Individual Life Combination Premium Grows 18% In 2017

WINDSOR, Conn., June 21, 2018 – Total new premium for life combination products (which combine life insurance with long-term care or chronic illness coverage) increased 18 percent to $4.1 billion in 2017, according to LIMRA’s 2017 Individual Life Combination Products Annual Review. This is the third consecutive year of premium growth.

Life combination product market share of individual life insurance premium has increased 10 percentage points over the last two years and represents 25 percent of total new U.S. life insurance premium in 2017.

“Life combination product premium has increased by double-digits in four of the last five years. Much of this growth may be attributed to the attractive value proposition these product offer to consumers,” said Elaine Tumicki, corporate vice president and director LIMRA Product Research. “Our consumer research finds more than a third of U.S. consumers said they would consider a combination product because no matter the circumstances they or their beneficiaries would benefit.”

LIMRA’s study finds there were 260,000 policies sold in 2017, five percent higher than 2016 results.

Over the last several years, this market has seen a shift in product design. In 2011, 61 percent of policies were sold on a recurring premium basis, while 39 percent were single premium policies. In 2017, 89 percent of policies sold were recurring premium.

“This shift suggests a growing movement to attract mass-affluent buyers who may not have the financial wherewithal to invest a large lump sum all at once but still want the dual protection these products offer,” noted Tumicki.

In 2017, the average premium amount increased for both single and recurring premium products. The average recurring premium for combination products in 2017 was $6,397, up 29 percent compared with 2016. The average single premium for combination products was $90,984 in 2017, an increase of 7 percent over 2016 results.

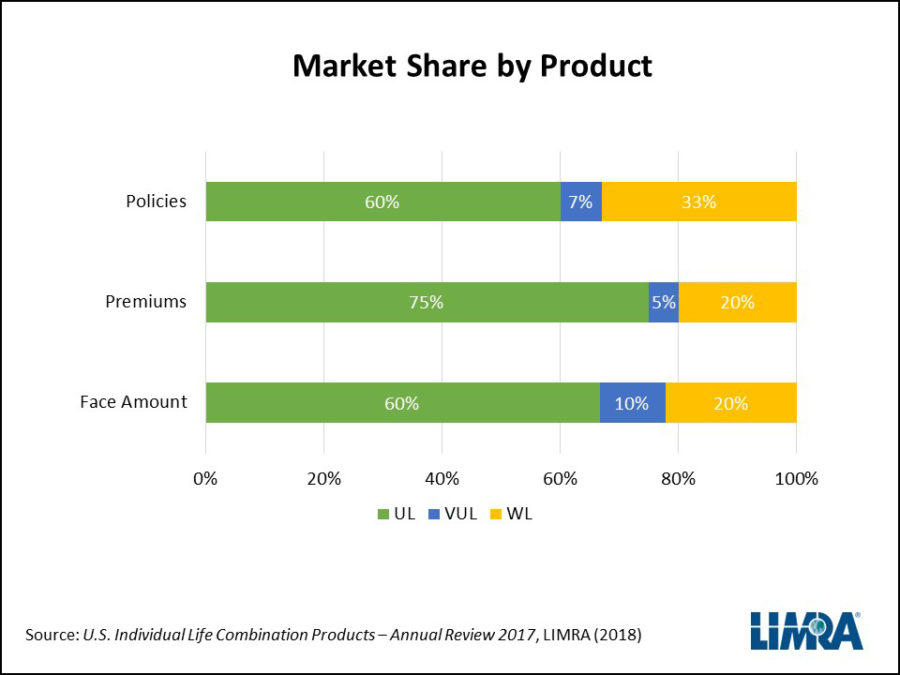

Sales of all product types increased in 2017. Universal life (UL) combination premium rose 20 percent; whole life (WL) combination premium increased 13 percent; and variable universal life (VUL) combination products grew 24 percent in premium in 2017. Universal life combination products continue to hold the majority of the market share by every measure (premium, policy count and face amount).

When looking specifically at the different types of life insurance combination products, LTC extension products account for 41 percent of all new life combination premium in 2017. Acceleration products, LTC and CI, make up 20 percent and 39 percent respectfully. LTC extension products also experienced the strongest growth in policy count, up 24 percent.

