Trust influenced by consumer experience, relationships

Why do consumers trust some financial institutions more than others? And what leads to that trust?

Multiple factors influence trust, as researchers at The American College’s Carey M. Maguire Center for Ethics in Financial Services explained at a recent webinar.

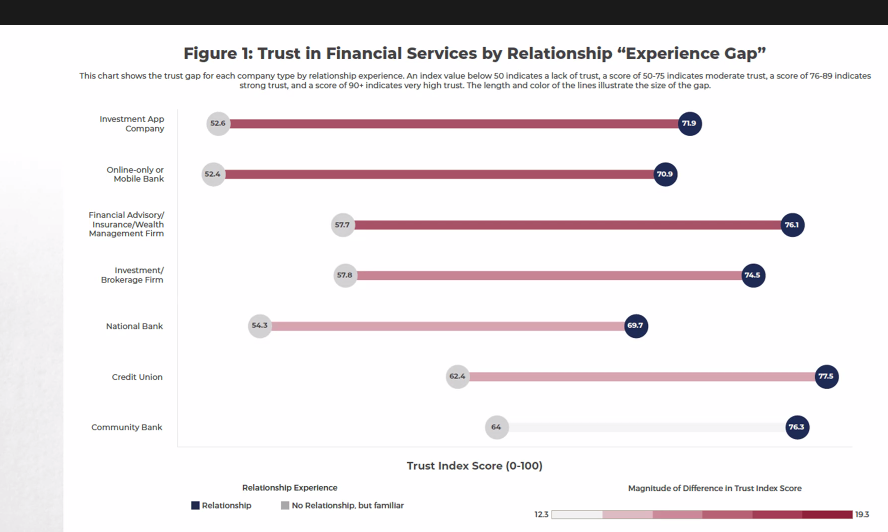

A difference in trust exists between consumers who have a personal relationship with a financial entity and consumers who are familiar with that entity but don’t have a relationship with it. That difference is called “the experience gap,” said Jason Pattit, associate professor at the University of St. Thomas (Minn.) and a fellow at the Maguire Center.

Researchers surveyed consumers on how much they trusted various financial entities and whether they had a personal relationship with that entity or whether they were familiar with it but didn’t have a relationship. The results were compiled into a trust index between 1 and 100, with a score of 90 or higher indicating a very high trust.

Among the financial entities studied, the two greatest experience gaps occurred with investment app companies and online-only or mobile banks. For investment app companies, the survey results showed a trust index of 71.9 for consumers who had a relationship versus a trust index of 52.6 for consumers who did not have a relationship. Online-only or mobile banks showed a trust index of 70.9 for consumers who had a relationship as opposed to a trust index of 52.4 for consumers who did not have a relationship.

Credit unions had the highest index – 77.5 - among consumers who had a relationship with them, followed by community banks at 76.3. National banks had the lowest index – 69.7 – among consumers who had a relationship.

Source: The American College

What influences trust?

Consumers generally trust based on several different psychological factors, Pattit said. They are:

- Visible reputation: captures whether a company has good reviews from reputable sources and provides transparent information about its services in a public space.

- Value alignment: covers aspects of company behavior like supporting the community, understanding the needs of different individuals, having similar values, and caring about individuals.

- Interest protection: covers aspects of operations such as protecting an individual from fraud, having clear fee structures, and resolving problems quickly.

- 4. Referent trust: indicates that consumers trust because they know someone with a relationship with the company.

- Personalization: points toward efforts a company makes to know the individual and help them individually.

Recommendations for advisors

Based on the information gleaned from the research, Pattit made three recommendations for financial professionals to increase consumer trust:

- Have consistent values in all channels.

- Create “experience points” for consumers.

- Recognize that bad experiences spill over.

Susan Rupe is managing editor for InsuranceNewsNet. She formerly served as communications director for an insurance agents' association and was an award-winning newspaper reporter and editor. Contact her at [email protected]. Follow her on Twitter @INNsusan.

© Entire contents copyright 2023 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Susan Rupe is editor in chief, magazine, for InsuranceNewsNet. She formerly served as communications director for an insurance agents' association and was an award-winning newspaper reporter and editor. Contact her at [email protected].

Study finds most Americans want to improve their financial literacy

Increasing number of U.S. households prioritizing wealth transfer

Advisor News

- NAIFA: Financial professionals are essential to the success of Trump Accounts

- Changes, personalization impacting retirement plans for 2026

- Study asks: How do different generations approach retirement?

- LTC: A critical component of retirement planning

- Middle-class households face worsening cost pressures

More Advisor NewsAnnuity News

- Ancient Financial Launches as a Strategic Asset Management and Reinsurance Holding Company, Announces Agreement to Acquire F&G Life Re Ltd.

- FIAs are growing as the primary retirement planning tool

- Edward Wilson Joins SEDA, Bringing Deep Expertise in Risk Management, Derivatives Trading and Institutional Prime Brokerage

- Trademark Application for “INSPIRING YOUR FINANCIAL FUTURE” Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Jackson Financial ramps up reinsurance strategy to grow annuity sales

More Annuity NewsHealth/Employee Benefits News

- Data on Managed Care Reported by Researchers at Dartmouth College Geisel School of Medicine (Impact of the Medicare carotid stenting national coverage determination on procedure utilization and long-term stroke risk after carotid …): Managed Care

- New Managed Care and Specialty Pharmacy Findings Has Been Reported by Howard Weston Schmutz et al (Challenges of the Inflation Reduction Act for long-term care pharmacy: Examining impact and policy solutions): Drugs and Therapies – Managed Care and Specialty Pharmacy

- University of Washington Reports Findings in Managed Care (Too Sick to be True? Evaluating Potentially Problematic Diagnosis Coding Practices in Medicare’s Patient-Driven Payment Model): Managed Care

- Falling off the cliff: Loss of insurance subsidies hits Durango's middle class

- Universite Paris 1 Pantheon-Sorbonne Reports Findings in Science (Misperception, self-reported probabilities and long-term care insurance take-up in the United States): Science

More Health/Employee Benefits NewsLife Insurance News