The ‘Monkey Brain’: Determine If A Prospect Will Accept You

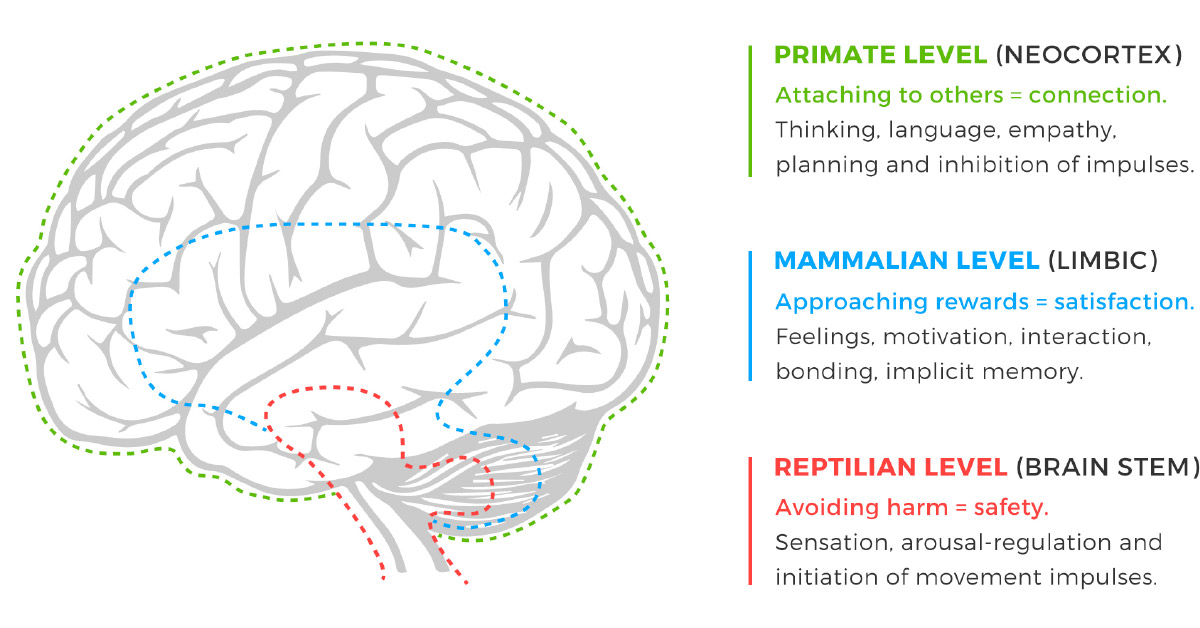

American physician and neuroscientist Paul D. MacLean pioneered the concept of the triune brain — the idea that the human brain evolved through three different stages. Those stages are known as the reptilian evolution or “crocodile brain,” the paleomammalian evolution or “monkey brain” and the neomammalian evolution or “modern brain.”

We’re going to explore what are called the two F's of the monkey brain and how they separate people into their tribes. The two F's of the monkey brain also determine whether someone will accept you as their advisor.

The monkey brain evolved from our earliest days of protohumanity and early societies. In that stage of our evolution, we definitely were not the alpha predators of the planet. We had no claws, fangs or armor. The only way we could survive was by banding together against the fiercer animals. And even in those early days, we would fight other groups of people when encountered.

So we learned to quickly recognize friend or foe (the two F's of the monkey brain) and either attack or accept individuals and organizations.

The monkey brain exists on the border between the conscious mind and the subconscious, in that fuzzy space that is slower than a gut reaction but quicker than the analytical neocortex of rational thought. This stage of our brain developed the complexity of emotions that separate us from the lower mammals (as well as the cold-blooded hunting animals that residually remain in our crocodile brain) and is the powerhouse of the subconscious and encoding and decoding memories.

This is why emotions and barely recognized memories are so powerful in our decision-making processes, much more powerful than our logical conscious mind powered by the highly evolved and much larger neocortex that is the modern brain.

Engaging The Monkey Brain

So how do we apply this understanding of brain function to acquire clients?

These days, the “tribe” is not the small community group that was dependent upon each other for physical survival in the harsh environment. The tribe is anyone who has sufficient overlap in experiences and attitudes for us to glom onto and is as dynamic and varied as our society. Some people naturally have smaller “circles” due to their mental makeup, family and experiences, while others (often attracted to the financial services industry) have a much larger or looser set of criteria that expands their network tremendously.

