FRDs: The money must go somewhere

Over the past several years, record-breaking fixed-rate deferred annuity sales have been driven by elevated interest rates and the fact that they offer much more yield than money markets and low certificate of deposit rates do. FRDs’ rate appeal — along with complete protection of principal — means clients can rest easy knowing that no matter the market volatility, their principal is protected and they will be guaranteed to have more money in their FRD contract tomorrow than they do today.

From the onset of the pandemic (and in years prior), most FRDs were sold in shorter-term durations — generally three- and five-year contracts, which is another selling point for them. Many of those clients may now be approaching the end of their contracts and need to decide what to do next.

From the end of 2020 through the first half of 2024, well over a quarter of a trillion nonqualified FRDs were sold. Since an annuity contract holder under the age of 59½ will pay a 10% penalty if they surrender the contract and take constructive receipt of the asset, many may renew with the existing product or exchange or transfer to another carrier, potentially with lower credit rates due to forecasted rate cuts. Many of these clients will also lose tax deferral if they move to a CD or money market. This makes FRDs and other annuity product lines reasonably attractive going forward.

Many of the different annuity product lines offer income riders such as guaranteed living withdrawal benefits, which can provide lifetime income. Some can be added on, while others are imbedded. Fixed indexed annuities and traditional variable annuities also offer guaranteed minimum income benefit, and registered index-linked annuities as well as FRDs all offer these riders or variations. There are also more traditional income products, including single premium immediate annuities and deferred income annuities. With so many options available, financial professionals might want to talk with a wholesaler to determine which is best for their clients and prospects.

