Annuities Help Clients Spend More Money In Retirement

When advisors talk to their clients about annuities, the conversation usually centers on creating guaranteed lifetime income. But many clients might be more responsive to annuities if advisors turned the conversation around to discuss ways annuities can help clients spend more money in retirement.

That was the word from Harry Stout, founder of the FinancialVerse Organization and author of several books on annuities. Stout spoke at a recent webinar sponsored by the National Association for Fixed Annuities.

“I find that many people relate better to lifetime spending than they do to lifetime income. It gets back to our culture,” he said.

Lifetime income is still an important issue to discuss with clients, however. Stout pointed to a recent study by CANNEX and Greenwald Research that showed consumers’ No. 1 fear about retirement is running out of money.

“When you look at what’s going on in the market today, there are still very few if any cost-effective alternatives to annuities for guaranteed lifetime income,” he said. “Taking advantage of the guarantees that exist is really powerful.”

Two Buckets

When planning for retirement spending, Stout likes to put retiree spending levels into two buckets: discretionary and nondiscretionary.

The nondiscretionary spending bucket is all about paying for the basic expenses of daily living.

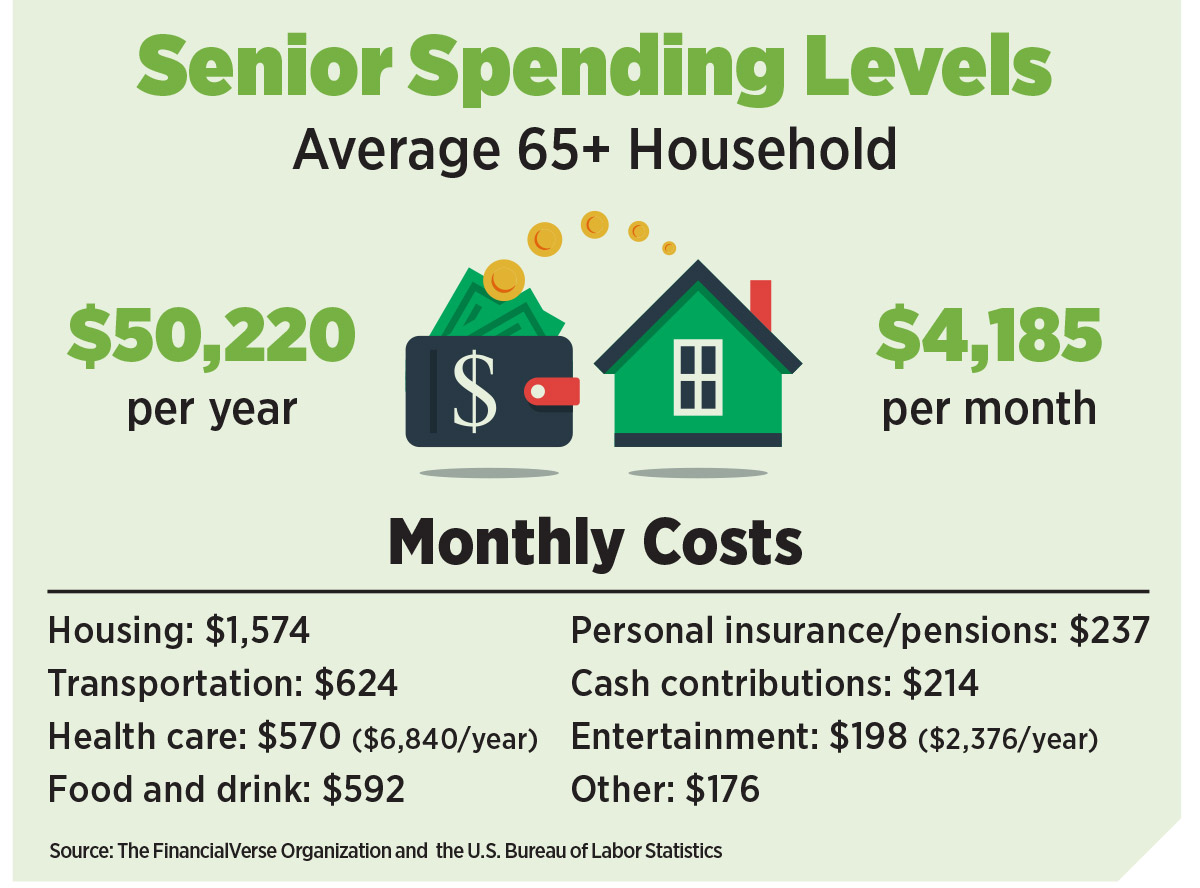

Stout quoted numbers from the U.S. Bureau of Labor Statistics showing that the average household of someone age 65 or older spends $4,185 per month — or $50,220 per year — just to maintain their daily lives. Those monthly expenses include the costs of housing, health care, transportation, food and entertainment.

