The Medicaid SPIA: Helping Clients Alleviate LTC Costs

Retirees continue to have significant concerns about outliving their income. This is especially true if expensive long-term care issues come into the picture.

Most Americans who reach age 65 will need long-term care at some point in their lives, according to the U.S. Department of Health and Human Services. Most advisors are aware that the costs of care in a nursing home can be financially devastating to a client in a matter of months. However, clients may not know they have additional options besides using their savings to cover this long-term care in a time of need.

Advisors can help educate clients about a Medicaid SPIA, or a single premium immediate annuity, which can help alleviate the unpredictable and often high costs associated with long-term medical care. Most clients don’t know that a Medicaid SPIA exists — let alone the steps they should take when considering one.

Advisors have an opportunity to help clients find solutions for financial stability through sharing information about specialized options, like a Medicaid SPIA. Whether for a client or their spouse, there are a few considerations clients should know when considering a Medicaid SPIA in a time of need.

A Medicaid SPIA should be on the table as an option for most clients. The clients who would benefit most from a Medicaid SPIA include a broad range of people. I have seen this immediate annuity help those in the low-to-moderate-income range. Those who could benefit from a Medicaid SPIA make up about 80% of the general population. Knowing this can make it easier for advisors to identify the clients who should be educated about and who should consider a Medicaid SPIA to meet their needs.

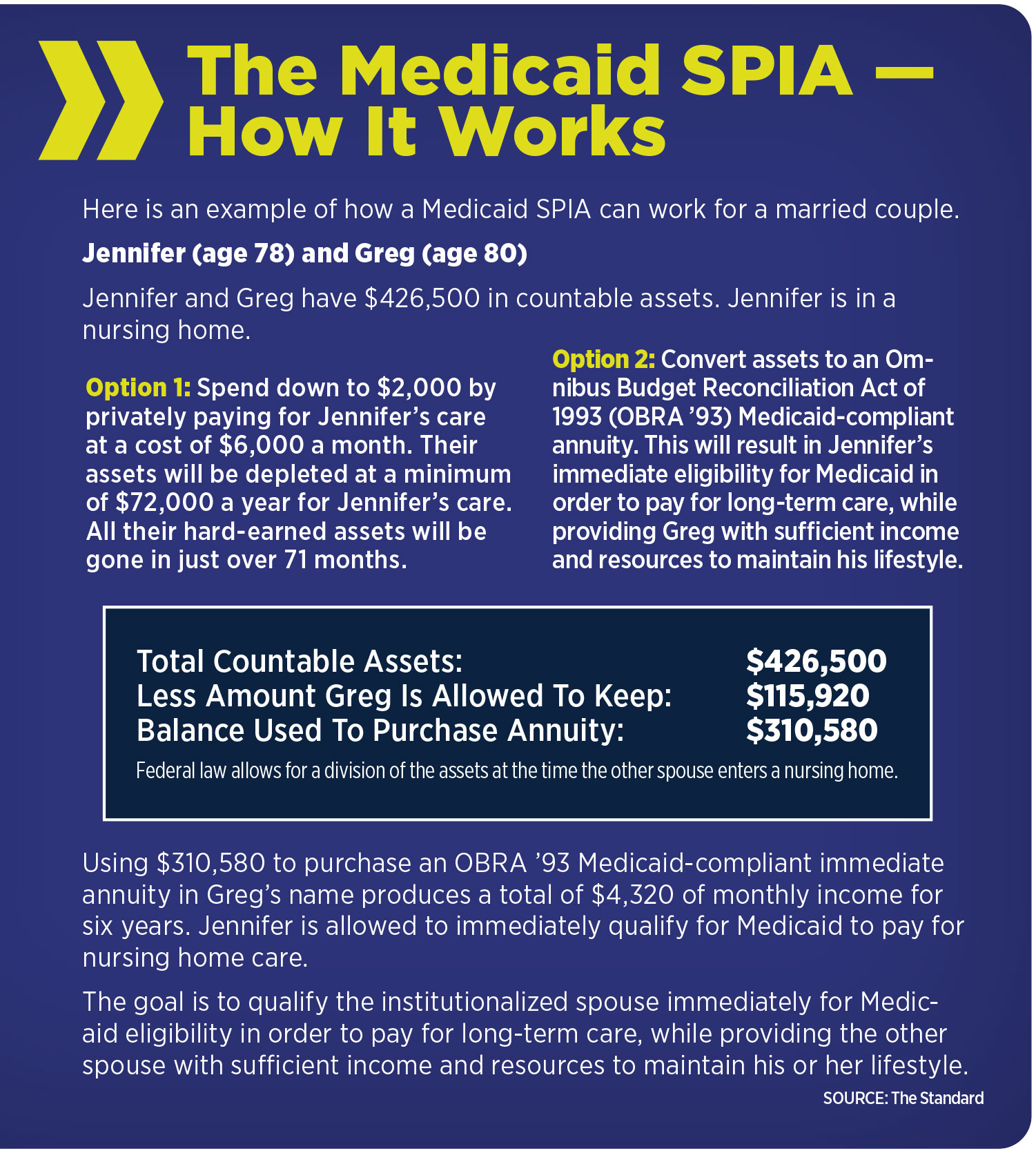

Know the basics of a Medicaid SPIA. Although regulations vary from state to state, assets placed within a Medicaid-compliant immediate annuity are considered income. Medicaid-compliant annuities can be used in Medicaid planning for single individuals, though they are more commonly used with couples.

