Surveys find economists agree recession likely, as consumer fatigue sets in

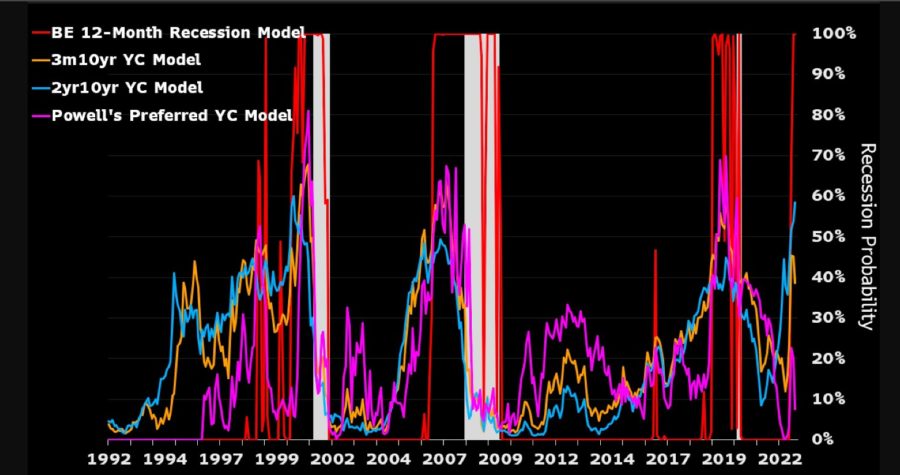

The best investment over the next year might be betting on the odds of a recession occurring, because while many economists are saying it is likely, two Bloomberg analysts saying they are 100% sure of it happening by next October.

The likelihood is almost inevitable given the Federal Reserve’s aggressive increases in its funds rate – designed to slow down the economy to control persistent 40-year-high inflation.

Bloomberg economists Anna Wong and Eliza Winger have said they are 100% certain that a recession will hit by next October, a dramatic increase since their 65% prediction in their last estimate.

Bloomberg also surveyed economists, who are pessimistic about the next 12 months as well. In that poll, 60% of 42 economists predicted a recession will occur within the next 12 months. That is up from 50% just a month ago.

That result tracks closely with a Wall Street Journal survey of economists, showing the likelihood of recession at 63% over the next year, up from 49% in July.

It was the first prediction over 50% since the brief recession in 2020. The last time the gauge hit that high before 2020 was January 2009.

“Economists now expect gross domestic product to contract in the first two quarters of the year, a downgrade from the last quarterly survey, whereby they penciled in mild growth,” according to The Journal.

Survey offered some hope

But the survey did offer some hope that Federal Reserve Board Chair Jerome Powell will be correct in predicting a soft landing for the economy as the central bank raises rates. The WSJ economist survey predicted a mild contraction, with the GDP slowing 0.2% in the first quarter and 0.1% in the second.

That slower growth in the first half of 2023 is expected to prompt employers to cut jobs mid-year, dropping 34,000 monthly in the second quarter and 38,000 a month in the third. That is an abrupt about-face from the previous prediction of adding 65,000 jobs a month in those quarters.

“Some 58.9% of economists said they think the Fed will raise interest rates too much and cause unnecessary economic weakness, up from 45.6% in July,” The Journal reported.

Also on Tuesday, Goldman Sachs CEO David Solomon agreed in a CNBC interview that the economy is headed for a recession, and that it is time to take risk off the table.

“I think it’s a time to be cautious,” Solomon said. “And I think that if you’re running a risk-based business, it’s a time to think more cautiously about your risk box, your risk appetite.”

He did add a hopeful note that the downturn will be mild. That doesn’t mean for sure that we have a really difficult economic scenario,” he said.

‘Recession fatigue’

If you are feeling a little “recession fatigue,” you’re not alone, according to a Bankrate survey, taken even before the latest recession predictions.

The pollsters attributed recession fatigue for the low level of preparedness for an economic downturn. The survey found that 31% of Americans are not taking any steps to get their finances ready, with 42% admitting that they are not prepared for recession.

That fatigue is deep in the bones of younger generations, who have lived under the dark clouds of economic turmoil since they were born. Gen Z’s birth years span from 1997 to 2012, bridging from one significant recession to one that was considered the worst since the Great Depression.

Is it any wonder that 40% of Gen Zers are not taking any steps to be prepared for a downturn? That compares with 31% of millennials, 30% of Gen X and 27% of boomers.

Another survey showed that the younger generations just might be used to living in volatility. Call it adjusting to the new normal or just plain denial, but a survey by the tech and marketing company Scorpion showed millennials and Gen Zers are trying to live their best life.

Like the Bankrate poll, the younger generations are more likely to experience “inflation fatigue,” but rather than feel beaten down by it, they seem OK with things.

Generational differences

Gen Z and millennials are three times more likely to say they're better off financially this year compared to Gen X and Baby Boomers (38% vs. 13%), according to the Scorpion survey.

They are also spending like it’s 1999, with Gen Z and millennials two times more likely to spend on luxuries, such as electronics, dining out and travel. Meanwhile, half of Gen Xers and boomers planned to put off spending if prices kept increasing.

The survey found that overall, consumers will be doing more things for themselves and taking a closer look at the value they get for their money. Joe Martin, vice president at Scorpion, said the findings are a red flag for businesses to tighten up their processes and focus on service.

"As many Americans accept today's challenging economy, this is a good time for businesses to focus on winning and retaining customers,” Martin said. “With increasing competition in most industries, customers expect excellent service, fair pricing, transparency, and many other things from the businesses they buy from.”

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

© Entire contents copyright 2022 by InsuranceNewsNet. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

Equitable president Nick Lane receives leadership award

Four things employers should know for open enrollment season

Advisor News

- Economy showing momentum despite uncertainty

- 7 ways financial advisors can benefit by giving back to nonprofits

- Emergency Preparedness: How advisors can prepare clients for hurricanes

- Federal employees: An emerging market for advisors

- The financial advisor’s guide to creating an effective value proposition

More Advisor NewsAnnuity News

Health/Employee Benefits News

- Long-term care planning can help people retain independence

- Health insurance for millions could vanish as states put Medicaid expansion on chopping block

- Targeted by Trump, Medicaid funding stirs debate as CT changes rules for hospitals

- Nassau County corrections officer facing grand larceny charges

- Findings from Brown University in Health and Medicine Reported (Oregon’s Hospital Payment Cap and Enrollee Out-of-pocket Spending and Service Use): Health and Medicine

More Health/Employee Benefits NewsLife Insurance News

- AM Best Places Credit Ratings of Banner Life Insurance Company and William Penn Life Insurance Company of New York Under Review With Developing Implications

- Best's Review Examines Value in Innovation Culture

- Initial Registration Statement for Employee Benefit Plan (Form S-8)

- Securian Financial Enhances Its Flagship Indexed Universal Life Insurance Product

- AM Best Affirms Credit Ratings of The Dai-ichi Life Insurance Company, Limited

More Life Insurance News