Don’t End Valentine’s Day Brokenhearted: The Right Insurance Can Safeguard Your New Valuables

Experience the interactive Multimedia News Release here: https://www.multivu.com/players/English/8018251-iii-insurance-valentines-day/

Jewelry losses are among the most frequent of all homeowners content related insurance claims. Fortunately, there are four steps to ensure proper protection for your new ring:

1. Contact your insurance professional immediately.

Find out whether you will need additional insurance. Most standard homeowners and renters insurance limit the dollar amount on jewelry to

2. Obtain a copy of the store receipt.

Forward a copy of the receipt to your insurer—so that your company has a record of the current retail value of the ring—and keep a copy for your own records.

3. If you received an heirloom piece, have it appraised.

Antique jewelry will need to be appraised for its dollar value. You can ask your insurance professional to recommend a reputable appraiser. It's also a good time to have existing pieces reappraised as the value of jewelry can change over time.

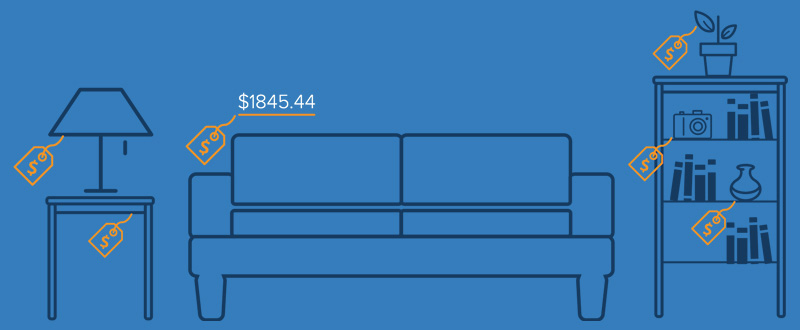

4. Add the item to your home inventory.

An up-to-date inventory of your personal possessions can help you purchase the correct amount of insurance and speed up the claims process if you have a loss, so remember to add your new ring to your inventory. To make creating a home inventory as easy as possible, the I.I.I. offers a free app at Know Your Stuff®.

The I.I.I. is a nonprofit communications and research organization supported by the insurance industry.

To view the original version on PR Newswire, visit:http://www.prnewswire.com/news-releases/dont-end-valentines-day-brokenhearted-the-right-insurance-can-safeguard-your-new-valuables-300403808.html

SOURCE

A.M. Best Removes From Under Review and Upgrades Credit Ratings of Granite Re, Inc.

Research Reports Coverage on Healthcare Stocks — BioScrip, Select Medical, Nobilis Health, and Health Insurance Innovations

Advisor News

- More than half of recent retirees regret how they saved

- Tech group seeks additional context addressing AI risks in CSF 2.0 draft profile connecting frameworks

- How to discuss higher deductibles without losing client trust

- Take advantage of the exploding $800B IRA rollover market

- Study finds more households move investable assets across firms

More Advisor NewsAnnuity News

- Court fines Cutter Financial $100,000, requires client notice of guilty verdict

- KBRA Releases Research – Private Credit: From Acquisitions to Partnerships—Asset Managers’ Growing Role With Life/Annuity Insurers

- $80k surrender charge at stake as Navy vet, Ameritas do battle in court

- Sammons Institutional Group® Launches Summit LadderedSM

- Protective Expands Life & Annuity Distribution with Alfa Insurance

More Annuity NewsHealth/Employee Benefits News

- WHITEHOUSE REINTRODUCES BILL TO REFORM PRIOR AUTHORIZATION AND DELIVER CARE TO PATIENTS FASTER

- CVS Pharmacy, Inc. Trademark Application for “CVS FLEX BENEFITS” Filed: CVS Pharmacy Inc.

- Medicaid in Mississippi

- Policy Expert Offers Suggestions for Curbing US Health Care Costs

- Donahue & Horrow LLP Prevails in Federal ERISA Disability Case Published by the Court, Strengthening Protections for Long-Haul COVID Claimants

More Health/Employee Benefits NewsLife Insurance News