Talent gap narrows in financial services, but macro-economic concerns remain

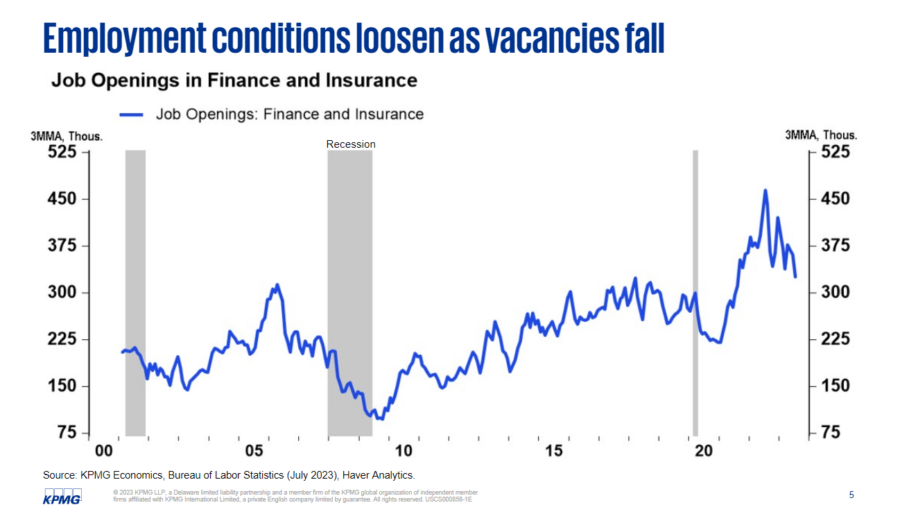

At its peak, the labor shortage in financial services hit an estimated 500,000 openings.

That number is down to about 325,000 and on a steady decline, said Kenneth Kim, a senior economist at KPMG. He spoke this week during the KPMG 35th Annual Insurance Industry Conference in Orlando, Fla.

The employment news for financial services is good, Kim said, but it isn't great.

"Yes, [job openings have] come down but if you take the latest figure and go back in time, just draw a straight line, you can see still see that the current level is still higher than the highs in the previous two business cycles -- the business cycle that lasted from 2001 to 2008, and the one that went from 2009 to the beginning of 2020."

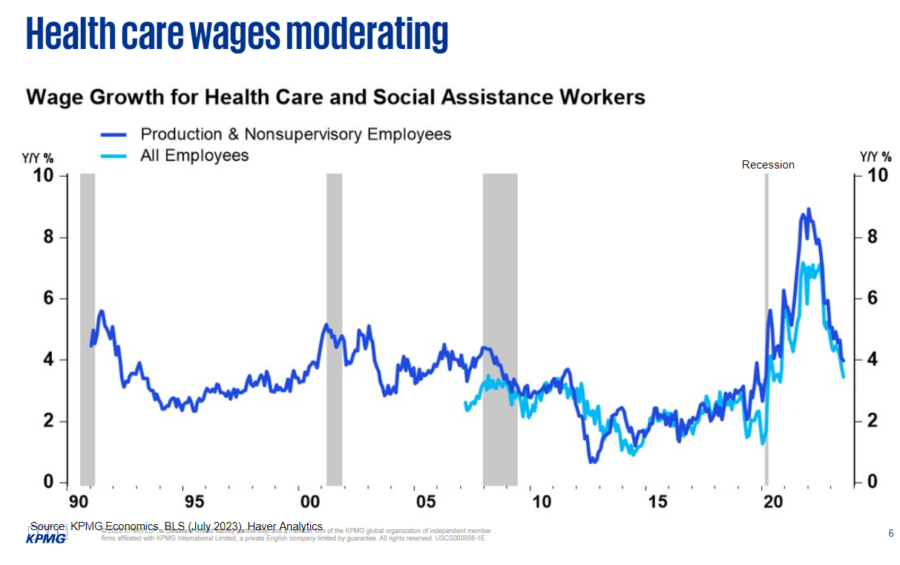

A lot of what has happened with wages and employment can be traced to inflation and rising interest rates. Health care and social workers were seeing wage increases in the 9% range for a short time, Kim noted. Those rising wages are cooling, but remain higher than pre-COVID-19.

"The Fed's interest rate increases, bringing up from zero percent to five-and-a-half percent currently is having the intended impact," he said, "not only on inflation, but also on labor market costs."

KPMG: Rate hikes are done

On Wednesday, the Federal Reserve said it will maintain its target range for the federal funds rate at 5.25% to 5.5%, as recent economic indicators show a mix of promising and concerning signals.

Analysts speculated on Fed making at least one more tweak in interest rates before the end of the year, but Chairman Jerome Powell said that final decision by the board of governors would be dictated by data.

