4% is a safe starting withdrawal rate for retirees, research finds

When trying to figure out the optimum starting withdrawal rate for your retirement account, you might hear the voice of Lawrence Olivier from the film “Marathon Man” in your head: “Is it safe?”

The optimum, or sustainable, withdrawal rate is the estimated percentage of savings a retiree can safely draw down each year throughout their retirement without running out of money. The variables in such a calculation are numerous. When will you retire? How much money do you have? How much money do you need per year? How old are you? How long do you expect to need retirement income — 10 years? 20 years? 30 years? Where’s the economy likely to go? And that’s just for starters.

“Retirement is inherently about making decisions today in a state of uncertainty,” said Luke Neumann, wealth planner at Crestwood Advisors in Boston. “We can only make educated guesses about what long-term returns might look like, while short-term returns are a random walk.”

Neumann advises his clients to focus more on the things they can control when making decisions in uncertain times.

“Am I making purchases that feel important to me?” he asked. “Am I living my best life and creating lifelong memories with friends and family? Do I feel as though I am overspending?”

Leave it to the experts, economic prognosticators and advisors to come up with an actual withdrawal rate.

The good news is Morningstar has done just that and calculated that the safe starting withdrawal rate for retirees is currently the highest it has been in years — maybe ever. Morningstar’s latest research reveals that the highest safe starting withdrawal rate for retirees is now 4%, signaling an increase from the 3.8% reported in 2022 and the 3.3% in 2021. The surge in the withdrawal rate is attributed to higher fixed-income yields and a reduced long-term inflation estimate compared with the previous year. The safe withdrawal rate may in fact be an economic indicator of its own.

Three key variables

“History demonstrates that the ‘right’ withdrawal rate depends on three key variables: the market environment that prevails over a retiree’s drawdown period, the length of the drawdown period, and the portfolio’s asset allocation,” the report said.

The report underscores the importance of understanding the impact of withdrawal strategies on portfolio performance and highlights the delicate balance between starting withdrawal rates, ending portfolio values and cash flow volatility. One notable finding is the impact of dynamic withdrawal strategies, which can enhance portfolio consumption efficiency by considering both portfolio performance and spending. However, the downside is the introduction of variability in cash flows, a factor that may not be acceptable for all retirees.

The highest starting safe withdrawal percentage comes from portfolios that hold between 20% and 40% in equities and the remainder in bonds and cash. Portfolios with equity allocations other than 20% to 40% have slightly lower starting safe withdrawal rates. In compensation, portfolios with higher equity weightings provide higher median residual balances at the end of the 30-year period than do bond-heavy portfolios.

“Absent greater GDP growth, we may see lower equity returns over the coming period,” Neumann said. “Investors use prevailing interest rates to appropriately value equity investments — and that value will remain lower while interest rates are higher. For diversified investors, though, higher yields on bonds should help offset these lower equity returns.”

Nevertheless, many investment consultants and retirement advisors agree that 4% sounds right for a starting withdrawal rate at the moment.

“Given where interest rates are, this is about right,” said Doug Carey, a chartered financial analyst at WealthTrace, headquartered in Boulder, Colo.

But there are caveats.

“It is important to point out that a big part of the increase in interest rates is due to inflation,” Carey said. “Part of the increase in the withdrawal rate is also due to inflation. As inflation recedes, it is likely that interest rates will decline, and the withdrawal rate will need to decline as well.”

Indeed, even Morningstar agrees.

“The ongoing negative effects of higher inflation and the 2022 bear market are a sobering counterpoint to the generally positive findings from this year’s study,” it concludes.

