Better Medicare Lead Generation: 6 out of 10 Seniors Plan to Enroll in Parts A and B

This is the third article in this series based on DDG’s National Medicare Enumeration Survey and 2022 Medicare Options Consumer Key Driver Study. Reference the introductory article for survey methodology.

Approximately 60% of senior Medicare consumers plan to enroll in Parts A and B without enrolling in Part C or other Medigap coverage. Thus, when 10 seniors engage with your provider website, that does not mean that the agent has 10 opportunities to close a sale.

One of the important findings of our research* is how similar certain behaviors of current Medicare members are when comparing them to behavior expected from the soon-to-be Medicare-eligibles (i.e., 64-year-olds) once they begin shopping for and using Medicare plans. For example, 38% of those 65+ reported that they currently have Medicare Advantage, while 36% of 64-year-olds said they would consider this type of plan. The actual penetration of Medicare Advantage in the market is about 40%,1 similar to the results of our study.

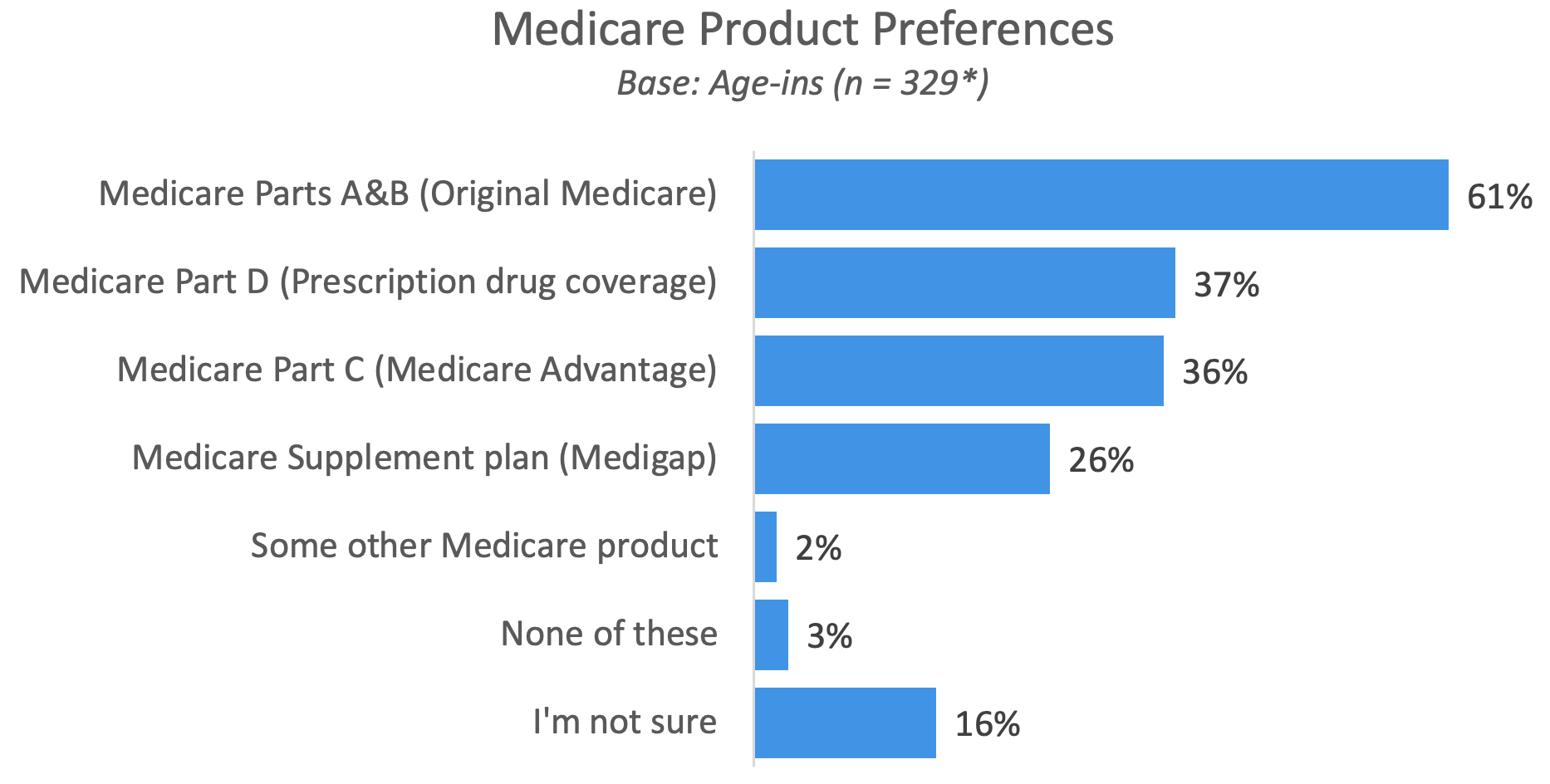

Probable Medicare Product Selection Among Age-Ins (Age 64)

Beyond Original Medicare, age-in consumers tend to prefer Medicare Advantage over Supplement plans. Prescription drug coverage is a main priority, regardless of the plan type under consideration.

