The annuity puzzle is especially puzzling for older retirees

Buying an annuity, a product that provides income for life, offers increasing value as you age, as opposed to attempting to self-insure longevity risk. This is due to “mortality pooling,” a principle that leverages the increasing odds of death with age to provide larger payouts.

For example, when you reach age 65, the payout rate for a life-only immediate annuity is typically around 7.5% (as of Dec. 27, 2023, according to CANNEX). By age 80, this rate can increase to about 11.8%, an increase of about 58%. Despite these growing benefits as one ages, interest in annuities paradoxically tends to decrease with age.

If people fully grasped the benefits of risk pooling, we might expect their interest in annuities or similar products to rise with age. However, reality paints a different picture. Survey data, such as that from the 2017, 2019, 2021 and 2023 LIMRA Consumer Retirement Investors surveys, show that while about 60% of respondents in their 40s are interested in annuities, interest drops to around 20% for those in their 70s (Figure 1).

Despite the overall decline in interest as age increases, there has been a consistent uptick within each age group over time, with a notable rise in 2023. For example, only 30% of respondents ages 60-69 were interested in annuities in 2017 versus 41% in 2023. That’s definitely progress, and it suggests that the public is gradually recognizing the potential benefits of annuities.

Part of the increase in 2023 could likely have been attributed to stock market volatility and the notable rise in interest rates; however, the trend is still present (although less pronounced) if we focus on only 2017, 2019 and 2021. These survey results suggest that although interest in annuities is growing, a significant barrier remains among older investors, who theoretically would benefit most from these products.

One reason for this pattern could be a mismatch between how long people think they will live (their subjective estimates) and their actual life expectancy. Some might underestimate their lifespans, seeing less need for long-term income security. On the other hand, studies indicate that retirees often overestimate their longevity.

