What will the DOL rule mean for advisors?

The Department of Labor has several objectives in issuing its latest iteration of the fiduciary rule and one of them is expanding the scope of fiduciary activities, a Washington attorney said.

The National Association of Insurance and Financial Advisors gave a breakdown of how the fiduciary rule will impact advisors and consumers during a recent webinar.

“What’s important on this, and the biggest conundrum for the DOL is that they can only regulate fiduciaries. If you’re not a fiduciary, they don’t have any regulatory purview over you,” said Scott Sinder, partner in the Washington law firm Steptoe.

DOL aims at 'regulatory gaps'

Another DOL objective is to address changes in the market and address what Sinder called “regulatory gaps.” The rule would cover one-time advice on rollovers and would cover independent insurance agents under a federal best-interest standard to “level the playing field.”

“To do that, they have to make everyone a fiduciary,” he said. “So anytime you're suggesting that somebody buy something, you are then within the fiduciary definition of the regulation.”

What does this mean for the advisor who is working with clients?

The main thing, Sinder said, is that almost everyone will become a fiduciary and must satisfy a prohibited transaction exemption. New standards and review of independent producers will require approval on a transaction-by-transaction basis.

The rule also will require extensive new disclosure and compliance requirements, he said. Expanded litigation liability exposure, including private rights of action, means advisors must tell their customers they are a fiduciary, which then exposes the advisor to common-law, fiduciary duty-type claims.

“You'll have to adapt your sales, marketing and customer service procedures to comply with the rules,” he said.

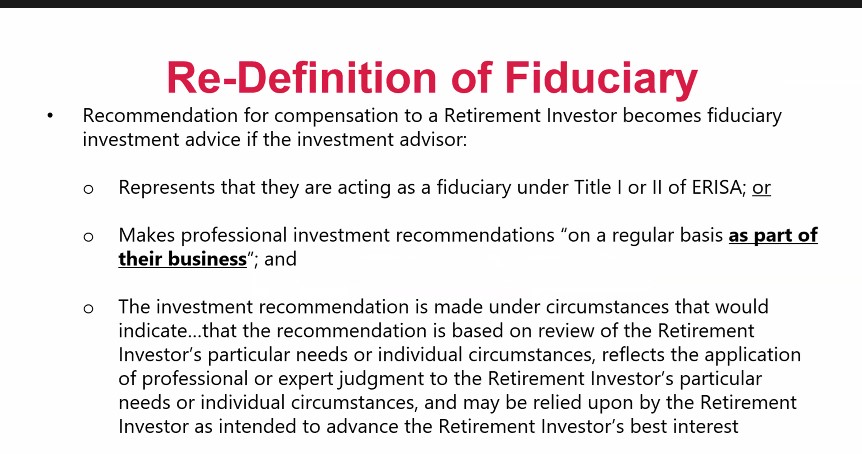

The DOL redefines fiduciary in the following ways, Sinder said.

The provision that a fiduciary makes professional investment recommendations “on a regular basis as part of their business” is the biggest change in the definition, Sinder said.

The rule also redefines fiduciary as someone who provides investment “recommendations” to a “retirement investor” for compensation, including specific investments, portfolio composition and rollovers. A retirement investor is defined as a participant or a beneficiary of a retirement plan such as a 401(k), the owner of an individual retirement account or a fiduciary acting on behalf of a retirement plan or an IRA. A recommendation is defined as a call to action as per Reg BI.

Limited exceptions to the rule will apply, Sinder said. Fiduciary obligations will not apply to investment information or education made without a recommendation. Providing a list of products available in the market without giving a recommendation does not fall under the rule. A cold call that is not based on individual circumstances or particular needs is not considered fiduciary investment advice.

Certain rule aspects have 1-year transition

The rule’s effective date is Sept. 23, but Sinder said there is a one-year transition period from that date for certain aspects of PTE 2020-02 and PTE 84-24. Impartial conduct standards and acknowledgement of fiduciary status are two conditions of PTEs that must be met on the Sept. 23 effective date. The final PTE 2020-03 and PTE 84-24 only apply to new investment advice given after Sept. 23. They do not apply to ongoing compensation for a recommendation made before that date.

If an advisor is considered a fiduciary, they must satisfy PTE 2020-02 or PTE 84-24 to receive commissions or compensations from third parties, Sinder said. PTE 84-24 is available only to independent agents and brokers. The PTE is modified in the final DOL rule to allow an agent who is an employee of one company to use the exemption if selling a product of an unrelated company. Both PTE 2020-02 and PTE 84-24 closely mirror each other, but under PTE 2020-02, both the financial institution and the investment advisor acknowledge fiduciary status while under PTE 84-24, only the advisor acknowledges fiduciary status.

The DOL rule removes a restriction in PTE 84-24 regarding compensation payments, Sinder said. The proposed rule would not have allowed independent producers to claim revenue-sharing payments, administrative fees and marketing payments, as well as any payments from someone other than the insurer and its affiliates. The final DOL rule removes this restriction and allows for “indirect or direct receipt of reasonable compensation.”

In addition, the rule modifies the requirement for the independent producer to disclose their compensation. Instead, the final rule requires the independent producer to provide, if requested by the retirement investor, a reasonable estimate of compensation.

