2020’s Health And Financial Challenges Likely To Linger

After an unpredictable 2020 and with a COVID-19 vaccine in the early stages of distribution, optimism and fresh starts are the sentiments ringing true right now.

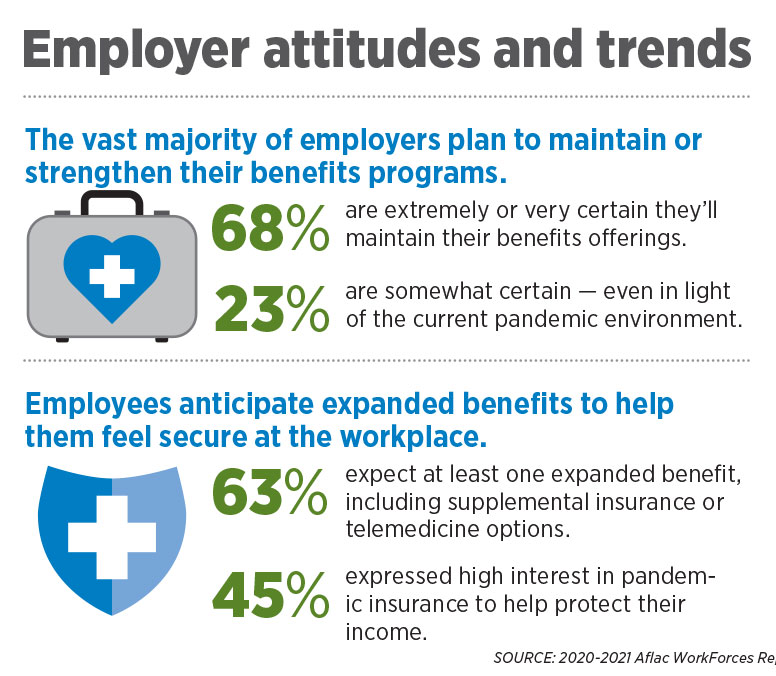

However, the health and financial challenges of 2020 will likely linger for some time. In fact, the 2020-2021 Aflac WorkForces Report found that 67% of U.S. employees experienced at least a minor financial impact because of COVID-19.

Given the importance of every dollar during this time, brokers and agents can work with human resource managers to ensure all aspects of policies are discussed — from wellness claims to insurance riders. This ensures HR managers have the knowledge and resources to advise employees on how to best use their benefits. Together, agents and brokers can support workforces by highlighting the following:

1. Provide additional support

Even after COVID-19 dissipates, the pandemic will undoubtedly have a lasting effect in the years and even decades ahead. In addition to the chronic health issues that some will face, anxiety surrounding financial security has only grown with COVID-19.

According to the Aflac WorkForces Report, high medical costs or bills adversely affected more than half of the U.S. workforce, and there is growing concern about covering health care costs.

Nearly 1 in 4 employees said they or an immediate family member experienced a serious health event or accident requiring hospitalization. These health care costs caught nearly all of these individuals or families off guard. In fact, 92% said at least one health care cost related to the event surprised them.

One way to help offset the anxiety of health care costs is by offering supplemental insurance plans. Even though most HR managers are familiar with how these policies work, many clients might be surprised to learn that supplemental insurance helps with more than just the basics.

For example, some critical illness policies go beyond offering benefits for heart attacks, with some paying a cash benefit for covered illnesses such as Lyme disease or bacterial meningitis.

Hospital indemnity insurance plans often include benefits that help cover prescription drug costs, and can even help cover the cost of a newborn’s routine doctor’s appointments.

Additionally, some supplemental insurance policies include a wellness benefit that pays cash for covered health exams or procedures, such as annual physical, dental or eye exam, mammogram, prostate screening, and more. Insureds can use this benefit even when their health insurance covers it, meaning more money in their pocket.

New riders may be added to supplemental plans, providing an additional layer of financial protection from out-of-pocket expenses that can result from an unexpected critical health event such as COVID-19.

Offering supplemental insurance is one way clients can demonstrate to their employees that they care about their health and financial well-being.

In addition, research shows it can be an effective retention tool. Among organizations offering supplemental insurance, 50% reported that it helped with employee recruitment and 60% reported that it helped with employee retention.

2. Embrace total well-being

Between social distancing orders, economic volatility and the constant news cycle, 2020 took an emotional toll on many Americans. Consequently, companies are looking to add benefits that help address not just employees’ physical health but also their emotional and mental health.

Employee assistance programs, commonly known as EAPs, provide short-term support from work-life specialists who can help resolve personal problems affecting employees’ performance at work. These specialists are trained to assist with a range of issues, including substance abuse, work-life balance, and child care or relationship difficulties.

Another valuable benefits offering is a health advocacy program that provides a personal health care concierge who can assist with numerous tasks, such as explaining a diagnosis, clarifying health care coverage, addressing claim denials, obtaining second opinions, negotiating bills, and finding doctors and treatment centers.

Wellness programs continue to grow in popularity, helping develop and nurture healthier lifestyles through digital workshops, discounts, meal planning, and stipends for gym memberships and online fitness classes. Other benefits such as pet insurance and financial and legal advisory services can help improve clients’ offerings and help provide their employees with comprehensive financial protection and peace of mind should they face a health issue.

3. Launch virtual care offerings

Over the past year, use of telehealth services has surged because it provides easy access to remote consultation and immediate care.

A recent Amwell survey found that the number of consumers who reported having a virtual visit jumped from 8% in 2019 to 22% in 2020. More than half of all consumers said they expect to use telehealth more often following COVID-19 than they did before the pandemic, while 92% of providers said they expect to continue video visits after it is considered safe to see patients in person.

As a result, 53% of large employers will offer more virtual care options in 2021, according to a Business Group on Health survey. Despite the shift to virtual care, health care costs continue to rise, so it will be important for brokers and agents to highlight how some supplemental insurance policies offer benefits that cover the cost of a telehealth visit.

Get ahead of the curve

By highlighting benefits trends that address the challenges and hardships carried over from 2020, brokers and agents can help clients support their workforce and establish greater trust and collaboration. Ringing in a new benefits package can also give everyone a reason to celebrate.

COVID-19 Forced Advisors To Adapt In The Midst Of Disruption

The Fateful Date

Advisor News

- TIAA, MIT Age Lab ask if investors are happy with financial advice

- Youth sports cause parents financial strain

- Americans fear running out of money more than death

- Caregiving affects ‘sandwich generation’s’ retirement plans

- Why financial consciousness is the key to long-term clarity

More Advisor NewsAnnuity News

Health/Employee Benefits News

- Expiring health insurance tax credits loom large in Pennsylvania

- Confusion muddies the debate over possible Medicaid cuts

- Trump protesters in Longview aim to protect Medicaid, democracy, due process

- Grant Cardone, Gary Brecka, settle dueling state lawsuits

- 9 in 10 put off health screenings and checkups

More Health/Employee Benefits NewsLife Insurance News

- ‘Really huge’ opportunity for life insurance sales if riddle can be solved

- Americans fear running out of money more than death

- NAIFA eyes tax reform, retirement issues in 2025

- Legislation would change tax treatment of life insurers’ debt investments

- Closing the life insurance coverage gap by investing in education

More Life Insurance News