Study Finds Links Between Planning And Happiness In Retirement

| PR Newswire Association LLC |

These are the first set of findings from the 2014 Planning and Progress Study, an annual research project commissioned by Northwestern Mutual that explores Americans' attitudes and behaviors toward finances and planning. The study found that:

- 70% of Highly Disciplined planners feel 'very financially secure' vs. 51% of Disciplined planners, 34% of Informal planners and 17% of non-planners

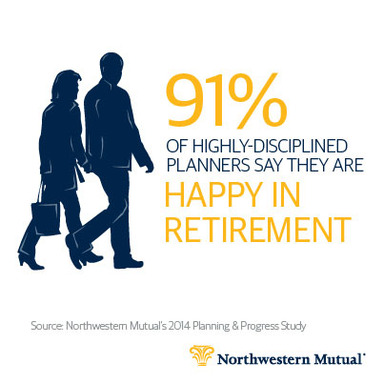

- Highly Disciplined planners who are retired are much more likely than non-planners to say that they are 'happy in retirement' (91% vs. 63%)

"Happiness can't be bought, of course, but it can be planned for," said

Oberland noted that the overall level of discipline that Americans bring to their finances remains low. According to the study:

- Less than one in five U.S. adults (18%) consider themselves a Highly Disciplined financial planner – i.e., they know their exact goals, have developed specific plans to meet them, and rarely deviate from those plans

- One-third (36%) consider themselves Disciplined – i.e., they know their exact goals and have developed specific plans to meet them, but those plans can deviate at times because they don't always stay on top of them

- Nearly half of adults (46%) are either Informal planners or don't do any planning at all

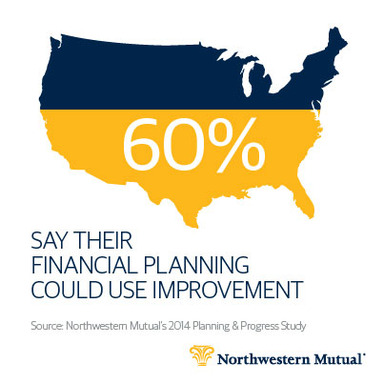

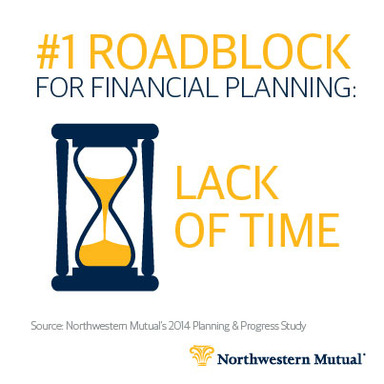

Additionally, 60% of all respondents in the study believe their financial planning could use improvement; and the number one roadblock, cited by more than one in four (27%), is lack of time.

Who are the Most Disciplined Financial Planners in America?

Younger adults (18-39) and more senior adults (60+) have something very important in common – they represent the most disciplined financial planners in the U.S. Meanwhile, adults who fall between ages 40-59 are the most financially unprepared and most likely to identify themselves as Informal or non-planners. The study found:

- 59% of younger adults (18-39) and 54% of more senior adults (60+) identify themselves as disciplined financial planners, while less than half of adults aged 40-50 believe they are disciplined

- More than half (51%) of adults aged 40-59 identify themselves as Informal or non-planners, whereas that number drops to 41% in younger adults (18-39) and 46% in senior adults (60+)

"It's interesting to see the differences in discipline among age groups, and whether they signal a pronounced shift in attitudes toward financial security in America," said Oberland. "It's worth noting that both young adults and seniors have experienced tough economic cycles during formative periods of their financial lives. Regardless of the explanation, we see the return to realistic expectations, prudent decision making and disciplined patience as a very positive trend."

Do Young Boomers Have Their Heads in the Sand?

The study found that 60% of the youngest Baby Boomers (50-59) acknowledge the need to improve their savings and investing discipline, yet they have the least appetite for doing so. Why the disconnect?

Oberland said that for 25% of Americans aged 50-59, the biggest barrier is simply a lack of interest (25%), while 13% cite lack of money.

Additionally, among these young Boomers:

- 70% don't use a financial advisor

- 40% say they take an "informal" approach to financial planning

- 12% wouldn't call themselves planners at all – the highest percentage of any age bracket surveyed

"Becoming financially disciplined is often a matter of priorities," said Oberland. "We work with young Boomers all the time, helping them juggle what can sometimes feel like financial overload. That's why the most critical piece is to address the issues head on rather than putting one's head in the sand."

About the Research

The 2014 Planning and Progress Study explores the state of financial planning in America today, and provides unique insights into people's current attitudes and behaviors toward money, goal-setting and priorities.

This study was conducted by Harris Poll on behalf of Northwestern Mutual and included 2,092American adults aged 18 or older who participated in an online survey between

About Northwestern Mutual

Northwestern Mutual has helped clients achieve financial security for 157 years. As a mutual company with

SOURCE Northwestern Mutual

| Wordcount: | 932 |

West Hollywood Dentist, Dr. Poneh Ghasri, is Offering a Special for New Patients

Advisor News

- Metlife study finds less than half of US workforce holistically healthy

- Invigorating client relationships with AI coaching

- SEC: Get-rich-quick influencer Tai Lopez was running a Ponzi scam

- Companies take greater interest in employee financial wellness

- Tax refund won’t do what fed says it will

More Advisor NewsAnnuity News

- The structural rise of structured products

- How next-gen pricing tech can help insurers offer better annuity products

- Continental General Acquires Block of Life Insurance, Annuity and Health Policies from State Guaranty Associations

- Lincoln reports strong life/annuity sales, executes with ‘discipline and focus’

- LIMRA launches the Lifetime Income Initiative

More Annuity NewsHealth/Employee Benefits News

- Broward schools cut coverage of weight-loss drugs to save $12 million

- WA small businesses struggle to keep up with health insurance hikes

- OID announces state-based health insurance exchange

- Cigna plans to lay off 2,000 employees worldwide

- Insurer ends coverage of Medicare Advantage Plan

More Health/Employee Benefits NewsLife Insurance News