The transformational potential of AI for advisors

The age of artificial intelligence is here, and it will undeniably transform our society and our industry.

Digital transformations in the insurance industry have been commonplace for about a decade, with AI driving its latest iteration. However, legacy systems, highly bespoke homegrown systems and highly customized off-the-shelf software continue to pose challenges. AI can enhance operational efficiency and drive substantial value across various facets of the industry.

Companies can maximize value from AI investments as business drivers by redirecting IT investments to fund AI initiatives, centralizing AI investments, and developing benchmarks for AI funding. Companies should prioritize educating financial professionals about tools that incorporate AI, especially generative AI.

To be successful, it is vital for leaders to be cognizant of the fact that jobs and professions will change in the next two to three years, but not necessarily be eliminated. Executives need to start thinking about skilling and reskilling employees, including training employees on how to use GenAI.

Just as vital, executives should lean on their chief information officers and cross-functional teams to maintain “humans in the center.” Enforcing the need for human judgment in the center of all use case implementations ensures that AI systems are implemented responsibly and ethically.

Carriers will need to have a documented AI strategy that takes a decided risk-based approach to strike an effective balance between innovation and agility, and governance and controls. It is strongly recommended that executives ensure their enterprise AI strategies place emphasis on explainable AI and focus on AI governance.

That’s one of the reasons we established the LIMRA and LOMA AI Governance Group — a cross-company industry-level consortia of over 90 business and technology executives, representing over 50 companies — in January.

In addition to surfacing insightful reports on the current state of AI in our industry, this group is actively developing tools, frameworks, scorecards and best practices for AI so that all firms can benefit from this technology.

