost half of consumers, which makes sense given their oftentimes integral role in the Medicare (and other) insurance paths to purchase. The second-highest number of consumers, according to our study, get their information from government websites such as Medicare.gov. As this survey was administered online — thus focused on consumers who are comfortable with (or at least experienced) using the internet— this result may not be representative of consumers who are less tech savvy or unconnected altogether.

Our research found that 64-year-olds are significantly more likely than those 65 and older to seek information about their options from government websites (45% versus 32%), Medicare provider websites (44% versus 31%) or word of mouth (46% versus 30%). Generally, however, insurance agents and brokers are the go-to source for information, as 41% of eligible or soon-to-be eligible consumers look to these professionals for information about their Medicare options.

The Kaiser Family Foundation notes that older enrollees, those in poor health and the less educated are much less likely to utilize the information resources at their disposal in the context of reviewing their coverage options during open enrollment.1 With these things in mind, providers may encourage people in this category to make certain they are getting everything they need out of their plan, or they even may provide extra resources to that end. In another KFF article, it is suggested that individual and community-based outreach may be key to reaching consumers less likely to use the resources2 we’ve listed here.

How to reach your target audience

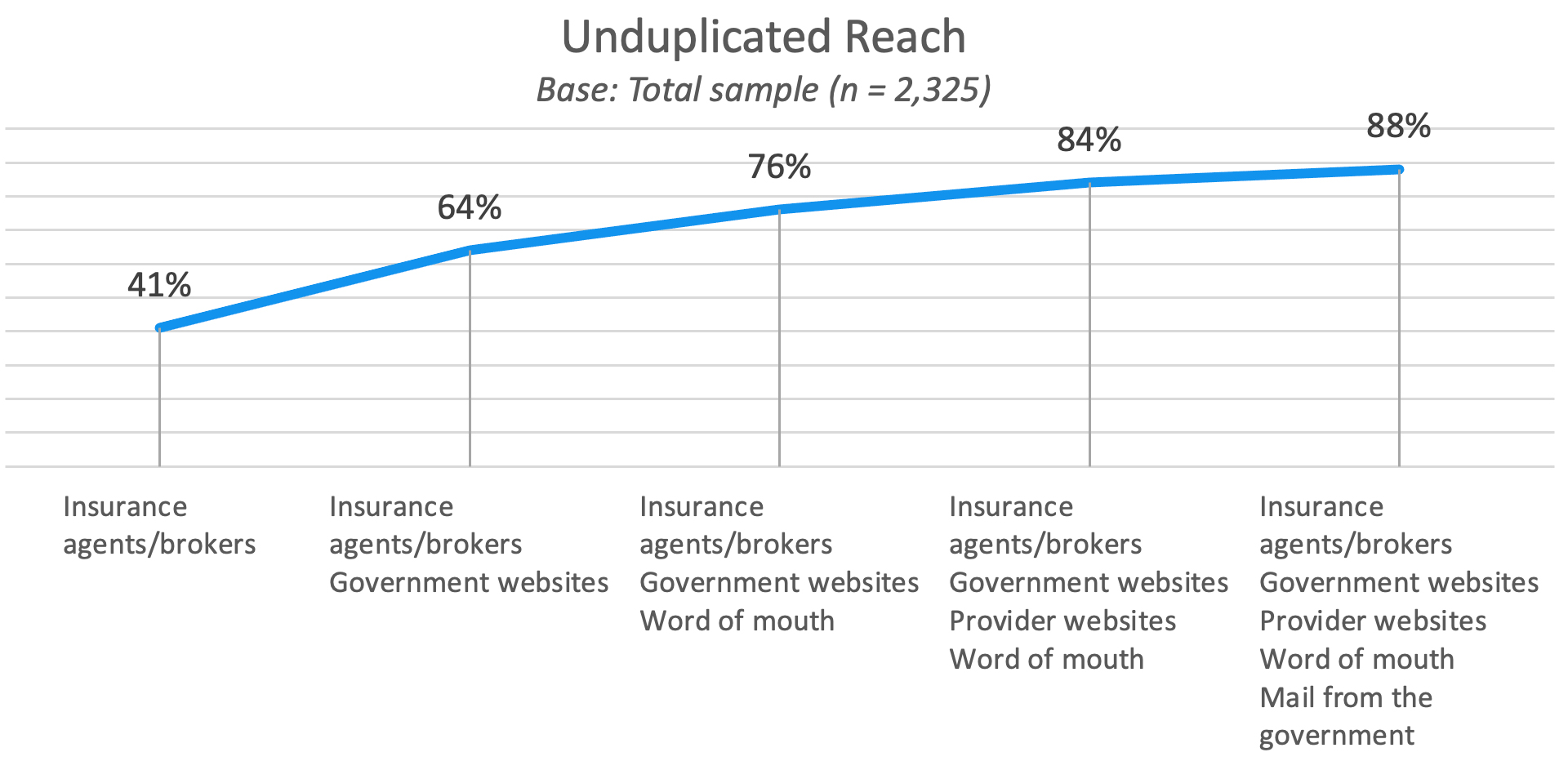

Without regard to the type of Medicare plan being offered, our study found that three-fourths of the target audience will be reached through the combination of insurance agents and brokers, government websites, and word of mouth.

TURF** analysis by Medicare product type

There are differences in how marketers might approach their targeting. For Medicare Advantage, the combination of insurance agents and brokers and provider websites — both of which are within marketers’ domain — can reach 62% of the target audience. For Medicare Supplement, however, 67% of the audience is reached through insurance agents or brokers and government websites.

Given the complexities of the market, insurance agents with certified financial planner certifications specializing in Medicare can be an invaluable resource to the age-in or Medicare-eligible consumer, even for those with a strong self-reported understanding of the options available to them. This outreach should begin as early in the decision-making process as possible.