KPMG does not expect any further rate hikes, Kim said, a stable forecast that should please financial services.

"We actually believe the Fed is finished raising rates for this interest rate cycle," he said. "But nevertheless, the bottom line is that whether they're done or they raise one more potentially 25 basis points, there is light at the end of the tunnel. Interest rates will not be moving materially higher in the coming year and next year."

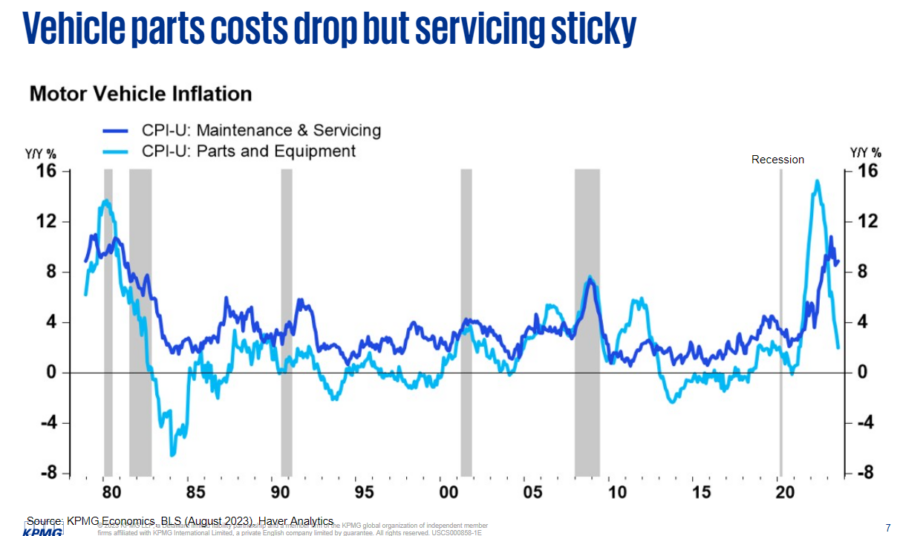

High inflation had a major impact in the property and casualty world, as vehicle parts and repair costs skyrocketed. The cost of parts is dropping, but service costs remain high, Kim said.

"Even though the parts costs have come down sharply from double digits, maintenance, servicing costs for vehicles is still very elevated," Kim noted. "Again, it's the highest since the 1980s currently, even though other measures of CPI have come down significantly."

It's a similar story in the housing sector, where the costs of materials have come down sharply. It's an indication that the Fed's work on interest rates is having the desired effect, Kim said.

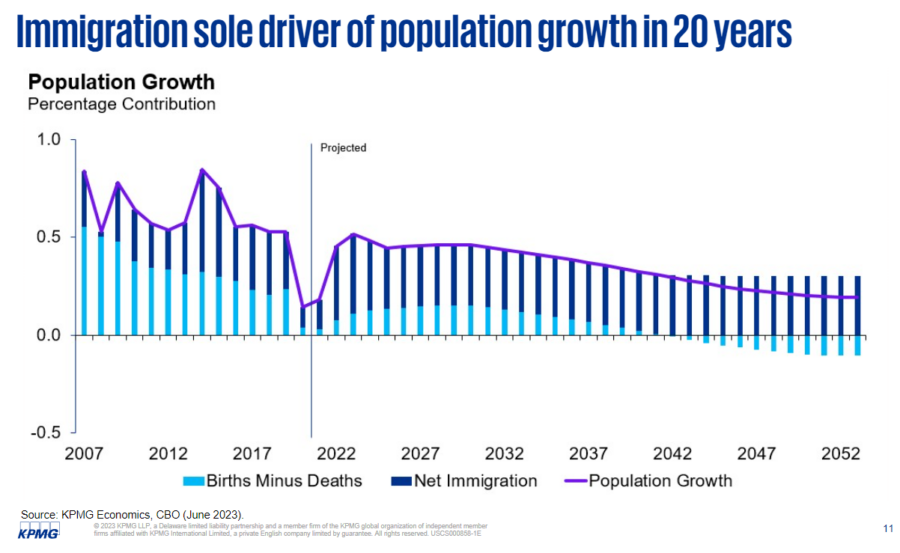

Immigration fueling growth

In the decades to come, as U.S. birth rates remain historically low, immigration will become a growing driver of population growth, Kim explained.

