Pandemic retirements likely speeded up annuity payouts, data shows

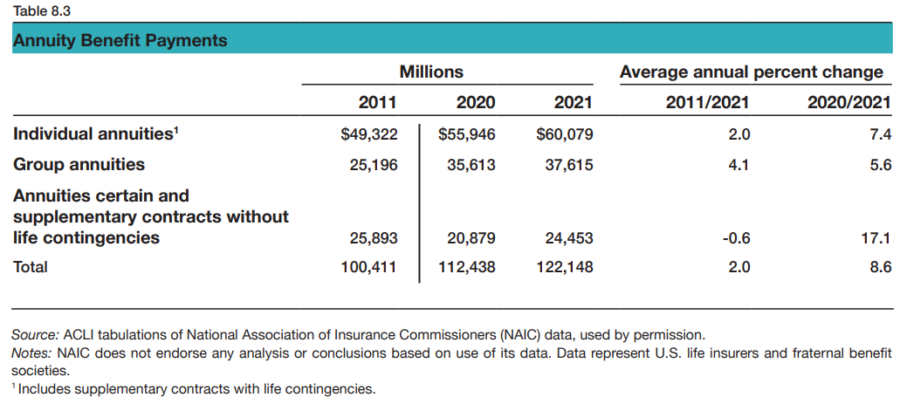

Annuity payments increased 7.4% in 2021, possibly due to lingering fallout from the COVID-19 pandemic.

The American Council of Life Insurers compiled extensive data on life insurance and annuity sales, industry rankings and other data in its 2022 ACLI Life Insurers Fact Book released this week.

Life insurance companies paid $100 billion to beneficiaries of life insurance policies and $97.7 billion to annuity holders in 2021, both record highs for a single year, ACLI said. Annuity payouts were well above the annual average for the past decade, the trade association found.

It is possible the pandemic influenced changes to retirement plans for many, said Andrew Melnyk, ACLI vice president, research and chief economist.

"The data in the Fact Book doesn’t point to any a specific cause" for the increased annuity payouts, Melnyk added, "but one reason may be the increase in the number of people who retired early during the pandemic. As a result, they may have taken their annuity payments before they had planned."

Likewise, payouts on annuity supplementary contracts sharply increased year-over-year. ACLI defines a supplementary contract as an agreement between an insurer and a life insurance policyholder or beneficiary in which the beneficiary chooses to receive the policy’s proceeds over a period of time instead of as a lump sum.

If this period is the lifetime of the beneficiary, the contract is a supplementary contract with life contingencies, essentially a life annuity; if the payments continue for a specific period, the contract is called a supplementary contract without life contingencies, or an annuity certain.

"The increase in supplementary contracts could have been from early retirees working with life insurance companies on how they receive payments as part of their financial planning," Melnyk said.

Annuity deposits were up 1.3% in 2021 over 2020, but contributions to group annuities nosedived.

The decline in contributions to group annuities, which are sold through employer-sponsored retirement plans, could be another reaction to the changing employment dynamics. These group annuities are ripe for growth thanks to the SECURE Act passed by Congress in 2019, and the follow-up SECURE 2.0 before Congress currently.

The 2019 legislation opened the door wider to annuities inside retirement plans. Under the SECURE Act, retirement plans now have “safe harbor” from being sued if annuity providers go out of business or stop making payments. Now that it’s less likely they will be sued, employers might be more open to offering annuities.

"It’s hard to make any predictions based on the data in the Fact Book but it is certainly possible that we’ll see more annuities offered in 401(k) and similar plans," Melnyk said. "The SECURE Act made it easier to include annuities in workplace retirement plans providing an option for workers seeking lifetime income. SECURE 2.0 makes further changes that provide even more choices for retirement savers."

Covid impact on buying habits

The pandemic substantially impacted life insurance sales. Nearly 46 million life insurance policies were purchased in 2021, a 6.1% increase over 2020, he said, and total life insurance coverage reached a record $21.2 trillion.

But annuities were also on the minds of consumers, Melnyk said.

"During times of uncertainty, people tend to look for sources of financial stability and peace of mind," he explained. "As the only product that provides a guaranteed stream of lifetime income, annuities offer peace of mind that retirees want and need especially during times of economic unrest."

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

© Entire contents copyright 2022 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

Reinsurance, capacity are concerns, following rising storm damage, inflation

What millennials need to know about Social Security

Advisor News

- Principal builds momentum for 2026 after a strong Q4

- Planning for a retirement that could last to age 100

- Tax filing season is a good time to open a Trump Account

- Why aligning wealth and protection strategies will define 2026 planning

- Finseca and IAQFP announce merger

More Advisor NewsAnnuity News

- Half of retirees fear running out of money, MetLife finds

- Planning for a retirement that could last to age 100

- Annuity check fraud: What advisors should tell clients

- Allianz Life Launches Fixed Index Annuity Content on Interactive Tool

- Great-West Life & Annuity Insurance Company Trademark Application for “SMART WEIGHTING” Filed: Great-West Life & Annuity Insurance Company

More Annuity NewsHealth/Employee Benefits News

- Medicare Moments: Are clinical trial prescriptions covered by Medicare?

- Blue Cross Blue Shield settlement to start payouts from $2.67 billion class-action suit

- Why the Cost of Health Care in the US is Soaring

- WARREN, HAWLEY INTRODUCE BIPARTISAN BILL TO BREAK UP BIG MEDICINE

- Proposed ACA regulations are a win for brokers, consumers

More Health/Employee Benefits NewsLife Insurance News