Applying the PTEs in the DOL rule

Sinder explained which PTE exemptions investment advisors will be able to rely on. If selling only through a broker-dealer or for one insurer, only PTE 2020-02 will apply. An independent producer also may use PTE 84-24 but the producer must sell fixed annuities or other nonsecurities insurance investment products for two or more insurers. For independent producers, the insurer will dictate whether PTE 2020-02 or PTE 84-24 is used. Insurers are expected to rely on PTE 84-24 when possible.

Both PTEs have four core sets of requirements, he said. They are impartial conduct standards, disclosures and obligations; policies and procedures; and recordkeeping, self correction and good faith compliance.

PTE 84-24 changes 'a big sea change'

But changes to PTE 84-24 under the DOL law “is a big sea change – where they will turn the insurer into the regulator,” Sinder said. The changes would increase an insurer’s oversight of independent producers by:

- Reviewing an independent producer’s specific recommendation of the insurer’s own products to a retirement investor.

- Developing a “prudent process” for authorizing an independent producer to sell the insurer’s annuity contracts.

- Reviewing the investment advisor’s rollover recommendations.

- Certifying policies and procedures to ensure the independent producer’s compliance with PTE 84-24.

- Instructing the independent producer to correct any prohibited transactions and pay any resulting excise taxes.

- Annually determining and reviewing whether the insurer can rely on the independent producer to adhere to the rule’s impartial conduct standards.

In addition, both PTEs would be impacted by the rule in the following ways, Sinder said.

- PTE maintains the current six-year recordkeeping requirements. PTE 84-24 requires independent producers to also maintain records for six years. The final PTE 84-24 removes the requirement to make records available to all state and federal regulators, to any plan fiduciary, any contributing employer and any participant, beneficiary or IRA owner.

- Self-correction. PTE 2020-02 maintains the current allowance for financial institutions to self-report and correct potential PTE violations. Under PTE 84-24, independent producers would be eligible to exercise the same self-correction rights as under PTE 2020-02. Both final PTEs would eliminate the requirement to notify the DOL to use the self-correction procedures.

- Good faith compliance. PTE 2020-02 creates a new exception to prevent foot-fault violations if the advisor is acting in good faith. The final rule also includes a good faith exception in PTE 84-24.

- Eligibility. The rule bars the use of PTE 2020-02 if the financial institution or investment professional is convicted of crimes related to investment advice to a retirement investor. The final rule narrows the eligibility restrictions from crimes committed by the financial institution’s “affiliates” to crimes committed by the institution’s “controlled group.” The final rule also removes the opportunity to petition the DOL for relief and removes the opportunity to be heard. PTE 84-24 mirrors PTE 2020-02’s amended eligibility provisions.

Susan Rupe is managing editor for InsuranceNewsNet. She formerly served as communications director for an insurance agents' association and was an award-winning newspaper reporter and editor. Contact her at [email protected]. Follow her on X @INNsusan.

© Entire contents copyright 2024 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Susan Rupe is editor in chief, magazine, for InsuranceNewsNet. She formerly served as communications director for an insurance agents' association and was an award-winning newspaper reporter and editor. Contact her at [email protected].

Wisconsin releases enforcement actions for April

Video: The ‘excess mortality’ phenomenon: What does the future hold?

Advisor News

- DOL proposes new independent contractor rule; industry is ‘encouraged’

- Trump proposes retirement savings plan for Americans without one

- Millennials seek trusted financial advice as they build and inherit wealth

- NAIFA: Financial professionals are essential to the success of Trump Accounts

- Changes, personalization impacting retirement plans for 2026

More Advisor NewsAnnuity News

- F&G joins Voya’s annuity platform

- Regulators ponder how to tamp down annuity illustrations as high as 27%

- Annual annuity reviews: leverage them to keep clients engaged

- Symetra Enhances Fixed Indexed Annuities, Introduces New Franklin Large Cap Value 15% ER Index

- Ancient Financial Launches as a Strategic Asset Management and Reinsurance Holding Company, Announces Agreement to Acquire F&G Life Re Ltd.

More Annuity NewsHealth/Employee Benefits News

- After enhanced Obamacare health insurance subsidies expire, the effects are starting to show

- CommunityCare: Your Local Medicare Resource

- AG warns Tennesseans about unlicensed insurance seller

- GOVERNOR HOCHUL LAUNCHES PUBLIC AWARENESS CAMPAIGN TO EDUCATE NEW YORKERS ON ACCESS TO BEHAVIORAL HEALTH TREATMENT

- Researchers from Pennsylvania State University (Penn State) College of Medicine and Milton S. Hershey Medical Center Detail Findings in Aortic Dissection [Health Insurance Payor Type as a Predictor of Clinical Presentation and Mortality in …]: Cardiovascular Diseases and Conditions – Aortic Dissection

More Health/Employee Benefits NewsProperty and Casualty News

- Should credit shape pricing?

Virginia bills say credit shouldn't be factor in auto insurance

- Florida Bar Board seeking applicants. To make appointments in May

- Multiple family members arraigned in coordinated auto insurance fraud scheme

- Virginia lawmakers consider removing credit as factor in auto insurance

- 2026 insurance satisfaction survey: How Gen Z, Millennials, Gen X and Boomers compare

More Property and Casualty News