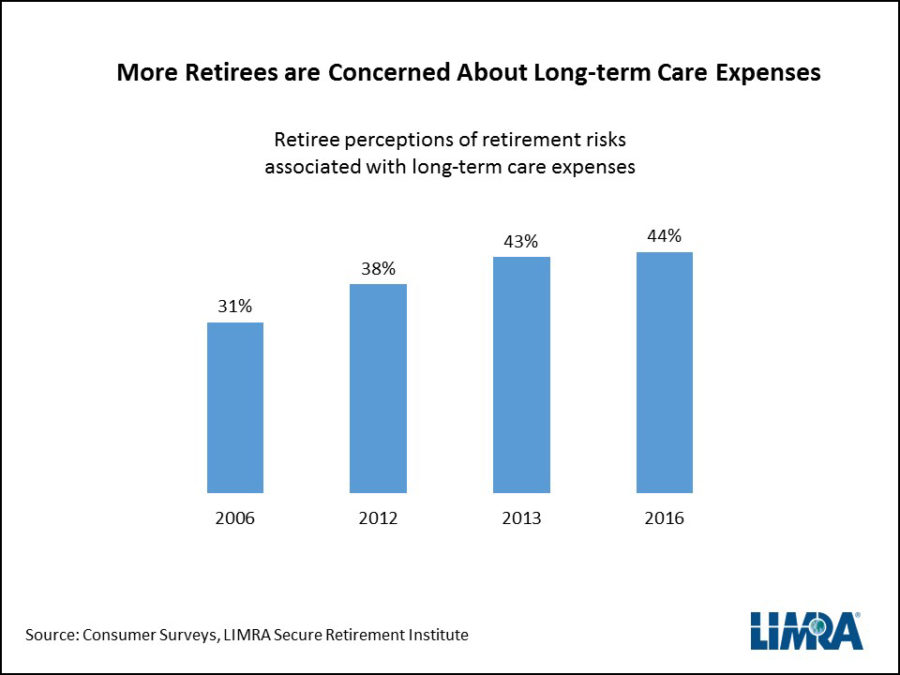

According to LIMRA data, there will be about 82 million retired Americans by 2040. The U.S. government estimates more than half of those 65 and older will need long-term care (LTC) during their lifetime. Retirees are growing more aware of the risks associated with LTC costs. According to LIMRA Secure Retirement Institute research, 44 percent of retirees are concerned about LTC expenses, more than 40 percent higher than in 2006.

“Combination products are a great way to mitigate some of the growing risk of paying for long term care that faces seniors so it is not surprising that sales of combination products are steadily increasing,” noted Tumicki. “Our research finds 6 in 10 consumers would consider purchasing a combination product to offset long-term care costs.”

In the LTC market space, LIMRA tracks three different types of options, Life LTC, Life CI and standalone long-term care insurance. Life LTC products increased their share of the broader LTC market by five percentage points at the expense of standalone long-term care insurance products. Combination products represent 80 percent of new sales in the overall market for individual LTC solutions in 2017.

Smart Harbor Launches Mobile Web App With Commercial Rating for Independent Agencies

UPDATE: H.R.4005 – Medicaid Reentry Act

Advisor News

- RICKETTS RECAPS 2025, A YEAR OF DELIVERING WINS FOR NEBRASKANS

- 5 things I wish I knew before leaving my broker-dealer

- Global economic growth will moderate as the labor force shrinks

- Estate planning during the great wealth transfer

- Main Street families need trusted financial guidance to navigate the new Trump Accounts

More Advisor NewsAnnuity News

- Product understanding will drive the future of insurance

- Prudential launches FlexGuard 2.0 RILA

- Lincoln Financial Introduces First Capital Group ETF Strategy for Fixed Indexed Annuities

- Iowa defends Athene pension risk transfer deal in Lockheed Martin lawsuit

- Pension buy-in sales up, PRT sales down in mixed Q3, LIMRA reports

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- Jackson Names Alison Reed Head of Distribution

- Consumer group calls on life insurers to improve flexible premium policy practices

- Best’s Market Segment Report: Hong Kong’s Non-Life Insurance Segment Shows Growth and Resilience Amid Market Challenges

- Product understanding will drive the future of insurance

- Nearly Half of Americans More Stressed Heading into 2026, Allianz Life Study Finds

More Life Insurance News