Survey: Medicare Advantage enrollees satisfied but price-sensitive

Most enrollees who switched from Medigap to Medicare Advantage plans did so because Medigap was too expensive, according to a recent survey.

Almost nine in 10 enrollees were happy with their Medicare Advantage plan, with 88% indicating satisfaction and 86% willing to recommend it to others, according to an eHealth survey in late May. About 27 million Americans are enrolled in Medicare Advantage, or 45% of those eligible for Medicare, according to AHIP, which represents health insurers.

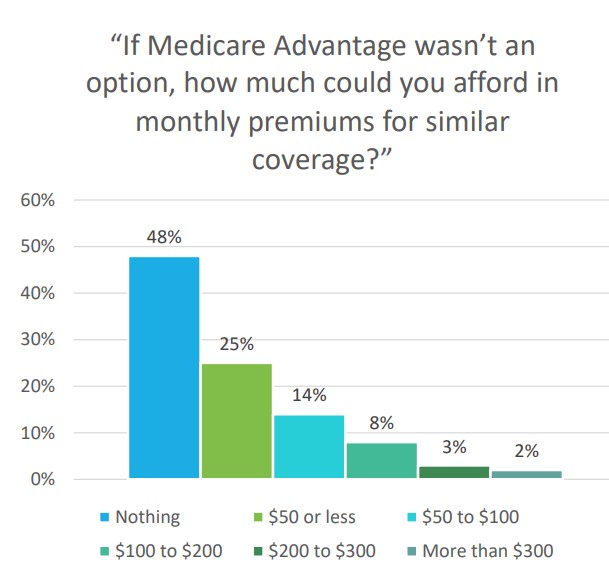

Medicare Advantage enrollees are particularly price-sensitive, with 73% saying they can afford only up to $50 monthly. That led many to switch from Medicare Supplement (Medigap) to Medicare Advantage, with 67% saying they did so because of cost.

Medicare Advantage, also known as Part C, combines Medicare Part A and B for comprehensive coverage in one plan, often including Part D prescription drug coverage. Coverage comes in many forms, such as including special needs plans, but often requires in-network providers.

Medicare Supplement, also known as Medigap, helps pay out-of-pocket expenses not covered by Medicare Parts A and B, but does not include Part D. Medigap protects against unexpected costs such as deductibles and co-pays and usually does not limit coverage to a provider network.

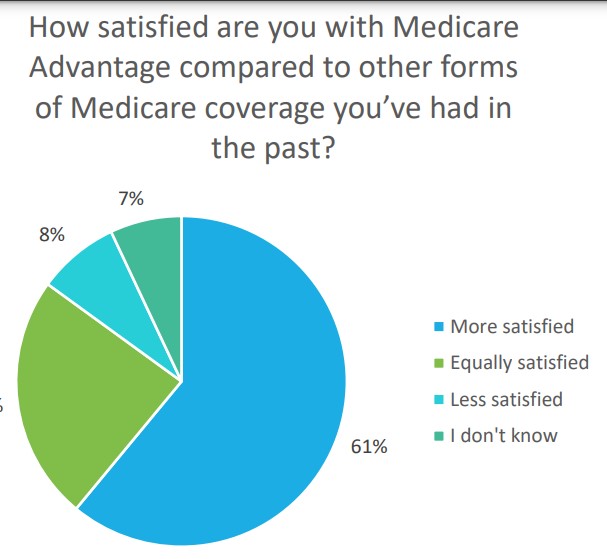

In the eHealth survey, most of those previously enrolled in Medigap prefer Medicare Advantage, with 59% previously enrolled in Medigap saying they are more satisfied with their Medicare Advantage plan and 23% equally satisfied.

A quarter of those who switched did so because Medigap did not offer prescription drug coverage.

Price Sensitivity

Nearly half (48%) of respondents said they could not afford to pay any premium, with an additional 25% saying they could pay up to $50.

