The Fateful Date

For young Stephen Kagawa, the date meant a chance to have a nice dinner with a lady and who knows where things might lead?

That the evening changed his life is not the surprising part. That it matched him to a lifelong love for life insurance and financial planning is.

Stephen was attending the University of Southern California at the time but coming no closer to choosing his life’s work — that’s when his father, Siegfried Kagawa, finally stepped in.

Known as “Sig,” he set Stephen up with a paid internship with Transamerica’s home office in Los Angeles. His life-changing client invited Stephen to her home for dinner. The date didn’t pan out romantically, but it gave Stephen a new perspective on the power of life insurance.

She told him about her late husband, a stubborn man who refused to pay an extortion demand for “protection” of their garment district business. In the months prior to that conflict, the couple were visited by an insurance agent trying to sell them a policy. He was for it, but she was opposed.

Every night for a week, the couple argued about life insurance. The woman eventually conceded and they purchased a family policy. Her husband was later shot and killed.

“She said, ‘Stephen, my life insurance saved my life and those very people that came to push the sale on us are now the heroes in my life,’” Kagawa said. “I ran out and got my license right away. Because all I could think about is what would happen if she died?”

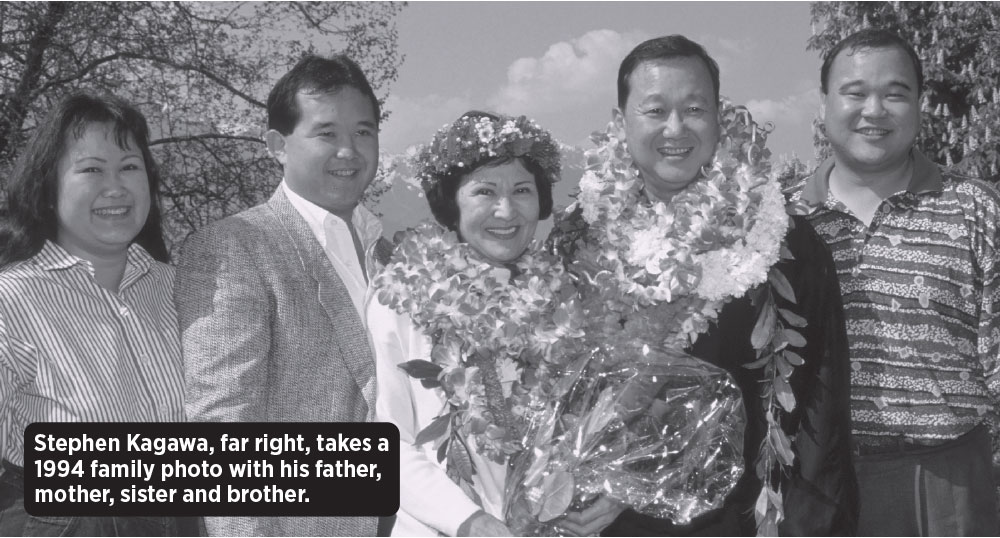

That was more than 35 years ago. Today, Stephen Kagawa sits atop a thriving financial and charitable network that starts with his Pacific Bridge Companies. He was recently named the 2020 Diversity Champion by the National Association of Insurance and Financial Advisors.

“In addition to serving the needs of his first-generation immigrant clients, Stephen mentors a diverse group of younger professionals and advises several insurance companies seeking to improve their reach into ethnic markets,” said Cammie Scott, NAIFA president.

Homeroom With Obama

By his own admission, Kagawa was a “spoiled kid” who grew up in Hawaii in a well-to-do family. The source of the family’s good fortune came from the life insurance business.

His father nourished a flourishing Transamerica satellite life insurance business on the island. His grandfather, Lawrence Kagawa, began the business but was forced into an internment camp during World War II.

Young Stephen was unaware of this family history until he was a young adult.

“Actually, I read that my family was in the insurance business in the papers. I was astonished that we were selling life insurance,” he recalled. “Everything I had heard about life insurance was not good. And I vowed to myself that I’d never get in that business.”

Hawaiian culture stresses strong family bonds and a rugged individualism. The Kagawa elders gave Stephen plenty of space to find his own way, and his journey included an important stop at the famed private Punahou School in Honolulu. His time there during the late 1970s coincided with the future 44th president, Barack Obama.

“He was a super nice guy,” Kagawa said. “He was like a gentle giant.”

As Kagawa matured, he realized his family’s Japanese heritage was not always welcomed on Hawaiian shores. Following the attack on Pearl Harbor and the U.S. entry into World War II, President Franklin D. Roosevelt made the controversial decision to order the internment of Japanese Americans.

Lawrence Kagawa, who started Occidental Underwriters of Hawaii in 1933, and his family were among the 800 Japanese Americans from Hawaii who were sent to camps. Most lost everything they owned, but Transamerica stood by Kagawa and he returned to the business following the war.

Stephen Kagawa was out of college before he heard the full story of his grandparents’ wartime detention. Sig and Stephen would become dogged supporters of Japanese American history preservation. In the mid-1980s, Sig was instrumental in securing funding for the Japanese American National Museum in Los Angeles.

“If I don’t even know what happened to the very community that I come from, my own family, how in the world would other people know?” Stephen said. “And if we don’t know, what if we did it again to ourselves? I mean we looked upon our own fellow citizens as enemy aliens, calling them ‘non-citizens.’”

Stepping Out

Once he embraced life insurance and how it can help protect families, Kagawa was on his way. After graduating from USC, he returned to Hawaii and worked for five years at the family business, Occidental Underwriters.