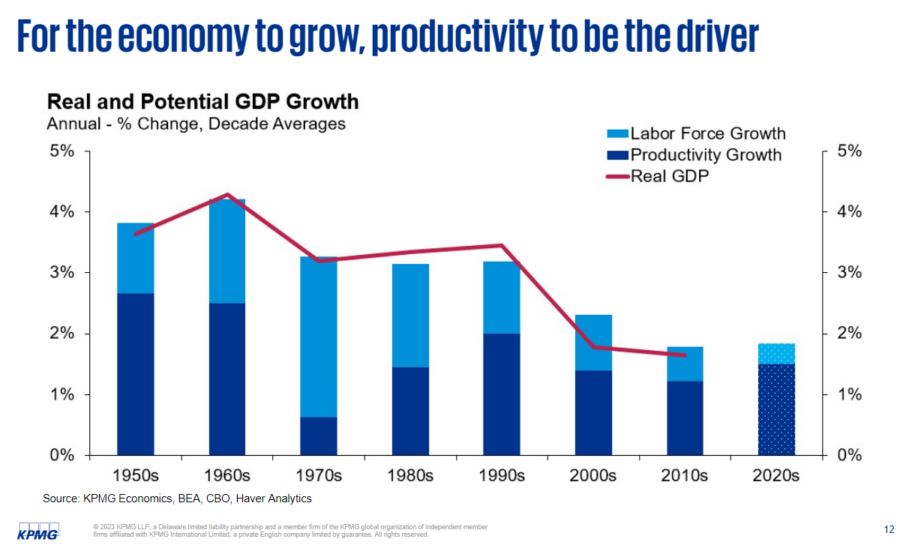

"This will be the challenge for the for our economy going forward," he said, adding that future GDP [Gross Domestic Product] growth is partially dependent on labor growth. "Household sizes have been becoming smaller, family sizes have been becoming smaller. But what that means is that that is the source of a future talent, right? So where is our growth going to come from?"

"Everything that we've heard about ... Gen AI, workforce, upscaling digital transformation, machine learning, large language models, all that fused into your current and future workforce, because that source of labor is going to be shrinking as we go forward," Kim warned.

Finally, Kim addressed the looming federal debt problem. The Congressional Budget Office is projecting that the federal debt will match the size of the overall U.S. economy next year.

"So what does that mean?" Kim said. "Well, interest rates are now under pressure. And there is the growing realization that this is a concern."

The United States has work to do to avoid having its own "Japan moment," Kim concluded. With a low birthrate and aging population, Japan's social security system is under strain and the country suffers from labor shortages.

"If we get high growth that would be a good thing for our economy going forward," Kim said. "And I am hopeful that we can do that."

InsuranceNewsNet Senior Editor John Hilton covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

© Entire contents copyright 2023 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

North Dakota judge halts long-term care bailout plan crafted in Pa.

Making your money last: The two-bucket investment approach

Advisor News

- Millennials are inheriting billions and they want to know what to do with it

- What Trump Accounts reveal about time and long-term wealth

- Wellmark still worries over lowered projections of Iowa tax hike

- Wellmark still worries over lowered projections of Iowa tax hike

- Could tech be the key to closing the retirement saving gap?

More Advisor NewsAnnuity News

- How to elevate annuity discussions during tax season

- Life Insurance and Annuity Providers Score High Marks from Financial Pros, but Lag on User Friendliness, JD Power Finds

- An Application for the Trademark “TACTICAL WEIGHTING” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Annexus and Americo Announce Strategic Partnership with Launch of Americo Benchmark Flex Fixed Indexed Annuity Suite

- Rethinking whether annuities are too late for older retirees

More Annuity NewsHealth/Employee Benefits News

- Findings from Belmont University College of Pharmacy Provide New Insights into Managed Care and Specialty Pharmacy (Comparing rates of primary medication nonadherence and turnaround time among patients at a health system specialty pharmacy …): Drugs and Therapies – Managed Care and Specialty Pharmacy

- Study Data from Ohio State University Update Knowledge of Managed Care (Preventive Care Utilization, Employer-sponsored Benefits, and Influences On Utilization By Healthcare Occupational Groups): Managed Care

- Recent Findings from Cornell University Provides New Insights into Managed Care (The Law of Large Umbrellas: Away From Risk Reduction In Health Insurance): Managed Care

- New Findings on Cancer from University of Texas Arlington Summarized (Systematic Review of Health Insurance and Survival Among Adolescent and Young Adult Cancer Patients): Cancer

- ‘Absolutely ferocious’: Idaho introduces plan to repeal Medicaid expansion

More Health/Employee Benefits NewsLife Insurance News

- Kansas City Life: Q4 Earnings Snapshot

- Gulf Guaranty Life Insurance Company Trademark Application for “OPTIBEN” Filed: Gulf Guaranty Life Insurance Company

- Marv Feldman, life insurance icon and 2011 JNR Award winner, passes away at 80

- Continental General Partners with Reframe Financial to Bring the Next Evolution of Reframe LifeStage to Market

- ASK THE LAWYER: Your beneficiary designations are probably wrong

More Life Insurance News