Workplace benefits help get employees in the door — and keep them there

In today’s competitive hiring environment, attracting and retaining top talent are key concerns for employers. And while offering a comprehensive benefits package has long been a significant tool to help attract talent, more employees — particularly younger employees — are looking for additional protections and options from their employers.

According to research from Lincoln Financial Group, our current economic climate has led 83% of workers surveyed to reevaluate at least one aspect of their life, finances, work or retirement. This number is even higher among the younger generations, with 91% of Generation Z and 89% of millennials reevaluating their finances and goals. Workers are placing a greater emphasis on what they value most in life and helping ensure they are financially prepared for the future.

This heightened interest in improving personal finances offers employers a significant opportunity to present employees with tools and resources to help secure their financial future. Offering workplace benefits and retirement plan options can also lead to an increase in employee satisfaction and a decrease in attrition. In fact, Lincoln Financial Group’s Small-Business Owner Survey found 82% of small-business owners see employee benefits as a top strategic priority, as these benefits play a critical role in impacting culture, morale and employee well-being and in attracting and retaining talent.

To help employers get new hires through the door — and keep them there — it’s important to communicate how benefits offered at the workplace can protect an employee’s finances today and help secure their tomorrow.

Benefits influence job decisions

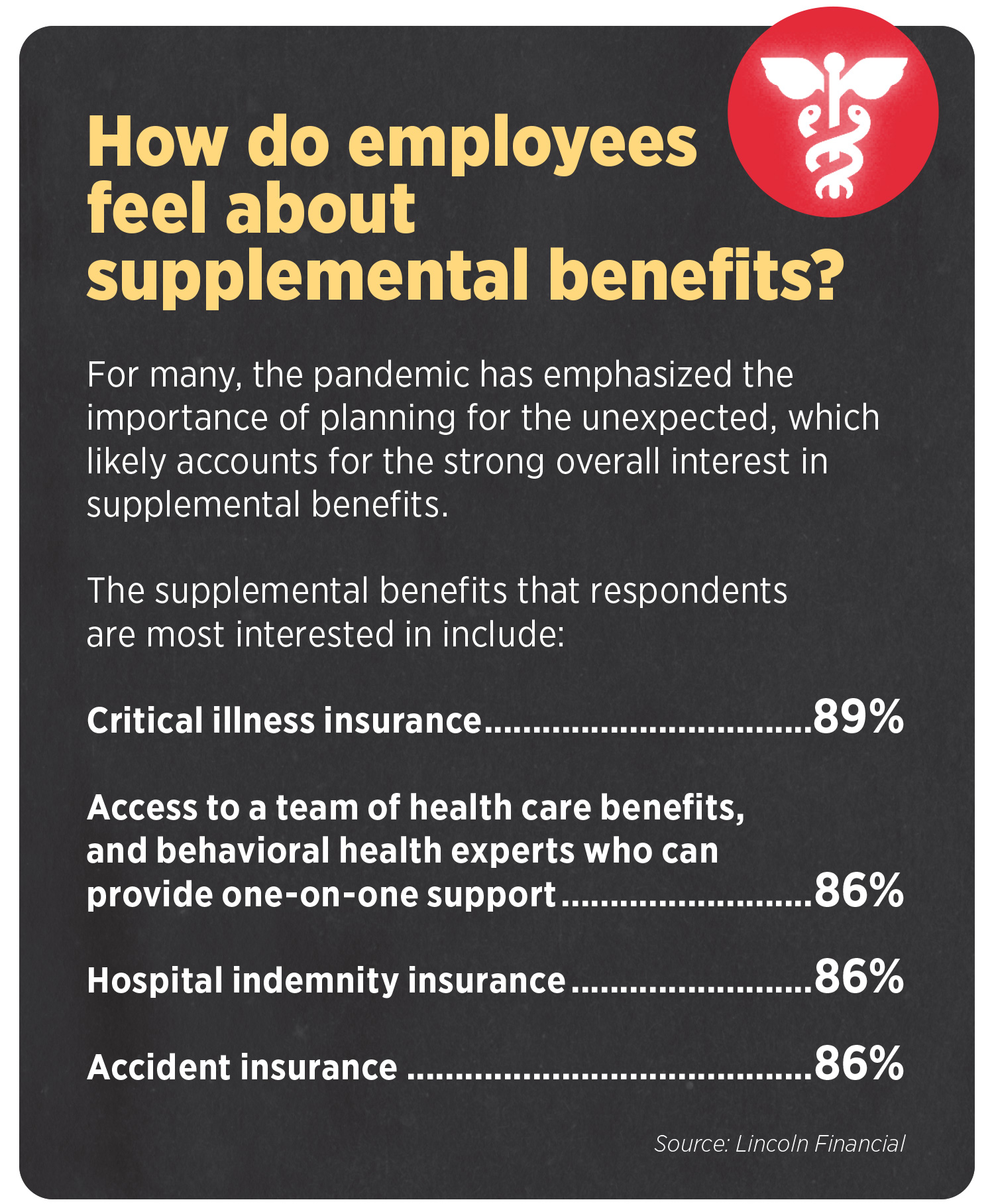

Offering a well-rounded benefits package sends a clear and deliberate message that a company cares about employees both inside and outside of the office. In the current competitive hiring market, this benefits package can move the needle for an employee choosing between job offers. Research shows 77% of employees surveyed see insurance benefits other than health insurance as a must-have or very important when deciding to take a new job.