*Data from DDG National Medicare Enumeration Survey

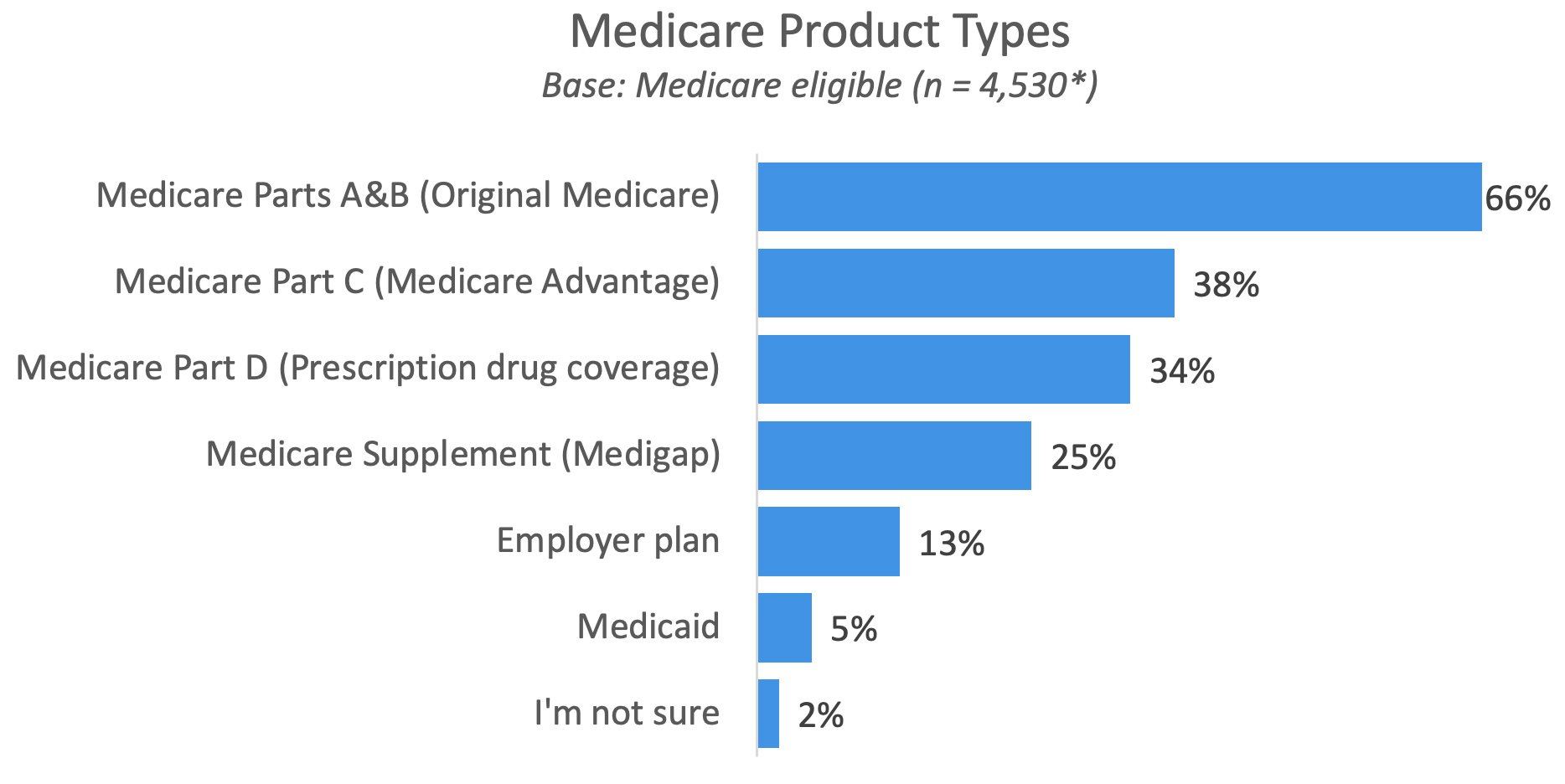

Medicare Products Among Medicare-Eligible (Age 65+)

Other than Original Medicare, members 65 and older are most likely to purchase Medicare Advantage. This aligns with Centers for Medicare & Medicaid Services data that puts Original Medicare enrollment at 35 million and Medicare Advantage enrollment at 29.1 million in 2022.2

While Medicare Advantage is preferred, it’s also true that based on 2018 data,3 about 21% of the Medicare-eligible population overall supplemented their coverage with Medigap. This percentage increased to about 23% in 2021.4

*Data from DDG National Medicare Enumeration Survey

The actual penetration of Medicare Supplement in the market is somewhat lower than reported in our study. This is understandable for age-ins; Medicare can involve a complex set of decisions on a subject that’s unfamiliar territory to most people. The difference also may be attributed, at least in part, to the fact that Medigap costs money, and 64-year-olds haven’t had to make that economic decision yet. Additionally, a KFF study posits that even most current Medicare enrollees are not aware of or using the official Medicare resources.5

