Tiburon Advisors: Americans’ Investable Assets Up Nearly 50% From 2018

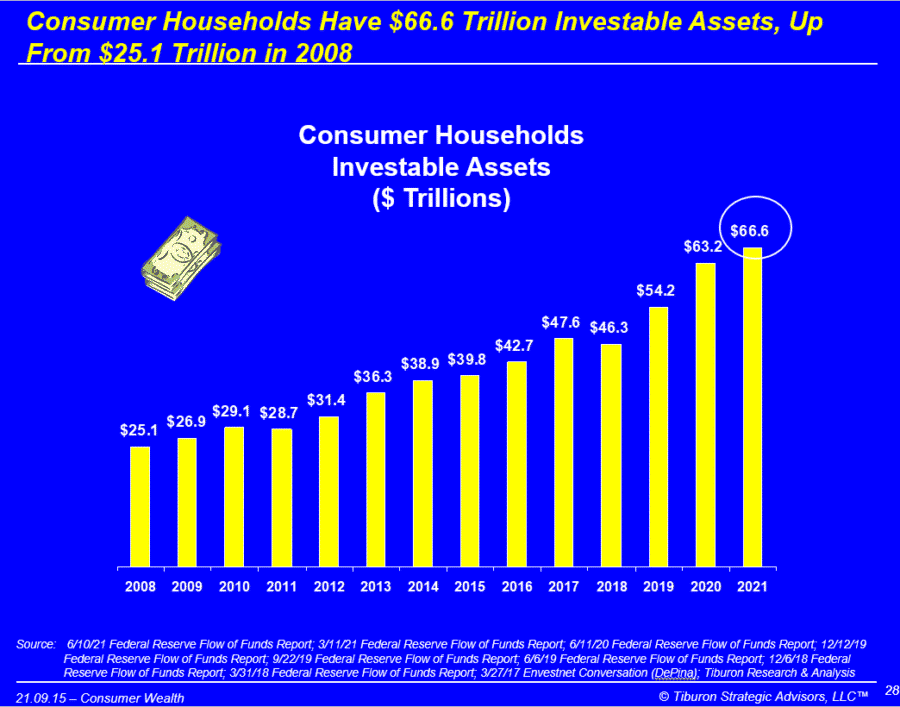

Americans have a whopping $67 trillion of investable assets, meaning that advisors are fishing in a well-stocked lake.

In fact, that figure is nearly 50% higher than just three years ago, said Chip Roame, managing partner of Tiburon Strategic Advisors. Roame delivered his annual research report on consumer wealth Thursday.

"If you're a consumer, a high-net-worth household, or even a massive-affluent household, and you've had your money in the stock market, you're feeling pretty flush right now," Roame said. "Things have been going your way. If you're a wealth manager, you probably think you're doing really, really well. The reality is everyone's doing really, really well."

