What millennials need to know about Social Security

Almost half of millennials do not expect to receive a dime in Social Security benefits, according to a survey by Nationwide Financial.

Advisors paying attention to Social Security Administration Trustee Reports will recognize that although the system is stretched, there’s every reason to believe Social Security will continue to play an important role in retirement for this and future generations.

The question that advisors must help answer is how much their millennial clients should expect to receive from the program when they retire.

A key benchmark is the SSA’s June 2022 report, which notes that without changes to the program, starting in 2035 there will only be enough funds to pay 80% of promised benefits. The report emphasizes the time-sensitive need to address funding: “If substantial actions are deferred for several years, the changes necessary to maintain Social Security solvency would be concentrated on fewer years and fewer generations.”

The report notes that benefits would need to be reduced by 24.9% across the board in 2035 if changes are not made before then. Millennials will start retiring a decade later. Since some generations already will be receiving benefits — which are unlikely to be cut — in the worst-case scenario, millennials would bear the brunt of benefit reductions.

In HealthView Services’ white paper “Social Security Benefits: What Should Millennials Expect?,” we outline steps Congress is likely to take to address the trust fund’s solvency and provide benefit projection data highlighting the impact on future retirees.

It is clear that this is not an intractable issue. As the most recent Social Security report notes, increasing the current payroll tax of 12.4% by 4.07 percentage points (typically split evenly between employees and employers), for a total of 16.47%, would address the program’s shortfall.

Other changes could include delaying full retirement age from 67 to 69, changing the earliest age at which benefits can be claimed from 62 to 65, and increasing the $147,000 cap on the payroll tax. All of these changes would decrease payouts or increase revenues for the program.

Given the potential political unpalatability of a significant tax increase, the most likely scenario — consistent with historical precedent — would be a combination of actions, with changes to eligible claiming ages likely to be phased in along with modest tweaks to payroll taxes.

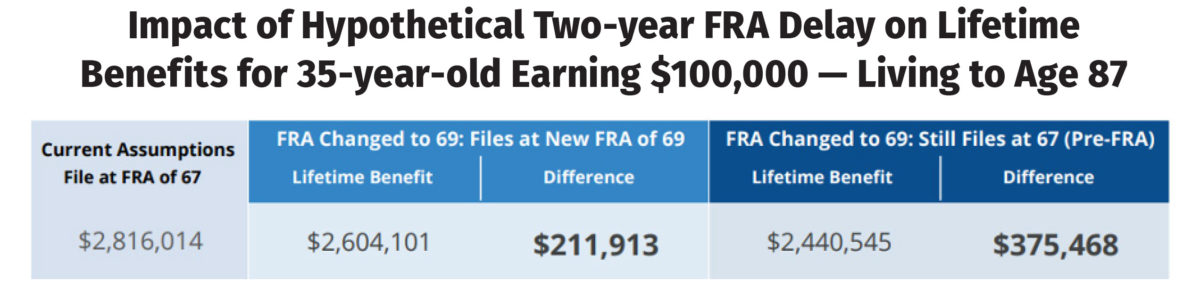

Changes to full retirement age and early claiming eligibility could allow the Social Security Administration to continue to pay out 100% of promised monthly benefits, although at a later date for the retiree, this effectively would be a cut in benefits for millennials. By extending full retirement age from 67 to 69, a 35-year-old making $100,000 this year would lose $375,000 in lifetime benefits if they claimed at age 67, or $210,000 if they claim at the new hypothetical full retirement age of 69. This one step would, on its own, be the equivalent of reducing lifetime benefits by 13.3% for those claiming at age 67 or by 7.5% for those who claim at age 69.

Changing the early claiming age from 62 to 65 would mean losing three years of potential Social Security income. The lost income from both a delay in full retirement age and early claiming would be significant.

Using a 20% reduction in lifetime benefits for millennials provides a middle path for planning purposes. For a 35-year-old millennial (the midpoint age of this generation) earning between $50,000 and $150,000, this would mean a reduction in lifetime benefits of between $365,000 and $675,000. This assumes claims are made at the current full retirement age of 67, the retiree lives to average actuarial longevity, and that annual cost-of-living adjustments projected by the Social Security Administration are applied.

