What’s next for the Department of Labor fiduciary rule proposal?

Now that the Department of Labor's two-day public hearing is over, Jan. 2 is the next big date for its controversial fiduciary rule proposal.

That is the day public comments are due after the department refused to grant an extension. As of Thursday, the government had received more than 8,000 comments on the fiduciary proposal.

"We take your comments very seriously," said Lisa Gomez, assistant secretary of labor, in kicking off the hearing Tuesday. "And we have every expectation that the final rule will benefit from your thoughtful participation."

Industry opponents doubted that sentiment, with several speakers critical of the DOL for refusing to grant an extension or to allow for review of other comments before the public hearing.

The current iteration of the rule is the department's fourth attempt to apply a tougher standard to rollover sales of insurance products. Each time, DOL regulators seem to take a more aggressive approach.

The last two rules, in 2016 and 2020, ended up in court after industry trade associations brought lawsuits. With the prospect of another legal battle high, both sides had an eye on contributing to the public record during this week's hearing.

Fifty-one people testified over two days, most of them representing 38 different trade associations, law firms, consumer groups and individual businesses.

Here are some additional highlights from the public hearing:

Bryon Holz, president of Bryan Holz and Associates, testified that as a registered investment advisor and a fiduciary, he opposes the DOL rule. Holz, president of the National Association of Insurance and Financial Advisors, testified with his long-time client Chuck Ross. They have worked together for decades.

Consumers are best served when they can choose how and from whom they receive financial services, Holz said. The DOL proposal would force many advisors to move to a fee-for-service model tailored to higher-income clients, he added.

When Ross began preparing for retirement, he had limited assets and likely would not have been able to work with Holz had the fiduciary rule been in place, he testified.

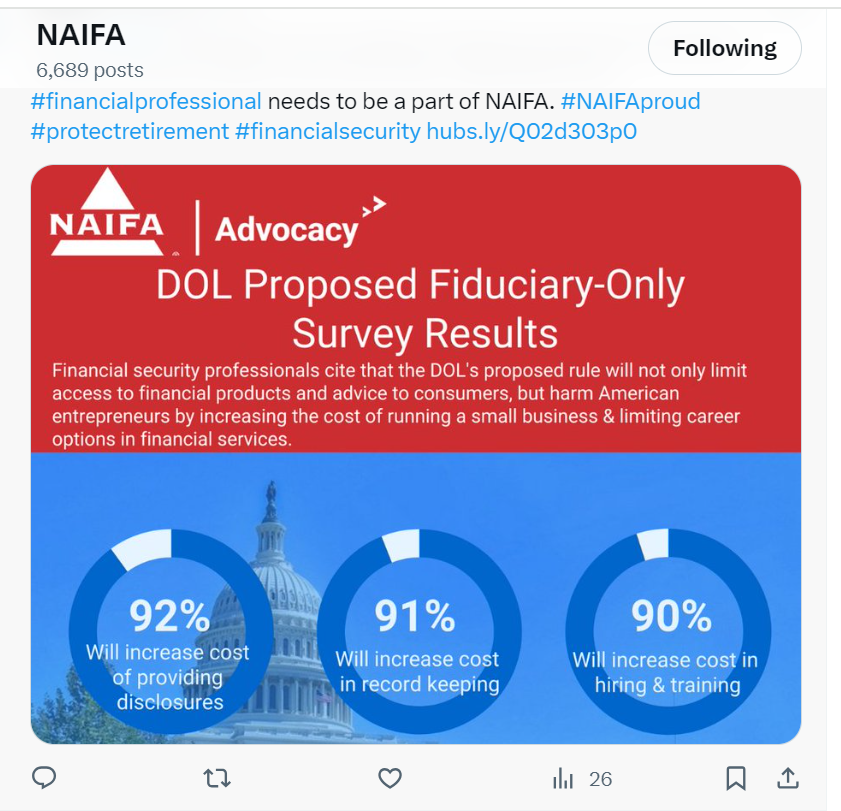

NAIFA also shared some recent study results with the department, which the association later shared on social media:

Dan Danford, founder and CEO of the Family Investment Center in St. Joseph, Mo., spoke for many on the advisory side in endorsing the rule. Speaker after speaker disagreed on whether the rule protects or harms middle-market retirement savers. Danford left no doubt where he stands.

