Protective’s Term Life Stands the Test of Time

Protective blends time-tested values with modern tools to redefine the term life experience through speed, simplicity, and service without losing sight of its core mission.

With more than a century of history and nearly 17 million customers, Protective is no stranger to stability. But what sets the company apart today, especially in the crowded term life insurance market, is its willingness to evolve.

“A legacy like ours isn’t something we take lightly,” said Aaron Seurkamp, Senior Vice President and President of the Protection & Retirement Division at Protective. “Every generation at this company has built upon the one before it. Our culture is service-oriented at its core, and that guides everything we do.”

Founded in 1907, Protective has long positioned itself as a trusted name in life insurance. Today, the company manages $125 billion in assets and has more than $1 trillion in life insurance in force. Yet despite its size and reach, Protective continues to act with the flexibility and the urgency of a company that knows its customers expect more.

We exist to protect people at the hardest moments in their lives.

Aaron Seurkamp, SVP and President, Protection & Retirement Division

Grounded in Values, Built for Today

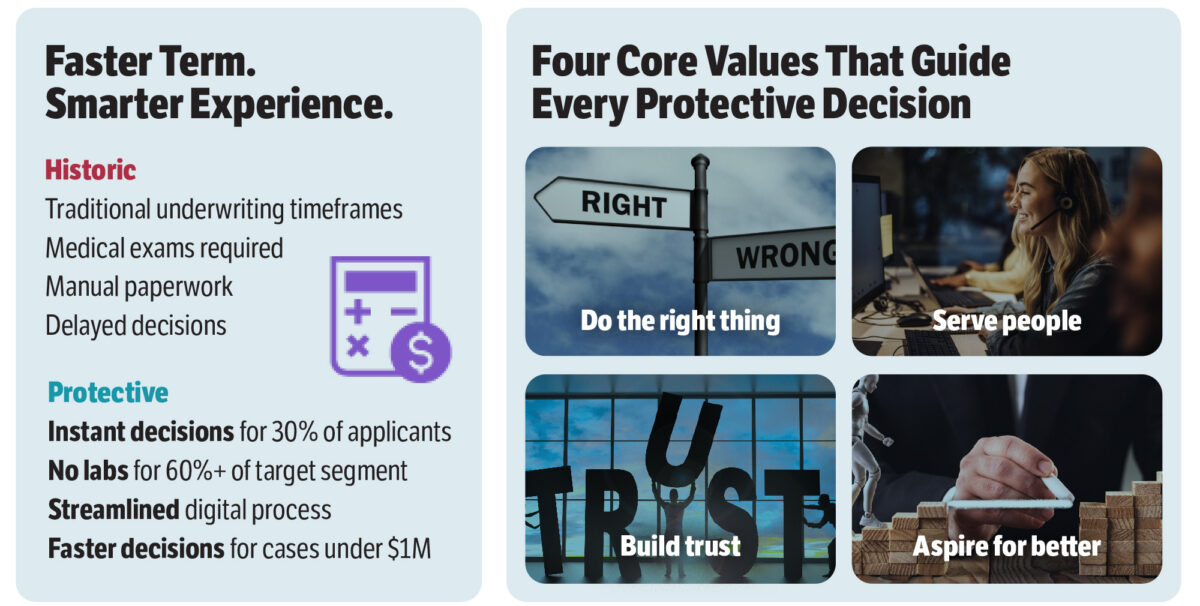

Much of Protective’s approach is shaped by four guiding values: do the right thing, serve people, build trust, and aspire for better.

“They’re simple, but they work,” said Seurkamp. “If you use those four values as your true north, you’re going to find your way to doing the right thing for the customer and for your distribution partners.”

Those principles are especially visible in Protective’s term life business. Often considered the “purest” form of protection, term insurance offers a financial safety net when families or businesses need it most. “We exist to protect people at the hardest moments in their lives,” said Seurkamp. “Term life is about showing up when it really counts—for a spouse, a child, a partner. It aligns perfectly with who we are as a company.”

Rethinking the Experience

Over the past year, Protective has made a concerted effort to improve how customers and agents engage with term life insurance. The company recently rolled out enhancements to its underwriting and application process, aimed at improving speed, reducing friction, and better meeting modern expectations.

“The reality is, people want things faster and simpler, especially younger buyers under 50,” said Seurkamp. “So, we’ve leaned into automation and data to make decisions more quickly, particularly for coverage under $1 million.”

As a result, more than 30% of Protective’s applicants in that target market are now approved immediately without lab work or lengthy waiting periods. More than 60% go through the process without additional medical requirements.