The average 35-year-old millennial earning $50,000 in 2022 would receive $13,500 less in annual Social Security income in the first year of retirement. And if they make between $100,000 and $150,000 in 2022, Social Security benefits would be reduced by $21,000-$25,000 the first year of retirement.

Closing the shortfall

Although these numbers are significant, it’s important to recognize that closing this shortfall is achievable, given millennials’ retirement time horizons. For a 35-year-old, a one-time investment today of $27,000 into a financial product generating an annual 5% return would close this gap by the time the person retires.

As is already widely recognized, delaying claiming to maximize lifetime Social Security income also offers ways to increase benefits. Our data shows that a 35-year-old earning $50,000 annually would increase their first year’s Social Security benefits by $40,000 if they claimed at age 70 rather than at age 62. A millennial earning $150,000 today would increase their first-year annual benefits by $75,000 when they retire.

The simplicity of the message (planning for a 20% reduction in benefits) provides a basis to engage with clients around the potential changes to the program that may impact this important component of retirement income.

The key to driving action is explaining that the additional savings required to make up this difference are modest and achievable. Should the actual reduction in retirement benefits be less than anticipated, the value of retirement portfolios will have increased, ensuring there is no downside.

Projected gross Social Security benefits are a starting point for retirement income planning that should lead into a discussion of expected net benefits. With Medicare Part B premiums (which are deducted from Social Security checks) rising faster than cost-of-living adjustments, income-based surcharges (income-related monthly adjustment amount), and the taxation of benefits, affluent clients will see smaller Social Security checks than they anticipate — requiring customized approaches to achieving their specific goals.

Encouraging clients to increase savings or investments now, in anticipation of lower lifetime benefits, provides the opportunity to take advantage of compounding returns. With a long time horizon, modest additional investments today avoid having to fill a much larger savings gap down the road.

Social Security’s own solvency data provides a reasonable basis for retirement planning. It strikes a balance between the Congress-does-nothing doomsday scenarios that millennials have bought into and the Panglossian idea that Congress can wave a magic wand and Social Security will continue to pay 100% of promised benefits without changes to the program.

Taking into account Medicare premiums and taxes to calculate the net Social Security checks millennials actually will receive offers advisors a significant opportunity to avoid surprises down the road, demonstrate expertise, build trust, and grow mind and wallet share.

It’s perhaps no surprise that with the confusion and low expectations around Social Security, millennials are asking advisors about its role in retirement plans. While advisors and their clients will need to play close attention to what Congress does over the coming years, assuming a modest reduction in benefits is a prudent step to ensure retirement plans will meet future needs.

Ron Mastrogiovanni is CEO and chairman of HealthView Services. Ron may be contacted at [email protected].

Pandemic retirements likely speeded up annuity payouts, data shows

Finding success with centers-of-influence marketing

Advisor News

- Retirement optimism climbs, but emotion-driven investing threatens growth

- US economy to ride tax cut tailwind but faces risks

- Investor use of online brokerage accounts, new investment techniques rises

- How 831(b) plans can protect your practice from unexpected, uninsured costs

- Does a $1M make you rich? Many millionaires today don’t think so

More Advisor NewsAnnuity News

- Great-West Life & Annuity Insurance Company Trademark Application for “EMPOWER BENEFIT CONSULTING SERVICES” Filed: Great-West Life & Annuity Insurance Company

- 2025 Top 5 Annuity Stories: Lawsuits, layoffs and Brighthouse sale rumors

- An Application for the Trademark “DYNAMIC RETIREMENT MANAGER” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Product understanding will drive the future of insurance

- Prudential launches FlexGuard 2.0 RILA

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- To attract Gen Z, insurance must rewrite its story

- Baby On Board

- 2025 Top 5 Life Insurance Stories: IUL takes center stage as lawsuits pile up

- Private placement securities continue to be attractive to insurers

- Inszone Insurance Services Expands Benefits Department in Michigan with Acquisition of Voyage Benefits, LLC

More Life Insurance News