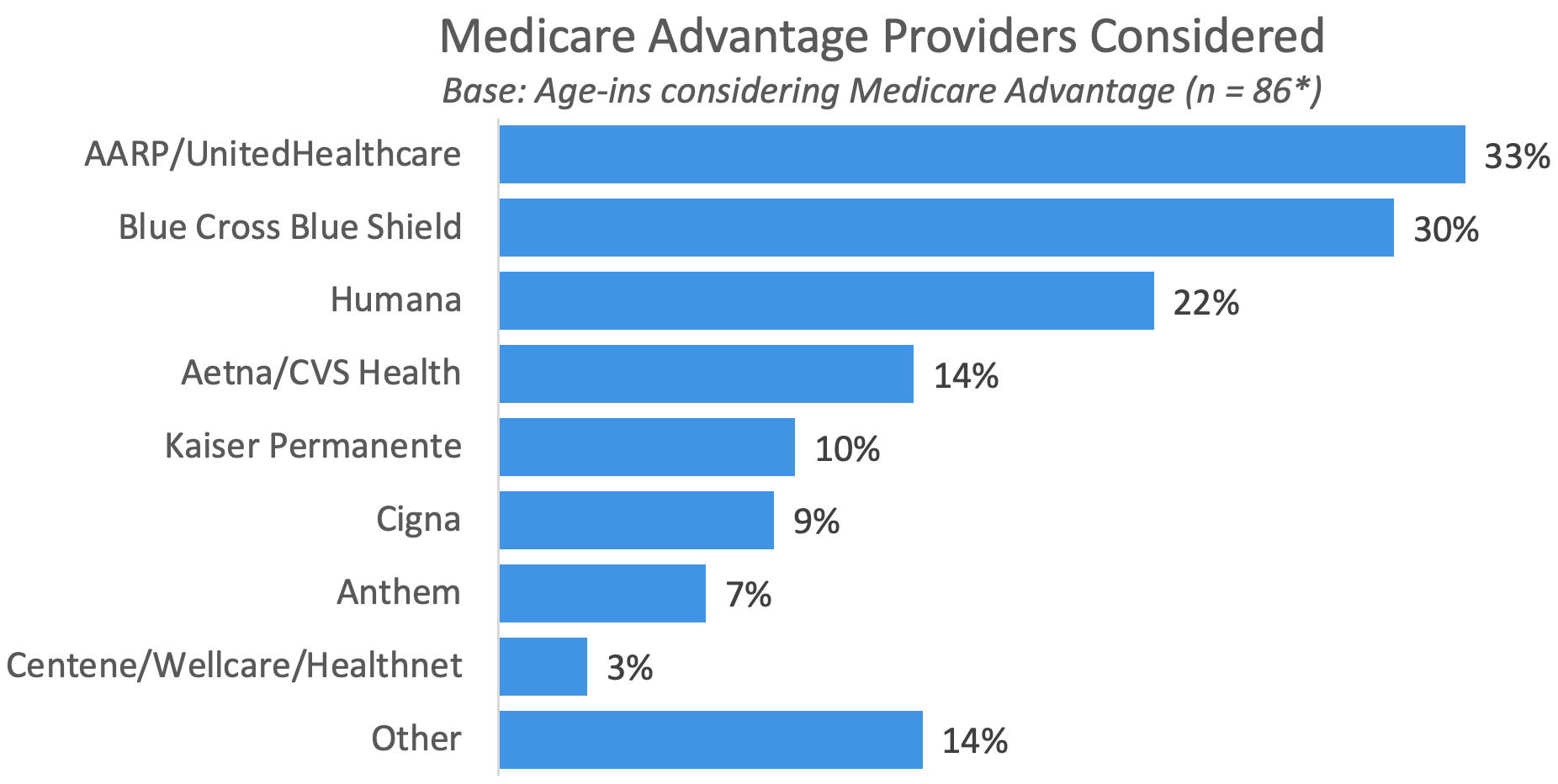

Probable Medicare Advantage Providers Among Age-Ins (Age 64)

Age-in consumers considering Medicare Advantage are most likely to choose AARP/UnitedHealthcare as their provider, followed by Blue Cross Blue Shield and then Humana.