“That’s a dramatic shift from the traditional model,” said Seurkamp. “And it’s helping our agents, too. When we remove some of the administrative burden, they can focus on what really matters—serving clients and growing their practices.”

That emphasis on partnership is intentional. Protective relies on a network of independent agents and distribution partners, and has made it a priority to incorporate their feedback into product and process design. Seurkamp said the latest enhancements reflect direct input from the field.

“They told us they needed more speed, more flexibility, and less paperwork,” shared Seurkamp. “We listened.”

Flexibility by Design

While Protective avoids one-size-fits-all solutions, flexibility is baked into its term offerings. The company offers term lengths up to 40 years, simplified issue options, and a variety of riders that support conversion or address chronic illness.

“Our goal is to meet customers where they are today and grow with them,” said Seurkamp. “Maybe someone starts with affordable term coverage in their 20s or 30s. But if their needs change—say they get married or start a business—we want to offer features that let them transition to permanent protection without starting from scratch.”

That kind of long-term thinking is one reason Protective has become a mainstay for independent advisors looking for reliability and responsiveness.

Built to Last

Of course, innovation only matters if the company behind it can deliver on its promises. Protective’s track record offers a reassuring answer.

“We’ve been through world wars, economic downturns, pandemics—you name it,” said Seurkamp. “We’ve paid out billions in claims. We’ve protected millions of families. And we’re planning to be here another hundred years.”

That staying power is reinforced by Protective’s consistently high financial strength ratings from major independent agencies. The company holds an A+ (Superior) rating from A.M. Best, AA- (Very Strong) from both S&P Global Ratings and Fitch, and an A1 rating from Moody’s Investor Services. These strong marks reflect Protective’s financial stability, claims-paying ability, and long-term commitment to the customers and partners who rely on them.

“Third-party validation is important. But for us, trust is built every day—claim by claim, interaction by interaction,” he said. “We want people to feel confident when they choose Protective, whether they’re buying their first policy or working with us for the 20th time.”

A Call to Reconnect

Despite Protective’s progress, Seurkamp acknowledged that the company’s innovations may not yet be fully appreciated by the broader market, particularly those who haven’t worked with the company in recent years.

“If someone reading this hasn’t done business with Protective lately, I hope they’ll take five minutes to give us another look,” he said. “Visit our portal. Check out the updated application experience. See how it feels to work with a company that combines history and heart with modern capabilities. I think they’ll be pleasantly surprised.”

In a time when the life insurance industry is racing to modernize, Protective is showing that doing the right thing isn’t just a value. It’s a competitive advantage.

“We’re not trying to be flashy,” said Seurkamp. “We’re trying to be better—every day—for the people who count on us.”

Trust and Tech in Tandem

Getting Clients to Act on the Long-Term Care Conversation

Advisor News

- Geopolitical instability and risk raise fears of Black Swan scenarios

- Structured Note Investors Recover $1.28M FINRA Award Against Fidelity

- Market reports turn economic trends into a strategic edge for advisors

- SEC in ‘active and detailed’ settlement talks with accused scammer Tai Lopez

- Sketching out the golden years: new book tries to make retirement planning fun

More Advisor NewsAnnuity News

- Annexus and Americo Announce Strategic Partnership with Launch of Americo Benchmark Flex Fixed Indexed Annuity Suite

- Rethinking whether annuities are too late for older retirees

- Advising clients wanting to retire early: how annuities can bridge the gap

- F&G joins Voya’s annuity platform

- Regulators ponder how to tamp down annuity illustrations as high as 27%

More Annuity NewsHealth/Employee Benefits News

- Mark Farrah Associates Analyzed the 2024 Medical Loss Ratio and Rebates Results

- PID finds violations by Aetna Insurance

- Iowa insurance firms warn bill would make health costs rise

- ELLMAN BILL PROTECTS ACCESS TO HEALTH COVERAGE, PREVENTS DENIALS OVER PAST-DUE PREMIUMS

- Blue Cross Blue Shield of Wyoming CEO Gore announces retirement; Urbanek to take lead

More Health/Employee Benefits NewsLife Insurance News

- Jackson Earns Award for Highest Customer Service in Financial Industry for 14th Consecutive Year

- Annexus and Americo Announce Strategic Partnership with Launch of Americo Benchmark Flex Fixed Indexed Annuity Suite

- LIMRA: Individual life insurance new premium sets 2025 sales record

- How AI can drive and bridge the insurance skills gap

- Symetra Partners With Empathy to Offer Bereavement Support to Group Life Insurance Beneficiaries

More Life Insurance News