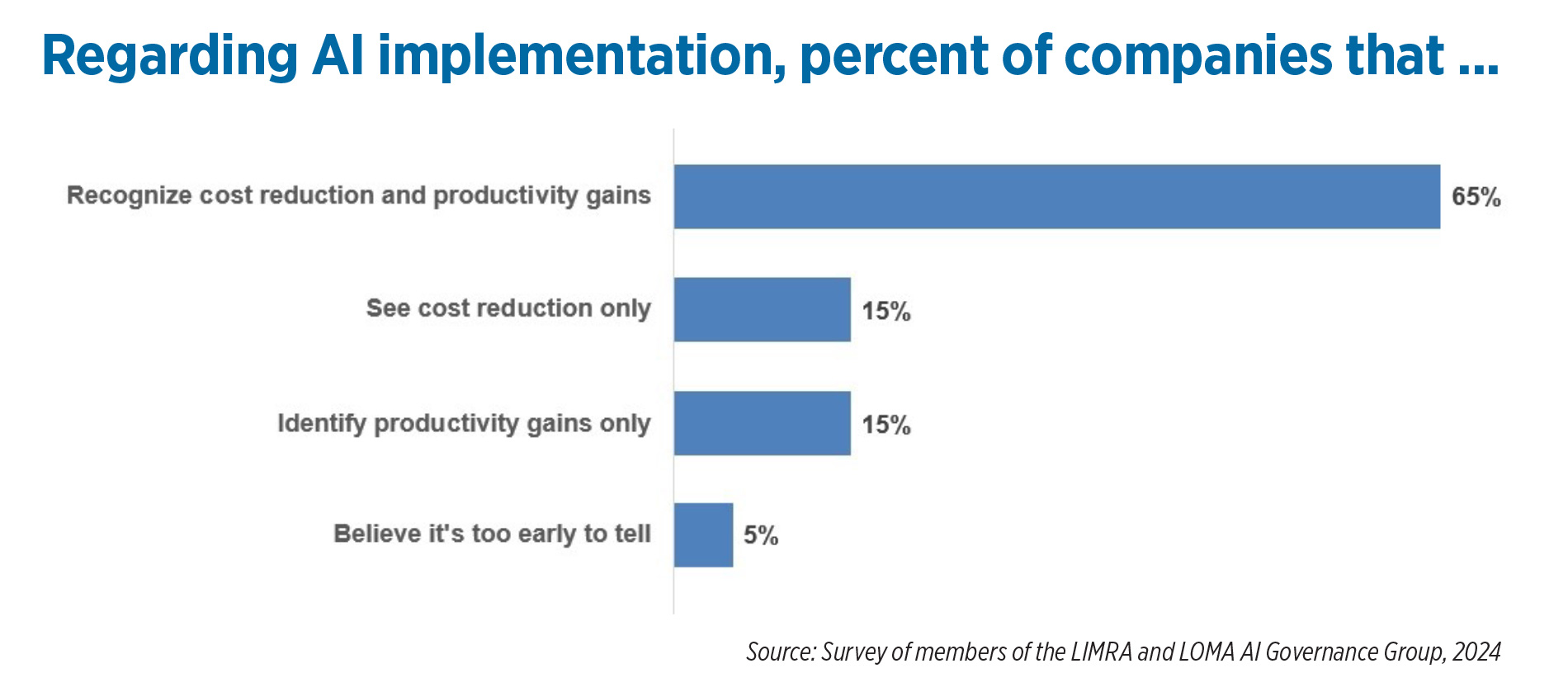

We recently surveyed group members on several AI-focused topics. It’s clear the implementation of AI and GenAI is a focus across our industry today. As companies begin GenAI implementations, they’re recognizing both cost reductions and productivity gains, and seeing few inaccuracies with their implementations — suggesting these innovations are opportunities for growth.

In the survey, 89% of executives believe that AI will have a moderate to significant impact on our industry over the next three years, and 70% believe that AI will have moderate to significant impact on their firms.

If there are rote, repeatable operational tasks that we perform at work, they will likely be automated by virtue of AI. As an example, financial advisors spend a considerable amount of time managing administrative tasks. AI can provide operational efficiency by automating these routine and repetitive tasks. This will allow advisors to focus on higher-value tasks such as managing risks (also enabled by AI), customer outreach and engagement.

With client expectations changing and a new purchasing demographic (Generation Z), AI offers significant potential to financial advisors to streamline operations and improve customer outcomes via intelligent prospecting, personalization, ongoing engagement and customer service. AI will enable financial advisors to remain competitive and elevate their practices. AI will also allow advisors to personalize financial advice, which can be individualized to customers’ financial goals, life stages and risk appetites. As AI continues to evolve, financial advisors who embrace these tools will be better positioned to stay competitive and grow their practices.

Kartik Sakthivel is LIMRA and LOMA chief information officer. Contact him at [email protected].

Is there a winning AI strategy for insurers? IBM says yes

What will 2025 hold for the insurance industry?

Advisor News

- GRASSLEY: WORKING FAMILIES TAX CUTS LAW SUPPORTS IOWA'S FAMILIES, FARMERS AND MORE

- Retirement Reimagined: This generation says it’s no time to slow down

- The Conversation Gap: Clients tuning out on advisor health care discussions

- Wall Street executives warn Trump: Stop attacking the Fed and credit card industry

- Americans have ambitious financial resolutions for 2026

More Advisor NewsAnnuity News

- Retirees drive demand for pension-like income amid $4T savings gap

- Reframing lifetime income as an essential part of retirement planning

- Integrity adds further scale with blockbuster acquisition of AIMCOR

- MetLife Declares First Quarter 2026 Common Stock Dividend

- Using annuities as a legacy tool: The ROP feature

More Annuity NewsHealth/Employee Benefits News

- Iowa House Democrats roll out affordability plan, take aim at Reynolds’ priorities

- Virginia Republicans split over extending health care subsidies

- Workers are stressed but optimistic about economy

- POTENTIAL IMPLICATIONS OF THE NEW MEDICAID DATA SHARING AGREEMENT BETWEEN CMS AND ICE

- MANAGING OVERHEAD COSTS? CHOOSE A STABLE HEALTH INSURANCE PLAN

More Health/Employee Benefits NewsLife Insurance News