As employees progress through different life stages, they are increasingly focused on things that may have an impact on their present and long-term financial well-being. Currently, more than 1 in 3 American labor force participants (35%) are millennials, making them the largest generation in the U.S. labor force, Pew Research found. To attract and retain this generation of employees, employers must not only offer benefits but also educate workers on benefits and investment, provide digital options, and illustrate how benefits can help instill confidence when it comes to unforeseen health issues or accidents. This is an impactful concept in the post-COVID-19 environment.

Small businesses are no exception, with more than a quarter (28%) of small-business owners surveyed offering better benefits to attract and retain talent following the pandemic. Here are some of the benefits offered:

» Disability insurance provides paycheck protection. If someone is unable to work due to an illness or injury, they won’t lose their source of income.

» Accident insurance helps pay for expenses that aren’t covered by health insurance, such as high deductibles.

» Critical illness insurance provides funds to cover day-to-day expenses — such as mortgage payments, childcare, food and more — while someone recovers from an illness.

These workplace benefits don’t only attract new employees; they help retain them as well. Research shows that 80% of employees said being offered group benefits — including life insurance — positively impacts their loyalty to their employer.

Offering these benefits is an important first step, but for employees to take full advantage of these protections, they first need to understand them.

Education for the evolving workforce

Choosing the right workplace benefits can be a complicated process. In fact, 54% of those surveyed say they would enroll in more benefits at work if they could understand them better — that number increases to 58% among Gen Z and 62% among millennials.

It’s important for employers to offer simple, relevant and personalized information that helps workers make informed decisions and achieve their long-term objectives. In an era of digital communication, it is also important to understand how to reach our audiences — and to reach the younger generation, companies must be online.

On-demand digital resources, virtual documents and digital tools showcase the added services that come with certain products and can help employees get the most value from their benefits. Employers can partner with their carriers to offer tools and resources that can help employees make these selections and understand the impact to their paycheck, including videos and digital calculators that can help estimate life insurance and disability coverage needs.

Developing a digital guide to understanding benefits can also go a long way toward winning trust.

Providing information through a variety of digital and mobile channels can help alleviate worker frustration.

Focus on financial wellness

Employees across all generations are increasingly focused on improving their finances, but they may need help navigating the challenges they face.

Balancing financial priorities is one of the main causes of stress among workers, with an overwhelming 93% of employees surveyed saying they feel stressed, and 34% saying this stress has negatively impacted their ability to focus on improving their health and well-being, Lincoln Financial’s Consumer Sentiment Tracker found. This heightened financial stress can make it difficult for workers to balance the needs of today with saving for the future.

Offering financial wellness resources can help. Of those surveyed who have used financial wellness resources, 77% said they’ve seen a positive impact and 69% said the support helped reduce the amount of stress they feel about finances, Lincoln Financial’s Wellness@Work survey showed. When employees improve their financial wellness, they’re able to better manage everyday expenses. This reduces worker stress levels and gives them confidence to plan ahead.

Offering financial wellness solutions can also have an impact on employee retention, with 56% of employees surveyed saying they would be more loyal to an employer who provided financial wellness benefits. By offering these resources, employers have a significant opportunity to improve employees’ financial health while also strengthening their businesses.

Employers don’t have to go it alone — insurance carriers and benefits brokers are here to partner with them and ensure their employees have the options and education they need to take charge of their financial wellness and benefits options.

James Reid is executive vice president of Lincoln Financial Group and president of Workplace Solutions. Contact him at [email protected].

Navigating uncertainty in a presidential election year

4% is a safe starting withdrawal rate for retirees, research finds

Advisor News

- How is consumers’ investing confidence impacting the need for advisors?

- Can a balance of withdrawals and annuities outshine the 4% rule?

- Economy ‘in a sweet spot’ but some concerns ahead

- Trump, Capitol allies likely looking at quick cryptocurrency legislation

- SEC panel reviews mandatory arbitration clause in investment advisory agreements

More Advisor NewsAnnuity News

Health/Employee Benefits News

- Connecticut Hospital Association points to insurers for ongoing financial woes post-pandemic

- 5 of the most frustrating health insurer tactics and why they exist

- Why health care costs more in America?

- Temple pushes for special session on insurance reform

- 5 of the most frustrating health insurer tactics and why they exist

More Health/Employee Benefits NewsLife Insurance News