Wholesaling: Finding The Opportunity In The Disruption

Wholesaling is a critical part of the distribution chain, and many forces that will impact its future are converging. Wholesaling models must adapt to the changing environment in order to remain relevant and valuable.

Advisors will continue to value external wholesalers for their product expertise and sales and marketing support but, going forward, they expect more value-added services. Wholesalers and advisors strongly agree that wholesalers need to bring more to the table. The global pandemic, rapidly evolving technology and disruptors yet to be envisioned will reshape how advisors and wholesalers meet at that proverbial table.

Redefining Face-To-Face

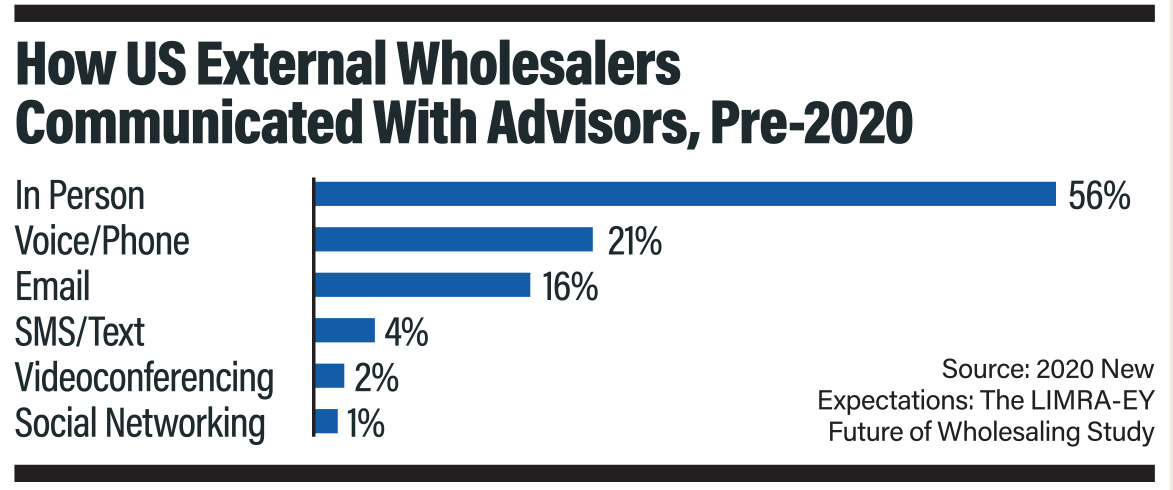

Face-to-face communication is foundational to wholesaling relationships. Prior to the global pandemic, this meant sitting down in person. Technology changed the way advisors and wholesalers communicated but we never anticipated it to accelerate so quickly. Pre-COVID-19, seven in 10 advisors said they expected wholesalers to be able to communicate virtually when needed.

Seven in 10 external wholesalers said they expected there would be more frequent videoconferencing in the next 3-5 years. When asked about their most valued relationships, both advisors and wholesalers who were using videoconferencing indicated they would be using it more in the future. Videoconferencing has transformed how we communicate, and face-to-face communication no longer implies being in the same location. The question is, will we keep what we’ve learned and experienced or go back to business as it was?

Technology Is Changing Expectations

Technologies, a significant investment for insurance carriers, promise to build efficiencies, which ultimately increase productivity. Delivering technology that advisors will value is critical to the carrier achieving a return on their investment. Pre-pandemic, more than half of advisors said that the way they work with wholesalers would change because of technology; 50% of external wholesalers agreed.

Carriers also should consider their wholesalers’ perspectives and what their wholesalers will value. It’s important to note wholesalers and advisors don’t necessarily agree on which technology advancements are most valued by advisors. For example, 55% of external wholesalers say simplification of the ticketing and submissions process is the top technological advancement to bring value to advisors, but only 23% of advisors agree.

The current environment, however, has accelerated submission of business, with many companies now offering e-app, accelerated underwriting, e-signatures, e-delivery and even e-claim. The ability to do business through a virtual environment has created not only new expectations but also opportunities. Technology that simplifies the process of doing business has transitioned from a competitive advantage to table stakes. The challenge for carriers is to retain the fundamental attributes that remain most valuable to advisors and wholesalers while simultaneously adapting to address technology advancements. Carriers who cultivate solutions and nurture new opportunities will foster future success.

Technology is the thread providing business continuity throughout this unprecedented reality. This industry remains a relationship business, and the global pandemic redefined not only how business is processed but also how everyone relates to and interacts with each other. Carriers who had invested in technology and laid the groundwork were able to pivot quickly, and the change thought likely to occur in 3-5 years is actually in place now.

The ability to adapt, create, innovate and thrive using new delivery systems, greater efficiencies and focused resourcefulness will be the keys to success. In the end, some adaptations may be only temporary, but some may be the beginnings of something new and possibly even better.

Laura A. Murach, ACS, ALMI, LLIF, is associate research director, distribution research, LIMRA. Laura may be contacted at [email protected].

Assumptions Vs. Reality: Considering Income Riders

Putting His Money Where His Hope Is

Advisor News

- Bessent confirmed as Treasury secretary

Former hedge fund guru to oversee Trump's tax cuts, deregulation and trade changes

- Jackson National study: vast underestimate of health care, LTC costs for retirement

- EDITORIAL: Home insurance, tax increases harm county’s housing options

- Nationwide Financial Services President John Carter to retire at year end

- FINRA, FBI warn about generative AI and finances

More Advisor NewsAnnuity News

- MetLife Among the World’s Most Admired Companies by Fortune Magazine

- Aspida and WealthVest Announce a Suite of New and Enhanced Indices for Their WealthLock® Accumulator Product

- Brighthouse Financial Inc. (NASDAQ: BHF) Sees Notable Increase in Tuesday Morning Market Activity

- Hexure Integrates with DTCC’s Producer Authorization, Providing Real-Time Can-Sell Check within FireLight

- LIMRA: 2024 retail annuity sales set $432B record, but how does 2025 look?

More Annuity NewsHealth/Employee Benefits News

- Cigna to ‘listen to the public narrative,’ promises pharmacy benefit reforms

- NC bill would limit insurers' prior authorizations

- Sermo Barometer Finds 78% of US Physicians Think Health Insurance Companies Have Too Much Influence Over Patient Care Plans; 52% Globally

- How small businesses can have success with health care benefits in 2025

- Legislators try again to create state board to review drug prices

More Health/Employee Benefits NewsLife Insurance News

- AM Best Maintains Under Review With Developing Implications Status for Credit Ratings of Solidarity Bahrain B.S.C.

- AM Best Maintains Under Review With Developing Implications Status for Credit Ratings of First Insurance Company

- AM Best Maintains Under Review With Developing Implications Status for Credit Ratings of Bahrain National Insurance Company B.S.C. (c)

- 2024 life insurance new premium tops $16B, sets new record, LIMRA says

- New York Life Announces Planned Leadership Transition within New York Life Real Estate Investors

More Life Insurance News