They also were less able to handle out-of-pocket expenses, with 74% saying they could afford only up to $1,000 per year.

Some critics are also price-sensitive, saying the Medicare Advantage program is too costly. (eHealth said it conducted its survey partly as a response to criticism.)

A former federal health policy researchers examined Medicare Advantage billing data and found Medicare overpaid the private health plans by $106 billion from 2010 through 2019 because of “upcoding,” or coding patients’ “risk scores” as sicker than they actually are, according to Kaiser Health News. Medicare Advantage plans are paid using a risk score coding system, which pays more for sicker patients, while original Medicare pays by each service provided.

The findings are in addition to whistleblowers who have filed complaints on upcoding, and greater scrutiny among Democrats in Congress calling for more diligent oversight from the Centers for Medicare & Medicaid Services.

The insurer association AHIP argued in a report that changing the coding system would reduce Medicare Advantage plans’ level of care and increase premiums.

“One of the great values of choosing MA is that plans coordinate care and offer benefits and services to help improve the health of enrollees living with chronic health conditions or serious illnesses,” according to the report. “Completely identifying each individual’s presenting health conditions and recording them in their patient record is essential to achieving their best health.”

Changes in the coding formulas could reduce the money the plans can pay providers and require an increase in premiums of $9 to $25 per month, AHIP said.

“The research finds that increases to MA coding intensity could mean no MA enrollees would have access to a $0 premium plan, a plan option selected by 55% of MA enrollees in 2021,” according to the AHIP report. “In fact, 66% of enrollees could pay a monthly premium of more than $25 if the coding intensity factor increased to 9%.”

In eHealth’s survey, most respondents said they thought Medicare Advantage is a good example of public/private cooperation, with 61% saying it was a good partnership, 33% said they did not know and 5% disagreed. In another question, less than half (46%) said that regulation was OK as is or should be reduced.

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

© Entire contents copyright 2022 by InsuranceNewsNet. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

Go where people are not going: Serving the female investor

House Democrats clamor for party leaders to save expiring ACA subsidies

Advisor News

- Bessent confirmed as Treasury secretary

Former hedge fund guru to oversee Trump's tax cuts, deregulation and trade changes

- Jackson National study: vast underestimate of health care, LTC costs for retirement

- EDITORIAL: Home insurance, tax increases harm county’s housing options

- Nationwide Financial Services President John Carter to retire at year end

- FINRA, FBI warn about generative AI and finances

More Advisor NewsAnnuity News

- MetLife Among the World’s Most Admired Companies by Fortune Magazine

- Aspida and WealthVest Announce a Suite of New and Enhanced Indices for Their WealthLock® Accumulator Product

- Brighthouse Financial Inc. (NASDAQ: BHF) Sees Notable Increase in Tuesday Morning Market Activity

- Hexure Integrates with DTCC’s Producer Authorization, Providing Real-Time Can-Sell Check within FireLight

- LIMRA: 2024 retail annuity sales set $432B record, but how does 2025 look?

More Annuity NewsLife Insurance News

- MetLife Among the World’s Most Admired Companies by Fortune Magazine

- Amalgamated Life Insurance Company Announces Amanda Turcotte as New Senior Vice President, Chief Actuary

- Aspida and WealthVest Announce a Suite of New and Enhanced Indices for Their WealthLock® Accumulator Product

- AM Best Affirms Credit Ratings of Members of Aegon Ltd.’s U.S. Subsidiaries

- Annual Report of Employee Stock Purchase/Savings Plan (Form 11-K)

More Life Insurance NewsProperty and Casualty News

- Editorial: Are Illinoisans paying more for insurance due to California and Florida disasters? More transparency, please.

- Florida approves more than 10 new insurance companies for growing property market

- Get rid of FEMA? Trump-appointed group to look at shifting disaster response to states

- PA man who defrauded CT insurance company sentenced to 20 months in prison, feds say

- This California bill would let victims, insurance companies sue Big Oil for disaster damages

More Property and Casualty News