In 1992, Kagawa moved to Los Angeles to help expand his family’s business on the West Coast. Later, he spun off and created what is now known as The Pacific Bridge Companies. The wealth management venture grew rapidly with a unique international reach into Asia. As the years went by, Kagawa built a mini-empire of financial advisors and specialists in banking, insurance, investments, tax and law. The Pacific Bridge umbrella encompasses several companies to provide full planning services across the two continents.

Headquartered in Monrovia, Calif., Pacific Bridge has offices in Honolulu, Tokyo and Hong Kong. The idea is to provide a comprehensive financial advisory framework for cross-nationals, and it is an idea that Kagawa hit on at the right time.

Migration from Asia to the United States rose dramatically with passage of the 1965 Immigration and Nationality Act, which removed national-origin quotas established in 1921 barring immigration from Asian and Arab countries and sharply limiting arrivals from Africa and eastern and southern Europe.

The number of Asian immigrants grew from 491,000 in 1960 to about 12.8 million in 2014, representing a 2,597% increase. In 1960, Asians represented 5% of the U.S. foreign-born population; by 2014, their share grew to 30% of the nation’s 42.4 million immigrants, according to the Migration Policy Institute.

Looking forward, Pew Research Center projects that Asian Americans will become the largest immigrant group in the country, surpassing Hispanics in 2055.

“One of the missions that we’ve been on for about 15, 20 years now is how can we fill gaps,” Kagawa explained. “Are there things from one country that we could bring into another country?

“At the same time, we learned about the differences in all these regulations and the opportunities that came about because of that. In order for us to navigate that, we realized we needed a lot of different companies, because of the different regulations — because of the things that we need to do to do it right.”

A typical Pacific Bridge client is a high net worth entrepreneur, or couple, who want to divest assets, transfer wealth or set up a philanthropic plan. Normal stuff, with a twist. Many have U.S. business interests or American partners. Some are Asian residents aiming to retire in the United States, where they have children and grandchildren.

It can add up to a complex web of legal, financial and tax implications. Pacific Bridge will often produce multilayered plans that utilize life insurance, trusts, buy-sell agreements and other tools to achieve the desired results.

“We’re not providing solutions to problems,” said Kagawa, who lost his wife to cancer five years ago. “We’re providing alternative paths to get to life fulfilled, wherever you might be around the world.”

Making Connections

After that early dinner date, Kagawa made a lot of pitches to single mothers. His passion for the products and the protection hardly seemed like selling at all, he said. The size of his first commission check came as a surprise, Kagawa said.

“I couldn’t believe it,” he recalled. “My mind was blown. I said, ‘Wait a second. All I’ve got to think about is helping people? And if I just care about that and do the right thing, that I might get paid well?’”

It became the right career choice for the right person. A gregarious man with an easy laugh, Kagawa devotes a lot of Pacific Bridge and personal resources to the many people with modest means.

He serves as the chair of the Circle of Ambassadors with the Go For Broke National Education Center, sharing stories across the United States and around the globe of World War II American soldiers of Japanese American descent. He is a trustee of the Japanese American National Museum, as well as a member of the inaugural board of directors and current council leader for the U.S.-Japan Council, founded in 2009 to strengthen U.S.-Japan relations via a range of cultural and networking initiatives.

“Throughout the time I have known Stephen, I have developed a profound respect and admiration for his dedication to his community, his belief in the core principal that everyone should be treated equally, and his tireless passion and dedication to innovation in the industry,” said Michael J. Gordon, group chief operating officer and U.S. chief executive with Lombard International.

With more than 35 years in the business, Kagawa moves into the final chapter of his career with firm goals. He gave up the president title in February 2017, but remains chairman of the board and CEO of Pacific Bridge Companies.

He has seen plenty of change in the business and hopes to see more.

“I think that we have a long way to go to rectify that salesman attitude and really focus in on the other person and what’s important to them, and their realities in their life,” Kagawa said. “Sometimes the reality is they come from a different world. … They need help and they need a different kind of help.”

2020’s Health And Financial Challenges Likely To Linger

How To Stand Out And Grow

Advisor News

- Americans increasingly worried about new tariffs, worsening inflation

- As tariffs roil market, separate ‘signal from the noise’

- Investors worried about outliving assets

- Essential insights a financial advisor needs to grow their practice

- Goldman Sachs survey identifies top threats to insurer investments

More Advisor NewsAnnuity News

- AM Best Comments on the Credit Ratings of Talcott Financial Group Ltd.’s Subsidiaries Following Announced Reinsurance Transaction With Japan Post Insurance Co., Ltd.

- Globe Life Inc. (NYSE: GL) is a Stock Spotlight on 4/1

- Sammons Financial Group “Goes Digital” in Annuity Transfers

- Somerset Reinsurance Announces the Appointment of Danish Iqbal as CEO

- Majesco Announces Participation in LIMRA 2025: Showcasing Cutting-Edge Innovations in Insurance Technology

More Annuity NewsHealth/Employee Benefits News

- Thousands of Missouri construction workers with Anthem health insurance left scrambling

- Don't let death penalty turn Luigi Mangione into a martyr

- More than 5M could lose Medicaid coverage if feds impose work requirements

- Don't make Mangione a martyr

- Boston Herald: Don’t make Luigi Mangione a martyr

More Health/Employee Benefits NewsLife Insurance News

- 2024 ModeSlavery Report (bpcc modeslavery report 2024 en final)

- Exemption Application under Investment Company Act (Form 40-APP/A)

- Annual Report 2024

- Revised Proxy Soliciting Materials (Form DEFR14A)

- Proxy Statement (Form DEF 14A)

More Life Insurance News