MEDIA ALERT: What Are the Tax Implications of Dying Without a Will?

This Smart News Release features multimedia. View the full release here: http://www.businesswire.com/news/home/20160621006192/en/

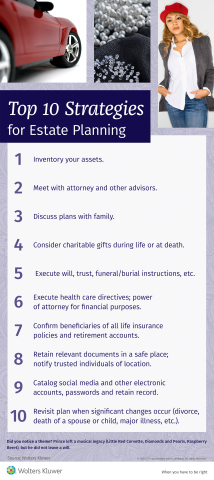

Estate planning infographic (Graphic: Business Wire)

What: When international superstar Price died in April, he left this world with 40 hits on Billboard’s Top 100 chart, an estimated

Why: Tax consequences can be severe when individuals die without a will. With proper estate planning, individuals can take federal and state estate tax into account and determine ways to potentially avoid leaving a financial burden and legal mess following an unexpected death.

Who:

- The tax benefits of making a will

- The potential costs involved with NOT creating a will

- How the value of an estate affects the tax burden

- The challenges with evaluating the value of an estate

- Death taxes and what beneficiaries of a will can expect

- The benefits of arranging a testamentary gift

When:

Contact: Please contact

View source version on businesswire.com: http://www.businesswire.com/news/home/20160621006192/en/

(847) 267-2213

or

(847) 267-7535

Source:

Younger Consumers Would Like To Receive Life Insurance Benefits As Monthly Income

Advisor News

- Six steps to turn HNW friends into clients

- The two-bucket investment approach to making money last

- Republicans confront difficult Medicaid choices in search of savings to help pay for tax cuts

- Economy showing momentum despite uncertainty

- 7 ways financial advisors can benefit by giving back to nonprofits

More Advisor NewsAnnuity News

Health/Employee Benefits News

- Studies from University of Occupational and Environmental Health Provide New Data on COVID-19 (Avoiding the Use of Outpatient Rehabilitation Services Under Long-term Care Insurance During the Covid-19 Pandemic): Coronavirus – COVID-19

- After more than 1,000 layoffs, worries persist about CVS Health's future in Connecticut

- This West Linn house, birthplace of Oregon prepaid health plans, is on National Historic Register

- Medicaid on the chopping block as Republicans release budget draft

- Wash, dry, enroll: Finding Medicaid help at the laundromat

More Health/Employee Benefits NewsLife Insurance News

- Annual financial and audit reports – JPMORGAN CHASE & CO.

- Conning research: Insurers must be flexible in the 2025

- AM Best Places Credit Ratings of Banner Life Insurance Company and William Penn Life Insurance Company of New York Under Review With Developing Implications

- Best's Review Examines Value in Innovation Culture

- Initial Registration Statement for Employee Benefit Plan (Form S-8)

More Life Insurance News