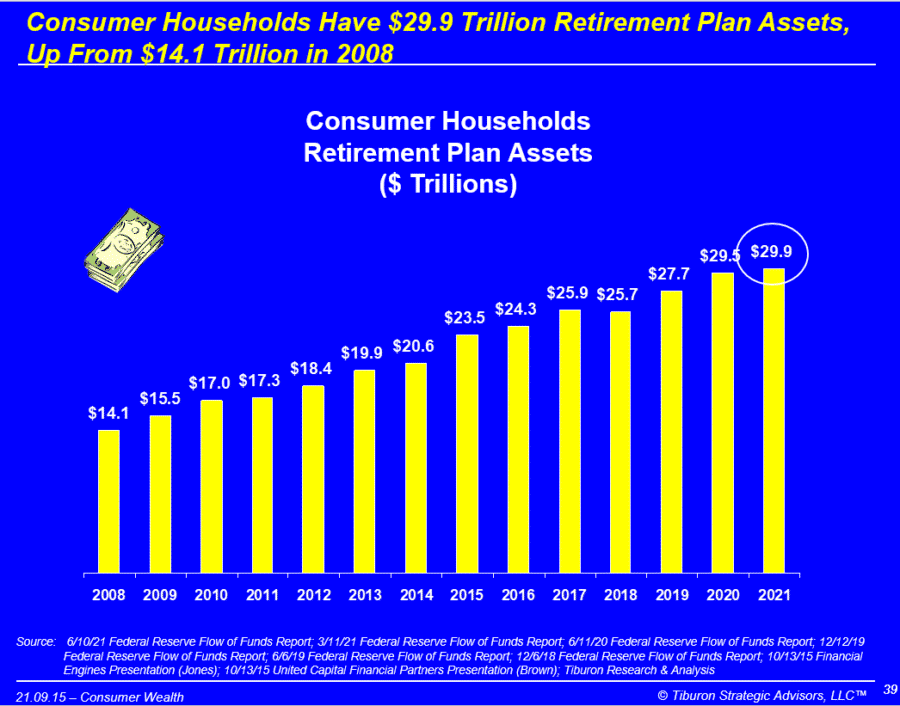

Unsurprisingly, retirement plan assets have grown nearly as well, doubling in 13 years to $29.9 trillion. Advisors and insurers are eager to take advantage of changes in the law that will make it easier to sell life insurance and annuities into these plans.

The shift to defined contribution plans is reflected in the assets, with $9.6 trillion now held in DC plans. That figure was $3.4 trillion in 2008, Roame noted.

Americans have $150 trillion in combined household assets, up from $118 trillion three years ago. This is largely a reflection of how well real estate has done in recent years, Roame said. The good news is household debt stands at $17 trillion and is rising at a much lower rate.

"Assets have doubled, and more than doubled, debt has only gone up about 30%," Roame explained. "And that bodes well for net worth in America."

Boomers Have More To Say

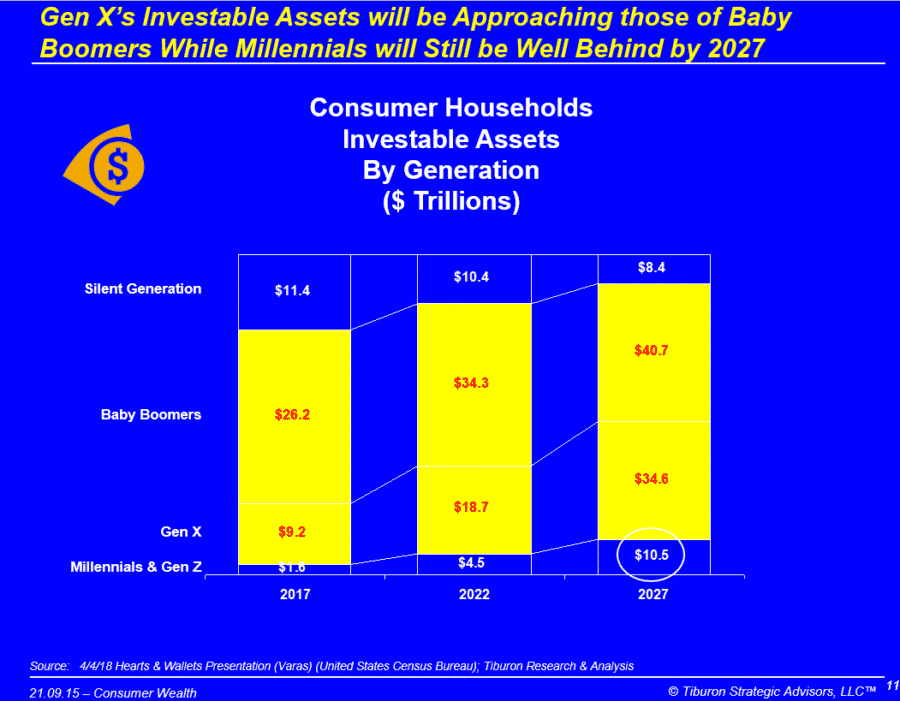

It would be incorrect to assume that baby boomers are yesterday's customer and the millennial and Gen Z clients are where the action should be, Roame said. Yes, millennial and Gen Z will make up 53% of consumer households by 2027 -- up from 40% in 2022.

However, they will still control a relatively small amount of investable assets.

"People are rushing the baby boomers into their retirement or into the grave," Roame noted. "Frankly, their money is still going up, not down. The silent generation's money is going down. And the millennials, which everyone is always overly excited about, sure they're growing, but it's a little sliver down at the bottom there."

