Will Rising Mortgage Rates Squash The Housing Market?

Commentary

The historic spike in mortgage rates instigated chatter across the country that the housing market is a bubble that will soon pop.

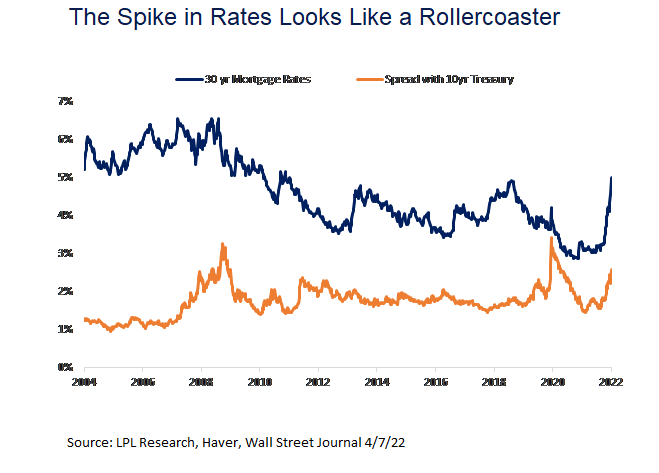

Mortgage rates made a steep climb recently as markets reacted to a newly-minted hawkish Federal Reserve. As seen in the LPL Chart of the Day, mortgage rates rose to levels last seen in 2011.

“Our view is the housing market is not necessarily a bubble, but rising rates will no doubt slow some of the irrational exuberance,” says Jeffrey Roach, Chief Economist at LPL Financial.

However, we don’t believe headwinds from higher rates will not fully negate the tailwinds of low inventory, pandemic reshuffling, and positive demographics. Other variables would have to turn over before the housing market materially declines.

Rates On The Rise

A 150-basis-point rise in mortgage rates is probably not enough to cause severe demand destruction.

Several months ago, a prospective homebuyer would pay $1,347 for a $300,000 loan at 3.50%. If the buyer waited until this week to lock in a new rate at 5.00%, the borrower would pay $263 more per month. For most households, an additional cost of $263 per month will cut into discretionary spending, and prospective buyers will reconsider housing options.

The initial response to higher rates will be most obvious for first-time prospective home buyers, who will bear the brunt of higher rates. This cohort will likely realign expectations or delay a home purchase altogether. But, those selling a current home could be more adaptable to higher rates, since this cohort can likely offset high costs with existing home equity.

Higher cost of funds will likely mean a cut in discretionary items most sensitive to relative price changes. Inflationary periods with high mortgage costs will weigh on the consumer but if rates stay contained, our baseline expectation is the consumer will wade through it.

Here Come The Millennials

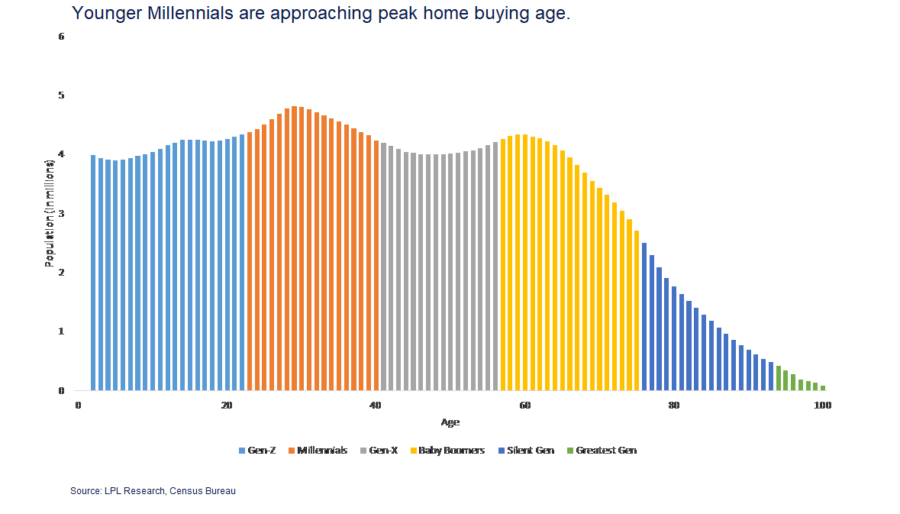

Long-term demographic trends will support housing. According to the latest data from the National Association of Realtors (NAR), the median age of first-time buyers has risen to 33.[1] The median age of repeat buyers is 55. The wave of millennials coming into peak buying age and high net worth of the boomers will help support the housing market even though mortgage rates and home prices are rising at an extraordinary pace.

Wage growth from a tight labor market also provides support in the near-term. Rising median age of repeat buyers, strong household net worth and low financial debt obligations explain why all-cash sales were roughly 30% of U.S. home purchases in 2021. As borrowing costs increase, all-cash sales will likely rise in 2022.

Years Of Underbuilding

Inventory of residential homes is at all-time lows according to Redfin Housing Market data. Other agencies corroborate: at the current sales rate of existing single-family homes, the entire inventory would deplete in less than two months. In some regions, inventory of homes is more scarce.

Perhaps some seasoned builders are reluctant to build after experiencing the Great Financial Crisis, but the lack of labor and high cost of raw materials weigh on builders. Therefore, we expect inventory to remain extremely tight, adding support to housing even during times of rising mortgage rates.

[1] https://www.nar.realtor/blogs/economists-outlook/age-of-buyers-is-skyrocketing-but-not-for-who-you-might-think#:~:text=The%20number%20that%20has%20changed,to%20a%20number%20of%20factors.

California Contractor Faces 21 Felony Counts Of Forgery, Theft, And Insurance Fraud

New Generation Of Women Investors Redefining Wealth And Influence

Annuity News

- Retirees drive demand for pension-like income amid $4T savings gap

- Reframing lifetime income as an essential part of retirement planning

- Integrity adds further scale with blockbuster acquisition of AIMCOR

- MetLife Declares First Quarter 2026 Common Stock Dividend

- Using annuities as a legacy tool: The ROP feature

More Annuity NewsHealth/Employee Benefits News

- Christine O'Brien, UnitedHealthcare CEO for La.-Miss., wants to lower insurance costs. Here's how

- In Snohomish County, new year brings changes to health insurance

- Visitor Guard® Unveils 2026 Visitor Insurance Guide for Families, Seniors, and Students Traveling to the US

- UCare CEO salary topped $1M as the health insurer foundered

- Va. Republicans split over extending

Va. Republicans split over extending health care subsidies

More Health/Employee Benefits NewsLife Insurance News

Property and Casualty News

- Nattakorn Wattanaumphaipong Joins Great American Insurance Company’s Singapore Branch

- Affordability on Florida lawmakers’ minds as they return to the state Capitol

- Enact Holdings Inc. (NASDAQ: ACT) Records 52-Week High Friday Morning

- Preliminary updated Tehama County flood maps from FEMA

- REP. FITZGERALD'S KEEPING VIOLENT OFFENDERS OFF OUR STREETS ACT PASSES HOUSE JUDICIARY COMMITTEE

More Property and Casualty News