* Small base

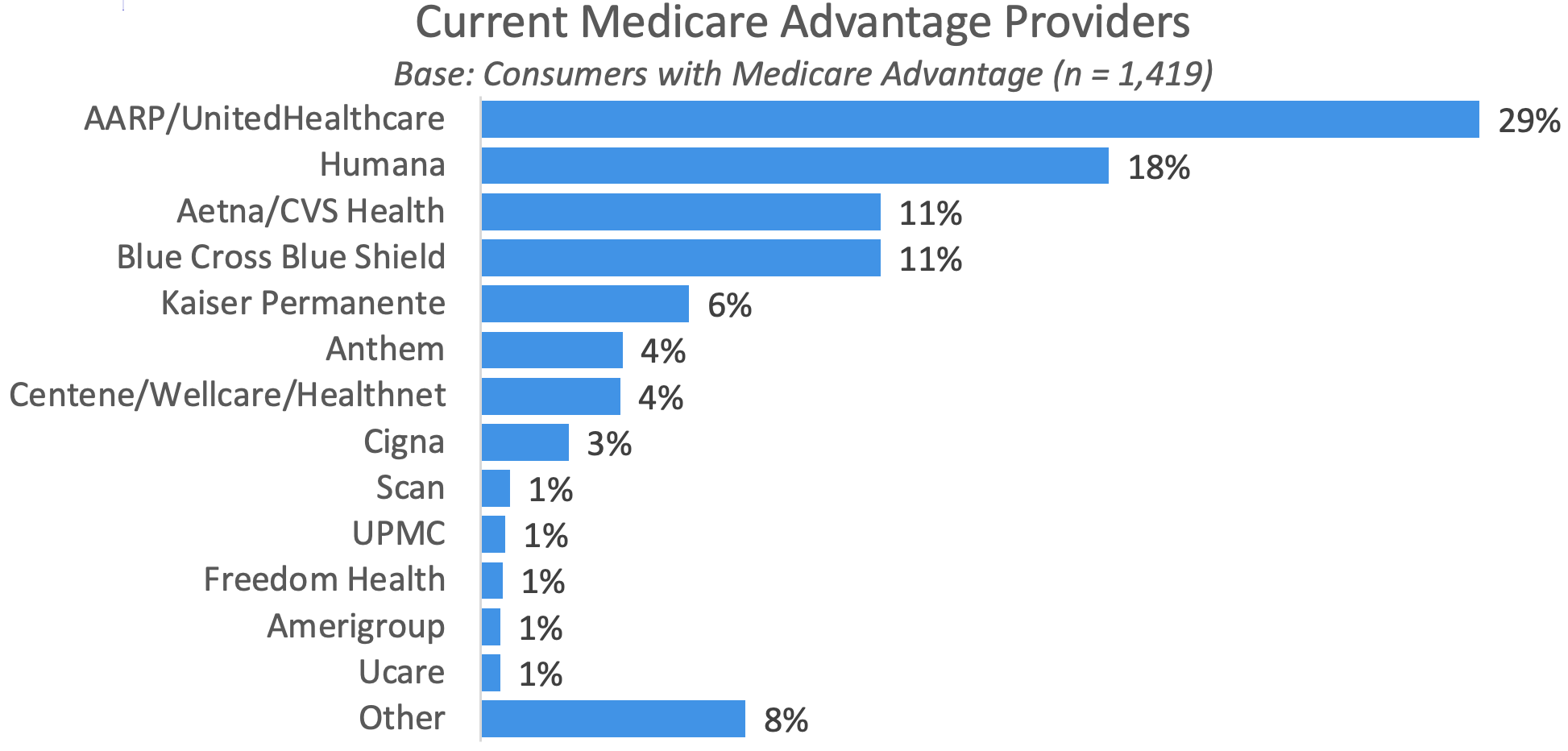

Medicare Advantage Providers Among Medicare-Eligible (Age 65+)

Members 65+ with Medicare Advantage are most likely to use AARP/UnitedHealthcare. These findings tally with KFF data that shows UnitedHealthcare and Humana accounting for 46% of Medicare Advantage enrollees, a share of the market they have held since 2010.6 Medicare-eligible consumers are much less likely to say they have Blue Cross Blue Shield (11%) compared to the percentage of age-ins who say they’re considering BCBS (30%), revealing a difference between stated preference before signing up and actual behavior once it’s time to make that selection.

