Annuity Awareness Month: Talking Annuity Benefits Year-Round

Most likely, your clients don’t know June is National Annuity Awareness month. That’s because most clients are not looking for a retirement product, they are pursuing their retirement priorities.

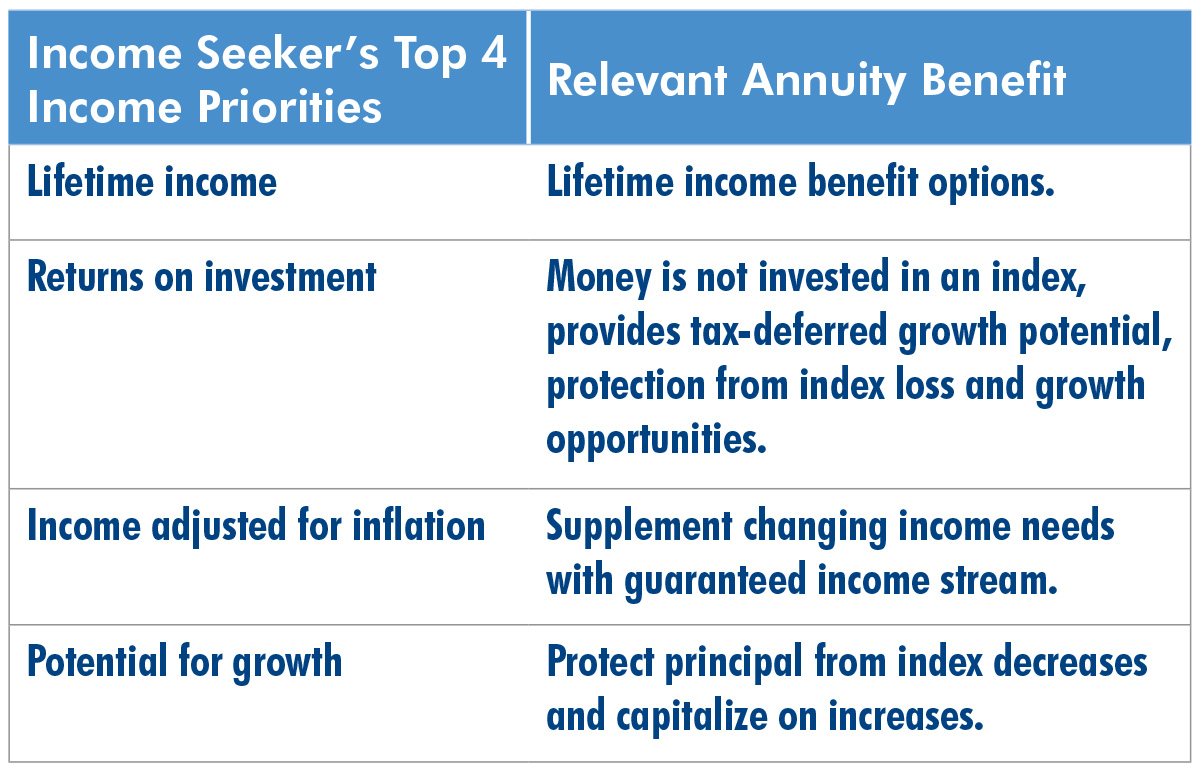

While client values may differ wildly from one to another, a recent LIMRA study reports more than a third of pre-retirees share a similar mindset. Based on what income product features clients value most, the study identified 36% of pre-retirees as income seekers. This is the largest cohort in the findings, and their top preferences can serve as a guide for matching annuity benefits with client priorities.

As a group, income seekers tend to have less than $1 million of investable assets. They believe employers should help convert workplace retirement savings into retirement income and many already own a deferred or immediate annuity. Also, they are considering turning assets into a lifetime annuity.

As a retirement income product, fixed index annuities can bring a lot to the table for income seekers. Aligning your messaging to products and features relevant to their preferences can help you focus your outreach. For example, an overwhelming preference for lifetime income may put more weight on lifetime income benefit options.

Every product benefit holds value for the contract owner. But, what’s of primary importance to one client may not be to another. Annuity Awareness Month is an opportune time to get the conversation going about what’s important to your clients and how these products can help.

American Equity’s line of fixed index annuity products and lifetime income rider options offer a combination of benefits to meet your client’s needs, wherever they are in their journey to and through retirement.

Whether it’s building up assets for retirement or preserving income for life and securing a legacy, we’ve got you covered with our AssetShield and IncomeShield fixed index annuities. For more specific information on products and resources on features, visit our product pages.

To learn more, visit www.american-equity.com.

American Equity does not offer legal, investment, or tax advice. Please consult a qualified professional.

*LIMRA. “Behavior Finance and Retirement Income Preferences” 2020.

Annuity contract issued under form series ICC17 BASE-IDX, ICC17 BASE-IDX-B, ICC17 IDX-11-10, ICC17 IDX-10-10, ICC17 IDX-10-7, ICC17 IDX-10-5 and state variations thereof.

Availability may vary by state. Guarantees are based on the financial strength and claims paying ability of American Equity and are not guaranteed by any bank or insured by the FDIC.

01AD-INN-AAM0420 04.01.20 © 2020 American Equity. All Rights Reserved.

Preparing For Retirement Is Not Like It Used To Be

Empowering agents to grow in a digital world

Advisor News

- Goldman Sachs survey identifies top threats to insurer investments

- Political turmoil outstrips inflation as Americans’ top financial worry

- What is the average 55-year-old prospect worth to an advisor?

- A recession could leave Americans humming 'Oh, Canada'

- Market volatility driven by fear, emotion

More Advisor NewsAnnuity News

Health/Employee Benefits News

- Hanyang University Reports Findings in Anterior Uveitis (Epidemiologic study of pediatric uveitis and its ophthalmic complications using the Korean National Health Insurance Claim Database): Eye Diseases and Conditions – Anterior Uveitis

- Proxy Statement (Form DEF 14A)

- Corporate Responsibility Report

- Gov. celebrates ACA's 15th anniversary

- Texas’ biggest health insurer may drop these Tarrant County hospitals from some plans

More Health/Employee Benefits NewsLife Insurance News