Sompo Japan Nipponkoa Insurance, Daiichi Kotsu Sangyo and Accenture to Develop Deep Learning Algorithm to Understand Driving Behavior, Improve Safety in Japan

Companies will research how to use data analytics to analyze behavior and potentially reduce automobile accidents

This Smart News Release features multimedia. View the full release here: http://www.businesswire.com/news/home/20170824005006/en/

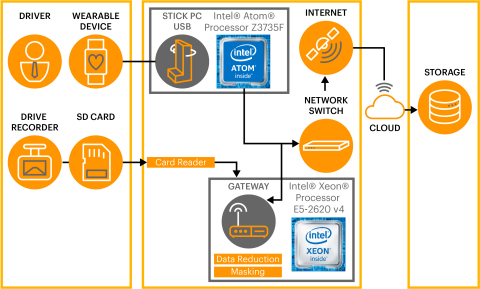

Data Flow Overview (Graphic: Business Wire)

The deep learning algorithm could enable transportation companies to provide personalized safety instructions for drivers, helping reduce the number of accidents, inform the development of optimal driver rosters, and enhance training programs.

As part of an ongoing strategic relationship between Accenture and Intel, the data will be processed securely and anonymously using the Intel® IoT Platform Reference Architecture that includes Intel® processor-based servers equipped with Intel®’s high-performance Xeon processors, Intel®

Accenture will use the input to develop an algorithm that will automatically assess the accident risk for each driver by collating and analyzing images, biometrics, and vehicle data indicating speed and driving behavior. Deep learning, which is one of the emerging advanced analytics techniques available today, will be integral to the data platform.

In an initial Proof of Concept experiment conducted in

“Rapid advances in IoT and autonomous driving technologies are bringing new challenges that can only be addressed by using new technologies such as this deep learning algorithm,” said

As part of this innovative collaboration, Accenture will continue to create new intelligence by applying the latest analytics technologies to address industry challenges. For example, the ability to analyze images on a large, commercial scale is still being developed, and as part of this project Accenture is applying the latest innovations in advanced analytics and data science tools to enable this.

About Accenture

Accenture is a leading global professional services company, providing a broad range of services and solutions in strategy, consulting, digital, technology and operations. Combining unmatched experience and specialized skills across more than 40 industries and all business functions – underpinned by the world’s largest delivery network – Accenture works at the intersection of business and technology to help clients improve their performance and create sustainable value for their stakeholders. With more than 411,000 people serving clients in more than 120 countries, Accenture drives innovation to improve the way the world works and lives. Visit us at www.accenture.com.

Accenture Analytics, part of Accenture Digital, helps clients to use analytics and artificial intelligence to drive actionable insights, at scale. Accenture Analytics applies sophisticated algorithms, data engineering and visualization to extract business insights and help clients turn those insights into actions that drive tangible outcomes – to improve their performance and disrupt their markets. With deep industry and technical experience, Accenture Analytics provides services and solutions that include, but are not limited to: analytics-as-a-service through the Accenture Insights Platform, continuous intelligent security, machine learning, and IoT Analytics. For more information, follow us @ISpeakAnalytics and visit www.accenture.com/analytics.

About

View source version on businesswire.com: http://www.businesswire.com/news/home/20170824005006/en/

[email protected]

Source: Accenture

Aflac Inc. Files SEC Form S-8, Securities To Be Offered To Employees in Employee Benefit Plans: (Aug. 10, 2017)

Baystate Franklin and Noble Nurses Vote to Reject Management’s ‘Best and Final’ Contract Offers; Noble RNs Authorize One-Day Strike

Advisor News

- CFP Board appoints K. Dane Snowden as CEO

- TIAA unveils ‘policy roadmap’ to boost retirement readiness

- 2026 may bring higher volatility, slower GDP growth, experts say

- Why affluent clients underuse advisor services and how to close the gap

- America’s ‘confidence recession’ in retirement

More Advisor NewsAnnuity News

- Insurer Offers First Fixed Indexed Annuity with Bitcoin

- Assured Guaranty Enters Annuity Reinsurance Market

- Ameritas: FINRA settlement precludes new lawsuit over annuity sales

- Guaranty Income Life Marks 100th Anniversary

- Delaware Life Insurance Company Launches Industry’s First Fixed Indexed Annuity with Bitcoin Exposure

More Annuity NewsHealth/Employee Benefits News

- Major health insurer overspent health insurance funds

- OPINION: Lawmakers should extend state assistance for health care costs

- House Dems roll out affordability plan, take aim at Reynolds' priorities

- Municipal healthcare costs loom as officials look to fiscal 2027 budget

- Free Va. clinics brace for surge

More Health/Employee Benefits NewsLife Insurance News