It’s All About Accumulation Potential

F&G’s New Accelerator Plus® FIA Series

How does the initial premium (vesting) bonus work?

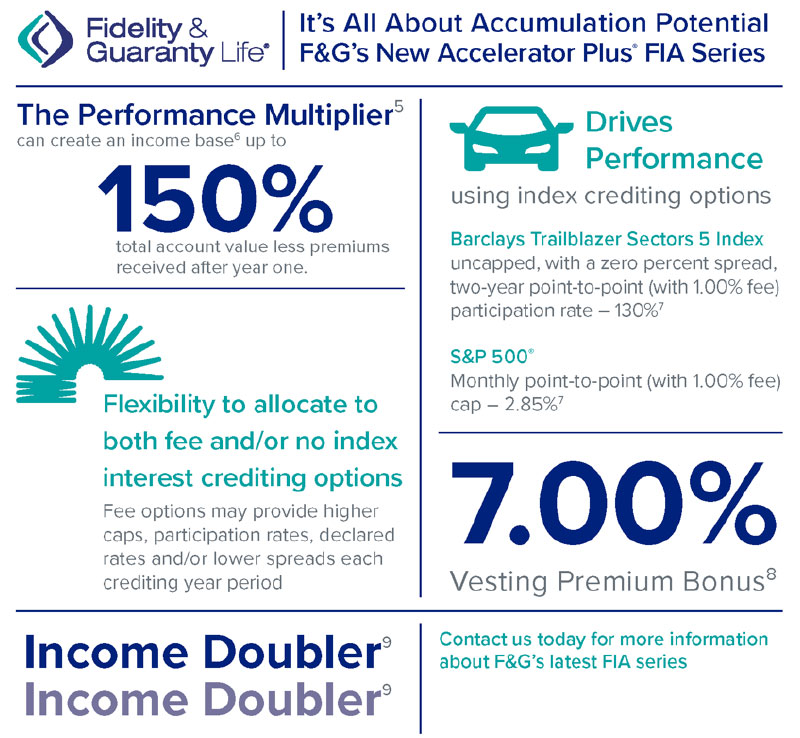

To jump-start a client’s account value, we apply a seven percent1 bonus to all funds received in the first year. This bonus amount is credited to the total account value and eligible to earn interest from the date of issue. The bonus is immediately available for income rider payments or as part of the death benefit. The bonus amount and any interest earned on that bonus amount vest over the annuity surrender charge period.2

How can index crediting options drive performance?

The protected growth of the accumulation values gives clients choices so that they can design and customize Accelerator Plus. F&G offers index interest crediting options for Accelerator Plus based on two indices: the S&P 500® or the exclusive Barclays Trailblazer Sectors 5. In addition, F&G offers a number of term options that the client may choose from. They can choose either a fee or a no-fee index interest crediting option; the fee options allow clients to buy higher caps or participation rates as compared with the no-fee option.3 Also, the client can still choose to put their money in a fixed crediting option for one year.4 The best part is the ability to diversify or allocate their funds in multiple index interest crediting options and, more importantly, reallocate at the end of each index interest crediting period.

What is F&G’s Power Producer program?

It’s a unique program that entitles F&G’s life and annuity producers to be part of a nonqualified, deferred compensation arrangement. For qualifying agents, F&G makes regular credits to an account established by the company for the producer’s benefit. Power Producers also receive red-carpet service and subsidized E&O coverage.

Ask your IMO partner whether you qualify for the unique Power Producer program, exclusively available from Fidelity & Guaranty Life Insurance Company. And discover whether F&G’s Accelerator Plus annuity could give your clients the very financial boost they’re seeking.

Visit https://www.fglife.com/annuities.html.

1. Varies by state and product.

2. Surrender charge period and amounts vary by state and product.

3. Annuities that offer bonus features may have higher fees and charges, longer surrender charge periods, lower credited interest rates, and/or lower cap rates and declared rates than annuities that do not provide the bonus feature.

4. Indexed interest rates are subject to a cap and/or a spread and a participation rate. Caps and spreads are subject to change at the discretion of Fidelity & Guaranty Life Insurance Company.

