Moody’s 2025 health insurance outlook is negative

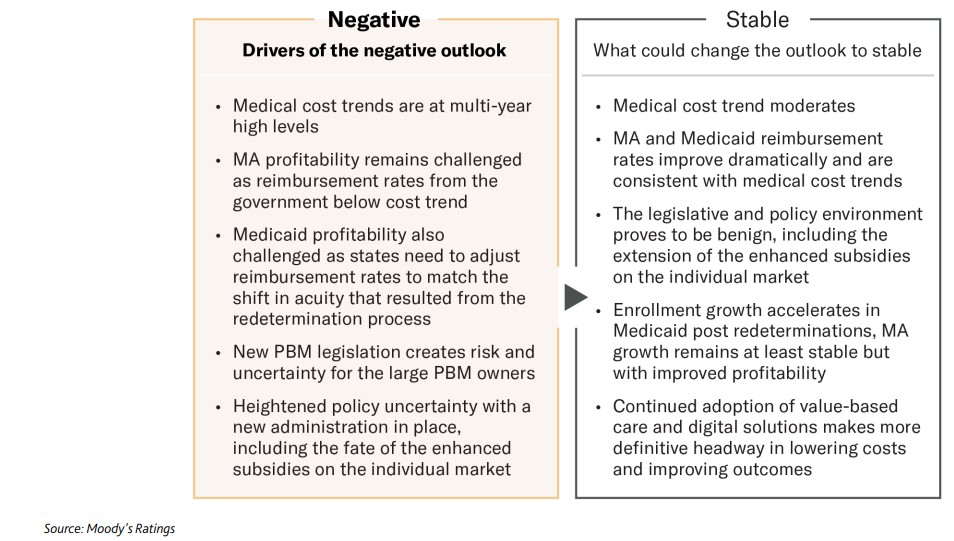

Moody's Ratings is changing its outlook on the health insurance sector to negative from stable.

Although Moody's said it expects earnings before interest, taxes, depreciation, and amortization growth to remain in the low single digits, insurers will continue to grapple with medical costs in excess of reimbursement rates for Medicare Advantage and Medicaid, while commercial coverage also faces continued high medical costs.

In addition, recently proposed legislation, if passed, could significantly weaken pharmacy benefit managers' performance. And at year end, enhanced subsidies on the individual market will expire, which could lead to significant enrollment declines in 2026. Additionally, the individual market had record enrollment this year, which bodes well for continued strong performance.

Medical costs are rising at fastest rate in 13 years. Commercial group health care spending is set to grow 8% in 2025, the fastest growth rate in 13 years, according to the PwC Health Research Institute. Individual market health spending is forecast to grow 7.5%, also the highest in recent years. These costs are driven by inflation, prescription drug spending, and increased usage of behavioral health. Furthermore, Moody's estimates that MA health spending will increase by 5%-7%.

Costs cannot be fully offset by premium increases. Although commercial rates are

negotiated among the insurers, clients and providers, rates are unlikely to fully offset higher

medical costs, given competitive pressures, Moody's said. MA and Medicaid should have better benefit profiles (lower benefits), but still not enough to offset higher costs and reimbursement rates that are below the medical cost trend.

Enrollment should improve in 2025. Enrollment growth in 2024 (through Q3) was flat

for the health insurers Moody's rates as growth in the individual market was offset by double-digit declines in Medicaid due to redeterminations, slower MA growth and mixed commercial

growth. In 2025, Moody's expects enrollment to grow overall, with Medicaid to remain at least

flat post-redeterminations, MA to grow at a similar level to last year, the individual market to continue its strong growth based on record enrollment in this year’s annual enrollment period and commercial to remain stable.

Scrutiny of PBMs could be credit negative for Cigna, CVS Health and UnitedHealth.

The Patients Before Monopolies Act is a bipartisan bill that would prohibit the parent

company of a PBM or insurer from an owning a pharmacy business. The pharmacies all

contribute significant earnings to the consolidated organizations. But there is a wide array

of other measures being considered.

