Legal Industry Embraces AI, Boosts Protections, and Navigates Evolving Risks, Embroker Survey Finds

New study finds AI usage among legal professionals surged from 22% in 2024 to 80% in 2025

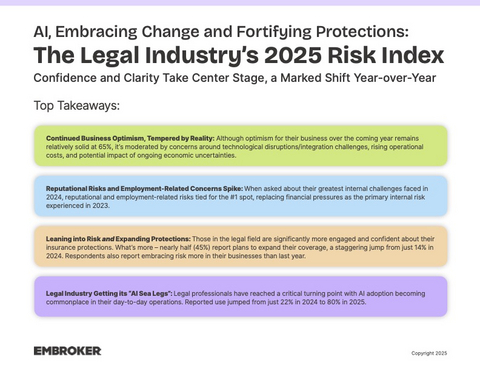

Embroker, the digital insurance company radically simplifying the insurance buying experience for businesses, today released its Legal Industry 2025 Risk Index, revealing significant shifts in business priorities within the legal profession year-over-year (YoY). Findings demonstrate rising confidence among law firms, with more deliberate risk management strategies, thoughtful AI integration, and an expanded risk appetite. Moreover, attorneys show a significantly increased confidence and awareness regarding their insurance protections.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20250723947919/en/

Legal professionals have reached a critical turning point with AI adoption becoming commonplace in their day-to-day operations. Reported use jumped from just 22% in 2024 to 80% in 2025.

Nearly half (45%) report plans to expand their coverage, a substantial increase from just 14% in 2024. Furthermore, 77% believe their current insurance policies would cover their greatest business risks, and more professionals are securing dedicated cyber insurance, reflecting its growing recognition as an essential protection.

AI Adoption: Cautious Optimism

The legal industry has reached an inflection point, with professionals strategically leveraging AI to enhance professional services, automate client support, and strengthen cybersecurity. Reported AI usage among legal professionals jumped from a modest 22% in 2024 to 80% in 2025. Concerns about AI persist, with respondents highlighting risks of over-reliance leading to professional liability risks (43%), data privacy breaches (38%), and legal/ethical issues due to misuse (37%). However, the increased use of AI suggests a growing comfort and understanding of its capabilities.

Amidst the rapid adoption of AI within the legal sector, a critical new challenge has emerged: the rise of malpractice suits linked to the wrongful or undisclosed use of AI tools. While legal professionals are leveraging AI to enhance services and streamline operations, this technological integration introduces increased professional liability risks if not used responsibly. Firms now face the complex task of not only navigating the ethical implications of AI but also ensuring transparency and accuracy in its use to avoid legal repercussions and safeguard client interests.

“Legal professionals are rapidly integrating AI into their workflows, but this surge in adoption introduces novel professional liability risks that firms must proactively manage. As the industry continues to embrace AI, it’s critical for firms to ensure they have guidelines in place to govern their AI use to minimize the potential for malpractice claims,” said

Internal Pressures and External Challenges

There is a notable shift in the primary internal challenges faced by law firms — when asked this year about the previous year’s challenges (2024), “reputational risks stemming from public controversies, client disputes, or social issues” tied with “employment-related claims (e.g., harassment, wrongful termination, discrimination)” as top internal issues, both at 47%. This marks a significant change from the prior year, when the “rising cost of business” ranked in the number one spot. This pivot underscores intensifying pressures related to staff management and public perception within the legal sector.

Externally, the top threats have also evolved. “Challenges adapting to disruptive technologies (e.g., AI tools, LLMs)” ranked as the number one external risk encountered at 53%, followed closely by “professional liability claims, legal malpractice threats, or other litigation suits” at 51%. “Cybersecurity breaches, attacks, or threats” came in third, at 40%. The data suggests that legal professionals are realizing that failing to incorporate and adapt to AI and other technologies poses the biggest threat of all.

While inflation concerns remain, they have significantly decreased from the previous year, from 52% in 2024 to 28% in 2025, indicating that law firms are more comfortable with, or at the very least more accustomed to, economic volatility than with emerging technological risks.

Strategic Shifts and Evolving Risk Appetite

Despite a slight decrease in overall business optimism (65% in 2025 compared to 70% in 2024), legal professionals are demonstrating a more strategic and confident approach to their operations and risk management. The top three business priorities for 2025 are infrastructure (IT, equipment, office space, etc.), technological advancement/support, and sales/revenue growth. This represents a shift from 2024's priorities of employee hiring/retention, networking, and sales growth, reflecting a clear emphasis on embracing new technologies and bolstering operational resilience.

Furthermore, the legal field is increasingly embracing risk. YoY data shows a significant increase in firms describing their approach to risk as an opportunity to drive growth (37% in 2025 vs. 18% in 2024) or fully embracing risk (23% in 2025 vs. 8% in 2024). This indicates a growing confidence in their ability to navigate potential pitfalls and leverage risk for business advancement strategically.

The 2025 Legal Industry Risk Index underscores an industry at a pivotal moment, characterized by a proactive stance towards technological innovation, strengthened insurance protections and a bolder strategic approach to risk, ensuring resilience and sustained growth in an era of rapid change.

The full report is available on Embroker’s website for download here.

Report Methodology: Embroker commissioned a survey of 245 US-based full-time legal professionals in

About Embroker:

Embroker is a digital-first insurance company helping businesses manage risk with a radically simple approach. Embroker is enhancing the legacy and manually intensive technology of the commercial insurance industry with an end-to-end digital insurance platform that intelligently recommends industry-tailored coverage programs, all in minutes. Through Embroker Access, Embroker provides partner agencies and wholesalers with the capability to offer all of Embroker’s industry-leading insurance products to their customers. Founded in 2015, Embroker is headquartered in

View source version on businesswire.com: https://www.businesswire.com/news/home/20250723947919/en/

Media Contact

104 West on behalf of Embroker

[email protected]

Source: Embroker

WATCH: Trump says he's considering 'no tax on home sales' proposal

Unite Us and Nomi Health Partner to Accelerate and Streamline Payments for Community-Based Organizations Serving Medicaid Managed Care Organizations

Advisor News

- Mitigating recession-based client anxiety

- Terri Kallsen begins board chair role at CFP Board

- Advisors underestimate demand for steady, guaranteed income, survey shows

- D.C. Digest: 'One Big Beautiful Bill' rebranded 'Working Families Tax Cut'

- OBBBA and New Year’s resolutions

More Advisor NewsAnnuity News

- MetLife Declares First Quarter 2026 Common Stock Dividend

- Using annuities as a legacy tool: The ROP feature

- Jackson Financial Inc. and TPG Inc. Announce Long-Term Strategic Partnership

- An Application for the Trademark “EMPOWER PERSONAL WEALTH” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Talcott Financial Group Launches Three New Fixed Annuity Products to Meet Growing Retail Demand for Secure Retirement Income

More Annuity NewsHealth/Employee Benefits News

- Rising health costs could mean a shift in making premium payments

- SENSITIVITY OF THE DISTRIBUTION OF HOUSEHOLD INCOME TO THE TREATMENT OF HEALTH INSURANCE FROM 1979 TO 2021

- Thousands in state face higher health insurance costs

- Thousands facing higher health insurance costs

- Trump wants GOP to 'own' health care issue but show 'flexibility' on abortion coverage restrictions

More Health/Employee Benefits NewsLife Insurance News