Conventional wisdom seems to focus most on baby boomers handing down assets and money to their heirs, Roame said, but that might not be accurate.

"What's really going to happen is baby boomers are going to liquidate money first," he explained. "So the boomers have their money in the retirement plans, in their homes and in the small businesses, and that money will move to become investable assets. So if I'm in the wealth world, or the investment management world, your first thing to think about is not the generational wealth transfer. It's the liquidation."

Women Hold The Keys

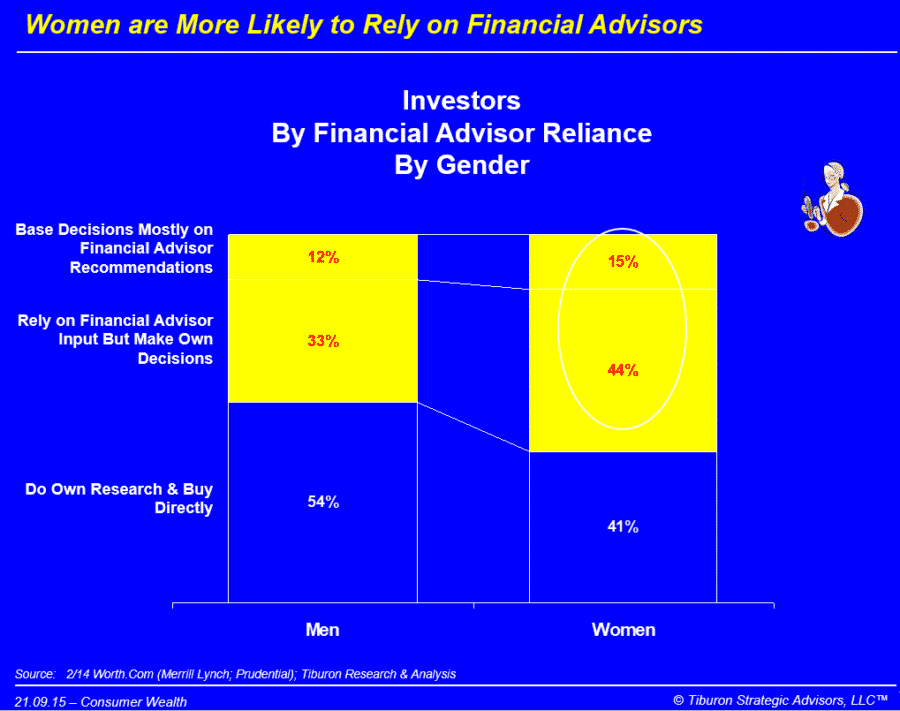

Women represent 51% of all Americans and control 51% of household wealth, Roame said. From there, the similarities seem to end. While 71% of men claim to be confident in their retirement goals, only 55% of women say they are.

Likewise, 70% of men say they are "extremely knowledgeable about investments," while 53% of women say they are. Whether the answers are accurate or not, it can mean more business for advisors.

"Women are more worried about running out of money," said Cheryl Nash, CEO of InvestCloud Financial Supermarket, in a comment Roame cited. "They outlive men so they need more savings."

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

© Entire contents copyright 2021 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

The New Way To Use LinkedIn, Plus 3 Easy Steps To Get Started!

Bestow Acquires Centurion Life

Advisor News

- Social Security staff cuts could ‘significantly impact’ beneficiaries

- Building your business with generative AI

- Study: key gaps advisors miss in retirement planning conversations

- T. Rowe Price: Trends that will shape retirement in 2025

- Trump revives plan for tax deduction on car loan interest payments, pushes sweeping tax cuts

More Advisor NewsAnnuity News

Health/Employee Benefits News

- Mark Farrah Associates Analyzed the 2023 Medical Loss Ratio and Rebates Results

- illumifin CEO Peter Goldstein Joins Alzheimer’s Association Board of Directors

- California has a lot to lose if Trump slashes Medicaid. Seniors, kids and more could face coverage cuts

- RFK Jr. pressed to reevaluate Pennsylvania’s Medicaid expansion

- New Mississippi Division of Medicaid director shares information with lawmakers, addresses concerns

More Health/Employee Benefits NewsLife Insurance News