The Fighter — With Birny Birnbaum

David 'Birny' Birnbaum is annoyed.

He’s not angry or emotional and certainly not losing his cool, but the veteran consumer advocate is definitely annoyed with how this particular conference call on insurance disclosures is going.

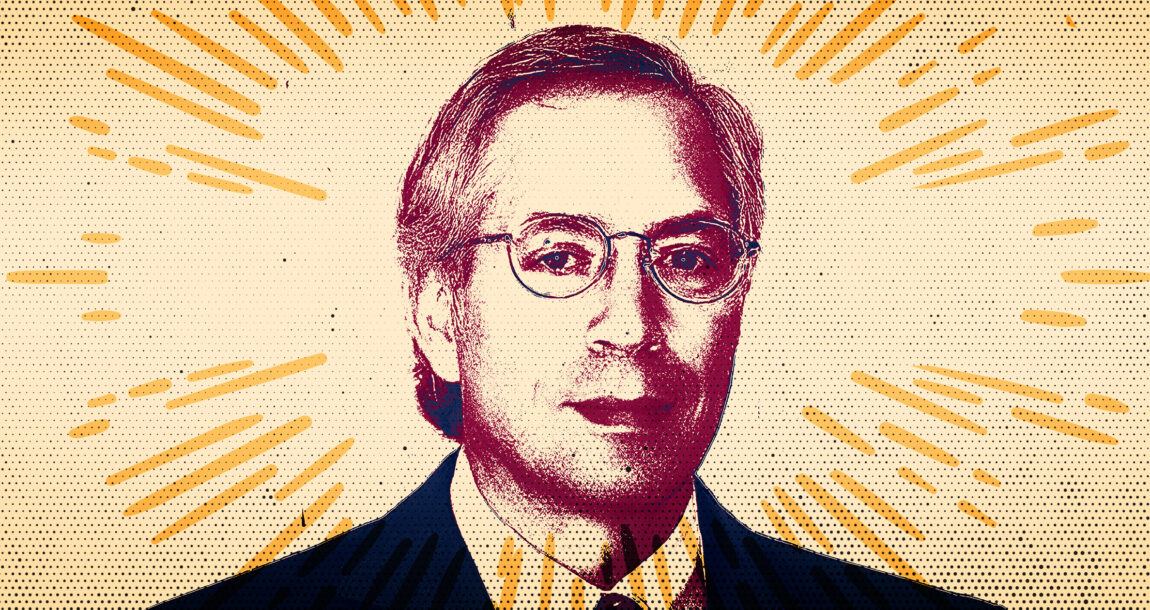

An executive with the American Council of Life Insurers is taking a combative stance on issues raised by the Center for Economic Justice, the organization Birnbaum heads. The bespectacled, amiable Birnbaum, known to all as “Birny,” responds with an uncharacteristically edgy tone.

“We appreciate the vigor in which ACLI is presenting its views,” he says calmly. “Unfortunately, in this instance, it’s incorrect on the points that it brings forth.”

A quick vote is taken on an ACLI proposal to combine two disclosure documents and it is shot down. Birnbaum’s position carries the call.

It’s a win for Birnbaum — a small win, but a win nonetheless. Twenty years ago, Birnbaum left the regulator side of insurance to fight for consumers. He takes wins wherever he can find them. Birnbaum lives in Maine, but he is on the road “more than half of the time.”

Much of the remaining time is spent on conference calls and in meetings. The 66-year-old is a ubiquitous presence at National Association of Insurance Commissioners gatherings, always in a plain business suit, round tortoise shell glasses and tousled hair that has long gone gray.

He stands out amid industry executives and regulators in better suits with the polish of financial world success. By contrast, Birnbaum keeps time with a simple Timex wristwatch and prefers a backpack to a briefcase.

“The way I look at it is that one of me requires several dozen of industry representatives to balance the scales,” he quipped.

Consumer advocates are not foreign to the insurance world. There are many different folks representing consumers in health insurance regulatory meetings, for example.