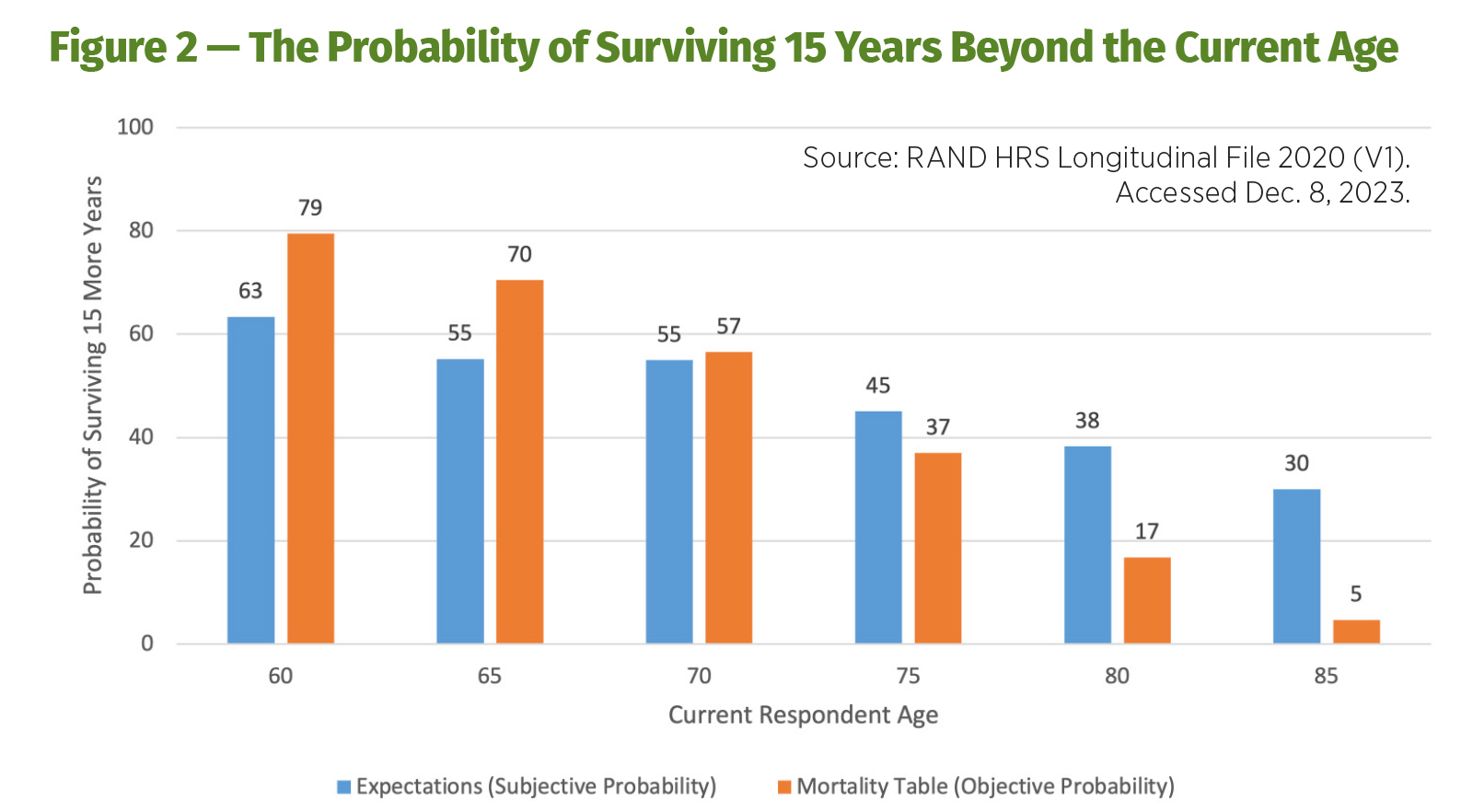

The Health and Retirement Study offers insight into this discrepancy by comparing individuals’ subjective longevity estimates with actual survival probabilities. Figure 2 compares respondents’ subjective estimates of living 15 more years (e.g., surviving to age 75 for someone who is currently 60 years old, and to age 85 for someone who is currently 70 years old) to the actual (objective) probabilities, using data from the latest Health & Retirement Survey wave (primarily conducted in the year 2020). Subjective estimates exceed objective reality for younger retirees, and this relationship flips at older ages.

This interplay between subjective and objective estimates would imply that younger retirees should be less interested in lifetime protection products, such as annuities, since they often underestimate their lifespan. Yet the reverse is true — annuity interest seems to decline, not rise, with age. This counterintuitive trend suggests that other factors, such as retirees already having sufficient income or certain psychological biases, may influence the decision-making process.

What could potentially explain the fact that people increasingly think they are going to live a long time as they age but become increasingly disinterested in annuities? One possible explanation for the lack of interest in annuities is that today’s retirees are already in fairly good shape in terms of lifetime guaranteed income sufficiency (e.g., they already have sufficient benefits). However, fewer and fewer future retirees are expected to enjoy this level of coverage.

Other decision-making tendencies and biases could be playing a role as well, such as loss aversion, temporal discounting and endowment effects, according to LIMRA’s 2020 report “Behavioral Finance and Retirement Income Preferences.” For people in their 40s and early 50s, the idea of converting some of their assets into lifetime-guaranteed income 20 to 30 years in the future is abstract and probably seems like a great idea (perhaps seen as a kind of “personal pension”). But when they actually reach retirement, annuitization becomes a much more real — and much more difficult — decision.

The relatively low level of annuity sales today, especially for those strategies focused on providing lifetime income, makes it clear that the “annuity puzzle” — the question of why more people don’t purchase annuities despite their benefits — persists. Although interest in annuities is increasing gradually, a significant gap remains, particularly among older retirees. This suggests a need for better education about the importance of incorporating longevity into retirement income strategies.

One potential path is emphasizing how annuitization, especially at older ages, is increasingly consistent with retirees’ own relatively optimistic forecasts around longevity. In other words, providing context on how annuities complement investors’ longevity expectations appears to be a potential path to at least solving part of the puzzle.

Although the demand for annuities is on the rise, more effort is needed to educate potential buyers, especially older ones, about their benefits. As people become more aware of how annuities can secure their financial future, we may see a shift toward more widespread adoption, which could lead to greater financial security and peace of mind for many retirees.

David Blanchett is research fellow, Alliance for Lifetime Income, and managing director and head of retirement research, PGIM DC Solutions. David may be contacted at [email protected].

Boost your confidence, embrace your uniqueness and transform your sales

The shadow caregiving system and economy

Advisor News

- Social Security retroactive payments go out to more than 1M

- What you need to know to find success with women investors

- Senator Gary Dahms criticizes Governor Walz's proposed insurance tax increase

- Social Security staff cuts could ‘significantly impact’ beneficiaries

- Building your business with generative AI

More Advisor NewsAnnuity News

Health/Employee Benefits News

- Idaho House approves Medicaid reform bill

- Pear Suite Partners with Health Net and Six Other Health Plans to Launch the Pear Cares Provider Network with 1,000+ Community Health Workers

- Pan-American Life Insurance Group Reports Record Net Income for 2024 On Strong Operating Performance

- GOP lawmakers commit to big spending cuts, putting Medicaid under a spotlight – but trimming the low-income health insurance program would be hard

- Bill aims to limit insurance denials by defining care standards

More Health/Employee Benefits NewsLife Insurance News