Build a ladder

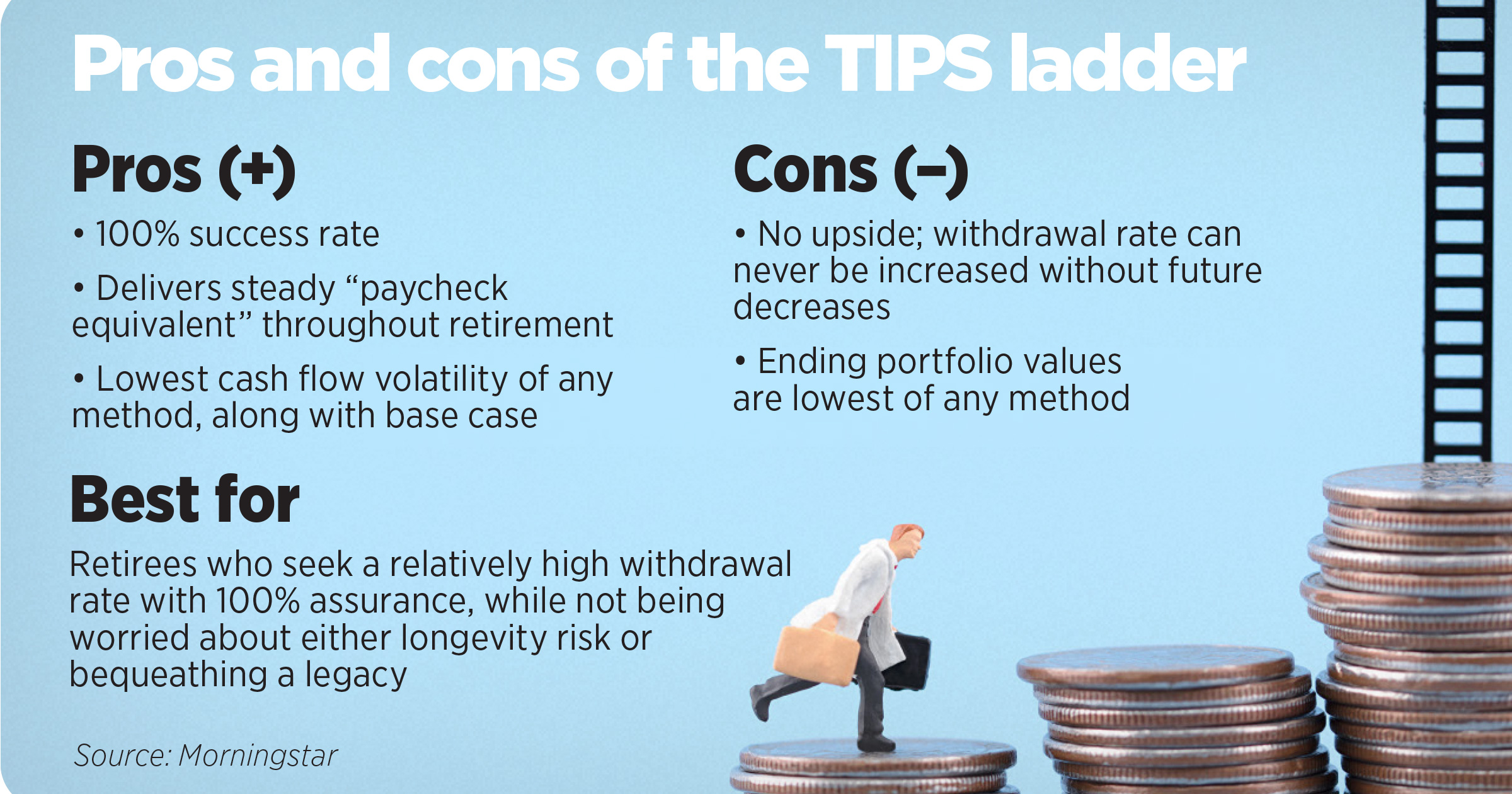

For those seeking a higher withdrawal rate than the base case of 4%, Morningstar and others suggest building a ladder of Treasury Inflation-Protected Securities (TIPS). This strategy provides a 4.6% withdrawal rate with a 100% probability of success but liquidates the portfolio entirely by the end of the 30-year period under all conditions.