*In the spring of 2022, datadecisions Group conducted the 2022 Medicare Options Consumer Key Driver Study, a large nationwide study of Medicare Advantage and Medicare Supplement alternatives among 2,324 current Medicare-qualified consumers and 64-year-olds who will become eligible soon. The margin of error for this study is approximately ± 2.0%. The National Medicare Enumeration Survey, also conducted in spring of this year, comprised over 5,500 consumers 64+ and had a margin of error of 1.2%.

**TURF is the acronym for a statistic known as total unduplicated reach and frequency.

datadecisions Group is a data-driven marketing services firm that delivers full-service primary marketing research, third-party data, modeling and analytics, and data integration to the client’s martech stack. We inform both corporate strategy and marketing execution.

1. Freed, Meredith. (Oct. 29, 2020). More Than Half of All People on Medicare Do Not Compare Their Coverage Options Annually. Kaiser Family Foundation. More Than Half of All People on Medicare Do Not Compare Their Coverage Options Annually | KFF

2. Pollitz, Karen. (Jan. 25, 2021). Opportunities and Resources to Expand Enrollment During the Pandemic and Beyond. Kaiser Family Foundation. Opportunities and Resources to Expand Enrollment During the Pandemic and Beyond | KFF

Better Medicare Lead Generation: 6 out of 10 Seniors Plan to Enroll in Parts A and B

Better Medicare Lead Generation: 6 out of 10 Seniors Plan to Enroll in Parts A and B

Advisor News

- Beyond Finance: How an inclusive approach builds client trust

- Study asks if annuities help financial advisors build client relationships

- California’s big pension funds lost billions in stock market selloff. Can they recover in time?

- Economist: Tariffs could dampen GDP growth; raise unemployment, inflation

- Medium tenure for workers remains at about 5 years

More Advisor NewsAnnuity News

- Emerging digital annuity sales process cutting cycle times by 94%, IRI says

- In times of market volatility, FIAs make the difference

- Charitable gift annuities gaining in popularity

- Nationwide and Annexus establish first actively managed mutual fund within a RILA

- AM Best Comments on the Credit Ratings of Talcott Financial Group Ltd.’s Subsidiaries Following Announced Reinsurance Transaction With Japan Post Insurance Co., Ltd.

More Annuity NewsHealth/Employee Benefits News

- Texas House panel escalates inquiry into Medicaid insurer that investigated lawmakers

- Minnesota Couple Indicted in $15 Million Medical Billing Fraud Scheme

- Stalled talks put Blue Cross Blue Shield of TX patients through ‘absolute hell’

- More cancer coverage for firefighters clears hurdle

- AG files suit against Syracuse claiming misappropriated funds

More Health/Employee Benefits NewsLife Insurance News

- Proxy Statement (Form DEF 14A)

- Proxy Statement (Form DEF 14A)

- Jackson Announces New President and Chief Risk Officer

- Proxy Statement (Form DEF 14A)

- Proxy Statement (Form DEF 14A)

More Life Insurance News