Medical cost trend remains high, constraining growth. A key factor in Moody's negative outlook is the unfavorable medical cost trend, which is exceeding health insurers' ability to offset through repricing. The commercial group medical cost trend will increase 8% in 2025, the highest it has been in 13 years, and the individual commercial trend, which includes the individual market as well as Medicare supplemental insurance, will increase 7.5%, according to

PwC estimates. In addition, Moody's estimates that cost trends in MA are in the 5%-7% range, but possibly higher.

The medical cost trend is impacted by a number of factors, including: price inflation, usage levels, new drugs and new technology. In recent years, there have been several factors increasing the medical cost trend. For example, there has been accelerated growth in the usage of mental health services. In 2024, there was also faster than expected growth in the use of high cost specialty drugs in general. For example, GLP-1 drugs were initially used for diabetes but are proving very effective for combating obesity, and usage of these drugs has been growing rapidly

Higher medical costs will result in higher medical loss ratios overall and constrain earnings. Moody's said it does not expect medical cost relief in 2025. The commercial group medical cost trend is likely to hit a 13-year high and other segments will likely also remain high. But trend is only part of the story. If costs rise but are fully offset by price increases,

that would maintain margins and earnings. One of the strengths of the industry has been its ability to reprice its products each year. Although this helps, the ability to reprice is not absolute; it is constrained by a variety of factors. In MA, which Moody's estimates was about

20% of industry earnings in 2023 (32% in 2019), the reimbursement from the Centers for Medicare and Medicaid Services was -0.16%, which is well below Moody's estimated medical cost trend of 5%-7%.

The final rate notice was announced in April 2024 and the health insurer bids are submitted in June 2024, so there was a window in which health insurers could adjust plan design. However, there are regulatory limits constraining the degree to which benefits can be reduced. Beyond regulation, there are competitive reasons that limit insurers' ability to reduce benefits.

The Inflation Reduction Act, which is changing the rules for Medicare part D (prescription drug plans), will also be a factor in elevating the cost trend and increasing the MLR in 2025. The main driver will be the new requirement for health insurers to cover 60% of the costs in the

catastrophic phase, up from 20% and 15% in 2024 and 2023, respectively. In addition, the catastrophic phase will kick in at $2,000 of out of pocket costs. The additional coverage will be offset by additional premiums, but given medical cost inflation and the uncertainty in a transition like this, Moody's expects the increased coverage requirements to further weaken the medical loss ratio.

Mark Bennett: Terre Haute native, fellow California mayors gather amid fire concerns

Mangrove Property Insurance lands ‘exceptional’ rating ahead of covering homeowners in Florida

Advisor News

- Why aligning wealth and protection strategies will define 2026 planning

- Finseca and IAQFP announce merger

- More than half of recent retirees regret how they saved

- Tech group seeks additional context addressing AI risks in CSF 2.0 draft profile connecting frameworks

- How to discuss higher deductibles without losing client trust

More Advisor NewsAnnuity News

- Allianz Life Launches Fixed Index Annuity Content on Interactive Tool

- Great-West Life & Annuity Insurance Company Trademark Application for “SMART WEIGHTING” Filed: Great-West Life & Annuity Insurance Company

- Somerset Re Appoints New Chief Financial Officer and Chief Legal Officer as Firm Builds on Record-Setting Year

- Indexing the industry for IULs and annuities

- United Heritage Life Insurance Company goes live on Equisoft’s cloud-based policy administration system

More Annuity NewsLife Insurance News

Property and Casualty News

- Insurance rates could go up under new homeowners bill

- Wicker, Hyde-Smith Reiterate Need for FEMA

- WICKER, HYDE-SMITH REITERATE NEED FOR FEMA TO ABANDON PRICEY BIDEN-ERA FLOOD INSURANCE CHANGES

- AM Best Affirms Credit Ratings of RF&G Insurance Company Limited

- AM Best Assigns Credit Ratings to Southbridge Compañía de Seguros Generales S.A.

More Property and Casualty News