But when it comes to issues such as life insurance illustrations and disclosures, Birnbaum is often the only consumer advocate working the room. And he is a formidable foe, said D.J. Powers, a former colleague at the Texas Department of Insurance where Birnbaum was an NAIC liaison.

“It’s a combination of unbelievable passion and unbelievable intelligence,” said Powers, now an attorney in Austin. “He’s smarter than anyone else in the room and I’ve never seen anyone with the passion for consumers that Birny has. This is a guy who has devoted his whole life to consumers and gave up what would have been a very lucrative career for it.”

‘A Miraculous Thing’

Incorporated in 1996, the Center for Economic Justice represents consumers “as a class on economic justice issues, primarily the availability, affordability and accessibility of insurance, credit and utilities.” It is funded via individual donations and foundation grants.

Birnbaum essentially is the center, answering to a board of directors. He is passionate about title and credit insurance, availability and affordability, and life insurance disclosures and annuity sales methods. Sometimes that passion results in strong words, but never in a raised voice.

“What you’re doing is providing a liability shield to insurers’ misleading practices,” he admonished regulators during a July call on index illustration rules. “Why in the world would you want to do something like that?”

Idaho Insurance Commissioner Dean Cameron is philosophically 180 degrees from Birnbaum when it comes to many insurance regulatory issues. A former insurance agent, Cameron often speaks wistfully of small-town agents helping clients and being hampered by rules.

Yet he admires Birnbaum’s approach to his role.

“Birny is a fearless advocate for consumers. He is undaunted by the volume or the credentials of his opponents and is perfectly confident to be the lone voice on any issue,” Cameron said. “He conducts himself with respectful professionalism. Even when I have disagreed with Birny, I have found my positions are better when I consider his perspective.”

To those he tangles with, Birnbaum can appear to be an opponent of insurance products. But that is far from the case.

“Insurance is really sort of a miraculous thing,” he said. “When you look at it as an institution and a set of products, it’s really hard to find institutions or products that are more important to the consumers and individuals leading happy and successful lives and sustaining our planet.”

Switching Sides

Birnbaum has a master of science in management and a master of city planning from the Massachusetts Institute of Technology. His career took off when he was named chief economist at the newly created Office of Public Insurance Council under progressive Texas Gov. Ann Richards in 1991.

Birnbaum and Powers were among staffers who represented consumers before the state board of insurance. For the young, idealistic Birnbaum, it was a couple of years filled with tremendous change in insurance regulation.

“We were really active,” Birnbaum recalled. “There were new things going on in terms of auto and homeowner’s insurance ratemaking (and) title and credit insurance ratemaking. OPIC participated in a number of rulemaking proceedings and industrywide rate proceedings, and I was one of the expert witnesses, often the only expert witness.”

In late 1993, Birnbaum joined the reorganized and renamed Texas Department of Insurance as chief economist and associate commissioner for policy and research. Birnbaum advised the commissioner on insurance issues.

After three years, he joined CEJ and returned to representing consumers. At the time, the NAIC had just created the consumer participation program to foster consumer involvement by providing financial assistance to groups that needed it. CEJ receives reimbursement for travel and other expenses. In addition, fees are normally waived for meetings and calls, and NAIC publications and data are provided for free.

Birnbaum served as the NAIC coordinator for the Texas Department of Insurance, which gave him an intimate familiarity with the inner workings of the organization.

“Over the years, I’ve worked on pretty much every type of issue that’s come up,” Birnbaum said. “In the ’90s, we worked on small face life insurance, genetic testing and credit scoring. In the aftermath of the financial crisis, we were involved in changes to accounting and reserve practices for life insurers. I’ve been active on availability and affordability issues from the get-go, particularly on risk classifications.”

Birnbaum took a two-year break in 2008, focusing on national/federal issues, particularly force-placed insurance and the development of the Consumer Financial Protection Bureau.

He has been back as an NAIC consumer advocate for the past decade. At times, Birnbaum conceded, he is significantly outnumbered and out-resourced in these policy discussions.