“Many folks — as they look at annuities and use annuities for planning and helping make sure they have the income to keep up their lifestyle — they try to look at what annuities can do to provide guaranteed income to help pay for some of these costs,” Stout said.

The problem with planning for nondiscretionary spending, he added, is that the average Social Security benefit does not provide enough funds for the average senior household to cover those monthly expenses.

“Today, for the average 65-year-old couple who’s retiring, their average Social Security benefits are a little more than $2,500 a month,” he said. “So for very simplistic reasons, I always look at this and say, the average couple is spending $50,000 a year, but the average Social Security benefit is about $30,000 a year. They have about a $20,000 gap. How are they going to fill that gap and what are they going to do?”

The $50,000 annual spending figure Stout cited doesn’t provide the entire picture of retirement spending. It does not include spending on items such as major household repairs, travel, support for grandchildren or other family members, providing a legacy through charitable contributions, or the cost of long-term care.

“As you help your clients prepare for their later years, you need to plan for these other items,” Stout said, adding that about 6% of households today are made up of grandparents raising grandchildren. “If you want these things to take place in your later years, you have to plan and you need to have the money and the sources of recurring income so you can spend.”

In planning for spending in retirement, Stout said, “It’s about maintenance.”

“What kind of lifestyle do people want to have? What do they want to do in terms of maintaining that lifestyle? You have to look at spending and how you can direct your clients to sources of income that will enable them to have that lifestyle.”

Medical Costs

After examining the cost of daily life and any discretionary spending a retiree may want to do, Stout said advisors must educate clients on the cold hard facts of medical costs in retirement.

Stout cited statistics from Fidelity Investments that show the average 65-year-old retired couple may need to save $295,000 after taxes to cover their health-care expenses in retirement.

Breaking it down further, that $295,000 equals $14,750 a year or $1,229 a month over the average 20-year span of retirement.

“Overall medical costs are a huge planning consideration,” he said. “How are people going to fund this and where will they get the cash to pay for this? Annuities are a great solution.”

LTC A ‘Wild Card’

The “wild card” in planning for retirement spending, Stout said, is long-term care.

“The difficulty we have in the financial world is that finding fully underwritten long-term care protection is becoming harder and harder,” he said. “The benefits have been reduced by a number of the companies. We’ve seen a number of companies exit the market, and at the same time, we’ve had companies significantly raise the cost of the coverage they have in place.”

Stout said advisors can help clients protect themselves against LTC costs by recommending an annuity with a long-term care rider.