"The proposal rule will close several big regulatory loopholes that exist under the current rule and that harm retirement savers," he said. "It would cover rollover recommendations to ensure that retirement savers receive strong protection when they are most vulnerable to receiving conflicted advice. Financial professionals often have strong incentive to recommend rollovers because each one can result in a big payday."

Most importantly, the proposed rule would cover advice to employers who sponsor 401(k) plans to ensure that the advice employees receive about plan investment options is not tainted by conflicts of interest, Danford noted.

"A one-time recommendation to a 401(k) plan sponsor may include investments that have high costs and low performance, which can erode employees' hard-earned savings and investment returns," he added. "This could cause a retirement saver to lose tens of thousands if not hundreds of thousands of dollars over time."

Micah Hauptman is the director of investor protection at the Consumer Federation of America. He accused the industry of resorting to "scare tactics" with claims that middle America will be left to fend for themselves.

The DOL fiduciary rule is in alignment with the Security and Exchange Commission’s Regulation Best Interest, Hauptman said.

"There is no evidence that that rule has reduced small savers’ access to investment recommendations," he testified. "We expect the DOL rule to operate similarly, providing comparable protections to retirement plans and participants and to IRA investors.”

Small savers are deserving of the most protections from bad advice and underperforming investment options, Hauptman explained, because they have the most to lose. The free market would correct any loss of advice options for the middle market, he insisted.

"If some firms were to decide to pull out of the market, others would step in to provide high quality products and services without harmful conflicts,” Hauptman said.

InsuranceNewsNet Senior Editor John Hilton covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

© Entire contents copyright 2023 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

Tech innovation will drive your wealth management practice to greater success

MDRT finds financial advisors quick to adopt generative AI

Advisor News

- Take advantage of the exploding $800B IRA rollover market

- Study finds more households move investable assets across firms

- Could workplace benefits help solve America’s long-term care gap?

- The best way to use a tax refund? Create a holistic plan

- CFP Board appoints K. Dane Snowden as CEO

More Advisor NewsAnnuity News

- $80k surrender charge at stake as Navy vet, Ameritas do battle in court

- Sammons Institutional Group® Launches Summit LadderedSM

- Protective Expands Life & Annuity Distribution with Alfa Insurance

- Annuities: A key tool in battling inflation

- Pinnacle Financial Services Launches New Agent Website, Elevating the Digital Experience for Independent Agents Nationwide

More Annuity NewsHealth/Employee Benefits News

- Universal health care: The moral cause

- IOWA REPUBLICANS GET WHAT THEY VOTED FOR: HIGHER HEALTH INSURANCE PRICES, FEWER PEOPLE ENROLLED IN THE ACA

- XAVIER RECEIVES $3 MILLION FOR OCHSNER MEDICAL SCHOOL SCHOLARSHIPS

- Gov. Phil Scott, officials detail health reform measures

- Idaho is among the most expensive states to give birth in. Here are the rankings

More Health/Employee Benefits NewsLife Insurance News

- Author Sherida Stevens's New Audiobook, “INDEXED UNIVERSAL LIFE INSURANCE IN ACTION: FROM PROTECTION TO PROSPERITY – YOUR PATH TO FINANCIAL SECURITY,” is Released

- AM Best Affirms Credit Ratings of Etiqa General Insurance Berhad

- Life insurance application activity hits record growth in 2025, MIB reports

- AM Best Revises Outlooks to Positive for Well Link Life Insurance Company Limited

- Investors holding $130M in PHL benefits slam liquidation, seek to intervene

More Life Insurance News