What’s influencing the employee benefits landscape?

A changing workplace, economic factors and an expanded array of options are among the issues influencing the employee benefits landscape in 2024, according to LIMRA research.

Patrick Leary, LIMRA corporate vice president and director of workplace benefits research, gave a rundown on the changing world of workplace benefits during a recent LinkedIn Live event.

The economic environment is one driver of change in the workplace benefits environment, he said.

“It’s still a hot labor market; the unemployment rate is still relatively low,” he said. “You think about employers and what they’re trying to do around talent – how much compensation and how strong their benefits have to be, depending on the strength of the labor market.”

High inflation is another economic factor impacting benefits. “Prices are still high and that has an impact on wallet share,” Leary said. “As employees think about benefits – particularly voluntary benefits – that they want to participate in, that wallet share has been squeezed by inflation.”

With five generations represented in the workforce, there are differences in what each generation looks for in their employee benefits, Leary said. In addition, the rise in hybrid and remote work “really upset the apple cart.”

“When selling workplace benefits in the past, you would go to a place of work – a factory or an office – and you would have the benefit fairs, have the reps come in to promote and sell all the different benefits. Now you can’t do that anymore with remote work; you have workers all across the country in some cases. It has impacted the way companies consider how they get their products to market in that workplace environment.”

But although the workplace has changed, workers’ dependence on benefits has not, Leary said.

“People still rely heavily on workplace benefits to address their needs across insurance, retirement and other types of protection needs – and even some new needs that came out of the pandemic such as caregiving benefits, wellness-type benefits.”

LIMRA and EY research found that employers remain committed to offering benefits as part of the value proposition that helps them attract and retain workers, he said.

However, the cost of benefits has been a concern of employers, he added, especially as inflation and rising costs of health care come into play.

The research found that many employers are cutting back on their human resources staff, meaning that employers are relying more on their benefits brokers to help manage benefits, Leary said.

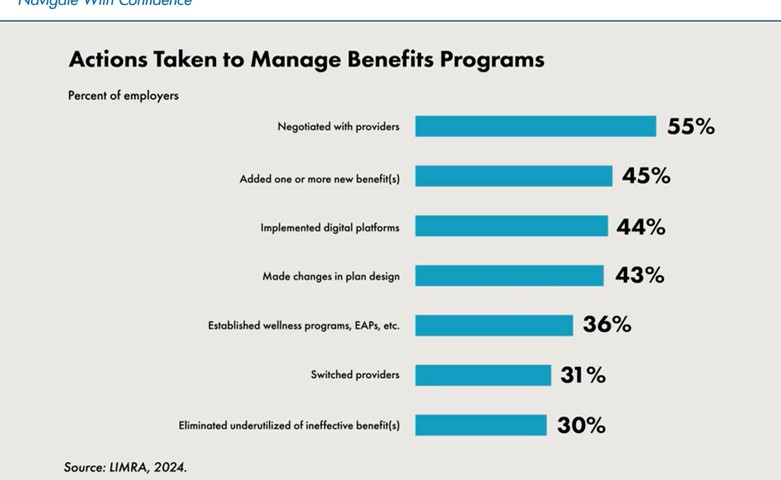

Employers have taken action to manage their benefits programs in other ways.

Workers also are challenged when it comes to selecting their benefits, Leary said.

“Employers looking to attract workers so they’re adding more benefits, but at the same time, workers are challenged to choose among those benefits. The complexity and number of benefits present a challenge,” he said. “Related to that is the whole wallet share concept. An employer can have a fantastic benefit package but employees have only so much money to spend on them.”

New data from LIMRA’s 2024 BEAT Study: Benefits and Employee Attitude Tracker reveals that employees are willing to spend less on their benefits than in previous years as benefits costs increase. The new monthly median consumers will spend is $120 (excluding retirement savings) — down $30 from the prior two years.

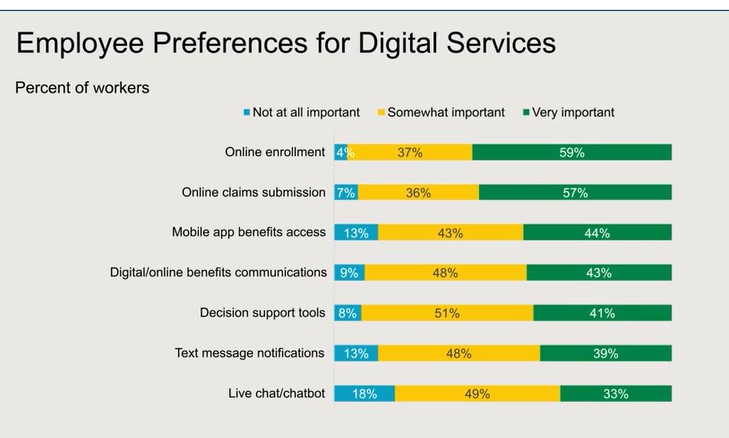

Digital solutions will play a critical role in reaching a remote workforce, Leary said.

More than half of workers surveyed said they believe online enrollment and claims submission are very important to them.

© Entire contents copyright 2024 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Susan Rupe is managing editor for InsuranceNewsNet. She formerly served as communications director for an insurance agents' association and was an award-winning newspaper reporter and editor. Contact her at [email protected].

American National introduces proprietary custom annuity index

Limited-pay options for lifetime coverage

Advisor News

- Ex-employees sue Verizon over pension transfer deal with Prudential, RGA

- Gary Brecka, Cardones file dueling lawsuits in battle of social media stars

- Confidence is key to cold calling success

- Overcoming the indecision of prospects

- What issues top consumers’ list of financial goals for 2025?

More Advisor NewsAnnuity News

- Sapiens wins XCelent award for Customer Base and Support for UnderwritingPro for Life & Annuities

- SB 263 expected to bring chaos to Calif. insurance, annuity sales come Jan. 1

- Lincoln Financial hires industry veteran Tom Morelli as Vice President, Investment Distribution

- Structured settlements protect young injury victims | H. Dennis Beaver

- MetLife Inc. (NYSE: MET) Highlighted for Surprising Price Action

More Annuity NewsLife Insurance News

- A-Cap suspends Sentinel Security Life business; gets reprieve for Atlantic Coast Life

- Hidden risk: The impact of financial markets on life insurance

- Registration Statement by Foreign Issuer (Form F-1)

- Confidence is key to cold calling success

- Exemption Application under Investment Company Act (Form 40-APP/A)

More Life Insurance NewsProperty and Casualty News

- Jim Beam column:State auto insurance sky high

- Evers signs executive order to support retaining state eligibility under the National Flood Insurance Program

- Home insurance costs in Florida spiked in third quarter. Are more increases on the way?

- North Carolina passes new laws effective January 1

- State takes final step to fix California's troubled home insurance market

More Property and Casualty News