Washington State LTC Law Provides Opportunity For Agents

It’s big news in the insurance industry, yet no one knows about it or talks about it - until now.

In 2019, the Washington state legislature and the governor passed a law in which, starting on January 1, 2022, all W-2 employees in that state will be assessed a 0.58% premium assessment based on their wages. The employer must collect this premium assessment through a payroll deduction. and remit the proceeds into a state trust account that will be used in the future to pay for people who are in a health crisis and need long-term care. Self-employed and federal employees are exempt from the mandate.

The state WA Cares Fund is a trust account created to hold the funds. When an individual meets the thresholds and eligibility, the fund will pay out a maximum of $36,500 over two years and will be adjusted through the years to the consumer price index. The plan will require an inability to perform three out of 10 activities of daily living to qualify for the benefit pay out as compared with two out of six required by normal qualified long-term care plans under section code 7702b. But if the employee leaves the state, they will not receive any long-term care benefits from the state nor will the taxes taken from their income be returned.

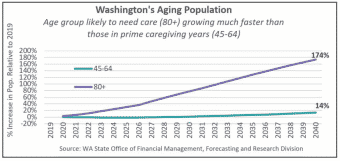

Washington state's aging population, particularly in the 80-plus age range, is growing beyond the ability of state’s Medicaid system to meet the demand for care.

By some estimations, the need to meet long-term care is likely to double over the next 20 years. This is outpacing the state’s ability to meet the burden of people who will be applying for future Medicaid long-term care benefits.

In Washington state, the average cost of in-home adult care is hovering around $50,000 a year and nursing home coverage is topping $100,000 per year. In the metro area of Seattle and the Puget Sound region, nursing home care is ranging between $125,000 and $145,000 a year, according to state statistics.

The state has opened a window of time until Nov. 1, 2021, for anyone to opt out of the state-mandated system by securing a privately owned plan or a group plan through their employers. They have until December 2022 to provide proof of coverage. But hardly anyone in the state knows anything about it and there seems to be no explanation as to why this is happening.

I came across correspondence from one of Washington state’s largest companies in which their human resources department announced to its employees three weeks ago that this mandate was coming and that the employees could explore the option of seeking out their financial advisors for a solution to opt out.

What is puzzling and even disturbing is the agencies that are responsible for putting this mandate into play are seemingly in disarray over this. In my opinion, they are basically building a plane while it is flying and have failed to notify its passengers that they are on that ride. Nearly no one knows about this coming mandate. In fact, my social media marketing team has conducted research and discovered only a few days ago that Google inquiries on this mandate were only hitting about 60 a day. My guess is that most of those searches were from insurance agents.

Over the past few weeks, I have encountered employees and managers from large companies such as Costco, Home Depot, Safeway and Albertsons and none of them had any idea that this mandate was heading their way. In addition, I have reached out to no fewer than 25 of my current clients who are W-2 employees and none of them had any idea that this was happening.

So the question is, why don’t they know? Why hasn’t the state notified all employers that coming January 2022, they are going to be mandated to withhold and send that tax into the state’s WA Care Trust account? I haven’t received any clear answers on this.

In all my discussions, every single client said that they want to secure private plans and be able to opt out of the tax mandate. But the challenge that agents face who are aware of this, is that the carriers who have provided LTCi in the state over the years are either leaving, changing underwriting requirements such as age eligibility or pulling certain products. Agents in the state who have traditionally worked in this arena have been running a 100-yard dash to help their customers, only to find that the insurance companies keep moving the goal post.

In large part, I agree with the state. The median income for seniors in Washington state is $56,000 annually and 50% have no pension or 401(k) type plans and for those age 67, the average retirement account balance is around $70,000. What the state is correctly pointing out is the vast majority of people have poorly planned for retirement they have not secured insurance plans that will take care of that need. The fact is, 7 out of 10 individuals will need some level of long-term care and they are not prepared for it.

This has fundamentally shifted how the state of Washington is going to address the future need. I suspect this is only the beginning as the state itself has admitted that the tax and the benefits can change in the future. I would say, bank on it.

Washington state isn’t alone. California and Minnesota are already working on their own versions of a state mandate to roll out over the next two years, and I surmise that other states will follow and implement their own plans as well.

In many ways, this is an indictment on our profession as insurance agents in failing our clients in helping them get prepared for retirement, as well as to help them set up plans to protect against the ravaging of illnesses that can destroy their retirement assets. But I also believe that this is an opportunity for us to step up to the plate and help our clients understand this issue and to provide them with solid planning and innovative products to meet this growing need. Those agents who understand this will thrive, find success and perform a great service to our clients.

Val Mikesell is owner and president of The Mikesell Group, Gig Harbor, Wash. He may be contacted at [email protected].

© Entire contents copyright 2021 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

3 Areas Of Focus For The Insurance Industry’s Continued Modernization

The Life Insurance Industry Provides Coverage And Protection Options For All Genders

Advisor News

- Six steps to turn HNW friends into clients

- The two-bucket investment approach to making money last

- Republicans confront difficult Medicaid choices in search of savings to help pay for tax cuts

- Economy showing momentum despite uncertainty

- 7 ways financial advisors can benefit by giving back to nonprofits

More Advisor NewsAnnuity News

Health/Employee Benefits News

- Studies from University of Occupational and Environmental Health Provide New Data on COVID-19 (Avoiding the Use of Outpatient Rehabilitation Services Under Long-term Care Insurance During the Covid-19 Pandemic): Coronavirus – COVID-19

- After more than 1,000 layoffs, worries persist about CVS Health's future in Connecticut

- This West Linn house, birthplace of Oregon prepaid health plans, is on National Historic Register

- Medicaid on the chopping block as Republicans release budget draft

- Wash, dry, enroll: Finding Medicaid help at the laundromat

More Health/Employee Benefits NewsLife Insurance News

- Annual financial and audit reports – JPMORGAN CHASE & CO.

- Conning research: Insurers must be flexible in the 2025

- AM Best Places Credit Ratings of Banner Life Insurance Company and William Penn Life Insurance Company of New York Under Review With Developing Implications

- Best's Review Examines Value in Innovation Culture

- Initial Registration Statement for Employee Benefit Plan (Form S-8)

More Life Insurance News