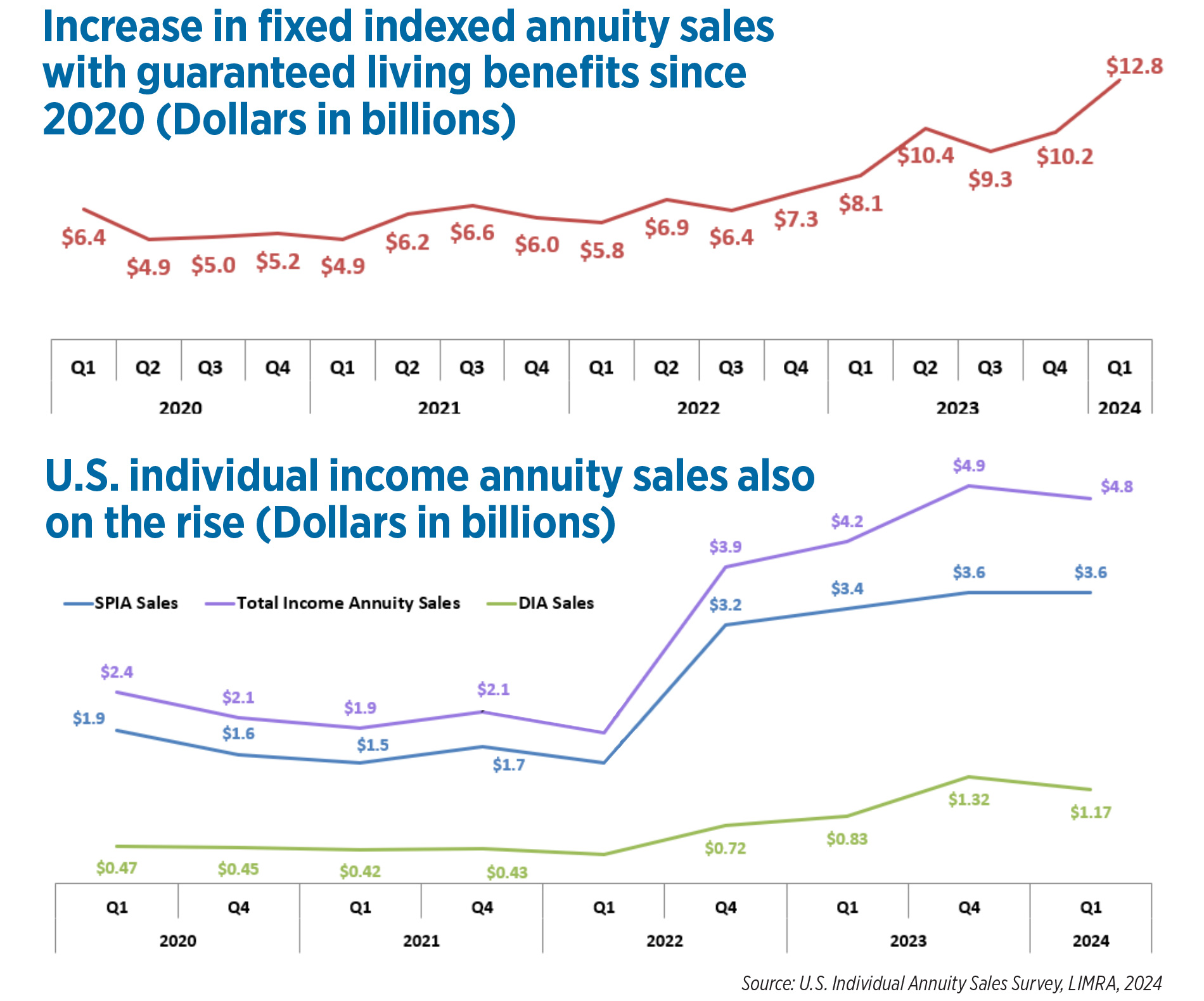

LIMRA data shows that in the first quarter of 2024, FIA income product sales increased 25% over the prior quarter and 58% year over year. Since the onset of the pandemic in the second quarter of 2020, FIA sales have increased a staggering 161%.

Although total income product sales decreased slightly in the second quarter of 2024, they have been on an upward trajectory since the pandemic; SPIAs are up 157%, and DIAs are up 234%, no doubt driven by elevated payout rates and the changing U.S. demographics.

Traditional VA income sales also increased, from $4.5 billion in the fourth quarter of 2023 to $5.1 billion in the first quarter of 2024, more than a 13% sequential increase. Historically, they’ve been the top annuity seller in the income space by far; for perspective, they sold $25.3 billion in the first quarter of 2011.

While short-term FRD annuity products have been an excellent place — and still may be — for some clients to “sit and wait things out,” other consumers may now have guaranteed income needs. Given the decline in employers offering pensions, many people nearing or entering retirement may need the peace of mind that comes with not running out of money before running out of life. Although an annuity is not a pension, it can help generate guaranteed income.

Given the aging U.S. population and the ability of annuities to provide clients with financial security in retirement, it might be time for financial professionals to start discussing these products in greater detail with their clients.

Roger Aucoin is senior research analyst, member benefits with LIMRA. Contact him at [email protected].

Transferring generational wealth involves more than financial assets

Creating the Preeminent Partnership — With Simplicity’s Bruce Donaldson

Advisor News

- Private equity, crypto and the risks retirees can’t ignore

- Will Trump accounts lead to a financial boon? Experts differ on impact

- Helping clients up the impact of their charitable giving with a DAF

- 3 tax planning strategies under One Big Beautiful Bill

- Gen X’s retirement readiness is threatened

More Advisor NewsAnnuity News

- LTC annuities and minimizing opportunity cost

- Venerable Announces Head of Flow Reinsurance

- 3 tax planning strategies under One Big Beautiful Bill

- MetLife Completes $10 Billion Variable Annuity Risk Transfer Transaction

- Gen X’s retirement readiness is threatened

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- On the Move: Dec. 4, 2025

- Judge approves PHL Variable plan; could reduce benefits by up to $4.1B

- Seritage Growth Properties Makes $20 Million Loan Prepayment

- AM Best Revises Outlooks to Negative for Kansas City Life Insurance Company; Downgrades Credit Ratings of Grange Life Insurance Company; Revises Issuer Credit Rating Outlook to Negative for Old American Insurance Company

- AM Best Affirms Credit Ratings of Bao Minh Insurance Corporation

More Life Insurance News