For married couples, immediate annuities such as a Medicaid SPIA can help an ill spouse qualify for Medicaid to pay for long-term care. This immediate annuity pays the principal back to the healthy spouse in incremental payments over a set period of time, allowing the ill spouse to have quality medical care coverage without impoverishing the healthy spouse.

A Medicaid SPIA is a helpful solution for a situation that could have put the healthy spouse at risk of financial hardship, even devastation, to pay for the medical care of their loved one. The ill spouse receives the care they need, and the healthy spouse continues to have enough income to maintain their lifestyle.

Clients should consult an elder law attorney. Regulations for a Medicaid SPIA vary from state to state. It’s essential that clients understand the laws and regulations for a Medicaid SPIA in their individual state before they move forward with this type of solution.

Advisors should encourage clients to seek out a local elder law attorney. The elder law attorney can provide state-specific expertise and a thorough understanding of the individual regulations for the state in which the client resides.

An elder law attorney can also ease clients’ minds and answer any questions about moving their countable assets into a properly designed immediate annuity. Suggesting clients consult an elder law attorney to understand the product better and protect themselves in this situation also provides an opportunity for advisors to build deeper trust with their clients.

Planning and preparation are crucial for a Medicaid SPIA. There may be financial decisions that clients need to make before purchasing the Medicaid SPIA. For example, clients may want to take care of any lingering financial obligations for any needs before moving the bulk of their countable assets into the immediate annuity. This can be very beneficial if the healthy spouse is in need of a vehicle or home repairs or if there is something costly they anticipate could happen while their assets are in the immediate annuity. Elder law attorneys also can help with this planning process along with the advisor.

Advisors can grow their business by supporting the needs of adult children. Advisors can open the door to a productive conversation about a Medicaid SPIA by discussing it with clients who may have older parents. This provides these adult children with valuable information they could bring to their parents, as many adult children assist their parents with financial matters.

On the other side of the coin, clients who are looking for options to keep their own financial stability while covering the cost of long-term care often have adult children. These adult children should be aware of a Medicaid SPIA and the benefits, should they be in a similar situation someday. This is another opportunity for advisors to build trust and better support their clients, and perhaps assist multiple generations from the same family.

Working with a quality carrier is encouraged. It’s important for clients to know that only a limited number of carriers offer a Medicaid SPIA. Ensuring that the carrier is reputable and established in the annuities space should be a set standard for clients in these circumstances.

The decisions surrounding the long-term medical care of a loved one are some of the most difficult that clients will ever have to make. People shouldn’t be deterred by the often-high cost of long-term medical care. They also shouldn’t be financially devastated by having to pay for that care for their spouse.

Advisors can better support both their clients and their clients’ adult children by opening the door to conversations around long-term care. Keeping clients informed and educated about specialized solutions, like a Medicaid SPIA, allows them to make the best possible decisions about their futures.

Mark MacGillivray is director of financial institutions, annuities, at The Standard. Mark may be contacted at [email protected].

COVID-19 May Prompt More People to Buy Life Insurance

How Split-Dollar Life Insurance Rescues Nonprofits

Advisor News

- Prudential study: Babies born today will likely need nearly $2M to retire

- Economy performing better than expected, Morningstar says

- Advisors have more optimism post-election

- How to get people to share personal information

- Trump pick for Treasury: extending tax cuts the ‘most important’ issue

More Advisor NewsAnnuity News

- Allianz Life Retirement Solutions Now Available Through Morgan Stanley

- Midland Advisory Focused on Growing Registered Investment Advisor Channel Presence

- Delaware Life Announces Suite of Innovative Fixed Index Annuities

- Allianz Life moves to strengthen annuity operations with own reinsurer

- Global Atlantic Announces New Registered Index-Linked Annuity

More Annuity NewsHealth/Employee Benefits News

- Study Findings from University of Pennsylvania Broaden Understanding of Geriatrics and Gerontology (The Role of Managed Care in Home- And Community-based Services Spending): Aging Research – Geriatrics and Gerontology

- Reports Outline Managed Care and Specialty Pharmacy Study Findings from University of Chicago (Evaluating the Burden of Illness of Metabolic Dysfunction-associated Steatohepatitis In a Large Managed Care Population: the Ethereal Study): Drugs and Therapies – Managed Care and Specialty Pharmacy

- Research from University of Pittsburgh Has Provided New Data on Geriatrics and Gerontology (The Effect of Medicaid Managed Long-term Services And Support on Participant Quality of Life And Unmet Need): Aging Research – Geriatrics and Gerontology

- East Carolina University Researcher Adds New Findings in the Area of Geriatrics and Gerontology (History of Health Insurance Coverage Gaps And Health Care Use After Gaining Age-based Medicare Coverage): Aging Research – Geriatrics and Gerontology

- Findings from University of Maryland Broaden Understanding of Insurance (Health Insurance and Part-time Employment: the Influence of the Affordable Care Act): Insurance

More Health/Employee Benefits NewsLife Insurance News

- Allianz Life Retirement Solutions Now Available Through Morgan Stanley

- Lincoln Financial Expands Life Insurance Portfolio With Launch of Two New Variable Universal Life Products

- AM Best Affirms Credit Ratings of Prudential Financial, Inc. and Its Life/Health Subsidiaries

- Symetra reaches $32.5 million settlement over cost-of-insurance charges

- Registration Statement – Specified Transactions (Form S-3)

More Life Insurance News