‘We could analyze this forever’: Regulators defend LTC rate review process

Studying the long-term care rate review issue for nine years is plenty long enough, said Fred Andersen of the Minnesota Department of Commerce.

It is time for regulators to act, he added Monday during a Long-Term Care Actuarial Working Group call.

In October, the working group agreed on a single long-term care rate review process based on the Minnesota method. It includes a cost-sharing component to spread the burden of LTC rate hikes.

Insurers and regulators alike struggled for years with incongruent LTC rate review standards. With many LTC insurers – Genworth, for example – doing business nationwide it created a laborious process for all involved. And large LTC price hikes for consumers.

While regulators chose to move forward with the Minnesota method over the Texas process, they opted to set aside the cost-sharing details for future meetings. The rate-review strategy will need several more approvals before it is sent to the states for consideration.

Consumer advocate Birny Birnbaum questioned whether nine years of work reached the crucial conclusions. Specifically, Birnbaum, executive director of the Center for Economic Justice, called for criteria and metrics showing what blocks are affected, how many people are in the block and the numbers of cumulative rate increases.

“I honestly think we could analyze this forever and never come up with a satisfying result,” Andersen responded. “This was a project that was due last year from the commissioners, and there will always be an opportunity … to improve [it].”

‘A tired excuse’

Regulators “should be able to answer the question” of whether the proposal will generate more premium for LTC insurers, Birnbaum shot back, and whether some policyholders will end up subsidizing other policyholders.

“This thing that ‘Well, we could research this for another year,’ is really getting to be a tired excuse for not doing the things that you might have done or could have done up until this point,” Birnbaum said. “There's no reason not to collect the information in order to run the actual data through your various proposals to see what the impact is going to be.”

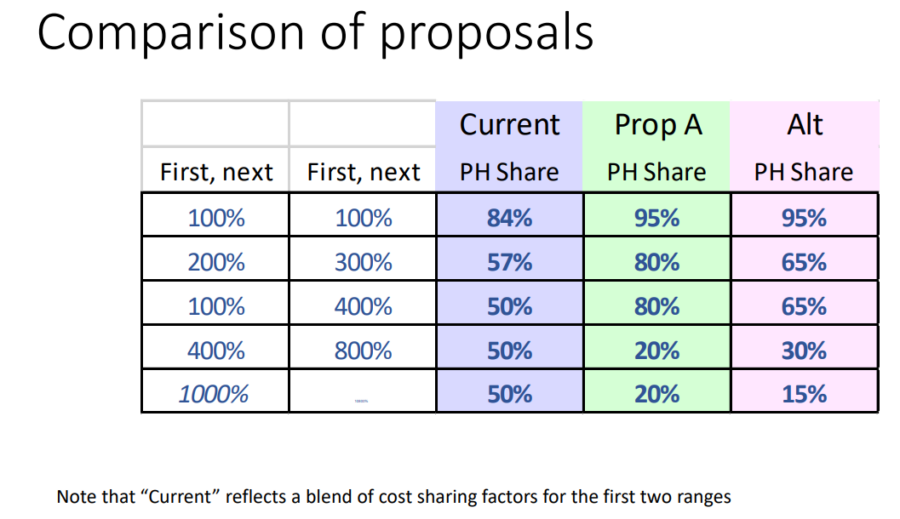

The working group took no votes and made no decisions. Regulators face two proposals for cost-sharing with the goal of reducing the overall impact of rate increases on policyholders with cumulative increases of 400% or more, explained Paul Lombardo, director of the Life & Health Division at the Connecticut Insurance Department.

"We believe that the explicit cost-sharing formula is an approach that does not step into the lane of discrimination. It does not step into the idea that we are going to have situations that were not contemplated with the pricing," Lombardo said. "We are not going to have varying rate increases based upon attained age versus issue age versus how long you've had the policy for."

Andersen introduced and reviewed each of the proposals.

Not an actuarial review

As he has in several meetings, Tomasz Serbinowski, actuary with the Utah Insurance Department, again found fault with the cost-sharing aspect.

"It's a beauty contest. We don't have really any metric by which to judge," he said. "It doesn't feel to me like an actuarial exercise. It looks like policymaking, and I'm having a very hard time ... figuring out some more actuarial, so to speak, way of deciding which proposal is more appropriate."

Andersen, responding to comments from Birnbaum and Serbinowski, said regulators held "at least one" session where company-specific examples were reviewed.

Whatever proposal the working group goes with, Lombardo and Andersen agreed that it will largely eliminate the need for repeated rate increases by LTC insurers.

"I probably received dozens of rate increase filings each year," Andersen said. "I do not recall more than maybe one for business that's been issued in the past 10 years. So, I think we're trying to be practical and address the major issue that's out there."

© Entire contents copyright 2025 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

Texas AG Ken Paxton sues Allstate over collection of driver data

Is ‘lack of vision’ key to the AI readiness gap in the insurance industry?

Advisor News

- Why you should discuss insurance with HNW clients

- Trump announces health care plan outline

- House passes bill restricting ESG investments in retirement accounts

- How pre-retirees are approaching AI and tech

- Todd Buchanan named president of AmeriLife Wealth

More Advisor NewsAnnuity News

- Great-West Life & Annuity Insurance Company Trademark Application for “EMPOWER READY SELECT” Filed: Great-West Life & Annuity Insurance Company

- Retirees drive demand for pension-like income amid $4T savings gap

- Reframing lifetime income as an essential part of retirement planning

- Integrity adds further scale with blockbuster acquisition of AIMCOR

- MetLife Declares First Quarter 2026 Common Stock Dividend

More Annuity NewsHealth/Employee Benefits News

- Trump wants Congress to take up health plan

- Iowa House Democrats roll out affordability plan

- Husted took thousands from company that paid Ohio $88 million to settle Medicaid fraud allegations

- ACA subsidy expiration slams Central Pa. with more than 240% premium increases

- Kaiser affiliates will pay $556M to settle a lawsuit alleging Medicare fraudKaiser affiliates will pay $556M to settle a lawsuit alleging Medicare fraudKaiser Permanente affiliates will pay $556 million to settle a lawsuit that alleged the health care giant committed Medicare fraud and pressured doctors to list incorrect diagnoses on medical records to receive higher reimbursements

More Health/Employee Benefits NewsLife Insurance News