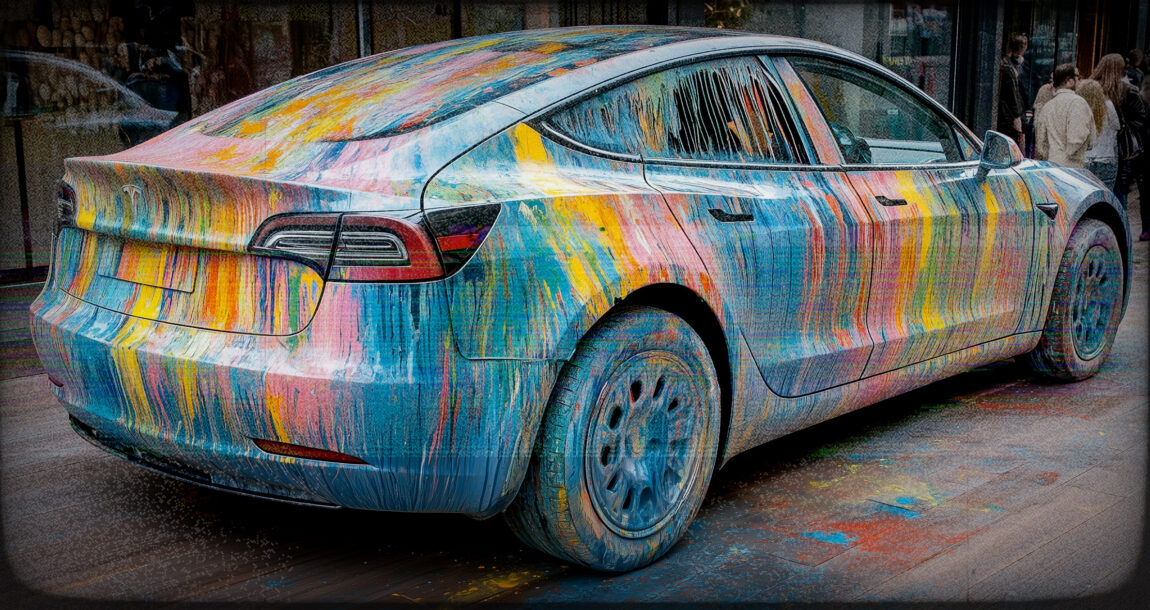

Vandalism may drive up insurance costs for Teslas

While all motorists are bracing for increasing auto insurance premiums, partly due to Trump-era tariffs, Tesla owners may feel the pinch even more due to increased reports of vandalism and other acts of protest directed at Tesla CEO Elon Musk.

Some analysts say that due to the vandalism, insurers may raise the cost of insuring the cars and some might even refuse to offer coverage altogether. The incidents come amid growing criticism of Musk’s involvement in cutting government spending as the head of DOGE, the Department of Government Efficiency established by President Trump.

Across the country, Teslas have been shot at, set on fire, keyed, and painted with swastikas by protesters. Since insurance companies consider factors like theft and vandalism when determining rates, a sustained rise in such incidents could result in increased premiums for comprehensive coverage.

'Insurers will take notice' of Tesla vandalism

“It's rare for a CEO's public persona to have any impact on insurance costs; it's not something I've ever heard of before,” said Matt Brannon, a data analyst at Insurify, a digital insurance agent that helps users compare car insurance quotes from multiple providers. “But when brand perception leads to targeted vandalism like that, insurers will take notice.”

Brannon said it is too early to tell if the vandalism incidents will result in higher insurance premiums for Tesla owners but he notes that insurers will likely include such factors in their underwriting if more reports of vandalism surface. He noted that in 2023 a TikTok theft trend targeting certain Kia and Hyundai models led to increased premiums and coverage refusals for those brands.

“Insurers need to prove that they're spending more money on Tesla claims before they raise rates,” Bannon said.

Tesla owners are already paying up for insurance, according to Insurify. In a listing of the top 50 automobiles ranked by their insurance costs, four Tesla models are already the most expensive.

“Three Tesla models that saw their insurance go up $800 to $900 over last year, so, you know, this vandalism is just another factor that underwriters will consider,” said Bannon.

Moreover, it may not be only Tesla owners, but their neighbors as well who could be impacted by rising rates.

“If your zip code becomes a hotspot for Tesla vandalism again you as a policyholder might also be affected even if you don't drive a Tesla because zip codes are part of what goes into how insurance companies calculate rates,” Bannon said.

Numerous incidents reported

Numerous incidents of vandalism have been reported against Tesla vehicles and properties. Recent incidents include:

- San Jose, California: A suspect was arrested for keying a Tesla in a Costco parking lot, an act captured on the vehicle’s camera and widely circulated online.

- Encinitas, California: Deputies discovered swastikas and profanities spray-painted on multiple Teslas and the dealership building.

- Loveland, Colorado: A suspect was arrested for using incendiary devices to damage vehicles and a dealership building.

- Portland, Oregon: A Tesla showroom was targeted, with bullets fired through windows, damaging vehicles inside.

- Dedham, Massachusetts: Two Tesla Cybertrucks were defaced with graffiti and had their tires slashed. The tires of a Tesla Model S were also damaged.

- North Charleston, South Carolina: A man allegedly set Tesla car chargers on fire.

The incidents have led some people to affix a notice to would-be vandals saying “Car was purchased before Elon Musk went crazy,” according to one police report.

The backlash has also spread to Capitol Hill where some lawmakers are second guessing their decision to buy a Tesla.

Sen. Mark Kelly (D-Ariz.) said he plans to ditch his Tesla because of the politics surrounding the vehicle.

“Every time I get in this car …it reminds me of just how much damage Elon Musk and Donald Trump is doing to our country,” Kelly said in a video he posted on social media. “It’s time to get rid of it, you know Elon Musk turned out to an a**hole. And I don’t want to be driving the car built and designed by an a**hole.”

© Entire contents copyright 2025 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Doug Bailey is a journalist and freelance writer who lives outside of Boston. He can be reached at [email protected].

Industry associations blast MedPAC view of Medicare agents

Premium financing options for agency success

Advisor News

- 2025 Top 5 Advisor Stories: From the ‘Age Wave’ to Gen Z angst

- Flexibility is the future of employee financial wellness benefits

- Bill aims to boost access to work retirement plans for millions of Americans

- A new era of advisor support for caregiving

- Millennial Dilemma: Home ownership or retirement security?

More Advisor NewsAnnuity News

- Great-West Life & Annuity Insurance Company Trademark Application for “EMPOWER BENEFIT CONSULTING SERVICES” Filed: Great-West Life & Annuity Insurance Company

- 2025 Top 5 Annuity Stories: Lawsuits, layoffs and Brighthouse sale rumors

- An Application for the Trademark “DYNAMIC RETIREMENT MANAGER” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Product understanding will drive the future of insurance

- Prudential launches FlexGuard 2.0 RILA

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- Baby On Board

- 2025 Top 5 Life Insurance Stories: IUL takes center stage as lawsuits pile up

- Private placement securities continue to be attractive to insurers

- Inszone Insurance Services Expands Benefits Department in Michigan with Acquisition of Voyage Benefits, LLC

- Affordability pressures are reshaping pricing, products and strategy for 2026

More Life Insurance News