Empowering agents to grow in a digital world

Legal & General America unveils a digital application platform that gives agents and their clients a best-in-class experience.

The big idea: a smart, fast and easy way to service clients.

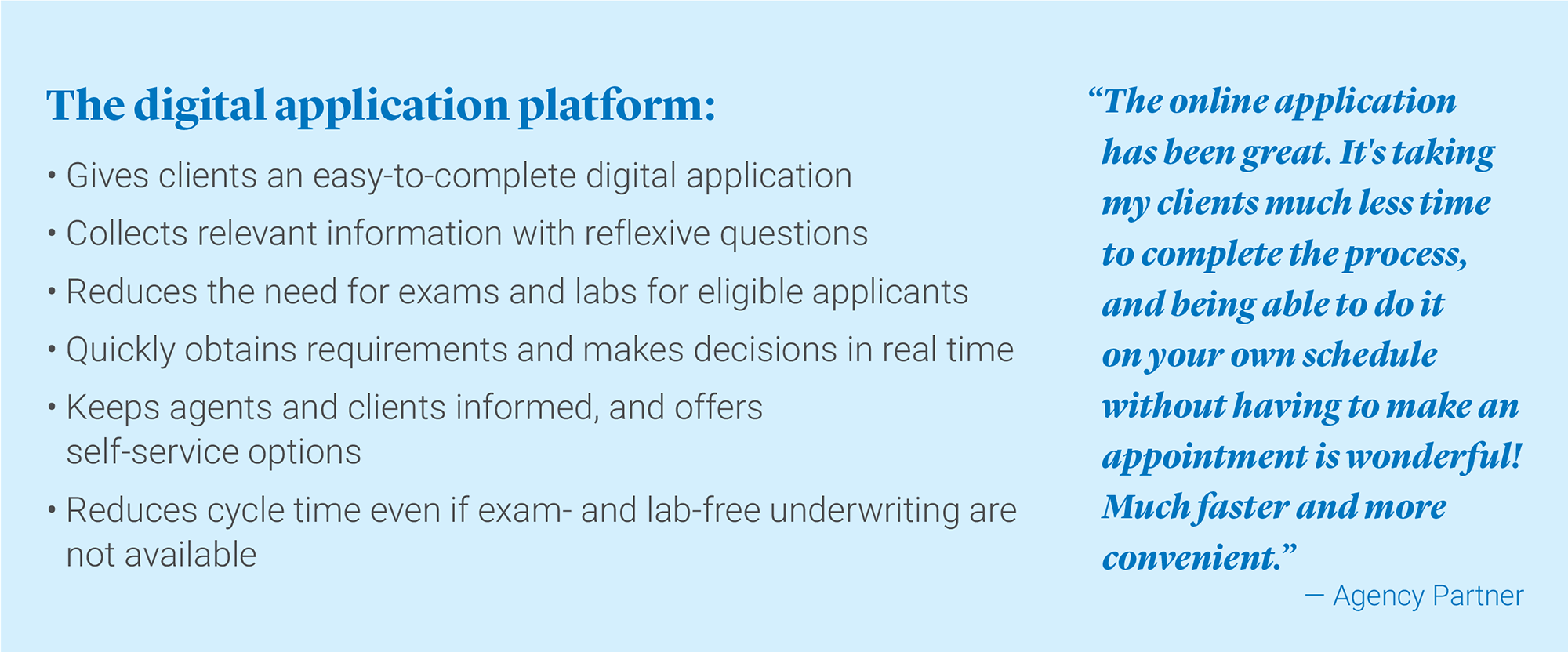

Fast-forward to 2020, when that foresight and preparation is proving essential — especially for distribution partners and their customers in the wake of COVID-19. Legal & General America launched its digital application platform* midway through 2019 in a company-wide effort to protect uninsured or underinsured Americans and meet consumers’ growing dependence on technology. “Working hand-in-hand with our distribution partners, we built our platform to make it easier for people to protect what matters most. The platform brings the life insurance application online, further automates the underwriting process and makes doing business better for everyone,” said Mark Holweger, president and CEO of Legal & General America.

It’s a win-win for customers and agents.

The platform is tailored for agents who want to give their clients superior service while still offering the same low-cost, high-value pricing and product options that Legal & General America has offered for decades. Now agents can serve these customers quicker and more efficiently — moving them through the process faster, which frees up more time to prospect for new customers.

An all-in, company-wide new way to do business.

While other companies are offering partial solutions with limited enrollment programs that may only serve a small portion of the market, Legal & General America’s new platform is much broader than just an electronic application. “We’re integrating this comprehensive platform into all our business processes and using technology that allows us to quickly enhance the process from start to finish. We developed it with transparency and flexibility at all levels to improve outcomes for everyone — especially as we release future capabilities,” said Brooke Vemuri, head of change and transformation at Legal & General America.

The best is yet to come: evolving our technology and processes.

The platform will continue to be enhanced in phases throughout 2020. Partners can look forward to new API solutions that make sharing data more readily available, including real-time status feeds.

At the end of the day, what we do together as an industry is to serve and protect people. By simplifying the life insurance process, we can make it easier for agents and advisors to reach more consumers and help them plan for life's most uncertain moments while giving them a faster, better experience.

Visit newdigitalplatform.com to access more information about our digital application platform, including training guides, videos and more.

*The new digital application is available for Banner Life business only at this time and is not available in New York.

Legal & General America life insurance products are underwritten and issued by Banner Life Insurance Company, Urbana, Maryland and William Penn Life Insurance Company of New York, Valley Stream, NY. Banner products are distributed in 49 states and in DC. William Penn products are available exclusively in New York; Banner does not solicit business there. Clients who do not fit all automated underwriting eligibility requirements may need to submit additional information like a paramedical exam or other labs or medical records. For broker use only. Not for public distribution. The Legal & General America companies are part of the worldwide Legal & General Group. For broker use only. Not for public distribution. 20-161

Annuity Awareness Month: Talking Annuity Benefits Year-Round

The Most Powerful Life And Annuity Insurance Sales Strategy Ever Introduced To The Advisor World

Advisor News

- Grant Cardone, Gary Brecka seek mediation in business breakup lawsuit

- How well do consumers anticipate retirement healthcare, LTC costs?

- CFP Board launches initiative to accelerate growth and leadership of female professionals.

- Strasburg council finalizes budget, moves toward public hearing

- Northwestern Mutual: Many Americans still struggling with inflation

More Advisor NewsAnnuity News

Health/Employee Benefits News

- TrueCare Announces Key Executive Appointments

- Proxy Statement (Form DEF 14A)

- A STRUGGLE FOR PASSAGE

- A 'MODEL FOR THE NATION'

- Health coverage for Chicago area immigrants jeopardized in Gov. Pritzker’s budget proposal

More Health/Employee Benefits NewsLife Insurance News