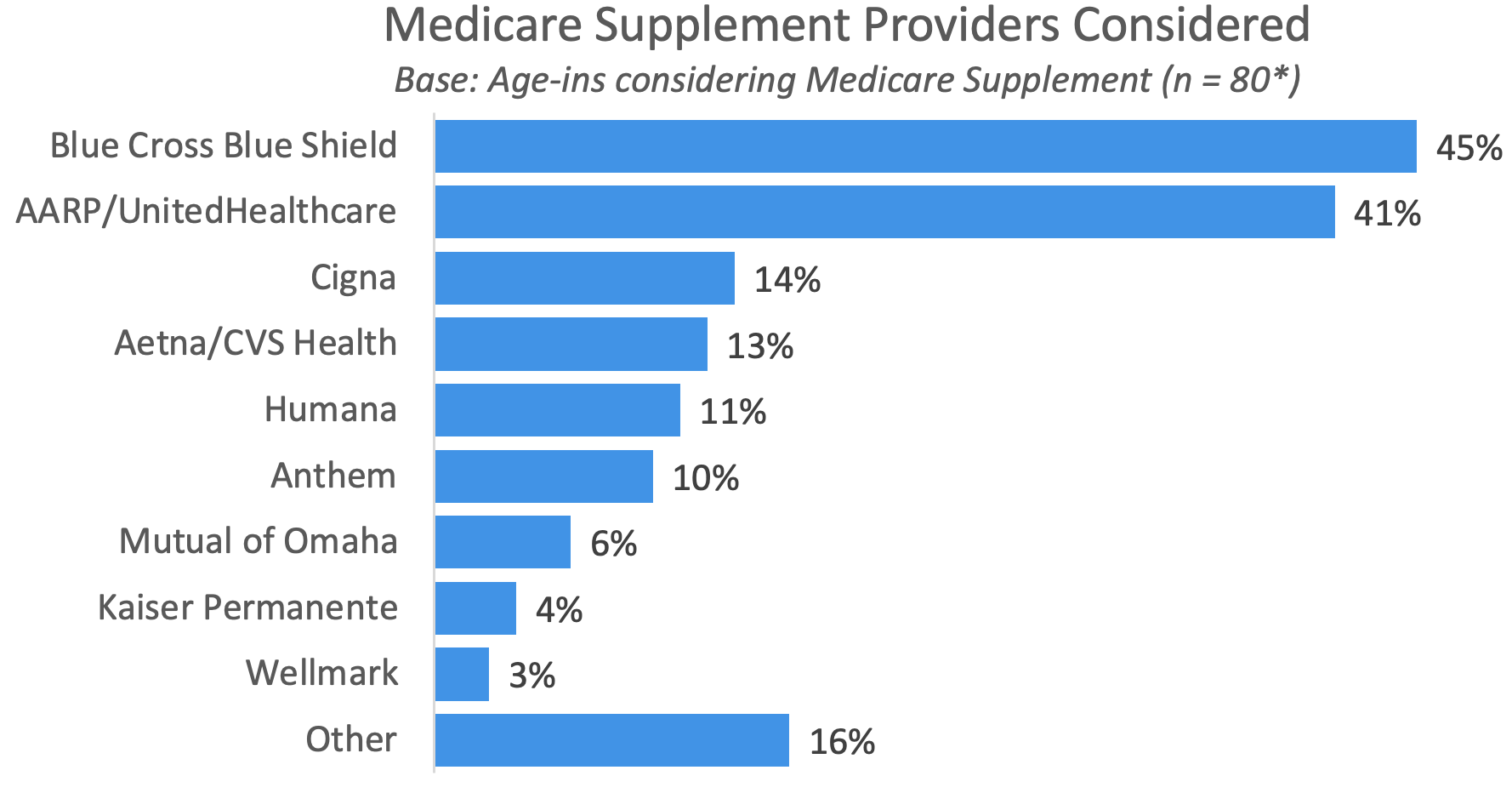

Probable Medicare Supplement Providers Among Age-Ins (Age 64)

Age-in consumers who prefer Medicare Supplement are most likely to choose Blue Cross Blue Shield, followed by AARP/UnitedHealthcare. This is the reverse of prospective Medicare Advantage customers. The percentages for other providers are roughly equal between the two Medicare options.