“I am a big fan of investing in TIPS right now,” Carey said. “Investors can get a 2.3% after-inflation yield on 30-year TIPS. This means they can lock in this real return for 30 years. We haven’t seen real yields this high in more than 15 years. Looked at another way, if we add the current inflation rate of 3.2%, this is a 5.5% total yield on a 30-year Treasury bond. Those close to or in retirement can especially benefit from locking in a real yield this high so they know exactly what their income will be over time.”

Indeed, TIPS seems to be the tip of the day.

“You can get more than 4% annually either inflation adjusted or not inflation adjusted,” said Michael Edesess, managing partner/special advisor at Chicago-based M1k LLC. “Currently, a single-premium immediate annuity purchased by a 65-year-old can yield more than 7% annually for the rest of their life — a $100,000 purchase yields more than $7,000 annually — though it will not be inflation adjusted, so the purchasing power of that $7,000 will deplete over time. But alternatively, one can buy a ‘ladder’ of TIPS — that is, a series of TIPS of different maturities — that will yield 4.5% annually for 30 years in inflation-adjusted dollars, so the purchasing power of the annual interest will not deplete.”

“I think life is far too ambiguous to use a strategy such as the 4% rule when planning for retirement withdrawals,” said Jake Falcon, of Falcon Wealth Advisors in Mission Woods, Kan. “Instead, individuals should seek out a wealth advisor who is acting in a fiduciary capacity to create a financial plan. Once a plan is established and investments are aligned, a proper withdrawal strategy can be applied. Most importantly, the financial plan should be reviewed at least once a year to make adjustments as life changes.”

Morningstar’s report highlights that retirees often decrease their inflation-adjusted spending over time, leading to considerably higher safe withdrawal rates. The appropriate level of flexibility in a retiree’s spending system is contingent on individual circumstances, including the extent to which fixed expenses are covered by nonportfolio income sources.

The study employs Morningstar Investment Management’s forward-looking asset-class return assumptions, reflecting current yields, valuations and inflation forecasts. A key change from 2022 is a slight drop in the inflation forecast, from 2.84% to 2.42% in 2023.

“I think it is fair to increase the safe withdrawal rate given higher yields on bonds,” said Crestwood’s Neumann. “It has been 15 years since we’ve been in a ‘normal’ interest rate environment for clients, and that’s refreshing. Investors are earning a real return — nominal return less inflation — on bonds across the yield curve currently. But don’t stop at withdrawal rates for retirement planning. The more granular you get, the greater confidence you will have.”

Doug Bailey is a journalist and freelance writer who lives outside of Boston. He can be reached at [email protected].

Workplace benefits help get employees in the door — and keep them there

If selling life insurance were easy, everyone would do it

Advisor News

- Bill aims to boost access to work retirement plans for millions of Americans

- A new era of advisor support for caregiving

- Millennial Dilemma: Home ownership or retirement security?

- How OBBBA is a once-in-a-career window

- RICKETTS RECAPS 2025, A YEAR OF DELIVERING WINS FOR NEBRASKANS

More Advisor NewsAnnuity News

- An Application for the Trademark “DYNAMIC RETIREMENT MANAGER” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Product understanding will drive the future of insurance

- Prudential launches FlexGuard 2.0 RILA

- Lincoln Financial Introduces First Capital Group ETF Strategy for Fixed Indexed Annuities

- Iowa defends Athene pension risk transfer deal in Lockheed Martin lawsuit

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- Judge rules against loosening receivership over Greg Lindberg finances

- KBRA Assigns Rating to Soteria Reinsurance Ltd.

- A new era of advisor support for caregiving

- An Application for the Trademark “HUMPBACK” Has Been Filed by Hanwha Life Insurance Co., Ltd.: Hanwha Life Insurance Co. Ltd.

- ROUNDS LEADS LEGISLATION TO INCREASE TRANSPARENCY AND ACCOUNTABILITY FOR FINANCIAL REGULATORS

More Life Insurance News