5. Part of EGMWB Rider that has an annual charge.

6. The income base is not a value that can be withdrawn or surrendered for cash. The income base is used solely to calculate the guaranteed withdrawal payment and rider charge.

7. 0% spread only guaranteed for initial crediting period. Caps, spreads and participation rates are current rates for Accelerator Plus 10 and are subject to change.

8. Vesting premium bonus reflects current Accelerator Plus 10 rate and is subject to change. State, age and surrender charge schedule variations apply.

9. Doubles income payments for single annuitant (1.5 times for joint annuitants) when clients cannot perform two of the six ADLs and meet other requirements. Subject to state availability.

Subject to state availability. Restrictions may apply.

Form numbers: API-1018 (06-11), ACI-1018 (06-11); et al.

For producer use only – not for use in solicitation of consumers.

“F&G” when used herein refers to Fidelity & Guaranty Life, the marketing name for Fidelity & Guaranty Life Insurance Company issuing insurance in the United States outside New York. Life insurance and annuities issued by Fidelity & Guaranty Life Insurance Company, Des Moines, Iowa.

The Power Producer arrangement is unfunded. Your account value is a “bookkeeping” account that is subject to risk of forfeiture in the event of insolvency or bankruptcy of the Company or such other claims as may be made by the general creditors of the Company. The Power Producer program is a deferred bonus compensation plan for eligible appointed agents of Fidelity & Guaranty Life Insurance Company. Terms are as stated in the Power Producer plan document, which Fidelity & Guaranty Life may amend, limit or terminate at any time. FGL reserves the right to exclude products at its discretion.

S&P 500® is a trademark of The McGraw-Hill Companies Inc. and has been licensed for use by Fidelity & Guaranty Life Insurance Company. Standard & Poor’s does not sponsor, endorse, promote or make any representation regarding the advisability of purchasing the contract.

Barclays Bank PLC and its affiliates (Barclays) are not the issuer or producer of Fixed Indexed Annuities and Barclays has no responsibilities, obligations or duties to contract owners of Fixed Indexed Annuities. The Index is a trademark owned by Barclays Bank PLC and licensed for use by Fidelity & Guaranty Life Insurance Company as the Issuer of Fixed Indexed Annuities. Fidelity & Guaranty Life Insurance Company as Issuer of Fixed Indexed Annuities may for itself execute transaction(s) with Barclays in or relating to the Index in connection with Fixed Indexed Annuities. Contract owners acquire Fixed Indexed Annuities from Fidelity & Guaranty Life Insurance Company, and contract owners neither acquire any interest in the Index nor enter into any relationship of any kind whatsoever with Barclays upon making an investment in Fixed Indexed Annuities. The Fixed Indexed Annuities are not sponsored, endorsed, sold or promoted by Barclays, and Barclays makes no representation regarding the advisability of the Fixed Indexed Annuities or use of the Index or any data included therein. Barclays shall not be liable in any way to the Issuer, to contract owners or to other third parties in respect of the use or accuracy of the Index or any data included therein.

18-0515

5 important steps a client should take following an auto accident

A Simple, Affordable, Secure Opportunity

Advisor News

- 2025 Top 5 Advisor Stories: From the ‘Age Wave’ to Gen Z angst

- Flexibility is the future of employee financial wellness benefits

- Bill aims to boost access to work retirement plans for millions of Americans

- A new era of advisor support for caregiving

- Millennial Dilemma: Home ownership or retirement security?

More Advisor NewsAnnuity News

- Great-West Life & Annuity Insurance Company Trademark Application for “EMPOWER BENEFIT CONSULTING SERVICES” Filed: Great-West Life & Annuity Insurance Company

- 2025 Top 5 Annuity Stories: Lawsuits, layoffs and Brighthouse sale rumors

- An Application for the Trademark “DYNAMIC RETIREMENT MANAGER” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Product understanding will drive the future of insurance

- Prudential launches FlexGuard 2.0 RILA

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- Baby On Board

- 2025 Top 5 Life Insurance Stories: IUL takes center stage as lawsuits pile up

- Private placement securities continue to be attractive to insurers

- Inszone Insurance Services Expands Benefits Department in Michigan with Acquisition of Voyage Benefits, LLC

- Affordability pressures are reshaping pricing, products and strategy for 2026

More Life Insurance News