* Small base

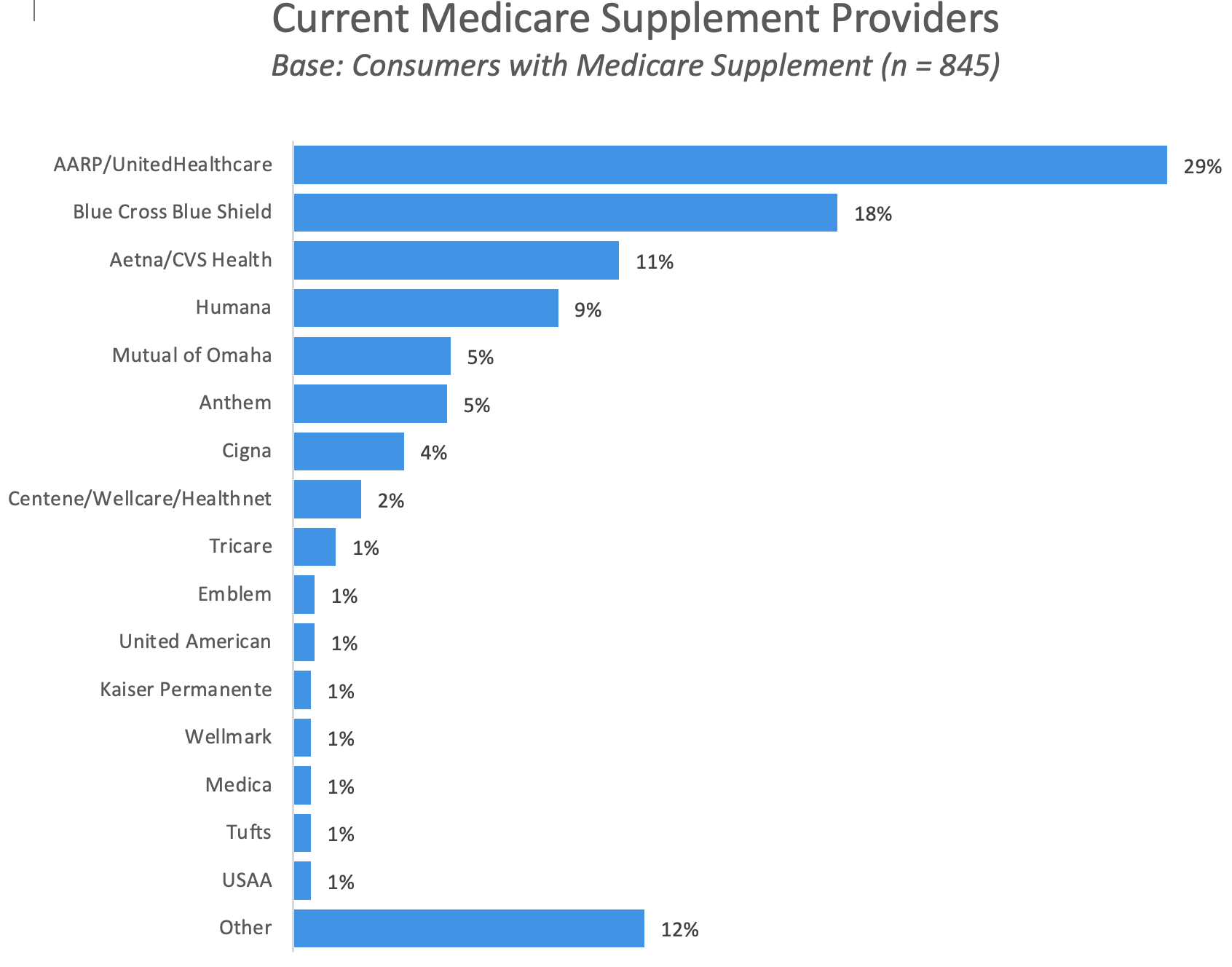

Medicare Supplement Providers Among Medicare-Eligible (Age 65+)

Members 65+ with Medicare Supplement plans are most likely to use AARP/UnitedHealthcare, followed by Blue Cross Blue Shield and Aetna/CVS Health. Although there is a great deal of variation in these proportions by state, AARP/UHC, BCBS, Aetna/CVS and Humana account for about two-thirds of the nationwide Medicare Supplement market. It also may be of interest that over 50% of Part D enrollees use Medicare Advantage drug plans, as stand-alone drug plan enrollment has been waning since 2019.7

Medicare Advantage and Supplement providers are well advised to begin the education of 64-year-olds as soon as it’s practical to do so, targeting them with useful plan information at minimum. One such opportunity may be through existing employer or union policies. KFF reports that nearly 20% of Medicare Advantage enrollees in 2022 are in plans offered by employers or unions. This provides a great opportunity for providers to reach a significant portion of their market.8

Last, the percentage of the total audience that intends to enroll in a Medicare coverage plan other than Part A or Part B is less than half. This suggests that the Medicare marketer should develop a targeting process to avoid wasting their budget, especially when you factor your brand awareness into that equation.

*In the spring of 2022, datadecisions Group conducted the 2022 Medicare Options Consumer Key Driver Study, a large, nationwide study of Medicare Advantage and Medicare Supplement alternatives among 2,324 current Medicare-qualified consumers and 64-year-olds who will become eligible soon. The margin of error for this study is approximately ±2.0%. The National Medicare Enumeration Survey, also conducted in spring of this year, comprised over 5,500 consumers 64+ and had a margin of error of 1.2%.

dataDecisions Group is a data-driven marketing services firm that delivers full-service primary marketing research, third-party data, modeling and analytics, and data integration to the client’s martech stack. We inform both corporate strategy and marketing execution.