“I don’t have nearly the success in getting consumer-friendly outcomes as I’d like,” he said. “I think that regulators sort of listen to what I say, but the fact of the matter is that the insurance industry just has a lot more influence. And that influence comes from a lot of places.”

The Insurance Economy

For many parts of the country, insurance is an economic development tool, Birnbaum explained. Many annuity sellers are headquartered in Des Moines, Iowa, for example. Vermont is home to the captive insurance industry, with the state even creating a website to showcase its more than 1,100 licensed captive agencies.

“Given that, there’s lots of scrutiny by the governor and others on what the insurance commissioner will do” in a given state, Birnbaum said.

These days, Birnbaum is heavily involved in annuity sales and disclosure regulations being debated by several NAIC panels.

He is participating in the Annuity Suitability Working Group’s effort to create an annuity sales model law. He is engaged with the Life Insurance Illustration Issues working group on its efforts to create a “policy overview” to accompany life insurance sales. And he is vocal with the Annuity Disclosure Working Group’s effort to regulate indexed annuity illustrations.

Birnbaum is on the short end more often than not.

“Some days I take it in stride and other days, I give back as good as I get,” he said. “There are some times when I get really frustrated because stuff seems really obvious to me and it becomes hard for me to understand why regulators will side with industry on an issue that affects consumers.”

But whatever the deficiencies the state insurance regulatory system has, Birnbaum remains supportive of it — to a point.

“One of the strengths of the organization is that you get perspectives from every part of the country, from small states to large states,” he said. “We’ve got a big country and a lot of different viewpoints on stuff.

“Getting people to a consensus or a majority agreement takes some time. Sometimes it involves some compromise where you have to give up what you think is the best approach to improve what the current situation is.”

He would like to see more states combine insurance and securities regulation under one roof. New York has done that with its Department of Financial Services. Federal oversight of insurer solvency is another idea worth exploring, Birnbaum added.

‘Issues Are Too Important’

Birnbaum’s big goals are numerous. He wants to improve the delivery of clear and factual information from insurers to consumers. He sees plenty of work to be done in the areas of risk classifications and insurers’ use of big data. And his passion remains with insurance affordability and availability issues.

“There are some real failures on the part of state insurance regulation,” Birnbaum said. “Most notably, in the areas of credit-related insurance, private mortgage insurance, title insurance, consumer credit insurance and workplace insurance.”

Birnbaum has no plans to slow down. His daughter is grown and his son was killed in a 2012 car accident. There’s “nobody else” working on the issues he works on, Birnbaum noted.

“I’ll keep doing it until either all the battles are won or I get out, one or the other,” he said. “The issues are too important to be ignored.”

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

5-minute Finance: The Right Way To Ask For Referrals

Sen. Warren Releases Plan To Pay For ‘Medicare For All’

Advisor News

- Regulator group aims for reinsurance asset testing guideline by June

- Bessent confirmed as Treasury secretary

Former hedge fund guru to oversee Trump's tax cuts, deregulation and trade changes

- Jackson National study: vast underestimate of health care, LTC costs for retirement

- EDITORIAL: Home insurance, tax increases harm county’s housing options

- Nationwide Financial Services President John Carter to retire at year end

More Advisor NewsAnnuity News

Health/Employee Benefits News

- Many died in sober living homes due to fumbled fraud response

- Let's talk about Long Term Care insurance

- Many died in sober living homes as Arizona officials fumbled Medicaid fraud response

- Peter Daniel: Government mandates are driving up healthcare costs in NC

- NC bill would limit insurers' prior authorizations

More Health/Employee Benefits NewsLife Insurance News

- Legals for January, 31 2025

- Automatic Shelf Registration Statement (Form S-3ASR)

- Best’s Special Report: Impairments in US Life/Health Insurance Industry Jump to 10 in 2023

- AM Best Maintains Under Review With Developing Implications Status for Credit Ratings of Solidarity Bahrain B.S.C.

- AM Best Maintains Under Review With Developing Implications Status for Credit Ratings of First Insurance Company

More Life Insurance News