Income Replacement

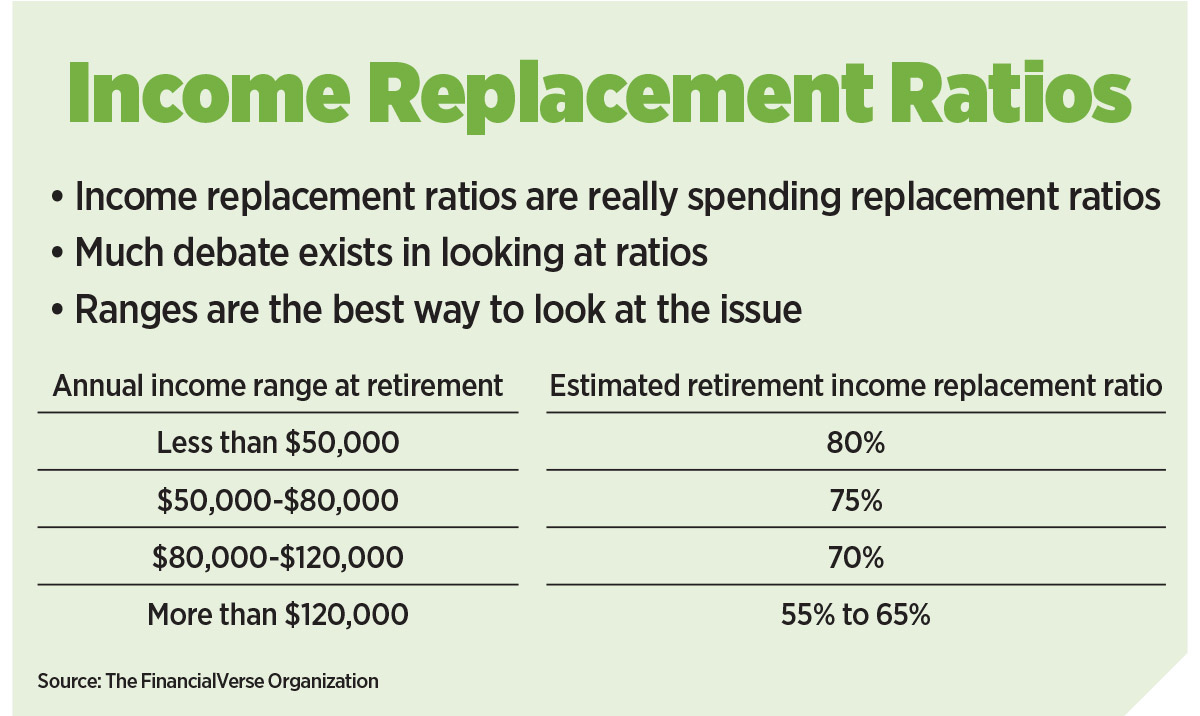

One of the biggest concerns clients have in planning for retirement, Stout said, is answering the question, “How much of my income should I replace in retirement?”

“To me, that’s a personal question and you really need to take a look at the individuals and their income levels and lifestyle to determine what that might look like as they begin their planning journey,” he said.

Stout cited statistics from Fidelity Financial Solutions that show those who make less than $50,000 a year might need to replace 80% of their income in retirement. At the opposite end of the spectrum, households making more than $120,000 annually may need to plan for replacing 55% to 65% of their annual income.

“There’s a lot of debate on income replacement ratios, but one of the ways you can position it really depends on the client’s income level pre-retirement as well as their lifestyle,” he said.

“This is a way to help people get their heads around what they should be planning, what kind of income replacement they should be looking for.”

Social Security

Social Security may be the foundation of most clients’ plans for retirement income and funding their spending, Stout said. But clients may not realize Social Security is designed to replace only 40% of pre-retirement earnings for the average person. “And when you get into the higher income brackets, that percentage drops significantly,” he said. “For most people, they just can’t live on that.”

Stout said he predicts a number of changes will happen to Social Security over the next few years.

1. Increase in tax rate. The tax rate that everyone pays for FICA is likely to go up.

2. Increase limit on wages subject to tax above 2021’s $142,800.

3. Expand the types of income subject to tax. Stout said perhaps unearned income in addition to earned income would be subject to FICA tax.

4. Looking at the full retirement age being raised, maybe as high as 72. “Overall, with life expectancies increasing, I can see that happening, especially for a lot of younger people,” he said.

5. Formula for inflation-based cost-of-living adjustments. Stout said there is some debate in Washington “that the inflation adjustment is not based on the cost of the basket of goods and services that seniors buy and needs to be adjusted. Many people feel inflation is higher on seniors than is being reflected.”

6. A progressive approach to increase the minimum benefit for those with lower incomes so older Americans have less poverty going into retirement.

Income planning for retirement is really spending planning, Stout said. “Annuities are a great tool for income planning,” he said. “And what you’re trying to do is fund senior spending to maintain their lifestyles. That’s really what we’re all trying to work for.”

In planning for clients to have enough income to pay for medical and long-term care costs, he said, “Annuities hit the sweet spot by being able to provide income for these things as well as assets that can accessed.”

The ‘Monkey Brain’: Determine If A Prospect Will Accept You

Ebony Ruffin Shows How Life Insurance Is Part Of A Luxury Lifestyle

Advisor News

- Americans fear running out of money more than death

- Caregiving affects ‘sandwich generation’s’ retirement plans

- Why financial consciousness is the key to long-term clarity

- Selling long-term-care insurance in a group setting

- How to overcome the fear of calling prospects

More Advisor NewsAnnuity News

Health/Employee Benefits News

- Low-income diabetes patients more likely to be uninsured

- UnitedHealth execs bemoan ‘unusual and unacceptable’ Q1 financials

- LTCi proves its value beyond peace of mind

- Governor signs ban on drug middlemen owning pharmacies

- The lighter side of The News: Political theater; A bone to pick with a Yankee; Health insurers have mascots?

More Health/Employee Benefits NewsLife Insurance News

- Americans fear running out of money more than death

- NAIFA eyes tax reform, retirement issues in 2025

- Legislation would change tax treatment of life insurers’ debt investments

- Closing the life insurance coverage gap by investing in education

- IUL sales: How to overcome ‘it’s too complicated’

More Life Insurance News