1. Pipes, Sally. (Jan. 31, 2022). “Medicare Advantage Gives Seniors an Advantage.” Forbes. https://www.forbes.com/sites/sallypipes/2022/01/31/medicare-advantage-gives-seniors-an-advantage

2. CMS/Office of Enterprise Data & Analytics/Office of the Actuary (August 2022). “CMS Fast Facts.” Centers for Medicare & Medicaid Services. CMSFastFactsAug2022.pdf

3. Koma, Wyatt. (March 23, 2021). “A Snapshot of Sources of Coverage Among Medicare Beneficiaries in 2018.” Kaiser Family Foundation. https://www.kff.org/medicare/issue-brief/a-snapshot-of-sources-of-coverage-among-medicare-beneficiaries-in-2018

4. O’Brien, Sarah. (Aug. 26, 2021). “Here’s what to watch for if you’re buying a Medigap plan to cover some Medicare costs.” CNBC. https://www.cnbc.com/2021/08/26/what-to-know-when-buying-a-medigap-plan-to-cover-medicare-costs.html

5. Freed, Meredith. (Oct. 19, 2020). “More Than Half of All People on Medicare Do Not Compare Their Coverage Options Annually.” Kaiser Family Foundation. More Than Half of All People on Medicare Do Not Compare Their Coverage Options Annually | KFF

6. Freed, Meredith. (Aug. 25, 2022). “Medicare Advantage in 2022: Enrollment Update and Key Trends.” Kaiser Family Foundation. Medicare Advantage in 2022: Enrollment Update and Key Trends | KFF

7. Cubanski, Juliette. (Aug. 17, 2022). “Key Facts About Medicare Part D Enrollment and Costs in 2022.” Kaiser Family Foundation. Key Facts About Medicare Part D Enrollment and Costs in 2022 | KFF

8. Freed, Meredith. (Aug. 25, 2022). “Medicare Advantage in 2022: Enrollment Update and Key Trends.” Kaiser Family Foundation. Medicare Advantage in 2022: Enrollment Update and Key Trends | KFF

Research Reveals Insurance Agents Are a Critical Source of Information for Medicare

Technology: Only as good as the problems it solves for agents and advisors

Advisor News

- Americans believe they will need $1.26M to retire comfortably

- Digitize your estate plan for peace of mind

- Finseca sees chance to ‘go on offense’ amid changes in DC

- Beyond Finance: How an inclusive approach builds client trust

- Study asks if annuities help financial advisors build client relationships

More Advisor NewsAnnuity News

- EXL named a Leader and a Star Performer in Everest Group's 2025 Life and Annuities Insurance BPS and TPA PEAK Matrix® Assessment

- Michal Wilson "Mike" Perrine

- Emerging digital annuity sales process cutting cycle times by 94%, IRI says

- In times of market volatility, FIAs make the difference

- Charitable gift annuities gaining in popularity

More Annuity NewsHealth/Employee Benefits News

- Intruder with gun arrested outside UnitedHealthcare campus in Minnetonka

- Pritzker's Proposed Budget Will Take Away Health Coverage From Some Immigrants Without Legal Status

- New Findings from University of California San Francisco (UCSF) in the Area of Endoscopy Described (Socioeconomic Factors Including Patient Income, Education Level, and Health Insurance Influence Postoperative Secondary Surgery and …): Surgical Procedures – Endoscopy

- DeSantis administration wants to inject Hope Florida into Medicaid program

- Medicaid cuts could cost 458,000 Coloradans health coverage, study claims

More Health/Employee Benefits NewsLife Insurance News

- Digitize your estate plan for peace of mind

- Best's Market Segment Report: AM Best Maintains Stable Outlook on U.K. Non-Life Insurance Segment

- Michal Wilson "Mike" Perrine

- Proxy Statement (Form DEF 14A)

- AM Best Affirms Credit Ratings of Subsidiaries of Old Republic International Corporation; Upgrades Credit Ratings of Old Republic Life Insurance Company

More Life Insurance News