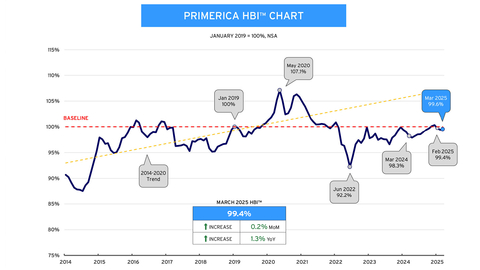

Primerica Household Budget Index™: Purchasing Power for Middle-Income Households Improves Slightly as Gas Prices and Auto Insurance Costs Decline

The latest Primerica Household Budget Index™ (HBI™), a monthly economic snapshot measuring the impact of inflation on middle-income households alongside their earned income, found the average purchasing power for necessities rose to 99.6% in March, a 0.2% increase from a month ago and up 1.3% from a year ago.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20250429280745/en/

The latest Primerica Household Budget Index™ (HBI™), a monthly economic snapshot measuring the impact of inflation on middle-income households alongside their earned income, found the average purchasing power for necessities rose to 99.6% in March, a 0.2% increase from a month ago and up 1.3% from a year ago. Purchasing power improved slightly in March as gas prices and auto insurance costs fell. However, rising food, utilities and healthcare costs offset against the falling gas and car insurance costs.

Purchasing power improved slightly in March as gas prices and auto insurance costs fell. Gas prices declined 0.9% and auto insurance costs fell 0.6% in March. However, rising food, utilities and healthcare costs offset against the falling gas and car insurance costs. Food prices rose 0.3% for the month and 3.4% for the year.

The Consumer Price Index (CPI) that measures inflation for a comprehensive basket of goods for all

For more information on the Primerica Household Budget Index™, visit www.householdbudgetindex.com.

About the Primerica Household Budget Index™ (HBI™)

The Primerica Household Budget Index™ (HBI™) is constructed monthly on behalf of Primerica by its chief economic consultant

The HBI™ uses

Periodically, prior HBI™ values may be modified due to revisions in the CPI series and

About

View source version on businesswire.com: https://www.businesswire.com/news/home/20250429280745/en/

Media Contact:

678-431-9266

Email: [email protected]

Investor Contact:

470-564-6663

Email: [email protected]

Source:

2024 Annual Report

Trump's Fed feud: Why interest rates won't budge anytime soon

Advisor News

- Advisors underestimate demand for steady, guaranteed income, survey shows

- D.C. Digest: 'One Big Beautiful Bill' rebranded 'Working Families Tax Cut'

- OBBBA and New Year’s resolutions

- Do strong financial habits lead to better health?

- Winona County approves 11% tax levy increase

More Advisor NewsAnnuity News

- Talcott Financial Group Launches Three New Fixed Annuity Products to Meet Growing Retail Demand for Secure Retirement Income

- Judge denies new trial for Jeffrey Cutter on Advisors Act violation

- Great-West Life & Annuity Insurance Company Trademark Application for “EMPOWER BENEFIT CONSULTING SERVICES” Filed: Great-West Life & Annuity Insurance Company

- 2025 Top 5 Annuity Stories: Lawsuits, layoffs and Brighthouse sale rumors

- An Application for the Trademark “DYNAMIC RETIREMENT MANAGER” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

More Annuity NewsHealth/Employee Benefits News

- My thoughts on Medicare Advantage

- Aetna to cover IVF treatments for same-sex couples in national settlement

- ‘Egregious’: Idaho insurer says planned hospital’s practices could drive up costs

- D.C. DIGEST

- Medicaid agencies stepping up outreach

More Health/Employee Benefits NewsLife Insurance News