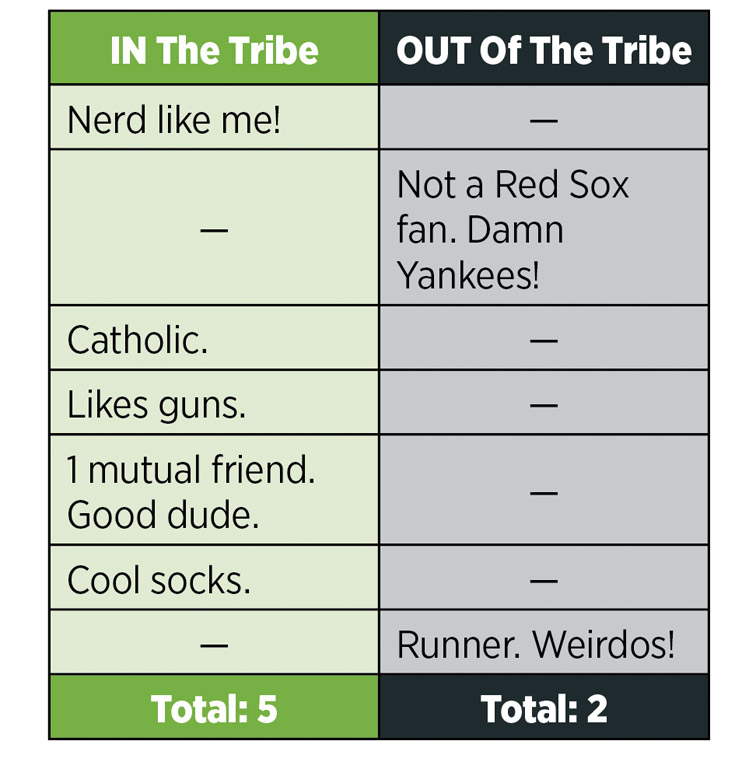

Each person runs every new contact with an unfamiliar individual through a series of filters that they rarely realize is the monkey brain in action. Think of it almost as if it is a T-bar analysis, barely noticing small details that are either assigned “in” or “out” check marks that are then subconsciously tallied and scored. Enough “in” ticks and you are accepted as part of their tribe, enough “out” (or certain bright line criteria violated) and you will be met with total distrust, and 80% of their mind is against you. In these situations, you need impressive sales skills to overcome the resistance of their entire subconscious aligned against you as their monkey brain allies with their crocodile brain.

So how do you use this accounting mechanism to your advantage, to stack the votes in your favor? The mind is funny in that almost all ideas (such as core values) are assigned essentially equal weighting. So five positive assessments, no matter how seemingly irrelevant, are still five positive checks. Every little thing is valuable in the grand scheme of the relationship. For example, in a theoretical meeting the prospect would assess me as follows:

In this subconscious calculus, this prospect would accept me even though my baseball team is much better than their poor choice.

As another example, I met a young woman the other day through a mutual acquaintance to do some work. She is of a different gender and ethnicity than I am, and she is 20 years younger.

Other than working heavily with startups, we apparently have few things in common. But she went to the same technical university I did, so that was a big common denominator.

Naturally, I encouraged her to discuss the overlap in our Venn diagram of experiences as opposed to the differences. As we talked for a few minutes about professors we had shared and a variety of other uniquely “our tribe” things, her mental counter of connections versus differences was spinning like mad. After a few minutes of our talking, I would have had to commit a major faux pas, a bright line violation of the tribal mores, for her to excommunicate me and not want to work with me. Her monkey brain weighed the differences and similarities and resoundingly concluded I was part of “her nerd clan” and safe to drop her guard around.

How do you tip the scales in your favor? Is the person introducing you to someone using similarity as a way to open the door with you such as, “You’ll like each other because you both are X team fans” and “Your kids both play soccer in Y League, I think”? Or are they making you seem foreign by focusing on your professional differences? Is your connection establishing a mutual enemy for you to combat, be it taxes or City Hall? Train your nominator to create initial ties of shared interests that, combined with the respect factor of their relationship, will smooth the path for you.

Furthermore, when you ask your client for introductions, start with asking for other members of the tribe because these are easy relationships for them to open up about, and people they generally want to strengthen their own tribe. “Who else do you know from our school that is doing X?” “Of everyone from our alma mater, who do you talk with the most?” “Who from where we both worked is the one that is going to lead the pack, the one that you see as having the most potential to have long-range success?” Since you are already part of the tribe, meeting other members of the group becomes much easier if you quietly reinforce that you are in the organization and trying to assist its members.

Expanding The Tribe

Further expand the borders of their tribe with questions of similarity. Who else is about to have a kid? Who else from your old company is like us? If you and I were to do X together, who would you call to join us?

These inclusive questions (contrasted with the exclusive one of “Who is the wealthiest person you know?”) allows the prospect to embrace you and these introductions as “part of the crew” and reinforces your bonds in their emotional monkey brain that will then tell the neocortex to do what it has to do to maintain this relationship with you, including buying products that they may not yet see the value of.

Our tech-driven, overstimulated and information-saturated economy and world are overwhelming in many ways, and competing in the complex but cold neocortex is inefficient.

Nor is it as emotionally rewarding as focusing on those fundamental connections that people are craving — the “one of us” and “you get me” that the monkey brain controls. Build the bridges and open your arms, and clients will walk into your practice because they feel safe in your tribe.

Joe Templin, MCEC, CEC, CLU, ChFC, CAP, is the author of Every Day Excellence and creator of the Financial Services Daily Drip-Every Day Excellence training email, https://www.salesactivitymanagement.com/everyday-excellence/. He is NAIFA New York State membership chair. He may be contacted at [email protected].

Why Black Women Make Good Advisors And Good Clients

Annuities Help Clients Spend More Money In Retirement

Advisor News

- Investor use of online brokerage accounts, new investment techniques rises

- How 831(b) plans can protect your practice from unexpected, uninsured costs

- Does a $1M make you rich? Many millionaires today don’t think so

- Implications of in-service rollovers on in-plan income adoption

- 2025 Top 5 Advisor Stories: From the ‘Age Wave’ to Gen Z angst

More Advisor NewsAnnuity News

- Great-West Life & Annuity Insurance Company Trademark Application for “EMPOWER BENEFIT CONSULTING SERVICES” Filed: Great-West Life & Annuity Insurance Company

- 2025 Top 5 Annuity Stories: Lawsuits, layoffs and Brighthouse sale rumors

- An Application for the Trademark “DYNAMIC RETIREMENT MANAGER” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Product understanding will drive the future of insurance

- Prudential launches FlexGuard 2.0 RILA

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- Baby On Board

- 2025 Top 5 Life Insurance Stories: IUL takes center stage as lawsuits pile up

- Private placement securities continue to be attractive to insurers

- Inszone Insurance Services Expands Benefits Department in Michigan with Acquisition of Voyage Benefits, LLC

- Affordability pressures are reshaping pricing, products and strategy for 2026

More Life Insurance News