Study: small business insurance customer satisfaction rebounding

Customer satisfaction of commercial line insurers among small businesses, which plummeted for two years during the pandemic, is showing signs of rebounding, according to a new J.D. Power study.

Business closings and disruptions combined with economic uncertainty and supply chain issues during the pandemic strained relationships between small businesses and their insurance carriers and had them singing “I can’t get no satisfaction” beginning in 2020 as fulfillment declined for the first time in seven years, J.D. Power said.

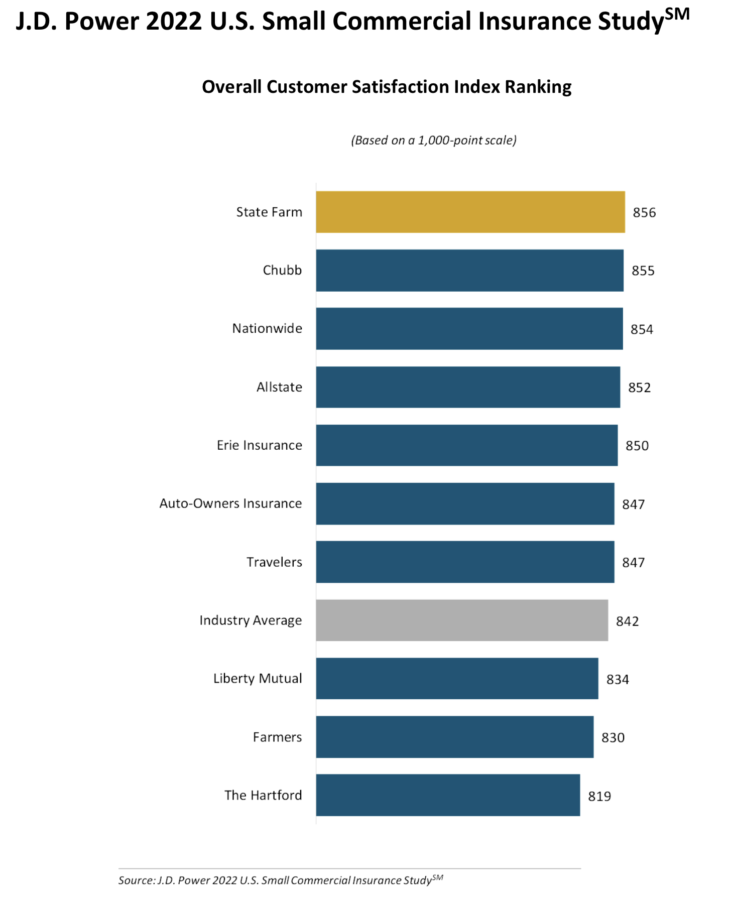

But that trend has reversed, with overall small business customer satisfaction climbing 13 points (on a 1,000-point scale) to just 2 points lower than its pre-pandemic high, according to the study.

“It’s noteworthy that we’re seeing increases in satisfaction across all factors—including price—at a time when 30% of small business customers have experienced an insurance premium increase,” said Stephen Crewdson, senior director of global insurance intelligence at J.D. Power. “That’s the highest proportion of customers experiencing price increases that we’ve seen in the past eight years.”

Overall small business customer satisfaction with commercial insurers is 842, up 13 points from 2021. Customer satisfaction improves across all factors in the study and is led by interaction; billing and payment; and policy offerings. Customer satisfaction with commercial insurance climbed steadily from 2013 until the pandemic, reaching an all-time high of 844 in 2019.

The smallest businesses, however, seem the least satisfied. Businesses with fewer than five employees have has a lower overall satisfaction score (826) than do medium-size (841) and larger (852) small businesses.

Customer satisfaction with the price of their small business insurance policies rises 3 points this year, despite 30% of small businesses experiencing a premium increase. The study finds that proactive communication plays a big role in that trend. When customers experience an increase—but are notified in advance, discuss ways to mitigate the effect of the increase and completely understand why their premiums increased—they are nearly as satisfied with price as customers who did not have an increase at all.

“Insurers that notify their small business customers in advance of a price increase and proactively work with them to mitigate the financial effects of those premium increases are finding that it is possible to drive strong customer engagement and high levels of customer satisfaction even in a difficult economic environment,” said Crewdson.

Among individual insurers, State Farm ranked the highest in overall customer satisfaction with a score of 856, J.D. Power said. Chubb (855) ranked second and Nationwide (854) ranked third.

The 2022 U.S. Small Commercial Insurance Study is based on responses from 2,254 small commercial insurance customers. The study, now in its 10th year, examines overall customer satisfaction among small commercial insurance customers with 50 or fewer employees. Overall satisfaction is comprised of five factors: billing and payment; claims; interaction; policy offerings; and price. The study was fielded from March through June 2022.

Doug Bailey is a journalist and freelance writer who lives outside of Boston. He can be reached at [email protected].

Integrity Marketing Group to acquire Senior Resource Services

Drug manufacturers will have few alternatives in negotiating Medicare rates

Advisor News

- Study finds more households move investable assets across firms

- Could workplace benefits help solve America’s long-term care gap?

- The best way to use a tax refund? Create a holistic plan

- CFP Board appoints K. Dane Snowden as CEO

- TIAA unveils ‘policy roadmap’ to boost retirement readiness

More Advisor NewsAnnuity News

- $80k surrender charge at stake as Navy vet, Ameritas do battle in court

- Sammons Institutional Group® Launches Summit LadderedSM

- Protective Expands Life & Annuity Distribution with Alfa Insurance

- Annuities: A key tool in battling inflation

- Pinnacle Financial Services Launches New Agent Website, Elevating the Digital Experience for Independent Agents Nationwide

More Annuity NewsHealth/Employee Benefits News

- Idaho is among the most expensive states to give birth in. Here are the rankings

- Some farmers take hard hit on health insurance costs

Farmers now owe a lot more for health insurance (copy)

- Providers fear illness uptick

- JAN. 30, 2026: NATIONAL ADVOCACY UPDATE

- Advocates for elderly target utility, insurance costs

More Health/Employee Benefits NewsLife Insurance News

- AM Best Affirms Credit Ratings of Etiqa General Insurance Berhad

- Life insurance application activity hits record growth in 2025, MIB reports

- AM Best Revises Outlooks to Positive for Well Link Life Insurance Company Limited

- Investors holding $130M in PHL benefits slam liquidation, seek to intervene

- Elevance making difficult decisions amid healthcare minefield

More Life Insurance News