Term to Universal to Whole Life: Matching client needs to the right product

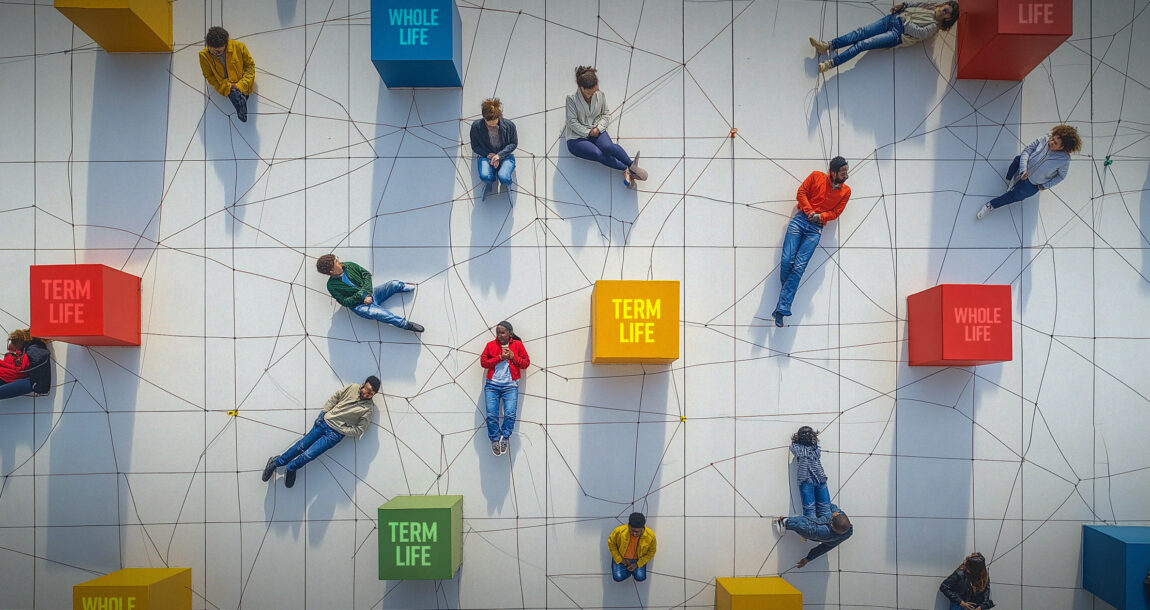

What is the right type of life insurance for your client?

This seems to be a harmless question, but it’s one that drives agents mad.

The typical answer is “it depends.”

And this drives customers mad because they think the agent has come with a product to sell rather than a solution that should come from a meaningful discussion about their needs.

So let’s talk about customer needs. We like to use customer profiles as a way to help agents get to the right answer and determine the right type of life insurance. This article will dive into three of the most common profiles agents encounter.

In the end, getting a meaningful customer profile is a combination of asking good questions based on a healthy dose of curiosity. The more interested and engaged the agent, the better the result in obtaining the right type of life insurance for their client.

Young Achiever

Young Achiever: Balancing risk readiness with financial reality

The Young Achiever is typically in their mid-20s to mid-30s, often single or newly married and early in their career. A growing number of Young Achievers are entrepreneurs. Their focus is financial independence with a goal of starting a family and/or a business. They are risk takers attitudinally across many financial categories, but cautious because of their financial situation.

Young Achievers value having financial protection during these first critical years of career development. They may be concerned about covering debts, providing income replacement for a spouse or partner or ensuring financial stability for a young family in the event of their untimely death. They are novices when it comes to life insurance, unclear why they might need it today and how much to purchase.

Insurance Needs: Term Life

Term life is perfect for this group. The simplicity and low premiums allow them to obtain adequate coverage while keeping within their budget, with the understanding that they can reassess their needs as their financial situation and needs evolve.

Family-Oriented Planner

Family-Oriented Planner: Focus on home and family

The Family-Oriented Planner is usually aged 35-50, married, with school-aged children. They are well-established in their careers and earn a steady income, typically in the $100,000-$175,000. This group prioritizes long-term financial security, wealth accumulation and estate planning.

Unlike the Young Achiever, this group has inserted a bit of moderation into their risk profile, preferring a larger dose of stability and guarantees as their children reach teenage years. This planner often seeks lifetime coverage to ensure their family's financial security and to leave a legacy. They value the stability of a guaranteed death benefit and are interested in the cash value component as an alternative means of accumulating savings.

Insurance Needs: Whole Life

Whole life’s permanent coverage, guaranteed death benefit and cash value accumulation fit their needs perfectly. Having access to the cash value through loans or withdrawals provides much needed flexibility with kids in school.

Curious Investor

Curious Investor: In a great position to think outside many different boxes

The Curious Investor typically falls within the 45-60 age range, with an annual income often exceeding $150,000. They may be corporate professionals, business owners or entrepreneurs and their children are likely grown.

They are savvy and curious investors and heavy users of more complex, higher risk insurance products. This group is often interested in a policy that offers both life insurance protection and the potential for cash value growth linked to market performance. They like the idea of thinking outside the box and, despite some of them nearing retirement, they are not risk averse.

Insurance Needs: Universal Life

Universal life and its many forms allow flexibility to adjust their premium payments and death benefits, making it an adaptable solution for changing financial circumstances. The policy's cash value component can be invested, offering the potential for growth, which appeals to clients comfortable with moderate to high market risk.

It is critical for agents to burrow into the details of a customer’s situation to understand not only the “what,” but also the “why.” Good questions without bias and good follow-ups are the right recipe. We like to use the word relentless when we work with agents on developing profiles. They take time and patience, but the wait is worthwhile.

© Entire contents copyright 2024 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Drew Gurley is a licensed life insurance expert with nearly 15 years of experience. During his career as both a licensed life insurance agent and industry executive he has helped thousands of clients with their life insurance needs through his work at Redbird Advisors and Senior Market Advisors.

Term life growth a bright spot in sluggish overall life insurance sales

Medicare clients ask about prior authorizations, higher premiums

Advisor News

- Main Street families need trusted financial guidance to navigate the new Trump Accounts

- Are the holidays a good time to have a long-term care conversation?

- Gen X unsure whether they can catch up with retirement saving

- Bill that could expand access to annuities headed to the House

- Private equity, crypto and the risks retirees can’t ignore

More Advisor NewsAnnuity News

- New York Life continues to close in on Athene; annuity sales up 50%

- Hildene Capital Management Announces Purchase Agreement to Acquire Annuity Provider SILAC

- Removing barriers to annuity adoption in 2026

- An Application for the Trademark “EMPOWER INVESTMENTS” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Bill that could expand access to annuities headed to the House

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- Judge tosses Penn Mutual whole life lawsuit; plaintiffs to refile

- On the Move: Dec. 4, 2025

- Judge approves PHL Variable plan; could reduce benefits by up to $4.1B

- Seritage Growth Properties Makes $20 Million Loan Prepayment

- AM Best Revises Outlooks to Negative for Kansas City Life Insurance Company; Downgrades Credit Ratings of Grange Life Insurance Company; Revises Issuer Credit Rating Outlook to Negative for Old American Insurance Company

More Life Insurance News